When Do You Get Your First Paycheck

The date of your first paycheck will ultimately depend on your company’s payroll schedule. Companies will typically have a specific payroll schedule, such as weekly, biweekly, monthly or on set days of the month. For instance, some companies’ payroll schedules set payment dates on the 1st and 15th of the month, or the closest business day prior if these dates land on a weekend or holiday.

Typically, companies issue paychecks on the last day of a pay period. Depending on your start date, you may expect your first paycheck at the end of the first full pay period that you work. For example, if you start working on the first day at the start of a new pay period, you can expect your first paycheck at the end of the pay period that your employer schedules.

If you start in the middle of a pay period, however, you may not receive your first paycheck until the end of the following pay cycle. In this case, you would work a full pay cycle plus the days in the middle of the cycle you worked before you receive your first paycheck.

Related:When Will I Get Paid? First and Last Paychecks Discussed

Pay Period Vs Pay Date

While a pay period and a pay date go together, they are different. A pay date is the day on which funds are issued to the employee, paying them for their work during the associated pay period.

There is usually a gap between a pay period and the pay date. Once a pay period has closed, the administrative process begins, reconciling the wages due from the pay period and calculating gross wages the employee earned. After the administration process has completed and the net payment is ready to be issued, the day it is paid out is the pay date.

How To Calculate Biweekly Pay

Read Also: How To Help With Period Back Pain

Types Of Payroll Schedules

Here are the four most common employee payroll schedules, according to the U.S. Bureau of Labor Statistics :

Weekly. A weekly pay schedule is the second-most-common pay schedule, with 34% of employers using it. With this pay schedule, youll pay your employees the most frequently generally, 52 times a year. Keep in mind, however, that leap year could add an extra pay period because it could lead to a 53rd week.

Weekly payroll schedules are the most time-consuming and costly payroll option. If you handle payroll on your own, it could chew up a lot of your time. And if you use an online payroll service, you may have to pay extra if your provider charges you each time you run payroll. However, some payroll services charge a flat rate for unlimited payroll runs. If you are using a weekly pay period schedule, we recommend finding a payroll provider that offers this option. Here are our picks for the best online payroll services.

Biweekly. A biweekly schedule means you pay employees every other week. According to the BLS, this is the most popular pay schedule, with 42% of U.S. employers using this model. Through this pay schedule, employees can expect to receive 26 paychecks in a year. However, because the year doesnt evenly divide into seven-day weeks, an extra paycheck could still occur, resulting in 27 pay periods in one year.

Understanding Semimonthly And Biweekly Pay Schedules

The Indeed Editorial Team comprises a diverse and talented team of writers, researchers and subject matter experts equipped with Indeed’s data and insights to deliver useful tips to help guide your career journey.

When starting a new position, one of the first questions you’ll want to know is how much you’re getting paid. The next most frequent question is when you’re getting paid. Understanding pay schedules can help you organize your money, create an adequate budget and make the most of added wages, like overtime hours. This article discusses the differences between and advantages of semimonthly and biweekly pay schedules.

Don’t Miss: How To Help Cramps During Period

More Straightforward Calculation Of Overtime Pay

There are benefits to bimonthly payments for both employees and the organization. For example, the payroll department often finds it easier to calculate overtime pay when employees are on a biweekly pay schedule. Because they typically calculate overtime based on an entire workweek, there’s never a need to split overtime between two pay periods. This can often occur with semimonthly pay schedules, which adds some minor complications to the payroll process.

Related: Your Guide to How Overtime Is Calculated

What Is The Difference Between Pay Period And Pay Date

A pay period is the length of time during which you work, and a pay date is the day on which your team receives their paychecks.

Letâs explore these concepts further.

A pay period is the time frame in which work is being done and paid for. For budgeting purposes, remember this would include any time your team is on the clock, including any onboarding or training time. Pay periods are typically referred to by their number.

Specifically, a bi-weekly payroll schedule has 26 pay periods per year. So the first two weeks of January would be pay period one, and the second two weeks of January would be period two, and so forth.

A pay date is the date on which companies pay employees for their work. Friday is the most common payday.

It can take a few days to process payroll. Therefore, the last day of the pay period is typically not when employees get paid for their work from that pay period. The pay date for the current pay period might be on the last day of the following pay period. If you use payroll software like Hourly, your employees can see their pay stubs even as payroll is processing.

Also Check: Do You Start Birth Control On Your Period

How Pay Periods Work

Employers set a regular pay period to ensure their employees receive consistent paychecks. While most companies base their pay schedule on the needs of the business, there are labor laws in place that govern the minimum consistency with which these schedules must comply.

Before choosing your pay schedule, its important to know how often your state requires employers to process payroll, which we detail in our state payroll guides.

Check out our state payroll directory for details.

Employers consider the minimum frequency at which they can legally process payrollusually monthlyto set a regular pay schedule. Remember, every pay schedule includes start and end dates for time worked and a payday on which employees receive their paychecks. The payday varies depending on the employer some designate the payday to be the last date of every pay period, while others may opt to pay a week after the pay period ends.

If youre using a professional employer organization , your payday options may be limited .

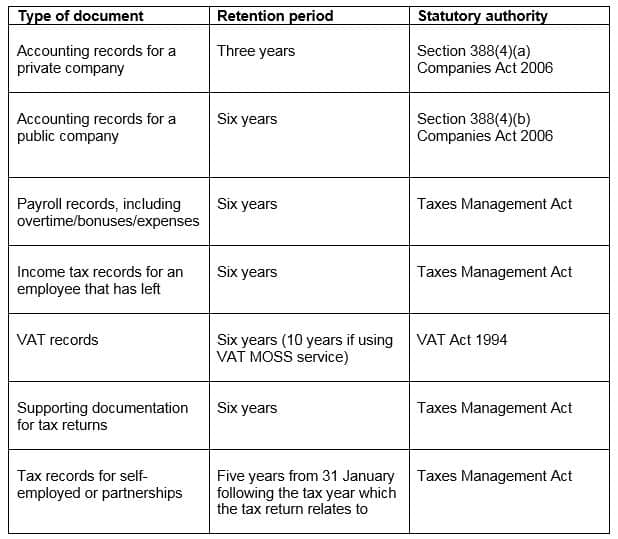

Failure To Maintain Correct Records

Employers are required under the FLSA to preserve pay records for three years, and certain states may demand even longer. Accurate records also assist ensure that personnel is appropriately designated as exempt, non-exempt, or independent contractors, allowing your company to stay in compliance with labor and tax rules.

Don’t Miss: Can A Uti Mess Up Your Period

How Do I Determine Which Pay Period Is Best For My Business

First, consider your companys cash flow. When in the month does your company have the most revenue at hand to put towards employee payroll? It makes more sense to have payments set for high flow times. If youre uncertain of these times, speak with your accounting department about which days are the best for completing payroll.

Also, keep in mind your companys size. If you are a smaller business with 100 employees or less, a biweekly pay period schedule might work the best. In contrast, if your company has 100 employees or more, a semi-monthly or monthly pay period may be better for your employees. Small businesses should keep the costs of payroll runs in mind when choosing pay period frequency.

Here are some more frequently asked questions about pay periods from employers like you:

- Can I choose any day of the week as a pay period date?

- What is the difference between a pay period and a pay date?

- Can I change my companys pay period during the year?

- Can I use different pay period schedules for each of my employees?

- How can I keep track of my employees pay periods?

When Do You Get Your First Paycheck A Complete Guide

The Indeed Editorial Team comprises a diverse and talented team of writers, researchers and subject matter experts equipped with Indeed’s data and insights to deliver useful tips to help guide your career journey.

When starting a new job, there may be a slight delay in seeing your first paycheck. This can sometimes happen because of a lag between your first workday and the company’s next pay period. However, knowing when to expect your first paycheck can help you plan your budget.

In this article, we discuss when you’ll receive your first paycheck after starting a new job and we review some common payroll deductions so you can calculate your take-home pay.

Don’t Miss: Plan B Missed Period Negative Pregnancy Test

Find Your Gross Income

The income you receive before any tax and benefit deductions is your gross income. This is always included in your pay stub, and is typically the stated salary in your employee contract. Your gross income is the amount you’ll subtract your taxes and benefits from. For example, if you receive an hourly income of $25 per hour and work a 40-hour workweek, your gross income for a week would be $1,000.

Which Pay Period Is Best

From the above, it may seem like there are a lot of options when it comes to choosing a pay period for your employees. That being said, some pay periods are better for certain businesses than others. In order to find the right fit for your business, youll need to take a few factors into consideration.

Don’t Miss: Types Of Birth Control That Stop Periods

How Many Pay Periods Have There Been This Year

27 pay periodsAs we enter 2021, it is important to note that some employers will have 27 pay periods this year due to the extra Friday that falls on the payroll calendar. This is in contrast to the normal biweekly 26 pay periods we see during a typical year.

How many pay periods in a year for semi-monthly?

24 pay periodsSemimonthly pay Employers who choose this schedule can either pay their employees on the first and 15th of the month or on the 16th and last day of the month. Semimonthly pay has 24 pay periods and is most often used with salaried workers.

What year has 27 pay periods?

27 PAY PERIODS IN LEAVE YEAR 2000. For most employees, leave year 2000 began on January 2, 2000, and will end on January 13, 2001. For these employees, leave year 2000 will have 27 pay periods.

Can I Change My Companys Pay Period During The Year

You can technically change your companys pay period during the year, but there are specific laws and regulations set in place by The Fair Labor Standards Act that you should review before you proceed. First, you need to provide a written notice to your employees of the intended changes at least a month before you plan to switch pay periods. Additionally, the FLSA states youll need to pay employees in accordance with the old pay schedule until the new one comes into effect. This helps ensure that there are no significant gaps in pay for your employees.

Also Check: Due Date Calculator For Irregular Periods

Cheque Vs Direct Deposit

Finally, there is the question of whether you intend to pay your employees via cheque or direct deposit. If youre planning to pay your employees with physical cheques, keep in mind that this will mean a lot of your time spent writing cheques and a lot of your employees time spent visiting the bank to deposit those cheques. In this case, less frequent payroll may be the better option.

On the other hand, direct deposit is quick and inexpensive, which lends itself to multiple different payroll schedules.

Common Pay Period Mistakes To Avoid

Mistakes with payroll can result in fines and deeply unsatisfied workers. In fiscal year 2019, the U.S. Department of Labor recovered $322 million in back wages owed to workers. And an average $1,120 was due per employee in back wages in FY 2020. Some common payroll mistakes include the following.

Recommended Reading: 6 Days Late Period How Many Weeks Pregnant

How Does A Biweekly Pay Period Work

- Biweekly pay periods happen every two weeks and typically have 26 pay periods in a year, but if a calendar year contains more than 52 weeks, the total number of pay periods may vary. If figuring this out is confusing, try using a biweekly pay period calculator. A biweekly pay period calendar template is also great for business owners who struggle with creating spreadsheets on their own. A calendar template is a simple way to organize information and keep all your payroll data in one place.

Place Of Payment By Cash Or Cheque

11 If payment is made by cash or cheque, the employer shall ensure that the cash or cheque is given to the employee at his or her workplace or at some other place agreeable to the employee.

Section 11 requires that wages paid by cash or cheque must be given to the employee at the workplace or an alternate location agreed upon by the employee. Such an agreement must be in writing as required under ESA Part I, s. 1. In the absence of such an agreement, payment must be made at the workplace.

Under ESA Part III, s. 7, an employees agent may agree on behalf of the employee to an agreement under this provision to designate some other place for the payment of wages.

Don’t Miss: Why Is My Period Late And I M Not Pregnant

The Bimonthly Pay Period Demystified

A bimonthly or semimonthly pay period occurs twice per month. Be careful with this one while it may appear to coincide with biweekly periods during shorter months, it’s not an exact match. A biweekly pay period means that there will be 26 pay periods per year, whereas a bimonthly pay period will have 24.

How Is A Pay Period Calculated

Companies decide what pay period length they want to run their payroll on.

This can be based on a variety of factors, like when the company gets paid for its products and services, how often employees need money, and whether you have hourly employees or if your team is on an annual salary schedule. Thereâs also state law to factor in â you may prefer to pay monthly while state law requires bi-weekly payments.

For example, a company that employs mostly hourly workers might find it beneficial to have a week-long pay period. Weekly payments are easier for financial planning and make employees happier by giving them access to more readily available cash flows.

However, a company that bills its clients at the end of the month and has mostly salaried employees may prefer to pay its employees less frequently â a bi-weekly basis is typical.

Also Check: Why Am I Sad On My Period

What Is A Semimonthly Pay Schedule

If you’re on a semimonthly pay schedule, you’ll receive two paycheques per month, a total of 24 paycheques throughout the year. Your employer will pay you in the middle of the month and on the last day of the month, or sometimes the first day of the following month. The two typical schedules are the 1st and 15th, or the 15th and final day of the month.

If you are a salaried employee on a semimonthly pay schedule, your employer may choose to divide your salary equally between 24 pay periods. Because the days within a month vary, and the days of work within each pay period differ, it’s usually easiest for a company to divide your payments equally and provide a consistent paycheque.

Related: How to Calculate Gross Pay

For example, if your annual salary is $50,000, your employer may elect to split up your compensation equally between 24 pay periods. This would provide $2,083 per paycheque before deductions.

Suppose you are an hourly paid employee or a salaried employee whose company chooses not to divide your compensation equally. In that case, you will need to be prepared for slight changes in your paycheque on a semimonthly pay schedule. Depending on the number of hours you worked between the 1st and 15th and the 15th and the end of the month, your paycheque will vary with each pay schedule.

Related: Gross Pay vs. Net Pay: Definitions and Examples