Open Enrollment And Special Enrollment Periods

Learn more about enrolling in a plan or making changes to your current plan.

There are certain times during the year when you can buy a health plan directly through Cigna or on the Health Insurance Marketplace. These periods of time are called the Open Enrollment and the Special Enrollment periods.

When to shop for health insurance on the Marketplace

What You Cant Do During Open Enrollment

You cant enroll in Parts A or B, and you cant enroll in a Medicare Advantage plan if you dont already have Original Medicare. You also cant enroll in a Medigap plan.

The best time to enroll in Parts A and B is often during your initial enrollment period or, for Medigap, during the Medigap open enrollment period. You can enroll in Parts A, B, and D or a Medicare Advantage plan during the general enrollment period if you miss your initial enrollment period. Your coverage would start July 1 in the year you signed up in this case.

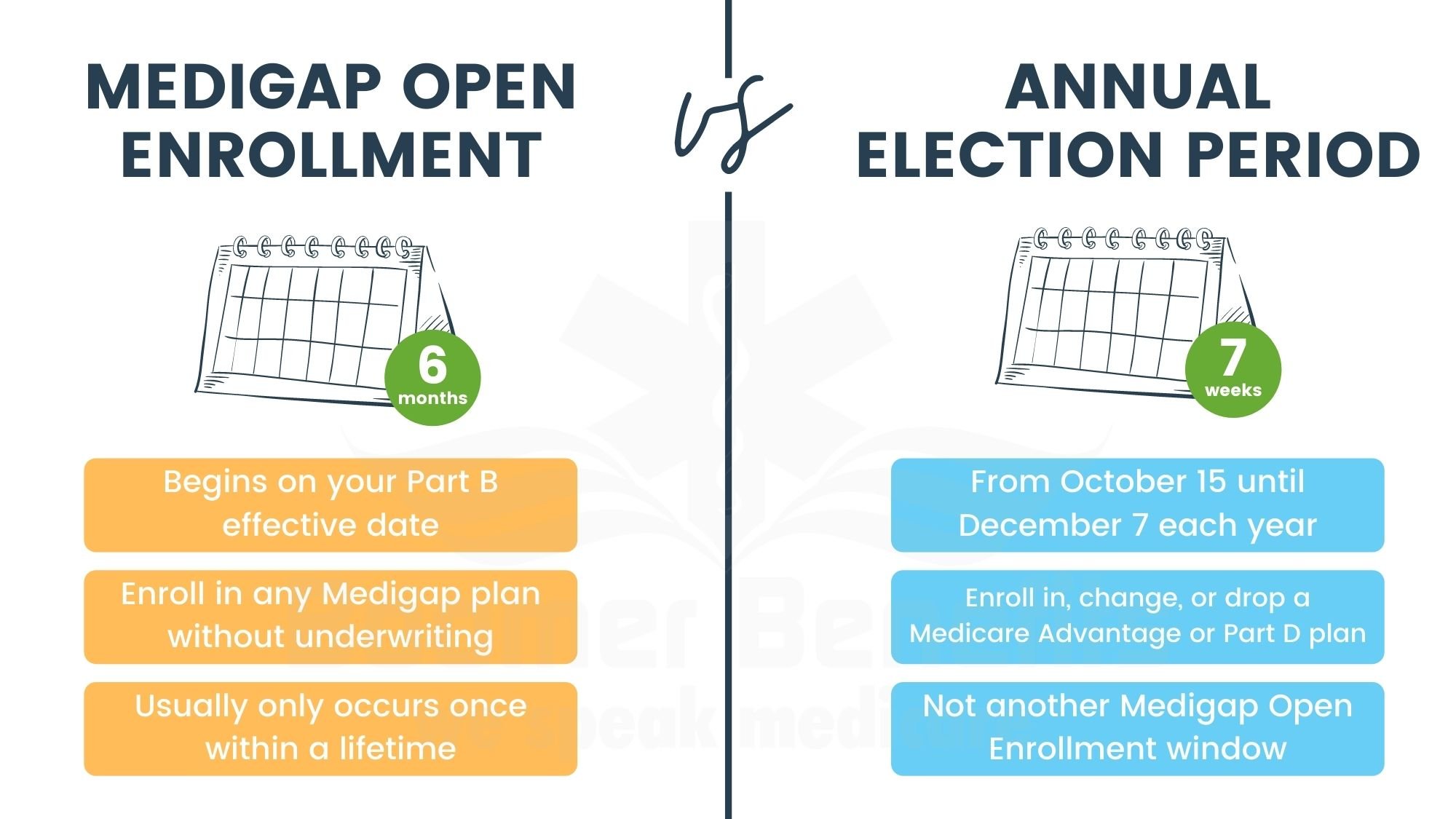

Medicare Supplement Open Enrollment

Medicare supplement plans, also known as Medigap, do not have specific enrollment periods. You can buy a Medigap plan during the 6-month period that starts the first day of the month when you turn 65. You need to be enrolled in Medicare Part B to apply for a Medicare supplement plan.

For people who are new to Medicare, you may be eligible for guaranteed issue rights, which means that an insurance provider cannot refuse to sell you a Medigap policy. This is the best time to enroll in a Medigap plan since you are guaranteed coverage.

You may also apply for a Medigap policy if you choose to drop your Medicare Advantage plan and return to Original Medicare.

Read Also: How Many Days After Period Fertile

Prepare For Medicare Annual Open Enrollment Period Now

Sovereign Select LLC is an independent insurance agency offering a wide array of insurance products from many different companies. With over 30 insurance companies products to choose from they offer health, life, long term care, dental, and specialize specifically in Medicare Supplements, Medicare Advantage plans, and Part D Prescription drug plans. They are able to custom fit individuals with an insurance program that best meets their specific needs. Call 262-641-4111 or email for more information. For more information, please visit www.sovereignselectins.com

Special Enrollment Is The Exception To Open Enrollment

Insurance plans that use an open enrollment system also have an exception that allows you to enroll outside of open enrollment under extenuating circumstances known as qualifying life events. When you experience a qualifying event, you’re eligible for a special enrollment period that allows you to sign up for health insurance outside of open enrollment. Qualifying life events encompass a variety of circumstances, including:

- involuntarily losing other health insurance coverage

- moving out of your old plan’s service area, or to an area where different health plans are available.

- getting married

- having a new baby or adopting a child

You won’t be eligible for a special enrollment period if you lost your other health insurance because you didn’t pay the monthly premiums though, or if you voluntarily canceled your prior coverage.

Note that although qualifying events and special enrollment periods in the individual market are similar to those that have long existed for employer-sponsored plans, they are not identical. Healthinsurance.org has a guide that pertains specifically to special enrollment periods in the individual market, on and off-exchange. And the Society for Human Resource Management has a good summary of qualifying events that trigger special enrollment periods for employer-sponsored health insurance.

Read Also: Is It Okay To Miss A Period

What Does A Medicare Supplement Insurance Plan Cover

Medicare Supplement insurance plans are standardized, and in most states theyre labeled A through N . These plans may cover a range of health-care costs, such as Medicare Part A coinsurance, blood, skilled nursing facility care coinsurance, Part A and Part B deductible**, and foreign travel emergencies up to plan limits.

While all Medicare Supplement insurance plans cover Medicare Part A coinsurance at 100%, the rest of the benefits vary among plans. For example, in 2021, Medicare Part A out-of-pocket costs include a $1,484 deductible for each benefit period. You typically pay a $371 coinsurance per day of hospitalization for days 61-90 for each benefit period, and a $742 daily coinsurance after that, up to a lifetime limit. Beyond Part A coinsurance, not all Medicare Supplement insurance plans cover all benefits at the same percentage.

Keep in mind that Medicare Supplement insurance plans only work with Original Medicare. You cant use these plans to pay for Medicare Advantage costs.

*Pre-existing conditions are generally health conditions that existed before the start of a policy. They may limit coverage, be excluded from coverage, or even prevent you from being approved for a policy however, the exact definition and relevant limitations or exclusions of coverage will vary with each plan, so check a specific plans official plan documents to understand how that plan handles pre-existing conditions.

New To Medicare?

Also Check: Employee Probationary Period Template

Why Do We Have Anopen Enrollment Period

The open enrollment period was put into place to discourage adverse selection which happens when sick people sign up for health insurance and healthy people dont. It greatly skews the amount of financial risk a health plan takes when insuring customers. It also helps protect people from the risk of not having health insurance when they incur expensive, unexpected medical care or have an existing chronic condition. During an open enrollment period, individuals cannot be turned down for ACA-compliant health insurance because of their health status.

Don’t Miss: Is It Normal To Have A Smell After Period

Medicare Initial Enrollment Period

The earliest time you can enroll in Original Medicare, a Medicare Advantage plan or a Medicare Part D prescription drug plan is during your Medicare Initial Enrollment Period .

Your Initial Enrollment period lasts for seven months:

- It begins three months before you turn 65

- It includes your birth month

- It extends for another three months after your birth month

If you are under 65 and qualify for Medicare due to disability, the 7-month period is based around your 25th month of disability benefits.

Who Can Enroll In Aca

Medicaid and CHIP enrollment is available year-round to eligible residents.

Year-round enrollment is also available in the Basic Health Programs in New York and Minnesota. Enrollment is also available year-round for the ConnectorCare program in Massachusetts, for people who are newly eligible or who havent enrolled before.

Native Americans and Alaska Natives can enroll year-round in plans offered in the exchange. Applicants who are eligible for Medicaid or CHIP can also enroll year-round. This is true every year, not just in 2021.

And CMS has finalized a new rule that allows people with income up to 150% of the poverty level to enroll year-round, as long as the American Rescue Plans subsidy enhancements remain in effect. This is currently in place through the end of 2022, but might be extended by Congress. This special enrollment period is optional for state-run exchanges, although several of them had already rolled it out as of early 2022. This special enrollment opportunity will be available on HealthCare.gov by late March 2022, but was available as of February for people who used the HealthCare.gov call center to enroll.

Also Check: Will I Get My Period On Lo Loestrin Fe

Original Medicare Open Enrollment Period

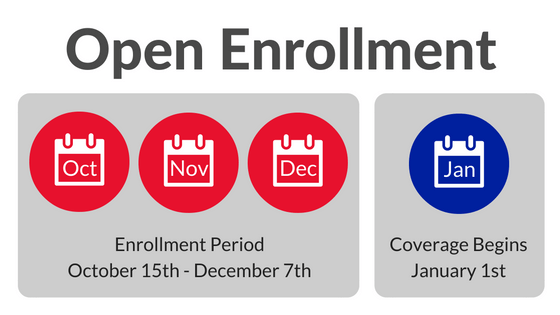

If you have Original Medicare, which includes Medicare Part A and B, the open enrollment period for your Medicare plan is between October 15th and December 7th each year. Within this period, you can make the following changes to your Medicare plan:

- Enroll in Medicare Advantage from Original Medicare

- Disenroll from Medicare Advantage to Original Medicare

- Enroll for Medicare prescription coverage or Part D

- Change your Medicare Part D plan

- Switch from one Medicare Advantage plan to another

It is important to note that if you did not enroll for Medicare when you first became eligible, you cannot enroll in a Medicare plan for the first time during the open enrollment period. The open enrollment period is for people who already have a Medicare plan but would like to switch the plan or purchase additional plans like Part D.

When Is The Medicare Open Enrollment Period

The Good Brigade / Getty Images

Meredith Mangan is a senior editor for The Balance, focusing on insurance product reviews. She brings to the job 15 years of experience in finance, media, and financial markets. Prior to her editing career, Meredith was a licensed financial advisor and a licensed insurance agent in accident and health, variable, and life contracts. Meredith also spent five years as the managing editor for Money Crashers.

Medicare is a government health insurance program for people 65 and older, as well as for people with certain disabilities and end-stage renal disease. Most people are eligible to enroll in Original Medicare , Part D, and Medicare Advantage plans during their initial enrollment period when they turn 65. Open enrollment is the time to do so if you want to make changes to your existing coverage or add Part D drug coverage.

Recommended Reading: What To Do When Your Dog Starts Her Period

What Types Of Insurance Have An Open Enrollment Period

Most health insurance plans have an Open Enrollment Period. This includes many workplace-based plans, including those offered by employers with more than 50 employees, individual policies you buy on your own for yourself or your family, and Medicare.

Since the passage of the Affordable Care Act in 2010, millions of people have been able to buy an individual plan through the state or federal Health Insurance Marketplace for whats often called Obamacare health insurance.

Plans sold on the exchange must cover preexisting conditions and 10 essential health benefits,1 including preventive and wellness services, hospitalization and outpatient care, prescription drugs, and pregnancy, maternity and newborn care.

And only policies sold on the exchange offer Obamacare subsidies for those who qualify based on income. These are discounts on your monthly health insurance payments and are also known as premium tax credits. You could also be eligible for cost-sharing reductions, which lowers the amount you pay for deductibles, copayments and coinsurance and also reduces your out-of-pocket maximum.

Open Enrollment Periods also apply to individual or family plans you can buy directly from an insurance company outside the exchange.

How To Sign Up For And Change Medicare Plans

Once youre enrolled in Medicare, youll have various opportunities to change certain aspects of your coverage. Heres an overview:

- During the annual open enrollment period , you can make a variety of changes, none of which involve medical underwriting:

- Switch from Medicare Advantage to Original Medicare or vice versa.

- Switch from one Medicare Advantage plan to another.

- Switch from one Part D prescription plan to another. Its highly recommended that all beneficiaries use Medicares plan finder tool each year to compare the available Part D plans, as opposed to simply letting an existing drug plan auto-renew.

- Join a Medicare Part D plan.

- Drop your Part D coverage altogether.

Read Also: What Happens If You Miss Your Period For A Month

When Is Open Enrollment

You can learn more in our comprehensive guide to individual market open enrollment.

Employers can set their own open enrollment windows, so although its common for them to occur in the fall, they vary from one employer to another.

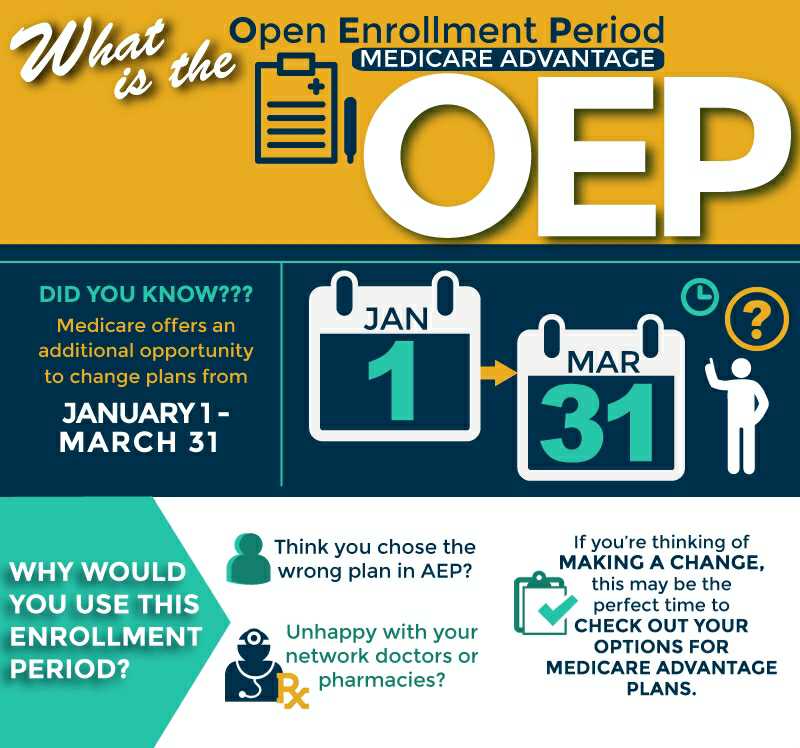

Medicare also has an annual open enrollment period in the fall for Medicare Part D and Medicare Advantage, as well as an open enrollment period at the start of the year for people who are already enrolled in Medicare Advantage.

You can learn more in our comprehensive guide to Medicare open enrollment.

When Can I Buy Health Insurance

Open Enrollment happens once a year, from November 1 to January 31. It is typically the only time you can enroll in coverage unless you have a qualifying life event.

Certain life-changing events such as getting married, moving, or losing job-based health coverage qualify you for a Special Enrollment Period . Some life events, such as pregnancy, having a baby, or adoption qualify you for an SEP and allow you to enroll in coverage with an earlier effective date. Certain life-changing events also allow consumers to make changes to their current coverage.

A new Special Enrollment Period is available for consumers based on yearly household income. Consumers with an annual income up to 200% of the Federal Poverty Level can now qualify for a Special Enrollment Period and can access nearly free health plans throughout the year.

If you qualify for an SEP, you usually have up to 60 days after the event to enroll or change your plan.

Also Check: Can I Get Pregnant Right Before My Period

I Want To Enroll In Medicare What Are My Next Steps

Once youâre ready to enroll in Medicare, youâll want to consider the following next steps:

C: Medicare Advantage Plans

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as âMedicare+Choiceâ. As of the Medicare Modernization Act of 2003, most âMedicare+Choiceâ plans were re-branded as âMedicare Advantageâ plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

Read Also: Home Remedies To Stop Prolonged Periods

Get A Medicare Agent To Help Avoid Penalties

There are several penalties related to missing Medicare enrollment deadlines. Have a Medicare agent on your side to ensure youâre on track and have the coverage you need when you need it.

Our licensed insurance agents at Sams/Hockaday have been helping individuals through the Medicare process for over 40 years. Call us to schedule your appointment at 217-423-8000!

Recommended Reading: 90 Day Probationary Period Policy Examples

Medicare Part D Prescription Drug Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes prescription drug coverage

- Enroll in a Medicare Part D standalone prescription drug plan

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent.

You can also enroll in a prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

Read Also: Natural Remedies For Severe Period Cramps

When Is Medicare Enrollment

Turning 65 or retiring in the near future? It could be time to choose your Medicare coverage. There are a number of different Medicare enrollment periods. One key Medicare enrollment period for changing your coverage is called the Annual Enrollment Period . This happens from October 15 to December 7 every year. During AEP, you can join, switch or drop a plan. If you dont make any changes during AEP, your current plan will automatically renew the next year.

Still Need 2022 Coverage

The 2022 open enrollment period has ended, but you may be able to enroll now if you qualify for one of the following:

- Special enrollment period: If you experience a major life event, like having a baby, turning 26 or losing your job, you may qualify to enroll in private health insurance outside the annual open enrollment period.

- Year-round enrollment: If you qualify for Medical Assistance or MinnesotaCare, or are a member of a federally recognized American Indian tribe, you can enroll any time of year.

Recommended Reading: How To Calculate My Last Period

How To Find A Policy That Works For You

As you approach 65, you want to start thinking about your health insurance plans â especially if you plan to use a combination of original Medicare and Medigap for your coverage.

There are ten standardized Medigap plans. Each is the same across every state, though not all states will offer all the available plans.

If you decide to go this route, here’s how to get started:

- Review the plans offered in your area.

- Pick the policy that looks best for you.

- Once you’re ready to buy, purchase your plan.

Remember, doing this within the open enrollment window will guarantee your coverage. However, if you decide to buy a Medigap plan later, you may not have that same guarantee.