How To Avoid Costly Gaps In Coverage When You Retire After 65

If you anticipate losing your employer-based health insurance, its best to enroll in Medicare before you lose that coverage. This will ensure that you dont experience any gaps in coverage. If you plan to retire, contact your or your spouses employer one or two months in advance to avoid costly gaps in coverage. The human resources department can help you time your Medicare enrollment to start once you lose your employer-based coverage.

Youre Automatically Signed Up For Medicare When You Turn 65 True/false

If you are enrolled or are enrolling for Social Security, then you will be automatically enrolled in Medicare. However, if you are not enrolled in Social Security, you must proactively sign up for Medicare.

You can do that during your Initial Enrollment Period , which starts three months before your 65th birthday, includes the month of your birth, and lasts for another three months.

Are there exceptions to this schedule? Yes. If you have certain physical or other limitations, you could qualify to sign up for Medicare before the seven-month IEP that surrounds your 65th birthday. Talk to a qualified Medicare consultant to learn more.

Recommended Reading: Employee Probationary Period Template

Medicare Initial Enrollment Period

The earliest time you can enroll in Original Medicare, a Medicare Advantage plan or a Medicare Part D prescription drug plan is during your Medicare Initial Enrollment Period .

Your Initial Enrollment period lasts for seven months:

- It begins three months before you turn 65

- It includes your birth month

- It extends for another three months after your birth month

If you are under 65 and qualify for Medicare due to disability, the 7-month period is based around your 25th month of disability benefits.

You May Like: What Prevents Your Period From Coming

Initial Medicare Enrollment Period

The time to start thinking about enrolling in Medicare for the first time is around your 65th birthday. The initial enrollment period is extremely important because missing the enrollment period can mean higher health insurance costs forever! Make sure to enroll in Medicare Part A and Medicare Part B .

- For example, if you were born on August 2, 1952, you would be turning 65 on August 2, 2017. Your initial enrollment window would then be between May 1st and November 30th 2017.

One must to enroll in Medicare Part A and B in order to enroll in Medicare Advantage, Part D or Medigap / Medicare Supplement. If you require prescription drug coverage , be sure to enroll for Medicare Part C / Medicare Advantage or a Part D Plan in the same initial enrollment period . If youfail to do so, you may wind up paying more for Part D Prescription coverage forever.

- â TIP: if you are approaching your 65th birthday : be safe and get Part A and B AND either Medicare Advantage with a drug plan or Part D Prescription Drug Plan. Pay more now and then scale back rather than paying a penalty for enrolling late .

Signing Up For Original Medicare

You can sign up for Medicare one of four ways:

For California residents, CA-Do Not Sell My Personal Info, .

1 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

You May Like: 41 Years Old Missed Period Not Pregnant

Medigap Plan C And Plan F Changed In 2020

A slight but important change was made to the selection of standardized Medigap plans available in most states.

Plan C and Plan F are no longer available to new Medicare beneficiaries who became eligible for Medicare after January 1, 2020.

If you were already eligible for Medicare before January 1, 2020, you may still purchase Plan C or Plan F in 2020 and beyond if either plan is available where you live.

But anyone who became eligible for Medicare after January 1, 2020, will not be allowed to enroll in either of those two plans.

Anyone currently enrolled in Plan C or Plan F will be allowed to keep their plan going forward.

This 2020 Medigap plans change came as a result of federal legislation that prohibits full coverage for the Medicare Part B deductible. Plan C and Plan F are the only standardized Medigap plans that provide this benefit.

Medicare Part D Prescription Drug Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes prescription drug coverage

- Enroll in a Medicare Part D standalone prescription drug plan

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent.

You can also enroll in a prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

Recommended Reading: Tumor Necrosis Factor Receptor Associated Periodic Syndrome

New Addition Of Race And Ethnicity Data Fields On The Pdp Model Enrollment Request Form

On July 5, 2022, CMS released the Model Individual Enrollment Request Form to Enroll in a Medicare Advantage Plan or Medicare Prescription Drug Plan , and Advance Announcement of January 2023 Software Release – Addition of Race and Ethnicity Data Fields on Enrollment Transactions memorandum via HPMS to announce the addition of race and ethnicity data fields on the model PDP enrollment form, OMB No. 0938-1378. These new fields are required to be included on the enrollment form however, applicant response to these questions is optional.

Part D plans are expected to use the new form for enrollment requests received on or after January 1, 2023. The new form should be used for all enrollments after January 1, 2023.

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Recommended Reading: Cramps And Lower Back Pain No Period

Avoid Medicare Part D Penalties

Suppose you move from a Medicare Advantage Plan that includes prescription drug coverage to a stand-alone Medicare Prescription Drug Plan . In that case, youll be returned to Original Medicare.

Suppose you disenroll in a Medicare Advantage Prescription Drug Plan and lose your creditable prescription drug coverage. In that case, you may have to wait until your next enrollment opportunity to get drug coverage. This may cause you to pay a Part D late enrollment penalty.

How To Get Medicare Part D Prescription Coverage

Medicare Part D coverage is available to you in two ways:

Its worthwhile to note that you cant get Medicare Part D coverage without also having Parts A and B.

Get Started Now Comparing Quotes

Personalized quotes in less than 2 minutes.

No signup required.

Recommended Reading: I Had Protected Sex And My Period Is Late

In Brief: Medicare Part D Coverage Plans

Medicare Part D coverage plans are designed to help ensure more people have affordable prescription drug coverage. For many, prescription medication can be the difference between life and death, and so having the right coverage in place helps protect us all. And with negotiated drug prices and premiums, coverage can be affordable and accessible, no matter where you live.

Questions?

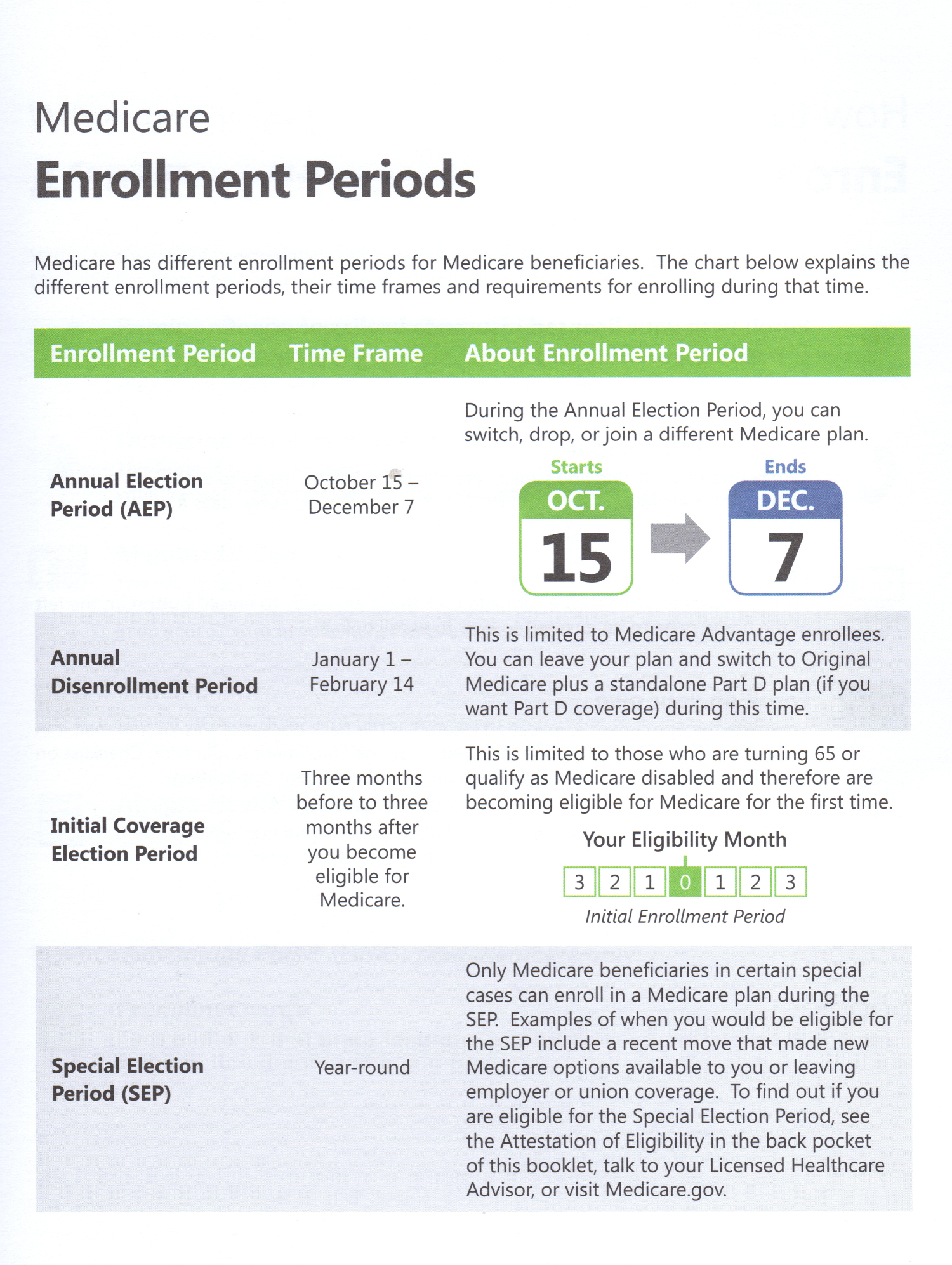

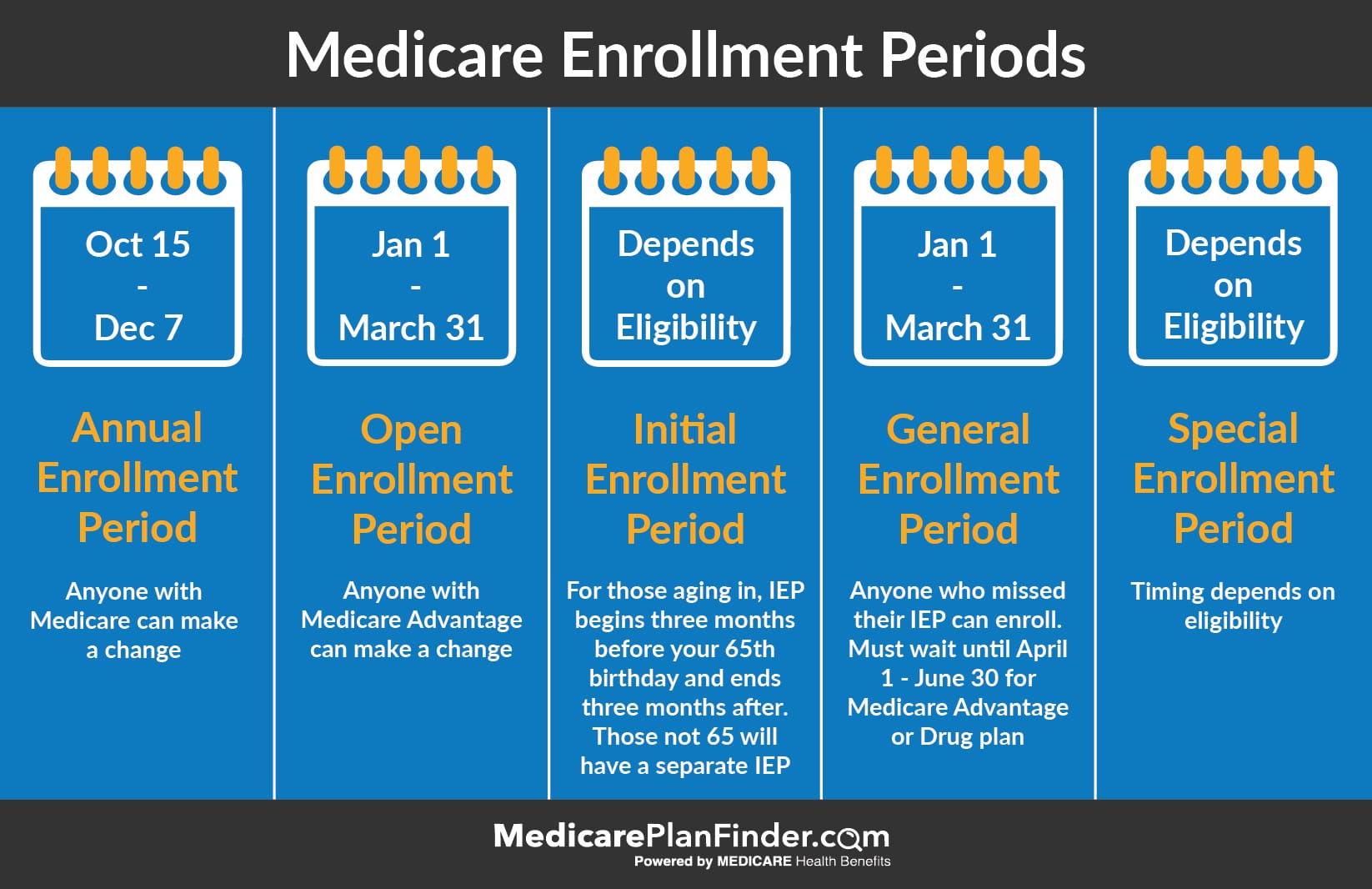

What Types Of Enrollment Periods Does Medicare Use

Medicares standard enrollment periods are:

Special Enrollment Periods are available to people experiencing what Medicare calls special circumstances, such as losing your employer coverage or moving. The full list is available on Medicare.gov here.

The Medicare Part B Special Enrollment Period is available to those who delay signing up for Part B because they have coverage through an employer . Once that coverage ends, they qualify for an SEP that lasts for eight months. It begins either the day coverage ends or the day employment ends whichever comes first.

Please note that, to qualify for the Part B SEP, you must have been actively employed. Health insurance through a retirement plan or COBRA does not qualify as you are not actively employed. The same is true if the insurance is through a spouses employment. Once you or your spouse is no longer actively employed, the Part B Special Enrollment Period begins. Full details are available from the Social Security Administration here.

Dont Miss: My Period Is 2 Days Late Should I Be Worried

Recommended Reading: Do Women Ovulate Before Or After Period

Can I Delay Enrollment In Part D Coverage

If you didnt enroll in prescription drug coverage either through a PDP or a Medicare Advantage plan during your initial open enrollment window and then you enroll during an open enrollment period in a future year, theres a late enrollment penalty that will be added to your premium .

The Part D late enrollment penalty would also apply if you drop your prescription coverage for more than 63 days and then re-enroll during the open enrollment period. Its important to maintain continuous drug coverage from the time youre first eligible, both to protect against significant prescription costs, and also to avoid higher premiums when you ultimately re-enroll.

Enrollment Periods For Medicare Advantage/part D

These enrollment periods apply only to Original Medicare, Medicare Advantage plans, and Medicare-approved prescription drug plans. You can enroll in a Medicare Supplement plan anytime, but the best time is during your initial enrollment period because you are guaranteed approval in your initial enrollment period. Most Medicare Supplement plans require underwriting if you are not in a guaranteed issue election period.

Youâre eligible for Original Medicare if you or your spouse paid into Social Security for at least 10 years through employment, you are a citizen or permanent resident of the U.S., and you are age 65 or older.

The full Social Security retirement age varies based on the year you were born , but youâre eligible for Medicare at age 65. You do not have to be retired to enroll. If youâll have employer-provided health coverage at age 65, contact your benefits administrator to find out how Medicare will work with your current coverage.

Plan Satisfaction

Beneficiaries who enroll in a Premera Blue Cross Medicare Advantage plan during the IEP can disenroll at any time within the first 12 months of coverage and return to Original Medicare and enroll in a prescription drug plan. This also allows you to enroll for a Medicare Supplement insurance policy without medical underwriting.

Recommended Reading: Average Age A Girl Starts Her Period

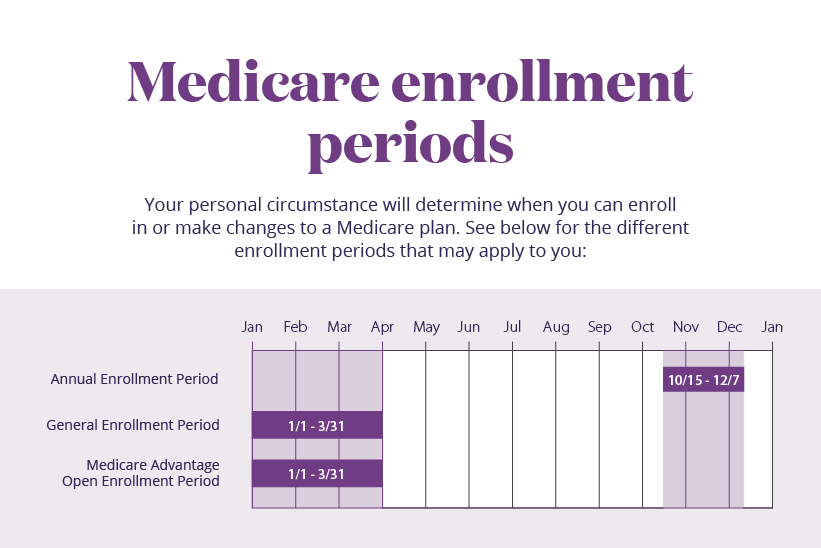

Medicare Enrollment 2022 Important Dates You Shouldnt Miss

When you first become eligible for Medicare , you will automatically be enrolled in original Medicare Part A and Part B if you are receiving benefits from Social Security or the Railroad Retirement Board . You have an Initial Enrollment Period of seven months to add additional Medicare health care coverage with an Advantage plan, or Supplemental Insurance and/or a Prescription Drug plan.

Medicare enrollment or changes to plans you are already enrolled in are limited to specific times.

Important dates to enroll in, switch or cancel a Medicare plan for 2022 are:

Visit www.medicare.gov to get detailed and current information about your Medicare eligibility and enrollment options, or call 1-800-MEDICARE or TTY 1-877-486-2048.

Also Check: Primosiston To Stop Period

What Is Medicare Open Enrollment

Medicare open enrollment is a designated window of time each year when individuals can make changes to their Medicare coverage.

Open enrollment is primarily for people who already have Medicare. New applicants should sign up during their initial enrollment period, which starts three months before they turn 65 and ends three months after the month they turn 65. If they miss their initial enrollment period, they can sign up during open enrollment.

The fall open enrollment period for Medicare begins Oct. 15 and runs through Dec. 7 in 2021. This enrollment period is open to people who are covered by:

- Medicare Part A

- Medicare Part B

- Original Medicare

A separate Medicare open enrollment period applies to people who are covered by a Medicare Advantage plan . The open enrollment period for Medicare Advantage plans runs from Jan. 1 to March 31 each year.

You May Like: Bleeding More Than Usual On Period

Special Enrollment Period For Medicare

One of the most complicated Medicare enrollment periods is the Special Enrollment Period. Not all Medicare beneficiaries will become eligible for a Special Enrollment Period, and those who do will need to prove their qualification.

A Special Enrollment Period happens when you delay Original Medicare enrollment when you were first eligible with creditable coverage in place. The most common reason for delaying Original Medicare coverage is because you have employer coverage in place at the time you turned 65.

Once your employer coverage is terminated, you will receive a Special Enrollment Period to enroll in Original Medicare. If you qualify, your Special Enrollment Period will last 8 months from the termination date of your employer coverage.

Once you have enrolled in Original Medicare, you will have a 63-day Special Enrollment Period to enroll in a Medicare Part D plan. It is important to enroll in drug coverage once you lose employer benefits to avoid paying the Medicare Part D late enrollment penalty.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Additionally, if you are on a Medicare Advantage or Medicare Part D plan and experience a life-changing event, you will qualify for a Special Enrollment Period to make a change to your plan.

These life-changing events include:

General Enrollment Period Vs Special Enrollment Period

While both the general enrollment period and special enrollment period let you sign up for Medicare if you missed your initial enrollment period, there are key differences between the two.

| General Enrollment Period | |

|---|---|

| Occurs from January 1 through March 31 each year. | Occurs within eight months after you stop working or your benefits end, whichever comes first. |

| Coverage starts on July 1 of the same year. | Coverage starts the month after you enroll but could be delayed up to three months. |

| For those who dont enroll in Parts A and/or B during the initial or special enrollment periods | For those who qualify for a special enrollment period, such as those about to lose employer coverage |

| Theres a penalty for delaying premium-based Part A and Part B enrollment. | Theres no penalty for delaying enrollment if you qualify for a SEP and sign up within the period. |

Recommended Reading: Why Do I Get So Depressed On My Period

Initial Enrollment Period 2

Another enrollment period that is also 7-months is the Initial Enrollment Period 2. The IEP2 is for people who were already eligible for Part A and B before they turned 65.

During the IEP2, you can sign up for a Medicare Advantage or Part D plan. The IEP2 runs for the same seven-month period as the IEP.

Also Check: Can You Donate Blood While Menstruating

When Does Medicare Part D Open Enrollment End

The 2022 AEP for Medicare Part D ended December 7. From the AEP start date , you have about eight weeks to enroll in Medicare Part D coverage before the AEP deadline. The coverage you choose during the Medicare Part D Enrollment will be effective the first day of the following year. For example, if you enrolled in a Part D drug plan by December 7, 2021, your coverage would start January 1, 2022.

Recommended Reading: Skipping Period With Birth Control Pills