When Is Open Enrollment For Medicare Supplement Plans

The six-month window is the best time to buy a Medigap policy. It begins on the first day of the month in which youre both 65 or older and enrolled in Medicare Part B. Some states have additional Open Enrollment Periods, including ones for people under 65.

During this window, insurance companies cannot deny you a Medicare Supplement policy based on health status or medical condition.

One of the most important things to know about Medigap plans is that you actually dont have many opportunities where youre guaranteed to be issued a policy, says Jacobson. Theres essentially three months prior to going on Medicare and three months after going on Medicare when you have that right to be issued any Medigap policy that you want. Beyond that, your opportunities can be relatively limited depending upon what state you live in.

If you think this sounds like a short amount of time, youre not alone. In 2016, there were an estimated 800,000 beneficiaries of the 55.3 million enrolled in Medicare that year who had not enrolled in Part B when they became eligible, and were paying a late-enrollment penaltyEmpowering Beneficiaries and Modernizing Medicare Enrollment. Better Medicare Alliance. Accessed 09/22/2021. .

When Working Past : 8

For people who work past 65 and qualify to delay Medicare with creditable employer coverage, there is an 8-month Special Enrollment Period that allows you to enroll in Part A , Part B , Part C and Part D without late penalties.

This Special Enrollment Period is tricky though. Why? Because while you have the whole 8 months to get Parts A & B, you only get the first 2 monthsto enroll in Part C or Part D without penalty. If you enroll after the two-month mark, youll face late enrollment penalties for Part D .

To qualify for the Part B Special Enrollment Period, you must have creditable employer or union health coverage based on current employment. Your Special Enrollment Period will begin eight months after your employer coverage ends or you leave your job, whichever happens first.

Preparing For Your Medicare Supplement Open Enrollment

Those who plan and apply for Medicare early will receive their Medicare card before their 65th birthday month. If you have your Medicare card, we can submit your Medigap application before your Part B effective date. The carrier will process your application as if youre already in your Medigap Open Enrollment Period, with no health questions.

Once you apply for Medicare, theres no need to wait to enroll in a supplement plan until you turn 65. With rates constantly changing, we often help our clients lock in their Medigap plan months before their 65th birthday. Keep in mind, you wont be able to buy the policy until youre 65 and have Part B.

Also Check: Primosiston To Stop Period

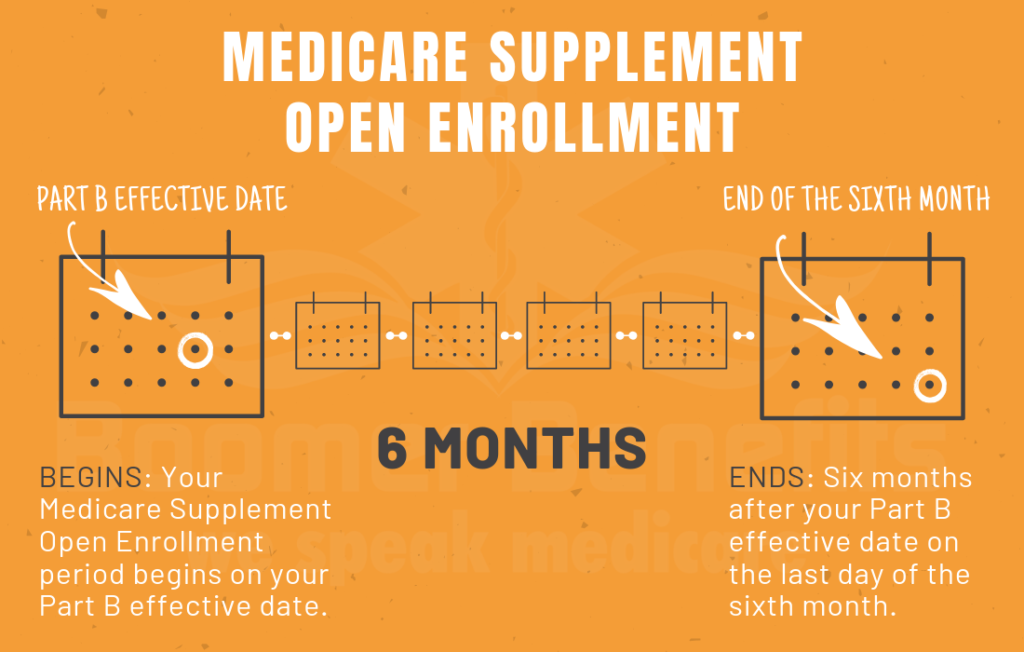

Open Enrollment Period For Medicare Supplement Plans

- Once-in-a-lifetime window

- Begins the same day as your Part B effective date

- No health questions during this time

- Not the same as the Medicare Annual Enrollment Period

Applying outside your open enrollment window can result in higher premiums, as well as restrict your coverage options. This window only lasts for six months for each new beneficiary.

Your Medicare Supplement Open Enrollment Period is not the same as the fall Annual Election Period. AEP pertains to Medicare Advantage and Part D plans and the dates are the same every year. With your individual Medigap Open Enrollment Period, the dates are unique to you and it only concerns Medicare Supplement plans.

Your individual Medicare Supplement Open Enrollment Period starts the first day of the month your Part B is in effect. You must also be 65 for this window to begin. For example, if your Part B coverage begins April 1st, then your individual Medicare Supplement Open Enrollment Period window will start then and continue for six months, ending September 30th.

For most, this period starts when they age into Medicare at 65 and enroll in Part B. Yet, others choose to delay enrolling in Part B due to through their large employer group plan. When they do retire and enroll in Part B, their Medicare Supplement Open Enrollment Period will commence on their Part B effective date.

Avoid Late Penalties By Signing Up During This Time

If you become eligible for Medicare because you turn 65, you have a window of time during which to apply for coverage. This is called the initial enrollment period: It begins three months before the month in which you turn 65 and ends three months after, for a total of seven months. If you miss the initial enrollment period, you may have to pay lifetime penalties if you enroll later. Heres more information on the initial enrollment period and why its important.

Don’t Miss: 90 Day Probationary Period Form

I Want To Enroll In Medicare What Are My Next Steps

Once you’re ready to enroll in Medicare, you’ll want to consider the following next steps:

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Recommended Reading: Period Blood Stains On Sheets

Getting Medicare For The First Time

Your Medigap Open Enrollment Period is separate from your Initial Enrollment Period when you first qualify for Medicare.

When you sign up for Medicare with Social Security or get automatically enrolled, you will not have a Medicare Supplement plan. What youll have is Original Medicare, or Medicare Part A and Part B . This is the traditional health insurance program thats run by the federal government.

Once you have Part A and B, you can get a Medicare Supplement plan.1

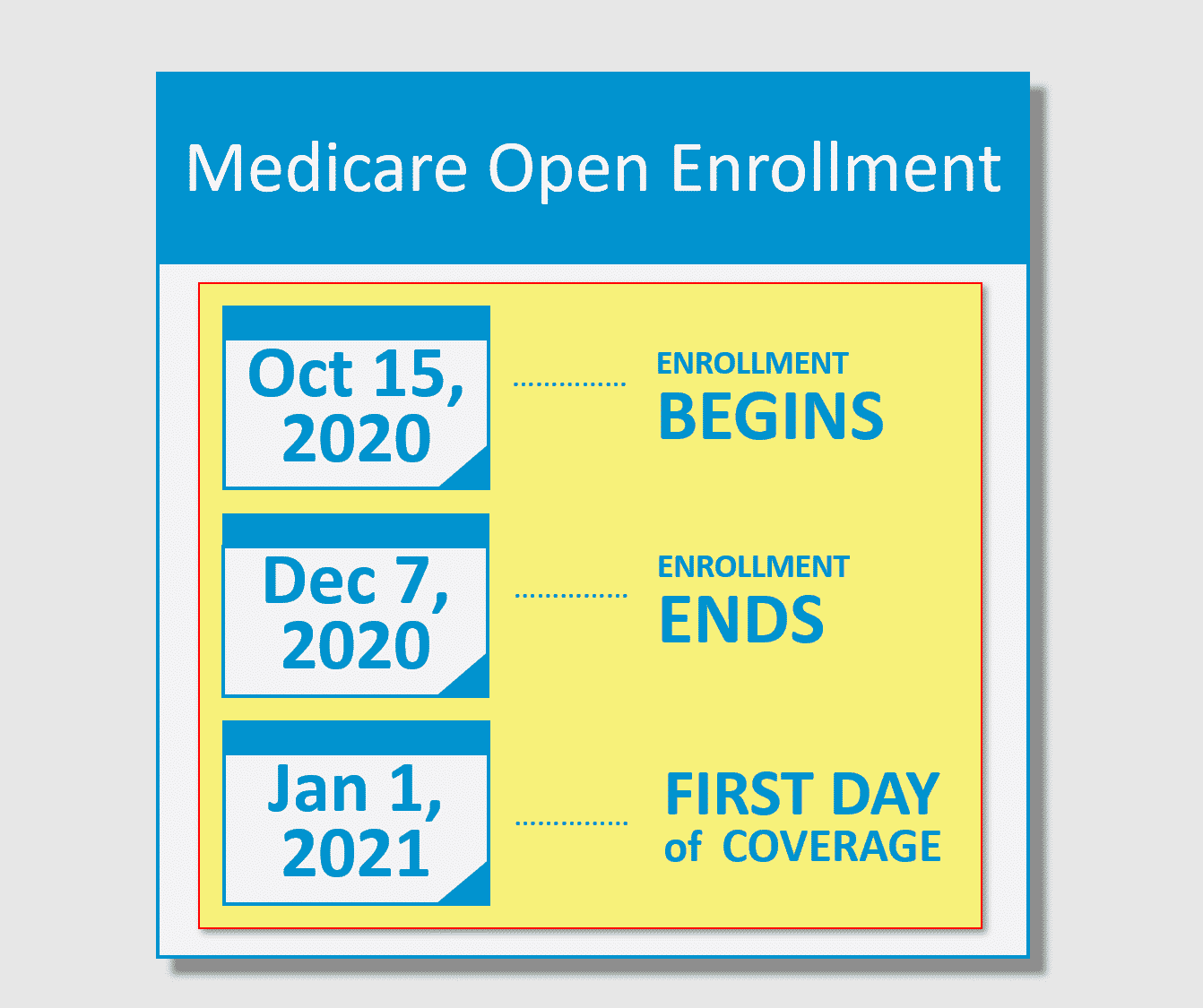

Tip: Be careful not to confuse your Medigap Open Enrollment Period, sometimes referred to as the Medicare Supplement Open Enrollment Period, with the Annual Enrollment Period that runs from October 15 to December 7 each year. The Annual Enrollment Period allows you to make changes to your Medicare coverage, such as switching between Original Medicare and Medicare Advantage.

What Is A Medicare Supplement Plan

Medicare consists of Part A which covers hospital, skilled nursing and hospice costs, and Part B which covers medically necessary services and supplies. Part A and Part B are often referred to as Original Medicare.

A Medicare Supplement plan is sold by private insurance companies and can help you get the coverage you need to fill the gaps in Original Medicare. Plans are lettered A through N and offer a standardized set of benefits, although each is a little different in what and how much they cover.

In 2015, one in four people with Original Medicare had a Medigap supplemental policy to help cover deductibles, cost-sharing and catastrophic expenses, according to a report from the Kaiser Family Foundation Boccuti C, Jacobson G, Orgera K, Neuman T. Medigap Enrollment and Consumer Protections Vary Across States. Kaiser Family Foundation. Accessed 09/22/2021. .

Indeed, Original Medicare coverage often contains large gaps. For example, nearly six million Medicare beneficiaries are currently facing out-of-pocket costs for COVID-19 treatment, because they had no supplemental coverage such as Medigap, to help pay for some or all of the cost sharingFreed M, Cubanski J, Neuman T. Medicare Beneficiaries Without Supplemental Coverage Are at Risk for Out-of-Pocket Costs Relating to COVID-19 Treatment. Kaiser Family Foundation. Accessedd 09/22/2021. .

Read Also: 90 Day Probation Period Template

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

What Does A Medicare Supplement Insurance Plan Cover

Medicare Supplement insurance plans are standardized, and in most states theyre labeled A through N . These plans may cover a range of health-care costs, such as Medicare Part A coinsurance, blood, skilled nursing facility care coinsurance, Part A and Part B deductible**, and foreign travel emergencies up to plan limits.

While all Medicare Supplement insurance plans cover Medicare Part A coinsurance at 100%, the rest of the benefits vary among plans. For example, in 2021, Medicare Part A out-of-pocket costs include a $1,484 deductible for each benefit period. You typically pay a $371 coinsurance per day of hospitalization for days 61-90 for each benefit period, and a $742 daily coinsurance after that, up to a lifetime limit. Beyond Part A coinsurance, not all Medicare Supplement insurance plans cover all benefits at the same percentage.

Keep in mind that Medicare Supplement insurance plans only work with Original Medicare. You cant use these plans to pay for Medicare Advantage costs.

*Pre-existing conditions are generally health conditions that existed before the start of a policy. They may limit coverage, be excluded from coverage, or even prevent you from being approved for a policy however, the exact definition and relevant limitations or exclusions of coverage will vary with each plan, so check a specific plans official plan documents to understand how that plan handles pre-existing conditions.

New To Medicare?

Also Check: Employee Probationary Period Template

When Can You Sign Up For Medicare Supplement Plans

When it comes to Medicare Supplement plans, you can join at any time of the year. If your Open Enrollment window has passed, you can still apply. However, youll most likely have to go through medical underwriting and answer health questions during the application process.

Outside your one-time open enrollment window, a carrier can deny you coverage due to pre-existing conditions or health issues. The only way around this is if youre granted guaranteed issue rights due to a circumstance that would qualify you for a Special Enrollment Period.

Some states have unique open enrollment rules, such as birthday rules that allow you to enroll in Medigap around your birthday each year, without answering health questions. In Connecticut, there is a year-round open enrollment window for all beneficiaries.

What Is The Medicare Advantage Open Enrollment Period

by The Medicare Gal | Feb 15, 2022 | General Medicare Information |

Did you know that you might be able to change your Medicare Advantage plan during Medicare Advantage Open Enrolment Period?

Its true. Whether youve just enrolled in Medicare or have been with your current plan for years, you have an opportunity to change plans during the Open Enrollment Period , which is DIFFERENT from the Annual Election Period .

There are many reasons people may decide to change their MAPD plan during this time. Sometimes their current doctor or providers may no longer accept their current plan. Maybe their plan changed and they didnt realize it.

Or they may find another plan that offers additional benefits such as a gym membership, or wellness services. Often Medicare beneficiaries are looking for better coverage on services such as dental, vision, or hearing. For whatever reason, if you are not happy with your current MAPD plan, you can enroll in a new MAPD plan during the open enrollment period .

Recommended Reading: Usaa New Car Insurance Grace Period

You May Like: 90 Day Probationary Period Policy Examples

What If I Miss My Medicare Supplement Open Enrollment Period

When you miss your Medigap Open Enrollment Period and are denied coverage, there are alternative options. If you have a serious health condition that causes a Medigap carrier not to accept you, you should be able to enroll in a Medicare Advantage plan.

Advantage plans only have one health question, and most applicants can pass. However, youll have to wait until the fall enrollment period to sign up for one of these plans.

Youll be required to stay within the plans network of doctors. However, if youre willing to pay more for a PPO plan that gives you access to doctors outside their network, you may be able to keep the same doctor.

How Medicare Defines A Pre

A pre-existing condition is any health issue you may have had and received documented diagnosis or treatment for before your new insurance policy is due to start. However, it may still be possible for a condition to be classified as pre-existing by Medicare even if its undiagnosed or untreated.

Lets say, for example, you are about to turn 65 and have diabetes requiring insulin and continuous glucose monitoring. You also have sleep apnea and use a CPAP, or continuous positive airway pressure, at night. Both would be classified as pre-existing conditions by Medicare, because youd have a documented diagnosis in your medical record and have been receiving ongoing treatment.

Each state regulates the coverage rules for pre-existing conditions under Medigap differently. Youll want to check with your states Medicare office to verify eligibility rulesespecially if you are interested in getting a policy outside of your initial enrollment period.

Read Also: Brown Stuff Instead Of Period

Medicare General Enrollment Period

If you don’t sign up during your Initial Enrollment Period and if you aren’t eligible for a Special Enrollment Period, the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

The General Enrollment Period lasts from each year.

You can only sign up for Part A and/or Part B during this period, and your coverage starts on July 1. You may have to pay a late enrollment period for Part A and/or Part B, as detailed below.

|

Part B Late Enrollment Penalty: If you do not enroll in Medicare Part B during your Initial Enrollment Period but decide to enroll later in life, you will have to pay a late enrollment penalty. Your Part B monthly premium could go up 10 percent for each 12-month period that you were eligible for Part B but didn’t sign up. You pay the Part B late enrollment penalty for the rest of your life as long as you remain enrolled in Part B. |