Fafsa Filing And Student Aid Award Review

The free application for Federal Student Aid can be filled with your child. The information from this packet determines the need and eligibility for financial assistance to pay for college.

As an initial step in filling out the FAFSA form, you can create an FSA ID. You need to remember your FSA ID, as youll need it when the Parent PLUS Loan Application is submitted. Once the FAFSA is submitted and processed, youll receive a Financial Aid Award Summary.

The Financial Aid Award Summary contains the details of all the financial aid that is awarded to your child. In order to find out if you have received the Parent PLUS Loans, you can verify the list of financial aids from your Financial Aid Summary.

Subsidized Loan Eligibility Time Limitation

In addition to the aggregate loan limits, which limit loan eligibility based on the amount of funds received over a students academic lifetime, there is also a loan eligibility limitation based on the passage of time. First-time borrowers may not receive Direct Subsidized Loans for a period that exceeds 150% of the published length of the academic program in which they are currently enrolled . This limitation on subsidized loan eligibility is often informally referred to as the 150% rule or SULA .

Parent Plus Loan Deferment Forbearance And Forgiveness

On the loan application, you can choose to defer parent PLUS loan payments during your students enrollment or begin making immediate full payments.

You can defer or seek forbearance for parent PLUS loans in other situations, too: if you lose a job, return to school, or encounter financial hardship or other qualifying circumstances. These loans are eligible for many other federal benefits and protections as well, such as forgiveness through the Public Service Loan Forgiveness program or other avenues, such as closure of your students school, or a death of the borrower or student.

Also Check: 90 Day Probationary Period Policy Examples

What Is An Adverse Credit History

An adverse credit history occurs in the following cases –

-

Delinquency of more than 90 or more for a sum of more than $2,085 in total debt.

-

More than $2,085 in total debt in collections, or is charged off in the past two years.

-

Foreclosure, repossession, tax lien, default, bankruptcy discharge, wage garnishment or write-off of student loan debt in the past five years.

What Is Adverse Credit History

- A current delinquency of 90 or more days on more than $2,085 in total debt or

- More than $2,085 in total debt in collections or charged off in the past two years or

- Default, bankruptcy discharge, foreclosure, repossession, tax lien, wage garnishment, or write-off of federal student loan debt in the past five years

You May Like: Can You Donate Blood While Menstruating

Loss Of Interest Subsidy On Direct Subsidized Loans

For borrowers who have a remaining eligibility period that is less than an academic year, the borrower can only receive a Direct Subsidized Loan if the school can properly originate a Direct Subsidized Loan that creates a subsidized usage period that is equal to or less than the borrowers remaining eligibility period .

In COD, there will be a SULA flag indicating the students status. For example, if a borrower has a remaining eligibility period of 0.2 years, and is enrolled full-time in a semester-based credit-hour program and has sufficient financial need to support receiving $4,000 in Direct Subsidized Loans, the minimum period for which the school could originate a loan is a term.

Because the number of terms in a semester-based programs academic year is generally two semesters, the subsidized usage period for the shortest loan period for which the school could originate a loan would be 0.5 years , which is greater than the students remaining eligibility period. Therefore, the student is not eligible for the subsidized loan.

If a first-time borrower exhausts his or her maximum eligibility period , or has a remaining eligibility period that is so short than the school cannot originate another Direct Subsidized Loan for the student, the borrower may not receive a Direct Subsidized Loan, but may receive the Direct Subsidized Loan amount the borrower otherwise could have received as part of a Direct Unsubsidized Loan .

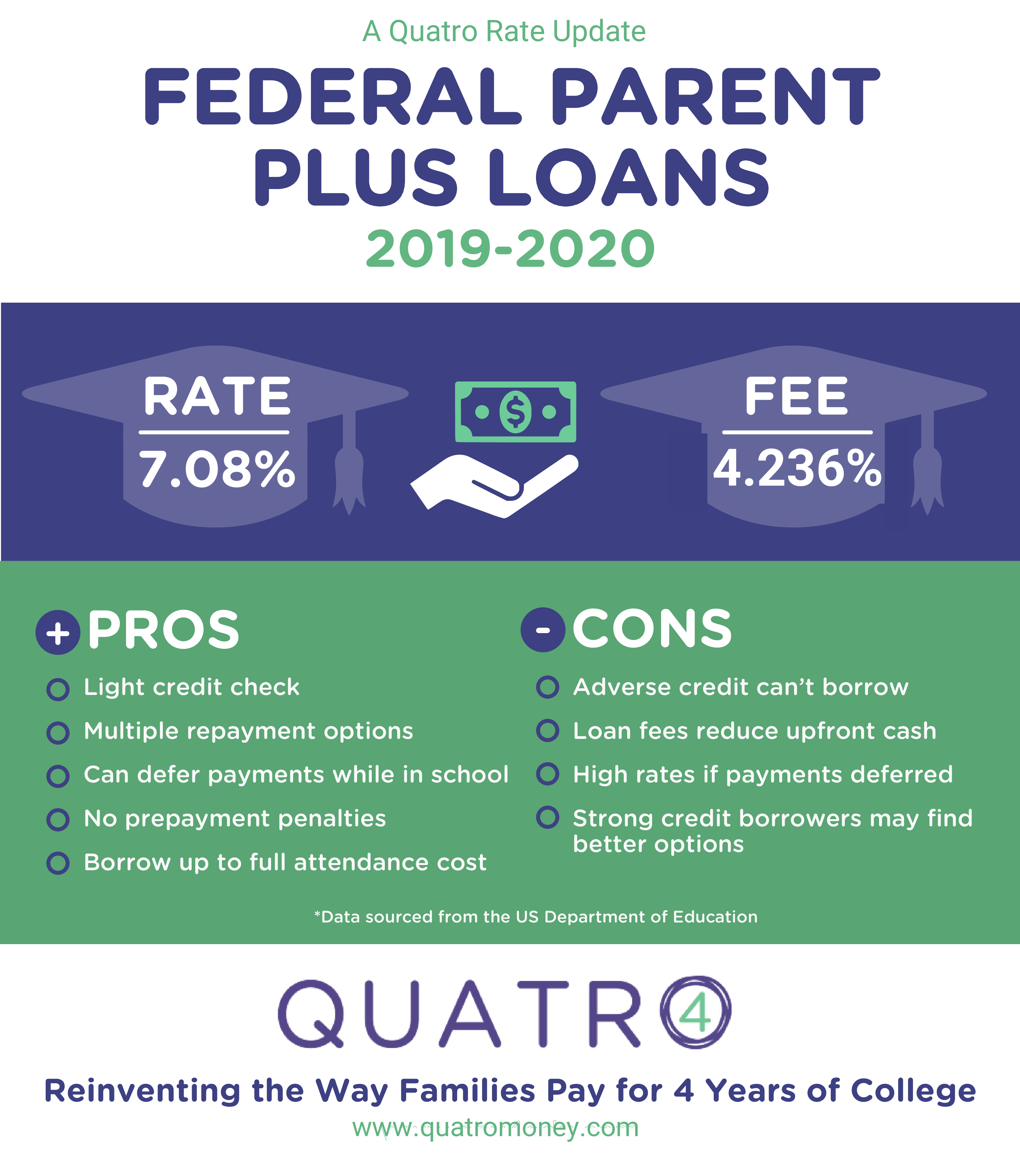

How Is The Interest Calculated For Parent Plus Loans

There is a daily interest formula that determines the amount of interest that will accrue on the loan between the monthly payments.

This formula comprises multiplying your loan balance by the number of days since you made your last payment and multiplying that result by the interest rate factor.

The interest rate factor is utilized to calculate the amount of interest that accumulates on your loan. It is determined by dividing your loan’s interest rate by the number of days in the year.

From the above understanding, we can devise the simple daily interest formula as under:

Interest Amount = x Number of Days Since Last Payment

As per the CBO , there is a formula used for different types of loans. The formula for Direct Plus loans is:

Direct PLUS loans: 10-year Treasury + 4.60%, capped at 10.50%

Recommended Reading: 90 Day Probation Period Template

Parent Plus Loan Eligibility

Parent PLUS Loans are available only to the parents of dependent undergraduate students. The parents of independent undergraduate students are not eligible for the Parent PLUS Loan.

If a dependent students parents are divorced, both parents can take out separate Parent PLUS Loans with separate Master Promissory Notes . But the combined Parent PLUS Loans cannot exceed your students cost of attendance minus other financial aid received.

How Do Parent Plus Loans Work

Most schools require parents to submit the PLUS loan application. You can find the application online atStudentLoans.gov, but its important to check with your childs school first. Some schools have different requirements and application processes youll need to follow.

The loan cant be borrowed by anyone else or transferred into another persons name, including the student you are supporting. You, the cosigner, will also be solely responsible for repaying the loan. It will not show up on your students credit or show on their credit history since this is not a cosigned student loan.

You can also borrow up to the total cost of your childs expenses after financial aid. If you havent completed the Free Application for Federal Student Aid , make sure you complete the application before you apply for the Parent PLUS loan.

Through the Parent PLUS Loan, you can borrow up to your childs total cost of attendance. Its up to your childs school to determine what that total cost figure will be.

Don’t Miss: New Hire 90 Day-probationary Period Template

Standard Term Nonstandard Term And Non

As explained later in this chapter, different rules apply for purposes of determining the minimum loan period for a Direct Loan and the type of academic year that a school may use to monitor Direct Loan annual loan limits depending on whether a program is term-based or is a non-term program , and in the case of a term-based program with nonstandard terms, depending on the type of nonstandard term, as described below. For detailed information on standard term, nonstandard term, and non-term programs, see Chapter 1 of this volume.

Nonstandard terms may be one of the following types:

Nonstandard terms that are substantially equal , and each of the terms is at least nine weeks in length.

Nonstandard terms that are substantially equal, but one or more of the terms in the academic year contains fewer than nine weeks.

Nonstandard terms that are not substantially equal in length .

We refer to the first type as SE9W nonstandard terms. We group the second and third types together and refer to them as non-SE9W nonstandard terms.

Programs with SE9W nonstandard terms are treated the same as standard-term programs for purposes of determining minimum loan period length and monitoring annual loan limits. However, programs with non-SE9W nonstandard terms are treated the same as non-term programs for these purposes.

The Endorser Program & Appeal Process

If your application is denied, you can ask someone with healthier credit to endorse your application . The endorser agrees to repay the Parent PLUS Loan if the borrower cannot.

If you dont have access to an endorser or cosigner, you also have the option of appealing a denial. In this situation, youll need to prove there were extenuating circumstances that caused your application to be denied.

If you accept the denial, your student will have the option to take an additional unsubsidized loan for $4,000 or $5,000. This amount will depend on their current year in school.

You May Like: Brown Stuff Instead Of Period

Repaying A Parent Plus Loan

You donât have to start repaying your Parent PLUS Loan until the student drops below half-time enrollment plus a six month grace period â but only if you requested a deferment. Interest will accrue as soon as the loan is disbursed.

Federal Parent PLUS loans are eligible for 3 repayment plans:

Itâs worth noting that Parent PLUS Loans are eligible for PSLF if you, the parent, make 120 qualifying payments while working full-time in a government or eligible non-profit organization.

You can consolidate your Parent PLUS Loan into a Direct Consolidation Loan, making the new loan eligible for ICR . After 25 years of payment based on income and family size, the remaining balance may be forgiven. But you may have to pay extra taxes.

Note: Parent PLUS Loans aren’t forgiven when you retire.

Definition Of Parent For Direct Plus Loan Purposes

Assuming that they meet all other Direct PLUS Loan eligibility requirements, the following individuals can borrow Direct PLUS Loans on behalf of a dependent undergraduate student:

-

The students biological parent

-

The students legal adoptive parent or

-

The students stepparent , but only if that individual is considered to be a parent in accordance with the instructions on the Free Application for Federal Student Aid for purposes of reporting his or her income and assets on the FAFSA.

Grandparents and other family members are not eligible to take out Direct PLUS Loans on behalf of a dependent undergraduate student unless they have legally adopted the student.

In addition to the parent whose resources are taken into account on a students FAFSA, any otherwise eligible biological or legal adoptive parent of the dependent undergraduate student can also take out a Direct PLUS Loan on the students behalf, even if that parents information is not reported on the FAFSA.

Note also that more than one parent can take out a Direct PLUS Loan on behalf of the same dependent undergraduate student. For example, if a students biological or legal adoptive parents are divorced, they may decide to each take out a Direct PLUS Loan for an agreed upon amount to help pay for the cost of the students education.

Read Also: Can You Donate Plasma On Your Period

Federal Direct Parent Plus Loans

The federal direct Parent PLUS loan is a credit-based loan that the parent of dependent undergraduate students may borrow to help pay educational expenses. The parent borrower may borrow up to the total estimated cost of attendance minus any other financial aid received.

UMBC includes the Parent PLUS loan as part of eligible students initial financial aid offers. The amount indicated represents the maximum amount of Parent PLUS loan funding for which the student is eligible. The Parent PLUS loan offer is only presented as a possible optionparents must confirm their eligibility by completing a separate Parent PLUS application. Any additional financial aid received after a Parent PLUS loan has been approved for the maximum amount may result in the adjustment of the Parent PLUS loan or other financial aid to comply with federal regulations.

If you do not wish to borrow the Parent PLUS loan, you do not need to take any action to decline the loan. If no action is taken, the Parent PLUS loan offer will be removed from your financial aid offer within 45 days. To remove the offer before then, you can complete and submit the Federal Direct Parent PLUS Adjustment Form.

Eligibility Requirements

Application Process

Complete all step in the Parent PLUS loan process to apply for the loan. Funds cannot be disbursed if any step is not completed. Please note: if you are borrowing a Parent PLUS loan for more than one student, you must complete a separate application for each student.

Can I Use Parent Plus Loan Funds For Non

Yes, you can use the Parent Loan to cover charges that are not billed by the college However, it is important to account for the timing of the loan disbursement, any outside scholarships, and unearned work study when you are calculating how much you must borrow in order to generate the refund you need. The Office of Financial Aid is happy to help you weigh the amount you plan to borrow against your expected charges to make sure that you borrow enough. Keep in mind the expenses that the refund will cover when you are applying for your loan because you will declare how your refund should be issued within the application. We strongly suggest that you complete an ACH Authorization Form so your refund can be issued by direct deposit. This can be especially important if you are borrowing to cover book costs at the beginning of the semester. The other choice is for the Coe Student Accounts Office to cut a paper check and mail it to the refund recipient.

Recommended Reading: Usaa Grace Period Auto Insurance New Car

Determine How Much You Can Borrow

Parent PLUS loans allow you to borrow up to the cost of attendance at the college or university your child plans to attend, minus any other financial aid received. The cost of attendance includes tuition, room and board, and other educational expenses such as books. Your school will provide the cost of attendance to help you determine how much you’ll need to borrow.

Because you can borrow up to the total cost of attendance doesn’t mean you should, however. If you have savings, such as money in a 529 plan, or monetary gifts from your child’s grandparents, for example, subtract those amounts from your financial need. Also consider additional ways your student can get money for college that can reduce your future financial burden, such as through scholarships and grants as well as working a part-time job while in school.

Two Versions Of The Federal Plus Loan

There are two versions of the Federal PLUS Loan: the Federal Parent PLUS Loan and the Federal Grad PLUS Loan.

Other than the differences in the borrower, the purpose of the loan and some discharge provisions, the Parent PLUS and Grad PLUS loans are nearly identical. The Federal Grad PLUS Loan first became available on July 1, 2006, through an amendment to the Federal Parent PLUS Loan.

You May Like: Can You Refinance An Fha Loan

Read Also: 90 Day Probationary Period Form