On What Markets Should I Use Rsi

Technically, you can use RSI on any market / timeframe. However, in the market on a strong trend, the indicator may remain in the overbought or oversold condition for a long period of time. Therefore, if you want to trade the classic RSI signals, choose a balanced market with alternating bullish and bearish movements.

How To Start Using Swing Trading Indicators

Any traders should start using swing trading indicators before opening any position. Generally, you will look for good entry points by using swing trading indicators.

It would also be best if you used the indicators to monitor the positions while they are open. By doing this, you can exit the market at the right time and take the maximum profits.

Interpretation Of Rsi And Rsi Ranges

During trends, the RSI readings may fall into a band or range. During an uptrend, the RSI tends to stay above 30 and should frequently hit 70. During a downtrend, it is rare to see the RSI exceed 70. In fact, the indicator frequently hits 30 or below.

These guidelines can help traders determine trend strength and spot potential reversals. For example, if the RSI cant reach 70 on a number of consecutive price swings during an uptrend, but then drops below 30, the trend has weakened and could be reversing lower.

The opposite is true for a downtrend. If the downtrend is unable to reach 30 or below and then rallies above 70, that downtrend has weakened and could be reversing to the upside. Trend lines and moving averages are helpful technical tools to include when using the RSI in this way.

Be sure not to confuse RSI and relative strength. The first refers to changes in the the price momentum of one security. The second compares the price performance of two or more securities.

Don’t Miss: How To Skip Period On Birth Control Pills

How Will The Rsi Setting Change The Indicator Trading Signals

The RSI setting will affect how frequently the RSI gives overbought and oversold signals as well as divergence signals to buy and sell.

What does RSI 14 mean? The default RSI setting for the RSI indicator is 14-periods. That means the indicator is calculated using the last 14 candles or last 14 bars on the price chart.

Using a shorter timeframe, for example 5-periods will cause the RSI reach extreme values more often. By the same token, longer timeframe settings will see the RSI indicator reach above 70 or below 30 less frequently.

The below shows how to change the various settings in the FlowBank trading platform.

How To Get Rsi Alerts

Luckily it’s easy to setup alerts, when trading RSI. This means that you don’t have to sit in front of your computer all day, in order to spot RSI trades.

There are 3 simple steps to using an alerts indicator for RSI divergence trading:

You can download easy-to-use RSI indicators here.

Don’t Miss: How Do You Know When Your Period Is Ending

Modify Rsi Levels To Fit Trends

The primary trend of the security is important to know to properly understand RSI readings. For example, well-known market technician Constance Brown, CMT, proposed that an oversold reading by the RSI in an uptrend is probably much higher than 30. Likewise, an overbought reading during a downtrend is much lower than 70.

As you can see in the following chart, during a downtrend, the RSI peaks near 50 rather than 70. This could be seen by traders as more reliably signaling bearish conditions.

Many investors create a horizontal trendline between the levels of 30 and 70 when a strong trend is in place to better identify the overall trend and extremes.

On the other hand, modifying overbought or oversold RSI levels when the price of a stock or asset is in a long-term horizontal channel or trading range is usually unnecessary.

The relative strength indicator is not as reliable in trending markets as it is in trading ranges. In fact, most traders understand that the signals given by the RSI in strong upward or downward trends often can be false.

The Flow Of Net Imbalances

Each day, there are tons of orders placed to get the closing print .

These are usually institutions like mutual funds and ETFs that require the massive liquidity provided at the market close. A few minutes prior to the close each day, the exchanges will disseminate information on the order imbalances at the market close.

That is, how many more shares are being bought than sold at the close? For example, if market-on-close buy orders are equalling 100,000 shares, and sell orders equalling 90,000 shares, thats a +10,000 share imbalance.

If there are persistent closing buy imbalances in one sector, its indicating that institutions are accumulating a position in that stock. This gives us vital information that a significant price move might be on the precipice.

The tool I use to gauge imbalance money flow is MarketChameleon. MC allows you to simply view 20-day or 50-day moving averages of capital inflows and outflows of sectors, industries, indexes, or watchlists.

Heres an example showing the 20-day moving average of daily imbalances in the financial sector:

As you can see, recently, the financial sector has seen an average of $50M of net sell imbalances each day, indicating moderate liquidation of financial services stocks by institutions.

This is an indicator to be combined with other indicators. Tracking money flow provides you a top-down view of the market. The flow tells you which areas of the market money are leaving, and where it is headed.

Also Check: What Is Considered Heavy Period Bleeding

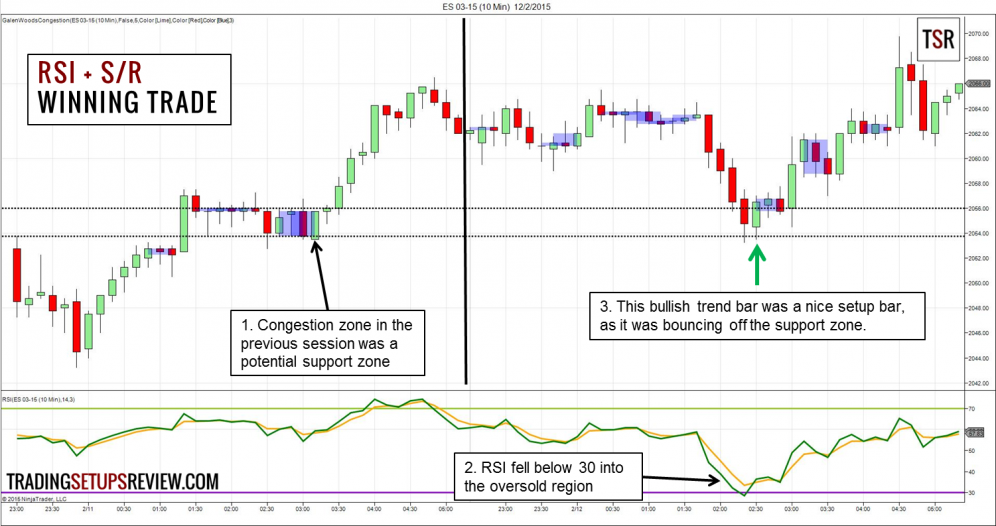

Support And Resistance Lines

A swing trader should always operate with support and resistance lines since its the most relevant when determining an assets price point that has had trouble exceeding in the period.

In short, the resistance level is an imaginary line that the price finds challenging to break and usually bulls back. While the support level is an imaginary line made of recent lows, which shows the price stops declining and bounces back. If theres a breakout within these lines, the price usually moves in the breakout direction.

Short Selling In Equities

As a beginner in the stock market, you should never begin trading by going short.

The reason is that the stock market and equities, as a whole, always go up in the long term. If you decide to go short on this long term trend, you are making things very hard for you. Instead of having the upward drive working in your favor as a trader who goes long has, it works against you.

Finding edges and strategies that work well for shorting equities is MUCH harder than finding strategies that go long. This is the main reason why traders should only focus on going long at the beginning of their trading career.

Also Check: What To Expect On Your Period

Testing The Rsi Signals

Strategy Testing

Strategy tester indicates that with this approach, when the trader is always in position, trading on the RSI signals on a four-hour on USDJPY chart showed a profit factor of 1.45. It is a worthy result, but 50 trades is not enough to prove the efficiency of the strategy. After performing more tests, we came to a conclusion that in the longer run, the result of based on the RSI indicator becomes less optimistic.

Is There Nothing Good To Find Online

Well, there certainly is, but for a beginner with no point of reference, it certainly is not easy. This is why we recommend you to never take a swing strategy you read online for a working strategy. Instead, use it as inspiration We certainly have been able to build strategies from ideas that in themselves were worthless, but that managed to spark an idea that led us right eventually.

Having said all this, lets explore swing trading strategies by first looking at the most common types of swing trading strategies!

You May Like: Can You Get Pregnant 10 Days After Your Period

How The Relative Strength Index Works

As a momentum indicator, the relative strength index compares a security’s strength on days when prices go up to its strength on days when prices go down. Relating the result of this comparison to price action can give traders an idea of how a security may perform. The RSI, used in conjunction with other technical indicators, can help traders make better-informed trading decisions.

What Is Rsi And How Does It Work

RSI indicator was developed in 1978 by an American mechanical engineer, Korean War veteran and a real-estate developer J. Welles Wilder, famous for developing not only RSI, but also a few other technical analysis indicators, including Parabolic SAR and Average True Range.

RSI, or Relative Strength Index, is a technical indicator used to evaluate overvalued or undervalued conditions in the price of an asset. In other words, it helps you understand if the coin trades at a higher price than its real fair- price, or, vice versa, at a lower market value than its intrinsic value. If the RSI indicator signals that the coin is overvalued or overbought, you may want to sell it, if the indicator says the coin is undervalued or oversold, it may be a good time to consider a buy deal.

Image Source: TradingView. Bitcoin volatility in July, 2022, RSI indicator

The RSI indicator is an indicator that oscillates or fluctuates between two extreme values, 0 and 100, and every value within the bounds might potentially show in what phase the market is now: bearish or bullish. For example, in an uptrend, or bull market, RSI normally doesnt fall below 40, with the 40-50 range acting as support. Of course, every indicator can be customized by an individual trader, and we will see the example of it below, but oftentimes 70 and 30 are the common levels to pay attention to. The level above 70 usually indicates that the market is overbought, and below 30 means that it is oversold.

Also Check: Can You Go To The Obgyn On Your Period

Why Indicators Are Crucial For Swing Trading

Swing trading is all about predicting what the market will do. And while some of that can be done by researching the Dollar rising thanks to U.S. yields and predictions from strategists that the stock market may soon become volatile, swing trading requires you to look at more minor fluctuations in detail.

We can do this with technical analysis a method of mathematically predicting when a change in momentum might occur. This is the basic strategy used by swing traders to profit from price volatility and minor trends. It is, in essence, the foundation of swing trading, and it makes use of indicators.

While you may undoubtedly have a favorite indicator, it’s a good idea to familiarize yourself with many and utilize them in conjunction with one another before entering or quitting a trade. The more arrows indicating a movement, the more likely the market will move in that direction.

In general, indicators will indicate the direction of a trend, the trend’s momentum , or the volume of trading on a particular asset. Combining indicators that illustrate each of these characteristics of security may aid incomprehension.

Along with these indicators, there are a few critical principles that you should constantly keep an eye out for while swing trading. In other words, familiarize yourself with those charts!

When To Use A Longer Rsi Timeframe

Longer timeframes work in the opposite manner to the shorter timeframes. An RSI with 20 periods or more will have fewer signals for traders to use. However, these signals are much more reliable and indicate overbought/oversold commodities much more accurately.

This is the same chart that was used previously, but now the RSI timeframe is set to 20. You can see that there is only one point in which the stock was oversold if you consider the data for the last 20 days. However, the overbought signals were much stronger and they are visible in this chart.

If you are someone who likes to hold stocks for longer periods, then using a 20-day period could be best. Thats because the signals upon which you are going to base your trade will probably carry more weight with the added length.

Another time when a longer RSI timeframe will be beneficial is when you are trading highly volatile securities. For example, Cryptocurrencies are extremely volatile and it will be difficult to read their RSI if you have a shorter timeframe since there will be far too many signals for you to interpret. Increasing the timeframe will allow you to smooth the curve a little bit and enter sensible positions.

Don’t Miss: Best Way To Get Rid Of Period Headaches

Example Of Rsi Swing Rejections

Another trading technique examines RSI behavior when it is reemerging from overbought or oversold territory. This signal is called a bullish swing rejection and has four parts:

As you can see in the following chart, the RSI indicator was oversold, broke up through 30, and formed the rejection low that triggered the signal when it bounced higher. Using the RSI in this way is very similar to drawing trend lines on a price chart.

There is a bearish version of the swing rejection signal that is a mirror image of the bullish version. A bearish swing rejection also has four parts:

The following chart illustrates the bearish swing rejection signal. As with most trading techniques, this signal will be most reliable when it conforms to the prevailing long-term trend. Bearish signals during downward trends are less likely to generate false alarms.

Rsi Trading Strategies That Will Boost Your Trading Prowess

May 25, 2018

The Relative Strength Index designed by J. Welles Wilder is a popular and versatile trading indicator.

You can vary its lookback period, combine it with different trading tools, look for divergences, and even draw trend lines on it. Each method produces a unique tool that enables diverse strategies.

Here you will find seven RSI trading strategies that showcase the different facets of this powerful indicator. Before you jump in to explore the trading strategies below, make sure you understand the basics of the RSI indicator.

Also, bear in mind that these trading strategies are not perfect and are unlikely to be profitable when traded mechanically.

However, by examining these diverse RSI trading methods, you will gain helpful insights into J. Welles Wilders most famous indicator.

Don’t Miss: How Long After Period Can You Get Pregnant

When To Use A Shorter Rsi Timeframe

A shorter period generates a lot more signals and thus is better for short-term traders. Short-term traders should be able to use the increase in the number of signals to better ascertain the immediate trend of the chart and go long or short based on their findings.

Take a look at the chart above. This is an RSI with a timeframe of 14, where the area between the lower and higher thresholds are marked with color. As you can see, there are a total of 3 oversold indicators along with 4 overbought indicators. You can also see that the oversold indicators are quite small in their size when compared to the overbought indicators indicating that people are generally quick to scoop up the stock as soon as they see a significant drop in its price.

Once you switch to an RSI with a timeframe of 10, you immediately notice an increase in the number of signals generated by the index. Short-term traders will now have more data upon which to base their strategy for trading at the expense of each indicator being a little less reliable than it would be if the timeframe was 14.

Rsi Trading Strategy: Rsi Divergence

Another way that you can use RSI is as a divergence indicator. This means that if you can spot RSI trending in the opposite direction of price, it is a possible signal that price it going to follow too.

Here’s what I mean

To trade RSI divergence, you would still look for an oversold or overbought situation. But at these extremes, you would also look for a second RSI valley or peak that is heading in the opposite direction from price.

So in the chart above, the blue line on the chart shows the two price peaks going higher, while the RSI peaks are going lower.

This signals a possible reversal to the uptrend.

As you can see, price does drop from this point, but depending on your profit target, it may not have been enough to hit your profit target.

Based on my testing, divergence usually gives you better results than the vanilla RSI method. But again, it all depends on your profit target and risk per trade.

There are at least two other divergences on this chart. Can you spot them?

Don’t Miss: What Do Period Cramps Compare To

Swing Trading Strategies For Intraday Trading

- Useintraday chart of the last 5 days with the 15-minute timeframe.

- AddRSI Indicator with default parameters

- CheckRSI above 50 or below 50 level

- If RSIis above 50, find negative divergence

- If RSIis below 50, Find the positive divergence

- Conformto entering into the trade with the help of MACD Buy and Sell Signals.

- Targetis an immediate demand area

- Stoploss is immediate supply is

For Buy Trade

- AfterPositive swing divergence with RSI.

- Forentering into a trade, take confirmation from the MACD buy signal.

Stop Loss:

- Close belowthe immediate bottom

Target:

- Next are ofResistance 1 and 2

Exit:

- After anegative swing divergence with RSI

- Forconformation: check MACD sell Signal

Stop Loss:

- Close abovethe immediate top

Target:

- Next areaof support 1 and 2

Exit:

- When MACDgives a Buy signal.

Example: