Medicare 2020 And 2021 Enrollment Dates: Key Takeaways

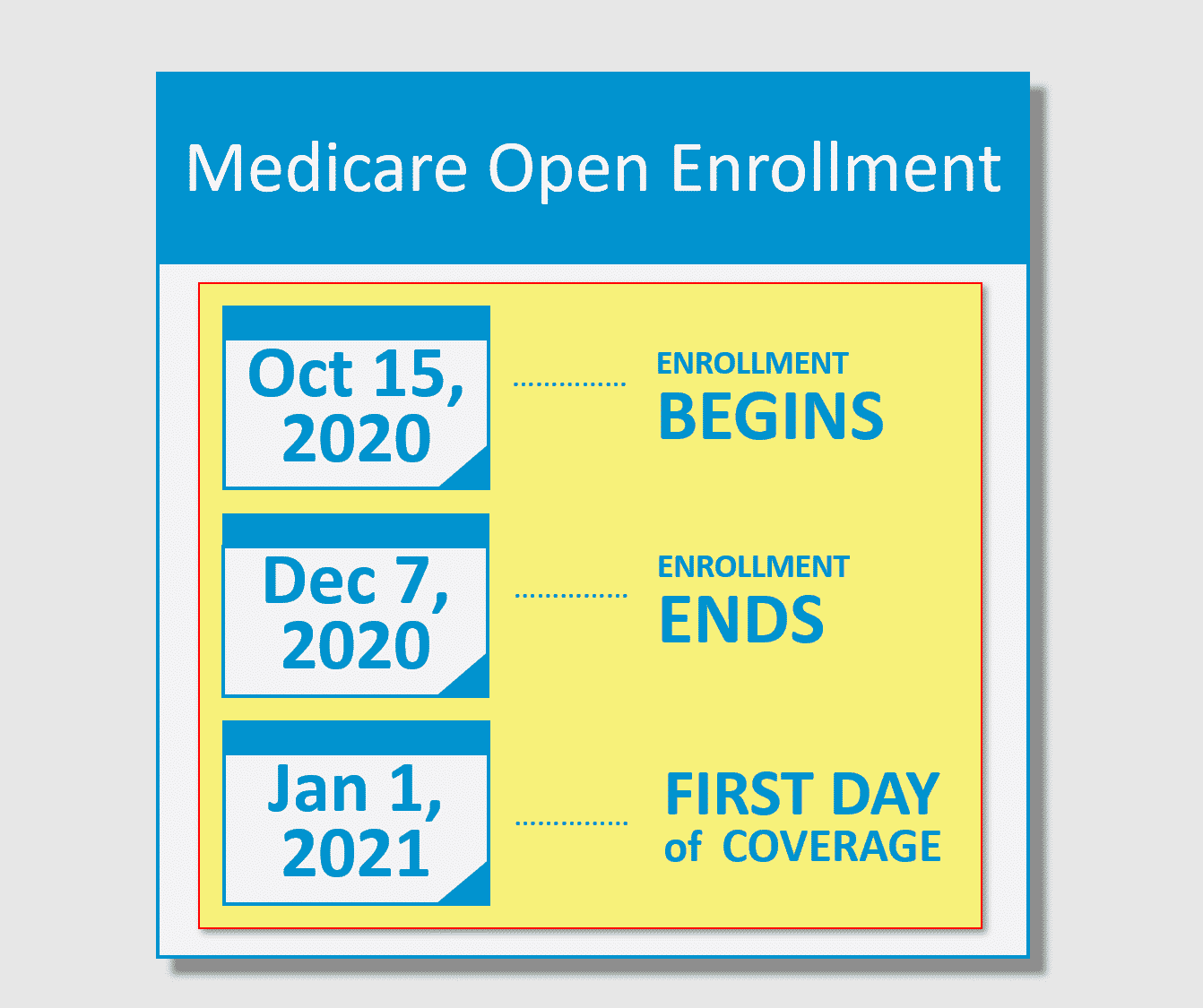

- The plan-year 2020 Medicare open enrollment period has ended. The next open enrollment period will run from October 15, 2020 to December 7, 2020, for coverage effective in 2021.

If youre enrolling in Medicare for the first time, theres a fairly straightforward process and timeline

But beyond that first opportunity to enroll in Medicare plans, the federal government provides other windows for enrollment: annual opportunities to enroll if youve delayed your enrollment for some reason, or to change your coverage if youve already enrolled.

Heres a quick guide to the times when you can enroll in or change Medicare coverage during the course of the year.

How To Avoid The Medicare Part D Late Enrollment Penalty

You are not required to do your Medicare Part D enrollment during your IEP. However, if you go without Medicare Part D or other creditable prescription drug coverage for a continuous period of 63 days or longer after your IEP is over, you could be subject to a Part D late enrollment penalty. Coverage could come from a stand-alone prescription drug plan, a Medicare Advantage plan with prescription drug coverage , or another type of creditable prescription drug coverage.

The amount of the Part D late enrollment penalty depends on how long you went without prescription drug coverage. Medicare calculates the amount by multiplying the number of months you didnt have prescription drug coverage by 1% of the national base beneficiary premium. In 2021, the national base beneficiary premium is $33.06.

The penalty amount is added to your monthly premium and you will continue to pay the penalty as long as you are enrolled in Medicare Part D. You can avoid this penalty by ensuring you dont go without creditable prescription drug coverage for 63 days or longer. Creditable coverage pays at least as much as standard Medicare coverage for prescription drugs.

Medicare Part D enrollment is the first step in getting the coverage you need for your prescription medications. With multiple plans to choose from, it is helpful to compare plans carefully to find the right plan for you. You can start by entering your zip code on this page.

New To Medicare?

How Do I Enroll In A Medicare Supplement Plan

During your initial Medigap enrollment period you cant be denied Medigap coverage or be charged more for the coverage because of your medical history.

But after that window ends, Medigap insurers in most states can use medical underwriting to determine your premiums and eligibility for coverage.

If youre under 65 and eligible for Medicare because of a disability, there are 33 states that provide some sort of guaranteed issue period during which you can purchase a Medigap plan. But in the majority of those states, the carriers can charge additional premiums for people under 65. You can click on a state on this map to see how Medigap plans are regulated in the state.

To find out about Medigap policies in your state, contact your State Department of Insurance or your State Health Insurance Assistance Program, or call 1-855-593-5633 to speak with one of our partners, who can help you find a plan in your area.

Also Check: How To Speed Up Your Period

Medicare Part D Standard Drug Benefit

The following table shows the Medicare benefit breakdown for 2020.

| Coverage Phase |

|---|

|

|

The costs shown in the table above represent 2020 defined standard Medicare Part D prescription drug plan parameters released by the Centers for Medicare and Medicaid Services in April 2017. Individual Medicare Part D plans may choose to offer more generous benefits but must meet the minimum standards established by the defined standard benefit.

The 2020 Medicare Part D standard benefit includes a deductible of $435 and 25% coinsurance, up to $6,350. The catastrophic stage is reached after $6,350 of out-of-pocket spending, then beneficiaries pay 5% of the total drug cost or $3.60 and $8.95 , whichever is greater.

2020 Donut Hole Discount:Part D enrollees will receive a 75% Donut Hole discount on the total cost of their brand-name drugs purchased while in the Donut Hole. The discount includes a 70% discount paid by the brand-name drug manufacturer and a 5% discount paid by your Medicare Part D plan. The 70% paid by the drug manufacturer combined with the 25% you pay, count toward your TrOOP or Donut Hole exit point. For example: If you reach the Donut Hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your 2020 total out-of-pocket spending limit.

Medicare Supplement Plans F And C Are Still Available

While the Centers for Medicare and Medicaid will no longer allow newly eligible Medicare beneficiaries to enroll in Medigap plans F and C, these plans arent disappearing completely. If you become eligible for Medicare before January 1, 2020 , you can apply for these plans now and in the futureeven if you arent already enrolled in Medigap.

If you become eligible for Medicare on or after January 1, 2020, you wont be able to enroll in Plans F or C now or in the future.

Also Check: What’s The Chances Of Getting Pregnant On Your Period

I Signing Up For Original Medicare

Suppose you already receive Railroad Retirement Board or Social Security benefits and live in the United States. In that case, the federal government automatically registers you in both Medicare Part A and Part B coverage at the age of 65. Your Medicare insurance card will arrive in the mail about three months before you turn 65, and your coverage will begin on the first of the month you turn 65.

The monthly premium for Medicare Part B is deducted from your Railroad Retirement or Social Security check. In 2021, the standard Part B premium is $148.50/month and is projected to increase in 2022. The Medicare Trustees Report expects a Part B premium of $158.50 per month for 2022 .

You can waive Part B and avoid the premiums, but its typically a good idea to do so only if you have health insurance from your current company or your spouses current employer and the organization has at least 20 workers.

If you reach the age of 65 but do not yet receive Railroad Retirement or Social Security benefits, you will not be automatically registered in Original Medicare. Instead, youll be able to sign up during a seven-month registration period that includes the three months preceding your birth month, the month you turn 65, and the three months following. So, if you turn 65 on July 14, your open enrollment period will run from April to October.

Signing Up For Original Medicare

You can sign up for Medicare one of four ways:

For California residents, CA-Do Not Sell My Personal Info, .

1 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Recommended Reading: When Will I Ovulate After My Period

Eligibility For Part D

Anyone with Medicare is eligible to enroll in a Part D plan. To enroll in a PDP, the individual must have Part A OR Part B. To enroll in an MA-PD, the individual must have Part A AND Part B.

Enrollees must live in their plans service area. In the case of homeless persons, the following may be used as a permanent residence: a Post Office box, the address of a shelter or clinic, or the address where the person receives mail such as Social Security checks.

PDPs are usually national plans, but MA-PDs have delineated regions, sometimes by state, sometimes by counties within states ). For this reason, MA-PDs may not be appropriate for those who travel a great deal or who maintain summer and winter residences in different areas of the country. NOTE: Some MA-PDs offer passport plans that allow members to obtain benefits outside their normal service areas.

Individuals who reside outside the United States* are not eligible to enroll, but may do so upon their return to the country. Incarcerated individuals may not enroll in Part D, but they may enroll upon release from prison. Prior to 2021, people with end-stage-renal-disease could not enroll in an MA-PD. Starting in 2021, people with ESRD can enroll in Medicare Advantage plans during the annual Open Enrollment Period.

There are no other eligibility restrictions or requirements for Part D.

What Was The Former Medicare Advantage Disenrollment Period

The Medicare Advantage Disenrollment Period was before 2019 a time when Medicare Advantage plan members could disenroll from their plan and revert back to Original Medicare.

This disenrollment period was done away with. Starting in 2019, the Centers for Medicare & Medicaid Services instituted the Medicare Advantage Open Enrollment Period .

The Medicare Advantage Open Enrollment Period lasts from January 1 to March 31. During this time, Medicare Advantage plan beneficiaries can:

-

Switch from one Medicare Advantage plan to another, even if they are provided by different insurance carriers

-

Disenroll from their Medicare Advantage plan and return to Original Medicare

If you choose to disenroll from a Medicare Advantage plan during this period and return to Original Medicare, you can also enroll in a standalone Part D prescription drug plan.

Read Also: Missed Period Bloated Stomach Negative Pregnancy Test

Changes In Medicare Advantage And Part D Plans

Every year, insurers make small changes to their Medicare Advantage and Part D plans. Typically, these changes include changes in premiums, deductibles, and other costs. Keep in mind, the Medicare program may not finalize these changes until right before fall Open Enrollment.

See the latest Medicare premiums and deductibles now or come back in October. Well share finalized changes as soon as they become available.

Refresh your general Medicare knowledge

While the Medicare program changes a bit each year, much of it stays the same. It never hurts to refresh your Medicare knowledge. We recommend starting with an overview of Medicare. This Medicare Glossary could come in handy, too, as you read through insurance documents.

Who Is Eligible For Medicare

You are eligible for Medicare Part A and Part B at age 65 if:

- You are a U.S. citizen or permanent legal resident who has lived in the U.S. for five continuous years

- You or your spouse have worked long enough to be eligible for Social Security or Railroad Retirement benefits

- You or your spouse are government employees or retirees who have not paid into Social Security but have paid Medicare payroll taxes

You can meet Medicare eligibility under 65 if you:

- Have been receiving Social Security disability benefits or certain Railroad Retirement Board disability benefits for at least 24 months

- You have End-Stage Renal Disease and you or your spouse have paid Social Security taxes for a certain length of time

You May Like: Can I Go To The Pool On My Period

Medicare Supplement Open Enrollment Period

If youre looking to supplement your Original Medicare coverage to help with additional costs, the best time to buy a Medicare Supplement plan is during the six-month enrollment period that starts the first day of the month you turn 65 as long as you have signed up for Medicare Part B.

If you dont sign up for a Medicare Supplement plan during this Open Enrollment Period, you may not be able to buy a Medicare Supplement plan. Unless you have a guaranteed issue right, you may be required to answer medical questions.

When Can I Join A Part D Prescription Drug Plan Or Switch Plans If I Already Have Coverage

En español | Medicare covers many of your health care expenses, but it doesnt provide prescription drug coverage.

You have two ways to get coverage: Buy a stand-alone Part D prescription drug plan, or sign up for a Medicare Advantage plan that combines medical and drug coverage. Private insurance companies that Medicare regulates offer both types of plans. Keep in mind, you can enroll only during certain times:

Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Open enrollment period, which runs annually from Oct. 15 to Dec. 7, with coverage beginning Jan. 1. You also can switch to a different Part D or Medicare Advantage plan during this time.

Medicare Advantage open enrollment period, which runs from Jan. 1 to March 31 each year. During this time, if you already have a Medicare Advantage plan, you can switch to another plan with prescription coverage. But if you switch to a Medicare Advantage health maintenance organization or preferred provider organization without drug coverage, make sure you have coverage from a retiree plan, Tricare or another option because you wont be permitted to buy a separate Part D plan. Or you can leave Medicare Advantage and return to original Medicare and buy a stand-alone Part D plan. The changes take effect the first day of the following month.

Keep in mind

Don’t Miss: Having Sex On First Day Of Period

The Part D Standard Benefit

At a minimum, plan sponsors must offer a standard benefit package mandated by law. The standard benefit includes an annual deductible and a gap in coverage, previously referred to as the Donut Hole. Sponsors may also offer plans that differ from but are actuarially equivalent to the standard benefit. Finally, they may also offer enhanced plans that provide benefits in addition to the standard benefit. Typically, the enhanced plans offer some coverage during the Donut Hole.

The Standard Benefit is defined in terms of the financial structure of the cost-sharing, not the drugs that must be covered under the plan.

Medicare does not establish premium amounts for plans. Instead, premiums are established through an annual competitive bidding process and evaluated by CMS. Premiums vary from plan to plan and from region to region. Medicare does establish the maximum deductible amount, the Initial Coverage Limit, the TrOOP threshold, and Catastrophic Coverage levels every year. The table below shows the standard benefit for this year .

Standard Part D Benefit 2020-2021

Alternatives to the Standard Benefit

Income-Related Monthly Adjustment Amount Part D

Income-Related Adjustments 2021

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $77.10 |

Drug Tiers

| Tier 1 | |

| $65 | 33% |

The Donut Hole

TrOOP

Once beneficiaries reach their out-of-pocket threshold costs), they move out of the Donut Hole and into Catastrophic Coverage.

EOBs

The Donut Hole Discount

| 63% | 75% |

Medicare Part D Coverage Gap

| ) |

The Medicare Part D coverage gap was a period of consumer payments for prescription medication costs that lied between the initial coverage limit and the catastrophic coverage threshold when the consumer was a member of a Medicare Part Dprescription-drug program administered by the United States federal government. The gap was reached after a shared insurer payment – consumer payment for all covered prescription drugs reached a government-set amount, and was left only after the consumer had paid full, unshared costs of an additional amount for the same prescriptions. Upon entering the gap, the prescription payments to date were re-set to $0 and continued until the maximum amount of the gap was reached or the then current annual period lapses. In calculating whether the maximum amount of gap had been reached, the “True-out-of-pocket” costs were added together.

A health insurance company provided this explanation about TrOOP:

“TrOOP includes the amount of your Initial Deductible and your co-payments or co-insurance during the Initial Coverage stage. While the Donut Hole includes what you pay when you fill a prescription and of the 75% Donut Hole discount on brand-name drugs, it includes the 70% Donut Hole Discount paid by the drug manufacturer. The additional 5% Donut Hole discount on brand-name drugs and the 75% Donut Hole discount on generics do not count toward TrOOP as they are paid by your Medicare Part D plan.”

Recommended Reading: Why Is My Period So Light

Iv Signing Up For Medicare Supplement Insurance

During your initial Medigap open enrollment period , you cannot be denied a Medigap plan or charged more for it because of your medical history.

Nevertheless, once that period ends, Medigap insurance providers in most states can use medical underwriting to determine your premium costs and eligibility for coverage. (New York, Missouri, Maine, Massachusetts, Connecticut, California, Washington, and Oregon, have laws that make it easier for people to sign up or switch to a new Medigap coverage after the initial open enrollment period has ended.

Thirty-three states offer a guaranteed issue window during which you can buy a Medigap plan if you are below the age of 65 and qualify for Medicare due to a disability. However, in most of those states, carriers can charge higher rates for people under 65. You can see how Medigap plans are regulated in each state by checking out NewMedicare.com.

To learn more about Medigap policies in your area, contact your states insurance department or the states health insurance assistance program, or call 844-844-3049 to speak with one of our agents who can help you find a health plan in your region.