Spending Down Assets Not Violating The Look

There are many ways tospend down assets over Medicaid limits without violating the look-back period. The strategies outlined below are ways to spend down assets however, the Medicaid look-back period is complex. It is recommended to consult an Elder Care Attorney before implementing any of the strategies listed below. Further, this list is in no way intended to be exhaustive as there are many options available under the law.

Annuities

Annuities, frequently referred to asMedicaid Annuities or Compliant Annuities, are also a common way to avoid violations. Here, a person will pay a lump sum with cash. In return for the annuity, the senior, or the seniors spouse, will receive a payment each month for a period less than their life expectancy. The annuities used for Medicaid are to convert an asset into an income stream. Thus, they lower the value of assets a person has to fall below theMedicaid eligibility limit and increase the spouses income which does not affect the nursing home spouses income or payments to the nursing home.

Buying annuities during the look-back time frame is not a violation of the rules for Medicaid. Each state has its own rules and regulations in regard to annuities and Medicaid. Keep in mind these annuities must comply with the rules and regulations.

Caregiver Agreements

- Life Care Agreements

- Long-Term Care Personal Support Services

- Elder-Care Agreements/Contracts

Home modifications

Irrevocable Funeral Trusts

Paying off Debt

What Happens If I Miss The Look Back Period

If you miss the Medicaid look-back period, there are financial penalties. Generally, youll be penalized based on the amount of money or other assets given away during the five years before you applied for Medicaid compared to the cost of nursing home care. For example, consider if you need to live in a nursing home, and your care costs $10,000 per month. However, you gave away $60,000 in assets last year. As a result, you may be ineligible for Medicaid for six months. However, after that time has passed, you can receive Medicaid benefits.

Thats why it is crucial to work with an elder law attorney as early as possible to address any asset concerns ahead of time. Similarly, if you are concerned that you have made a transfer that might jeopardize your eligibility, you should consult an elder law attorney right away to determine how you might move forward in addressing the transfer.

Medicaid For The Elderly And People With Disabilities Handbook

- Chapter I, Transfer of AssetsMenu button for Chapter I, Transfer of Assets”>

Revision 13-4 Effective December 1, 2013

Note: Examples in this section may not reflect the most recent amount of the average private-pay cost per day.

Investigation of transfers is part of the application or program transfer process. Activity during the month of application or program transfer and forward is investigated. Activity in the past is also investigated.

The look-back period is established under federal law. The date on which the look-back period is established is based on the application file date or the institutional entry date, whichever is later.

Under pre-DRA transfer of assets policy, the look-back period is 36 months from the later of the date of:

- institutionalization, or

- Medicaid application.

Under post-DRA transfer of assets policy, the look-back period is 60 months from the later of the date of:

- institutionalization, or

- Medicaid application.

Under both pre-DRA and post-DRA transfer of assets policies:

- When a person is already a Medicaid recipient before entering a nursing facility , intermediate care facility for individuals with an intellectual disability or related conditions , state supported living center, or institution for mental diseases , the look-back period begins with institutional entry.

- Penalties may be assessed for transfers occurring on or after the look-back date. Penalties cannot be assessed for time frames before the look-back period.

Examples:

Also Check: Good Foods To Eat On Period

Understanding The Medicaid Look

It’s possible that you’ve never heard of the Medicaid look-back period. You become so inundated with health, financial, and insurance information, it’s difficult to judge what’s important. The look-back period is a key Medicaid concept. It becomes relevant as you assess your need for long-term care and plan how to manage the costs. A Medicaid planning attorney helps you develop and implement a strategy. You can deal with this important issue before it jeopardizes your assets at the worst possible time. You want to consult with a Florida elder law attorney who specializes in Medicaid planning because we can discuss Medicaid-planning strategies that legally and ethically avoid triggering the look-back period.

Application To Different Medicaid Programs

There are many different types of Medicaid programs. And the look-back period does not necessarily play a role as an eligibility factor in all of them. However, this page is only concerned with those Medicaid programs that are relevant to the elderly. And the Medicaid look-back period applies to Medicaid long-term care services.

This means that if one is in violation of the penalty period, there will be a period of ineligibility for nursing home care, as well as services under Home and Community Based Services Waivers. Services and supports under HCBS Waivers may include adult day care/adult day health, in-home personal care, respite care, etc. Having said that, penalty transfers may not extend to all states for community Medicaid, such as in New York.

Eldercare Financial Assistance Locator

Read Also: Can You Masterbate While On Your Period

Tips On Getting Medicaid Help For Retirees

- Not having enough income in retirement is one of the biggest fears people have. A financial advisor can help you build a portfolio to meet your needs and calm your fears. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Medicaid covers long-term care costs, but it is better to have the money to pay for your medical needs. Investing for retirement can help you stay independent and in control of which providers that you choose. Our retirement calculator provides a personalized look at how much income you can expect in retirement.

Exceptions And Exemptions To Medicaid Gifting Rules

Not all asset transfers trigger a Medicaid gift penalty.

Continuing with the previous example, say your daughter lived in the aforementioned house while taking care of you for at least two full years before you applied for Medicaid. If your daughters care enabled you to delay the move into a nursing home, then the transfer of your primary residence into her name for less than FMV would not result in any kind of penalty. This child caregiver exemption is valid even if a senior applies for Medicaid within five years of the transfer.

Another exception to the general rule is asset transfers to a child who is blind or disabled under the Social Security Administrations rules. No penalty will be attached to such a gift, no matter how large.

Finally, there is never any penalty imposed on gifts between spouses. Since the total assets of both spouses are counted when one spouse applies for long-term care Medicaid, there is no reason to impose a penalty on such transfers, and that is exactly how the law reads.

Don’t Miss: Can You Still Get Pregnant On Your Period

Can One Get On Medicaid If The Applicant Has Violated Look

If one has income or assets above the Medicaid limits or knows they have violated the look-back period and will face a penalty, it is still possible to be approved for Medicaid Long Term Care benefits, including Nursing Home Medicaid and HCBS waivers. Firstly, consult a certified Medicaid planner, who will know exactly which steps to take depending on nuances in certain states rules.

Asset Recuperation: If the applicant has sold something for under fair market value within five years of applying for Medicaid it is possible to recover the asset to avoid a penalization period. Some states allow for partial recuperation resulting in a shorter penalty.

Undue Hardship: Someone who has violated the look-back period and cannot recuperate assets may still appeal to state Medicaid officials and claim that without Medicaid they will not be able to live with adequate food, clothing or housing. Undue hardship waivers are rare, and it must be clear and certain that without Medicaid the applicant will not be adequately cared for.

Exceptions To Assets And Resources Rules

Certain asset transfers do not cause a penalty to accrue to the person seeking Medicaid care benefits. Here are several of those exceptions.

- A home transferred to a spouse or a child under age 21, or a child who is blind or permanently and totally disabled

- A home transferred to a sibling with an equity interest in the home, and who has been living in the home for at least one year

- A child of the Medicaid applicant, who has lived in the house for two years

- Assets transferred for the sole benefit of a person’s spouse

- If enforcing a penalty would cause undue hardship .

Don’t Miss: How To Get Rid Of Back Pain On Your Period

Undoing A Medicaid Gift Penalty

It is possible to remedy a disqualifying asset transfer within a look-back period if all the gifted assets are returned to the Medicaid applicant.

This is not always, possible, though. Monetary gifts may have already been spent, or the recipients may refuse to return the assets in question. Of course, returning these funds will most certainly result in excess resources and still disqualify the applicant. However, they would have another opportunity to properly spend down their assets and fund their own care, if only for a short time, before qualifying for Medicaid long-term care.

What Assets Or Resource Transactions Violate Medicaid Guidelines

The person analyzing a potential Medicaid beneficiary’s financial transactions searches for the following types of assets and resources.

- Gifts: Cash, personal property , or real property that was given away as a gift

- Personal or real property that was sold for less than its fair market value.

- Personal or real property that was transferred to another owner

Read Also: Light Pink Blood When I Wipe But No Period

How Does The Medicaid Look Back Period Work

The Centers for Medicare & Medicaid Services explains that when applying for Medicaid to pay for nursing home care and other services associated with senior care while in a nursing home, the Medicaid eligibility worker asks if the individual recently gave away any assets such as vehicles or money. The representative also asks if the person sold property for less than its fair market value at the time of the sale within the past five years.

This transferring of assets usually results in a penalty, meaning that the person seeking senior living at a nursing home is ineligible for Medicaid, For as long as the value of the asset should have been used to pay for the nursing home care.

The site uses the example that if nursing home care costs $5,000 per month and the individual transferred $10,000, then the person is ineligible for Medicaid for two months. The penalty begins the month of the Medicaid application, not the month the individual transferred the property.

The individual then potentially qualifies for Medicaid benefits after the Medicaid look back penalty ends. That qualification is contingent upon the person not transferring any assets in any months while serving the initial look-back period penalty.

Section Vii Compliance With Tribal Consultation And Public Notice

Consistent with notice requirements, the State notified and sought input from Tribal leaders and colleagues in Indian Health Centers, posted public notice to the New York State Register and performed other notification and outreach seeking public input regarding implementation of a 30-month transfer of assets lookback period for coverage of CBLTC services, and approval to exclude Mainstream Managed Care and Medicaid Advantage enrollees from these rules. Refer to Appendix A for tribal consultation communications and Appendix B for public notice posting.

Public Notice Process

The State certifies that public notice of the formal waiver amendment was published in the New York State Register on August 19, 20201 and tribal notification for the formal waiver amendment was issued August 14, 2020, with written comments accepted by electronic or written mail through September 18, 2020 and September, 21, 2020, respectively.

The State also conducted six stakeholder outreach sessions in July, 2020 with consumer and advocacy groups, managed care plan representatives and local social services district representatives seeking public input regarding implementation of a 30-month transfer of assets lookback period for coverage of CBLTC services, and approval to exclude Mainstream Managed Care and Medicaid Advantage enrollees from these rules.

Public Comment

Public Comment Topics and State Responses

Concerns About Delays in Application Processing, Access to Care

Use of Pooled Trusts

Don’t Miss: At What Age Do Girls Get Their Period

When The Penalty Starts

Any penalty arising from gifts during the look-back period begins to run when the applicant would otherwise be eligible for benefits if not for the gifts.

Example: Harry signed over a vacation cabin worth $40,000 to his daughter four years before applying for Medicaid. On January 31, 2022, he made a payment of $11,000 to the nursing home and was left with $1,000 in his checking account .

Harry will be ineligible for Medicaid benefits for a period of almost three months . His ineligibility period starts to run February 1, the date he would have been eligible for benefits, if not for having made a gift.

Who Pays During Medicaid Penalty Periods

Keep in mind that there is no limit to how long a penalty period can be. Many families wonder what happens when a senior needs care, has spent down all their assets and wound up ineligible for coverage. Who pays for their care? If a senior has gifted countable assets during the look-back period and requires a nursing home level of care, they will have to pay for this care out of pocket somehow until either the look-back period has passed and the senior can apply for Medicaid without issue or until the penalty period runs out and they become eligible for coverage.

For example, if you live in a state with a $5,000 monthly penalty divisor, use a gift deed to transfer ownership of your home worth $350,000 to your daughter, and then apply for Medicaid four years later, you would be facing a 70-month penalty period! Ideally in this scenario, you would wait one more year until the asset transfer was just outside of the look-back period to apply for Medicaid. Yes, you and/or your family would have to pay for one year of nursing home care out of pocket totaling approximately $60,000. But, it would make far more sense than applying for Medicaid as soon as you need long-term care and incurring a nearly six-year penalty period during which you would still be responsible for paying your own long-term care costs. Remember, any gifts that take place outside of the five-year look-back period do not count against ones eligibility.

Read Also: Signs You Are Getting Your First Period

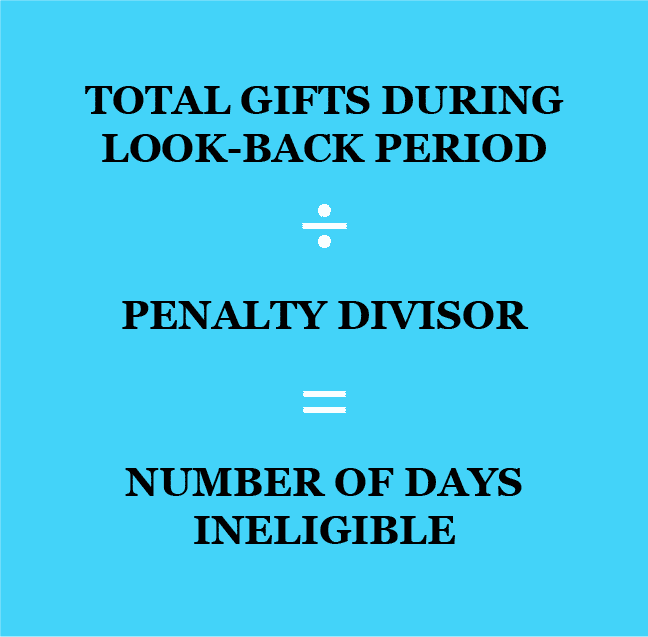

How Is A Medicaid Lookback Penalty Calculated

The lookback penalty is based on the total amount of ineligible transfers and the average private patient rate for nursing home care in your state. This average rate is also known as the penalty divisor. The Medicaid lookback penalty is calculated by taking the total of the ineligible transfers and dividing that by the penalty divisor. The result is the number of months that the senior is excluded from receiving Medicaid payments for their long-term care.

Heres an example that illustrates how the lookback penalty works. A senior makes $66,000 in ineligible transfers over the last five years. In their state, the average private patient rate is $6,000. When you divide the transfers by the penalty divisor, their penalty period is 11 months. The penalty period is the time in which the senior is ineligible for Medicaid and there is no maximum penalty limit.

Special Rules For Annuities And Loans

Medicaid law contains special rules applying to annuities, promissory notes, loans, and mortgages.

If an applicant buys an annuity during the look-back period, the annuity must comply with the requirements of the Deficit Reduction Act , a federal law that took effect in Pennsylvania in 2007. Among other requirements, the annuity must name the Pennsylvania Department of Human Services as the primary beneficiary to the extent of its applicable Medicaid costs.

The DRA contains other rules relating to promissory notes, loans, and mortgages made during the look-back period.

If the applicant or spouse transferred funds in connection with one of these financial instruments, that transfer may trigger a penalty period if the instrument fails to comply with the requirements of the DRA.

For that reason, it is best to avoid entering into one of these instruments if there is a reasonable chance you may apply for Medicaid within the next five years, unless you do so under the guidance of a lawyer well versed in the terms of the DRA. Annuities offer significant opportunities for asset protection, but also pose significant risks if not done correctly. So again, they should only be purchased with the assistance of an experienced elder law attorney.

Don’t Miss: How To End Your Period In One Day

Exceptions And Loopholes To The Look

Fortunately, Medicaids look-back period has some loopholes and exceptions. The applicant can make some transfers without being in violation in an effort to protect the family of the applicant from being destitute. Such exceptions allow for the transfer of assets without fear of any penalties. To avoid penalties, always consult a Medicaid attorney before making any transactions.