Do Dental Insurance Plans With No Waiting Period Cover Everything

It depends on the policy. The ones we have identified in our list have at least one policy that often does cover everything with no waiting period. However, even with these policies, you will see in the details that the coverage increases the longer you subscribe, often over three years.

When you are shopping for dental insurance policies with no waiting period, you’ll find that most plans do not have waiting periods on cleanings and exams, but they do for fillings, crowns, or braces. That’s because dental insurance divides care into three service categories: Preventive, Basic, and Major. Heres a rundown on those different categories:

- Preventive: This category is your routine dental care, usually including cleanings, X-rays, exams, fluoride treatments, and sealants. Dental insurance policies typically have no waiting period for preventive care.

- Basic: These are dental treatments that dentists handle in-house, like fillings, simple extractions, some periodontal care, like scaling and root planing, etc. Many policies add a waiting period of three to six months, and sometimes longer, on this category of care.

- Major: These treatments are more complex, like bridges, crowns, dentures, implants, and orthodontics, among others.

What Alternatives Are Available To Traditional Dental Insurance

Dental insurance isnt for everybody. Typically, it makes the most sense for people with no dental problems who only need preventative care. Even a very basic policy will usually cover dental check-ups, cleanings, and x-rays. Many people find they spend less on dental insurance than they would pay for preventative care out-of-pocket.

But dental insurance is far less helpful if you have a problem which needs immediate treatment. At best, youll have to deal with waiting periods. At worst, the procedure you need might not be covered at all.

Dental Discount Plans, also referred to as Dental Savings Plans, are another way to save. For around $10 to $12 a month, you can join a plan where youll be issued a special membership card. Simply present the card at the offices of any of the 110,000+ participating dentists nationwide for instant savings at the time of service.

Unlike dental insurance, Cigna discount plans have no annual limits, no waiting periods and no restrictions on pre-existing conditions. Your discount card starts working about 72 hours after making your first payment. Plus, plans are available which cover not just you but your entire family.

Cigna dental insurance provides excellent coverage if you only need preventative care. But if you have existing dental problems which need treatment right away, a Cigna dental discount plan is the faster way to save.

How Do You Apply For Dental Insurance

There are a couple of ways you can get dental insurance:

- Your employer may offer you dental coverage as part of your employment benefits. If so, you can apply for that during annual open enrollment. There may be different types of dental plans you can choose from that can help cover the type of dental care you expect to need.

- If your employer doesnt offer dental insurance, or if you lose a job or work for yourself, you can buy a dental plan on your own. You can do this either through a state health exchange or directly from a health insurance company like Cigna.

Recommended Reading: How To Stop Period For Sex

How We Chose The Best Dental Insurance With No Waiting Period

We looked at many variables when comparing the dental insurance policies with no waiting period. We started by choosing plans that had no waiting period in their policy description. Then we reviewed the number of programs available without a waiting period, the network size of the company, the number of states where it’s available, the annual maximums, and deductibles. We also compared coverage and the rates quoted to determine the best one. Lastly, we looked at the company’s ratings from unbiased sources. Also note: It is essential to investigate the policy stipulations for where you live.

Verywell Health/ Design by Amelia Manley

Can I Use Dental Insurance Right Away

In most cases, you can use dental insurance right away for preventive services, like cleanings and x-rays. However, depending on the policy, some basic services and major dental work such as fillings, extractions, or root canals will not be covered until after your dental insurance waiting period is complete. The waiting period is usually between six months to a year, although more expensive procedures may have a waiting period that’s even longer.

Recommended Reading: What Happens When You Have A Period

What Is A Waiting Period

A waiting period is a set amount of time you must wait before some of your dental coverage is effective. During this time, your dental insurance company may not cover some procedures. Waiting periods vary by insurer, policy, and type of insurance. After you buy a traditional dental insurance policy you could have a waiting period of six months to a year for some procedures, depending on your plan

Dental insurance companies have waiting periods to make sure that people dont sign up for dental insurance only because they need expensive dental work done and then cancel the policy after that work is done.

Cigna Dental: Most Affordable

Cigna is a health and life insurance company that offers three different dental insurance plans. Their network covers 93,000 dentists with over 297,000 locations across the nation. All of their plans include preventive care for free, including cleanings, oral exams, and routine x-rays.

Cigna’s two upper-tier plans, Cigna Dental 1500 and Cigna Dental 1000, waive waiting periods for restorative care if you have had a qualified dental insurance plan in place for at least 12 consecutive months before signing up for a plan with Cigna.

There is also no waiting period for any preventive care. They also offer a preventive care plan with premiums starting at just $19/month. This plan also has no waiting periods for routine checkups and cleanings however, major services and restorative care are not covered.

Have a look at the highlights of our choice for Cigna, the Cigna Dental 1500 plan:

Preventive services:

- 1 oral exam every 6 months

- 1 routine cleaning every 6 months

- 1 set of bitewing x-rays per year

- 1 fluoride treatment per year for patients under 14

Basic restorative services:

- 1 filling per tooth per year

- 1 full-mouth panoramic x-ray every 5 years

- Routine tooth extraction

- 1 deep cleaning every 3 years

- 1 crown per tooth every 7 years

- Wisdom tooth extraction

- Bridges every 7 years

Read Also: What Not To Do On Your Period

Aflac Dental Insurance Plans With Little To No Waiting Periods

At Aflac, well work with you so you can get the treatments you need on a timeline that works. Our network and employer-provided dental insurance have no waiting period for routine services and fair waits for more involved procedures.

In addition to manageable waiting periods, our dental coverage allows you the freedom to choose which dentist you work with at an affordable rate. Ask about the ability to add hearing and vision coverage to your plan to enhance your care.

Still have questions?

Best Dental Insurance Plans With No Waiting Period Of 2022

- Best Preventive Care: Denali Dental

- Best Basic Coverage: UnitedHealthcare

- Best Major Coverage: Spirit Dental

- Best for Orthodontics: Ameritas

- Best Affordable Coverage: Delta Dental

- Coverage Limit: $1,000 to $1,500

- States Available: 49

Humana offers the most diverse dental insurance options with no waiting period, with three different plan types to choose from. Factor that in with affordable premiums, low deductibles, and a huge network of providers, and this insurer easily comes out on top as best overall option in our review.

-

No waiting period for all covered services on some plans

-

Choose from three different plan types

-

270,000 in-network dentists

-

Higher coinsurance than some competitors

Humana offers no waiting periods with four of its seven dental plans, and the options and benefits available are some of the best in the industry. Those who want coverage to begin immediately can choose from a PPO plan, HMO, or a dental discount plan with some of the lowest premiums we were able to find from any provider.

Humanas Preventive Value Individual and Dental Loyalty Plus plans provide PPO coverage, and we were quoted reasonable rates. Preventive Value Individual is designed for those who need only preventive and basic services, while Dental Loyalty Plus adds major service coverage. Both plans pay for 100% of preventive services. These preventive services include the standard two cleanings with exams per year.

Don’t Miss: What Does It Mean When My Period Is Late

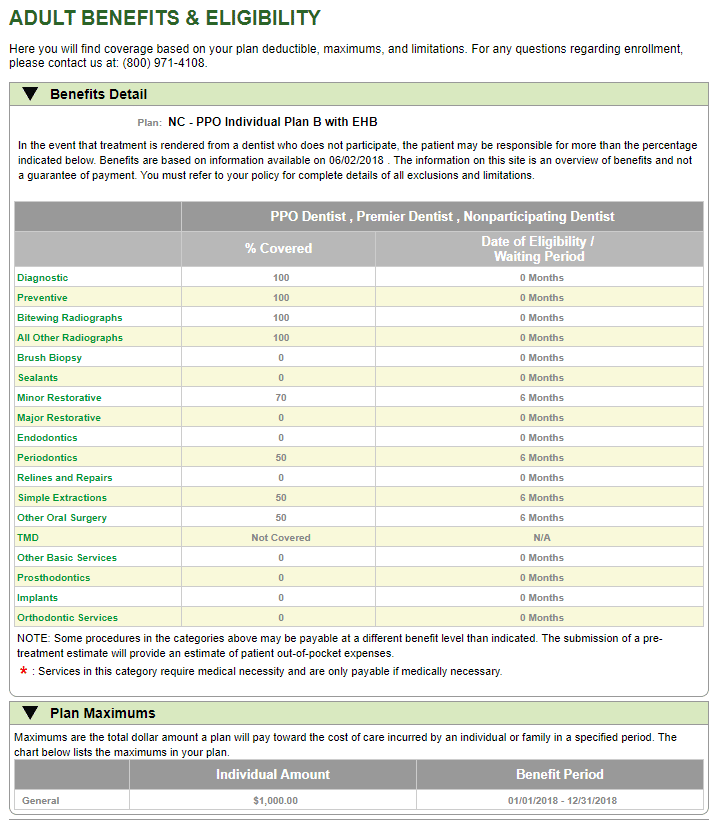

Dental Insurance Waiting Period And Dental Insurance Maximum Benefits Example

Edward needs to have “major work” done on a tooth, as defined by his plan, it is not covered under his dental insurance because he is still under the waiting period. The cost of the procedure is $1500 and the dental plan would have only paid 50%.

Also, the maximum payable for Edward’s plan per year is $1,500. He decides to get an estimate from his dentist of all the other basic work to be done, like having several cavities filled, X-rays, cleaning, and other basic and preventative treatments, Once he reviews everything, and calculates the deductibles, he realizes that he would hit the maximum of his plan even if the waiting period wasn’t in place. He decides to go ahead with the work and get a payment plan with the dentist, and use the insurance to do preventative treatment covered by the plan to prevent this from happening again in the future. He could also consider a dental savings plan to supplement his insurance coverage.

Which Services Have Waiting Periods

Dental insurance is focused on promoting oral health, so even policies with waiting periods usually cover preventive dental care right away. These covered expenses include things like routine cleanings, checkups, routine x-rays, and sometimes fluoride treatments. Dental plans often cover such preventive services in full, with no out-of-pocket cost to you. That’s valuable because these services can help avert more serious and expensive tooth problems in the future. However, services beyond cleanings often require at least a 6-month waiting period. Some policies may make you wait a year for major work. The kinds of treatments and procedures not covered during the waiting period typically include:

- Basic procedures and care: This may include fillings, non-surgical extractions, and other simple services

- Major procedures and treatment: Things like bridges, crowns, dentures, oral surgery

- Orthodontic treatment: Braces and other types of teeth aligners

It’s important to note that these service categories aren’t set in stone. For example, one insurance company might categorize a dental care procedure as basic another insurance company might categorize it as major. While these categories can give you a broad idea of what’s covered in full-coverage dental plans, you should also look at the Plan Summary to get more specific details about which basic and major services are covered.

You May Like: 4 Weeks Pregnant And Bleeding Like A Period

Dental Insurance With No Waiting Period: The Best Plans Of 2022

Dental insurance with no waiting period means that patients can receive insurance coverage for treatment without having to wait. If you don’t have a waiting period, you can sign up for insurance, and the day it begins you can start getting the treatment you need.

There are plenty of insurance companies that offer dental insurance with no waiting period, but some of them have high monthly premiums and low annual coverage limits.

We’re here to help you wade through the exorbitantly expensive plans to find the best dental insurance with no waiting period for your budget and your oral health needs.

There are a lot of dental insurance plans with no waiting period, especially when it comes to preventive and basic care, so you might be wondering how to get started. If you’d like some help, just head to Dentalinsurance.com. This online insurance marketplace makes it easy to find the best insurance plan for you.

Just enter some basic information and you’ll get to see the best plans available in your area. When you see a plan you like, just open up the plan details, and if there is no waiting period, it will be listed at the top of the page.

You can also call to speak to a friendly licensed agent.

Do Not Skip Steps When Verifying Patient Dental Insurance

You should have someone fully trained on your dental team to verify the patient’s insurance. Its a relatively straight-forward task, but this person should know all of the questions to ask, like is there a waiting period on this patients insurance policy? to avoid not being paid.

Insurance is messy and complicated. So staying up-to-date on what kind of information your practice should obtain when verifying insurance is key. To learn more about how to understand insurance limitations and rules, check out our educational resource, Dental Claims Academy.

Here, we help dental professionals like yourself navigate the complexities of insurance, CDT codes, and other administrative nuances that you may not have learned in dental school.

You May Like: Cramps For A Week But No Period

Can You Visit The Dentist During The Waiting Period

Yes, you can visit the dentist during your waiting period, and preventive visits will likely be covered, as most dental insurance plans include coverage for preventive services without a waiting period.

If you require basic care like an extraction or fillings, you may want to consider dental plans that feature short or no waiting periods.

If you need emergency dental work or major surgery within the waiting period, you will likely have to pay the costs of those services out-of-pocket. Be sure to check with your new dental insurer to understand your coverage if you anticipate dental work within a waiting period.

Here’s what you can expect for dental insurance coverage, based on the type of care you need, during the waiting period:

What Other Factors Should I Consider When Enrolling In Dental Insurance

When enrolling in a dental plan, there are two primary things to consider: need and cost. The primary role of a dental plan is to help keep your teeth and mouth healthy, which in turn can help protect your overall health against conditions like heart disease, diabetes, and other health conditions that are impacted by periodontal disease. Dental care can even help mental health by building self-esteem.1

Think about what services you may need in the not-so-distant future. If you or someone in your family has had dental health issues in the past, look at the insurance policy’s Plan Summary to see if those issues are covered. Even if you don’t have a specific concern, you should look at the dental procedures covered. You may not recognize them allbut the longer the list, the better. Finally, if you have kids, consider a dental insurance plan with orthodontic coverage.

If you choose a less expensive plan because the premiums are lower then skip needed dental work because of the out-of-pocket costs it will likely cost more in the long run. You could have more toothaches as well.

When choosing a dental plan, keep a few things in mind:

Are you a dental professional? Find out how to join Guardian’s growing network of dental benefit providers.

Don’t Miss: Can You Take A Plan B On Your Period

Can The Waiting Period Be Waived

In some cases, yes. You may be able to have the waiting period waived if you can demonstrate continual coverage, i.e., that you’ve had dental insurance in place with another dental insurance company for at least 12 consecutive months. You will need to supply a letter showing you had prior coverage and a summary of policy benefits from the previous dental insurance company. On the other hand, if you’ve had a lapse in coverage even if it was just a short one you will likely not be eligible to waive the waiting period.

Types Of Waiting Periods

Homeowner insurance wait periods will usually span 30 to 90 days before coverage is in effect. After the waiting period expires, policyholders may file claims against the policy. Wait periods will vary by the insurance provider. Also, in some regions, such as coastal zones, when a named storm is in the area, new policies will not go into effect until after the storm passes.

Some states may impose wait periods on other insurance products. As an example, Texas will place a 60-day wait on new auto insurance policies. This period gives the provider a chance to decide if the driver fits within their risk profiles. During the 60-day period, the company may cancel the auto policy if they have concerns about the risk profile or undisclosed issues.

Short-term disability coverage can have wait periods as short as a few weeks, but these policies will have higher premiums. Most short-term policies wait 30 to 90 days for coverage. Long-term disability wait periods can be between 90-days and a full year. As with other insurance products, during the probationary period, no benefits are payable. For Social Security, disability payments will also have a waiting period of five months.

Read Also: Things To Get Rid Of Period Cramps

How Do Dental Insurance Waiting Periods Affect My Practice’s Revenue

So, why should you ask about insurance waiting periods when verifying patient insurance? How does this affect your practice? The answer is pretty simple.

If either party, the patient or the dentist is unaware of the waiting period, and the procedure is not reimbursed by insurance, the patient is going to have to pay out of pocket. If this is a surprise they did not budget for, we can pretty much guarantee the patient will be unhappy.

Although it’s the patient’s responsibility to know their benefits, typically the office does the leg work as a courtesy to try and give patients close estimates to what their treatment will cost. The more a patient knows what they’ll owe, the more likely they’ll be to schedule. Hence why they get upset when they get a bill they were not expecting due to a waiting period

For example, say whoever verifies insurance doesn’t know about the waiting period, and they tell a patient you need a crown and crowns are covered at 50%. Everyone anticipates 50% of the crown to be covered by insurance but because of the waiting period, nothing is paid by insurance. Nope! The patient is then sent a bill that is twice the amount they were expecting. Youd be angry too if you were in their shoes!

Have you ever had a patient who got a bill that was bigger than they were expecting? Well, insurance is definitely not going to negotiate a different price with you we will know this. And if the patient simply cannot pay it, they wont.