What Is The Medicare Open Enrollment Period

The Medicare Annual Enrollment Period can feel like a chaotic time for many of those on Medicare. Many worry that they may enroll into the wrong plan or not realize the changes happening to their current plan. Its all too easy to misunderstand the rules or forget to check whether a certain doctor is in the network. Those enrolled in Medicare Advantage plans sometimes find themselves stuck in a plan that they do not like, due to mistakes like these. The Medicare Open Enrollment Period is designed specifically to help Medicare beneficiaries in these situations.

Deferring Enrollment Before It Starts

If you want to defer your enrollment, you will have to contact the Social Security Administration to make sure that you arent enrolled in Medicare. This should be a straightforward process, but make sure that you do it as soon as you can, so you dont pay any premiums and then have to cancel later.

How Do I Prepare For My Medigap Open Enrollment Period

When you start the Medicare journey as a future Medicare beneficiary, many try and research everything themselves.

Unfortunately, like so many other subjects, theres a lot of misinformation available. There are also many examples of overcomplicated explanations intending to confuse you.

The best thing you can do early is to speak with a licensed insurance broker. Find someone that represents most of the carriers in your area.

Do not use an agent that only offers one or two carriers. They work for the insurance company, not you. The plan they offer may be good for you, but there could be something that fits your needs better.

Start your enrollment process in Medicare as soon as you can. The sooner you have this taken care of, the easier the process will be.

Some carriers require your Medicare card to enroll in a Medigap plan. Others carriers do not require the Medicare card at the time of application. They will request a copy of it before the Medicare Supplement plan starts.

Lock in your rate early. Medigap plans usually have an annual rate increase. Some carriers like Mutual of Omaha will lock in your rate for 12 months based on the price at the time of application. Sometimes, this results in lower rates for the first 12 months of your policy.

To Recap:

- Apply for Medicare A and B during your Initial Enrollment Period

- Speak with a licensed agent that represents several carriers

- Do not over research

Read Also: 90 Day Employment Probationary Period Template

How To Enroll In And Change Medicare Plans

Once youve signed up for Medicare, youll have several options for changing certain aspects of your health coverage. Heres an outline:

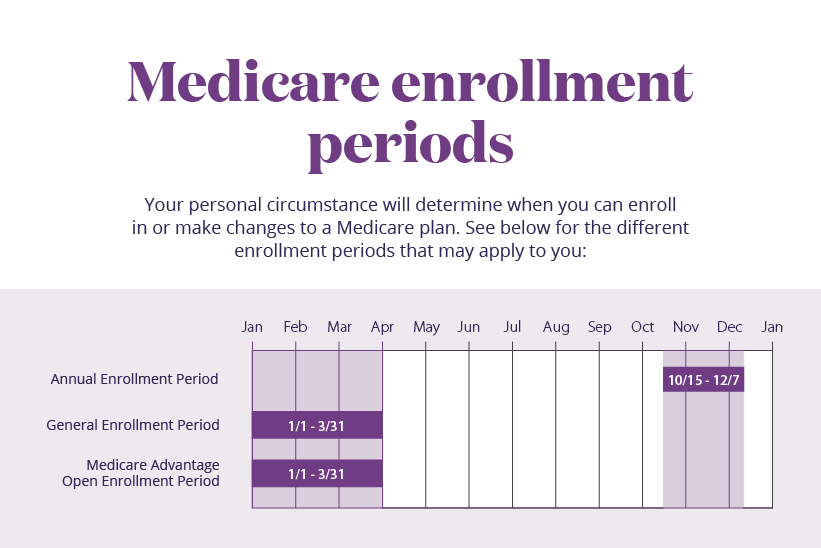

During the annual open enrollment window , you can make several changes, none of which require medical underwriting:

- Change your Medicare Advantage plan to Original Medicare or vice versa.

- Switch from one Medicare Advantage plan to a different one.

- Change from one Medicare Part D prescription plan to another. It is strongly advised that all recipients use Medicares program finder tool each year to compare available Part D plans, rather than simply allowing an existing drug plan to auto-renew.

- Sign up for a Medicare Part D plan.

- You can cancel your Part D coverage entirely.

During the Medicare Advantage open enrollment period, US citizens who already registered in Medicare Advantage plan can:

- Change to Original Medicare plan

- Change to a new Medicare Advantage plan.

- Only one plan alteration is allowed .

During the five-star registration period , persons who reside in a state with a five-star Medicare Advantage plan or Medicare Part D can switch to that program.

During the first year of Medicare Advantage enrollment, a person can change to an Original Medicare plan and a Part D coverage. They also have full access to a Medigap plan, with some exceptions.

A person registered in Original Medicare can apply for a new Medigap plan at any time of the year.

How Does Medicare Open Enrollment Work

Medicare consists of a few key parts. Original Medicare refers to Part A and Part B, the basic parts of Medicare that cover hospital care and outpatient care. There is also Medicare Part D, prescription drug coverage, and Part C, which allows you to receive Medicare benefits through a private insurance company.

If you would like to make changes to your Medicare coverage, there are options available. If you only have Part A, you can add on Part B, and vice versa.

Part D is offered through private insurance companies, and you may want to keep that coverage but simply switch to a different plan. These are the types of scenarios Medicare Open Enrollment is for: you are able to change any part of your coverage you like, to mix and match the parts.

Donât Miss: Usaa New Car Insurance Grace Period

Also Check: Can You Donate Plasma On Your Period

C: Medicare Advantage Plans

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as “Medicare+Choice”. As of the Medicare Modernization Act of 2003, most “Medicare+Choice” plans were re-branded as “Medicare Advantage” plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

You May Like: Period Blood Stains On Sheets

Preparing For Your Medicare Supplement Open Enrollment

Those who plan and apply for Medicare early will receive their Medicare card before their 65th birthday month. If you have your Medicare card, we can submit your Medigap application before your Part B effective date. The carrier will process your application as if youre already in your Medigap Open Enrollment Period, with no health questions.

Once you apply for Medicare, theres no need to wait to enroll in a supplement plan until you turn 65. With rates constantly changing, we often help our clients lock in their Medigap plan months before their 65th birthday. Keep in mind, you wont be able to buy the policy until youre 65 and have Part B.

What Is The Medicare Advantage Open Enrollment Period

by The Medicare Gal | Feb 15, 2022 | General Medicare Information |

Did you know that you might be able to change your Medicare Advantage plan during Medicare Advantage Open Enrolment Period?

Its true. Whether youve just enrolled in Medicare or have been with your current plan for years, you have an opportunity to change plans during the Open Enrollment Period , which is DIFFERENT from the Annual Election Period .

There are many reasons people may decide to change their MAPD plan during this time. Sometimes their current doctor or providers may no longer accept their current plan. Maybe their plan changed and they didnt realize it.

Or they may find another plan that offers additional benefits such as a gym membership, or wellness services. Often Medicare beneficiaries are looking for better coverage on services such as dental, vision, or hearing. For whatever reason, if you are not happy with your current MAPD plan, you can enroll in a new MAPD plan during the open enrollment period .

Recommended Reading: Usaa New Car Insurance Grace Period

When Working Past : 8

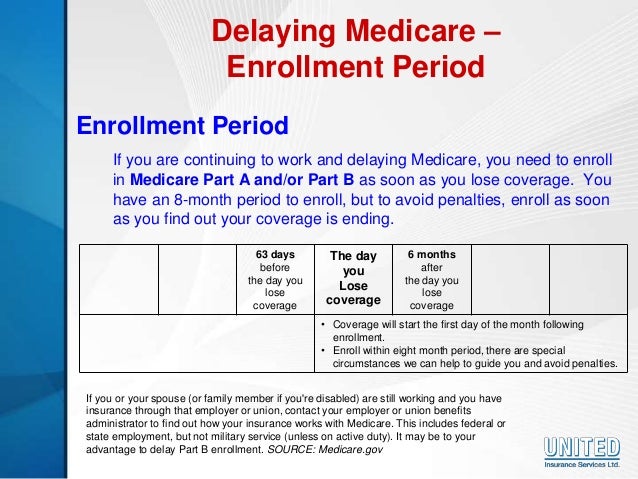

For people who work past 65 and qualify to delay Medicare with creditable employer coverage, there is an 8-month Special Enrollment Period that allows you to enroll in Part A , Part B , Part C and Part D without late penalties.

This Special Enrollment Period is tricky though. Why? Because while you have the whole 8 months to get Parts A & B, you only get the first 2 monthsto enroll in Part C or Part D without penalty. If you enroll after the two-month mark, youll face late enrollment penalties for Part D .

To qualify for the Part B Special Enrollment Period, you must have creditable employer or union health coverage based on current employment. Your Special Enrollment Period will begin eight months after your employer coverage ends or you leave your job, whichever happens first.

Medicare Special Enrollment Periods

If you miss the 7-month window of your initial enrollment period, you may have an opportunity to sign up for Medicare during a special enrollment period . You may be eligible for a SEP if:

- Through your current employment, youre covered under a group health plan, allowing you to sign up anytime outside of your initial enrollment period for Medicare parts A and/or B. You qualify for this SEP if you or your spouse is working and, based on that work, youre covered by a group health plan through the employer.

- Your employment or the group health plan from that current employment ends, in which case you have an 8-month SEP starting the month following those terminations. COBRA and retiree health plans are not considered coverage based on current employment, so youre not eligible for a SEP when that coverage ends.

- You have a health savings account with a high-deductible health plan that is based on your or your spouses employment. Although you can withdraw money from your HSA after enrolling in Medicare, you should stop contributing to your HSA a minimum of 6 months prior to applying for Medicare.

- Youre a volunteer serving in a foreign country, for which you may qualify for a SEP for Medicare Part A or Part B.

- change from original Medicare to a Medicare Advantage plan

- change from a Medicare Advantage plan to original Medicare

- join, drop, or switch Part D

- switch from one Medicare Advantage plan to another

Recommended Reading: Employee Probationary Period Template

What Part B Covers

Part B covers a wide range of outpatient services including Durable Medical Equipment, prosthetics, orthotics, and medical supplies.

Medicare Part B covers about 80% of medically necessary services that dont require a hospital stay. An annual deductible applies before this sharing of medical costs begins, and in 2021 that deductible is $203.

Over the course of a year, the deductible and 20% of expenses can add up to a significant amount, particularly for those with complex medical needs.

The remedy for the twenty percent payment may be a Medicare Supplement policy.

Get A Medicare Agent To Help Avoid Penalties

There are several penalties related to missing Medicare enrollment deadlines. Have a Medicare agent on your side to ensure youâre on track and have the coverage you need when you need it.

Our licensed insurance agents at Sams/Hockaday have been helping individuals through the Medicare process for over 40 years. Call us to schedule your appointment at 217-423-8000!

Recommended Reading: 90 Day Probationary Period Policy Examples

Iv Signing Up For Medicare Supplement Insurance

During your initial Medigap open enrollment period , you cannot be denied a Medigap plan or charged more for it because of your medical history.

Nevertheless, once that period ends, Medigap insurance providers in most states can use medical underwriting to determine your premium costs and eligibility for coverage. (New York, Missouri, Maine, Massachusetts, Connecticut, California, Washington, and Oregon, have laws that make it easier for people to sign up or switch to a new Medigap coverage after the initial open enrollment period has ended.

Thirty-three states offer a guaranteed issue window during which you can buy a Medigap plan if you are below the age of 65 and qualify for Medicare due to a disability. However, in most of those states, carriers can charge higher rates for people under 65. You can see how Medigap plans are regulated in each state by checking out NewMedicare.com.

To learn more about Medigap policies in your area, contact your states insurance department or the states health insurance assistance program, or call 844-844-3049 to speak with one of our agents who can help you find a health plan in your region.

Open Enrollment Period For Medicare Supplement Plans

- Once-in-a-lifetime window

- Begins the same day as your Part B effective date

- No health questions during this time

- Not the same as the Medicare Annual Enrollment Period

Applying outside your open enrollment window can result in higher premiums, as well as restrict your coverage options. This window only lasts for six months for each new beneficiary.

Your Medicare Supplement Open Enrollment Period is not the same as the fall Annual Election Period. AEP pertains to Medicare Advantage and Part D plans and the dates are the same every year. With your individual Medigap Open Enrollment Period, the dates are unique to you and it only concerns Medicare Supplement plans.

Your individual Medicare Supplement Open Enrollment Period starts the first day of the month your Part B is in effect. You must also be 65 for this window to begin. For example, if your Part B coverage begins April 1st, then your individual Medicare Supplement Open Enrollment Period window will start then and continue for six months, ending September 30th.

For most, this period starts when they age into Medicare at 65 and enroll in Part B. Yet, others choose to delay enrolling in Part B due to through their large employer group plan. When they do retire and enroll in Part B, their Medicare Supplement Open Enrollment Period will commence on their Part B effective date.

Don’t Miss: 90 Day Probation Period Template