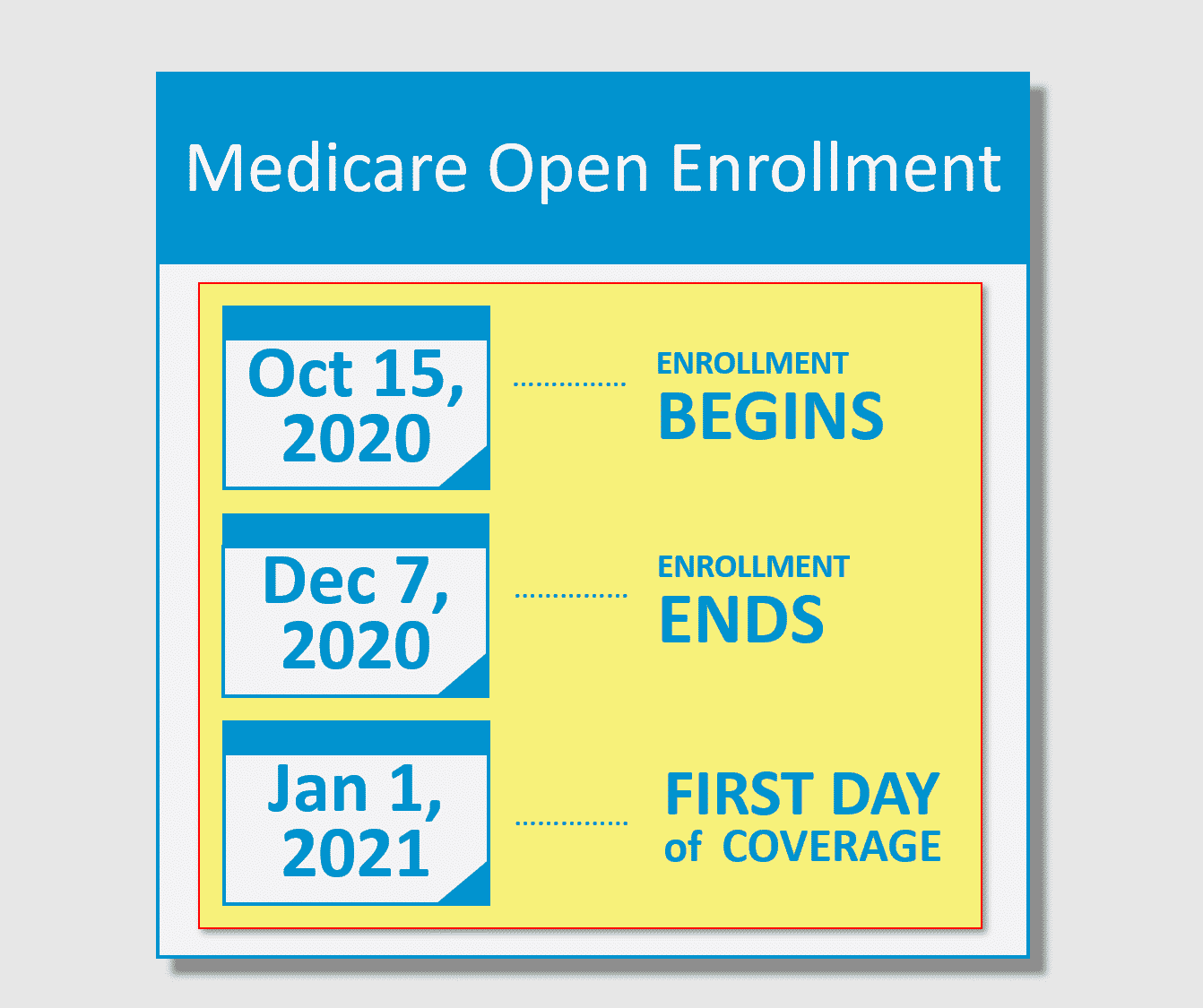

Medicare Beneficiaries Have 54 Days Until December 7th To Make Any Changes To Their Medicare Advantage And Part D Drug Coverage For 2021

To understand what you should do and are allowed to do during Medicare Annual Enrollment, first you need to understand the 4 parts of Medicare.

Medicare: Annual Enrollment 2020

On October 15th, the Medicare Annual Enrollment Period , sometimes referred to as Medicare Open Enrollment, starts. This is the time to make sure you have the best Medicare coverage for the upcoming year.

You Have A Chance To Get Other Coverage

- I have a chance to enroll in other coverage offered by my employer or union.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan to enroll in the private plan offered by your employer or union.

When?

Whenever your employer or union allows you to make changes in your plan.

- I have or am enrolling in other drug coverage as good as Medicare prescription drug coverage .

-

What can I do?

Drop your current Medicare Advantage Plan with drug coverage or your Medicare Prescription Drug Plan.

When?

- I enrolled in a Program of All-inclusive Care for the Elderly plan.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan.

When?

Anytime.

Do Some People Get A Second Open Enrollment Period For Medigap

There are very few situations where a beneficiary will get a second Medigap Open Enrollment Period. Below is a list of a few.

- If you retire, enroll in Medicare Part B, then go back to work and join your employers group health care coverage, youll get a second Medicare Supplement Open Enrollment Period when you retire again and enroll back into Medicare Part B.

- If you get Medicare due to a disability when youre under 65, youll get two Medigap Open Enrollment Periods. The first will start with your Original Medicare Part B effective date before you turn 65. The second will begin when you turn 65.

One reason a beneficiary on Medicare due to disability would choose not to enroll during their first Medigap Open Enrollment Period is due to the minimal Medigap plan options available to them. Only certain states require Medicare Supplement carriers to offer Medigap plans to people under 65.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

In fact, most states only offer Plan A to those under 65. Because of this, someone qualifying due to disability may not have many options when first eligible. Allowing for a second Medicare Supplement Open Enrollment Period gives these beneficiaries access to all plans in their area.

You May Like: Signs Of Pregnancy After Missed Period

Medicare Supplement Open Enrollment Period

Home / FAQs / Medicare Enrollment / Medicare Supplement Open Enrollment Period

The Medicare Supplement Open Enrollment Period is unique to each Medicare beneficiary. This enrollment period allows you to enroll in any Medigap plan without answering health questions. For most beneficiaries, this enrollment period happens once in a lifetime. Thus, it is the best time to sign up for a Medicare Supplement plan.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Although you can still sign up for a Medigap plan at any time of the year, your Medicare Supplement Open Enrollment Period prohibits carriers from denying you coverage because of pre-existing health conditions.

What If I Miss My Medicare Supplement Open Enrollment Period

Dont worry if you happen to miss your Medigap Open Enrollment Period and face denial of coverage. You still have options.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

If you have a serious health condition that causes a Medigap carrier to deny you, you should be able to enroll in a Medicare Advantage plan. However, youll need to wait until the Annual Enrollment Period to sign up for one of these plans.

Once on a Medicare Advantage plan, youll need to stay within the plans network of doctors. However, you may be able to keep the same doctor if you switch to a Medicare Advantage PPO plan.

Don’t Miss: Period Like Cramps During Early Pregnancy

When Do You Have Guaranteed Issue Rights To Buy A Medigap Policy Outside Of Your Oep

You usually have guaranteed issue rights when you have other coverage that changes in some way. For example, your insurance company stops offering coverage where you live. During this time, insurance companies must sell you a policy, cover all your preexisting conditions. In most cases, you have 63 days from the date your coverage ends to enroll in a Medigap policy.

Here are some of the most common situations for Medigap guaranteed issue rights.

- You have Original Medicare and group coverage through COBRA, an employer, or a union plan that pays after Medicare pays its portion, and that plan is ending.

- Youre enrolled in Medicare Advantage and the plan stops offering coverage where you live, you move out of the plans service area, or the plan leaves Medicare.

- You enrolled in Medicare Advantage when you were first eligible for Medicare at age 65, youre still within your first year of enrollment, and you want to switch back to Original Medicare.

- You left your Medigap policy to join Medicare Advantage for the first time, youre in your first year of enrollment, and you want to switch back to Medigap.8

When Is The Best Time To Enroll In A Medigap Plan

As mentioned, the timing of your enrollment may affect your coverage choices and costs. In general, the best time to enroll in a Medicare Supplement insurance plan is during your Medigap Open Enrollment Period. This is the six-month period that starts on first day of the month that you are both 65 or older and enrolled in Medicare Part B. Throughout this period, you can enroll in any Medigap plan offered in your service area with guaranteed issue. This means that insurance companies arenât allowed to use your medical history or pre-existing conditions as the basis for charging you more for coverage or denying you altogether. If you have medical issues or disabilities, itâs especially important to take advantage of this period: Your Medigap Open Enrollment Period may be one of the few times that you have a guaranteed right to enroll in any Medicare Supplement insurance plan in your area.

You May Like: Can You Take A Plan B On Your Period

Can You Enroll In Medicare Supplement Plans At Other Times

Medicares open enrollment period, which is Oct. 15 through Dec.7 annually, allows you to make changes to your health and drug coverage. But 57% of Medicare enrollees dont take advantage of the potential money-saving option to compare their Medicare coverage choices, according to data from the Kaiser Family FoundationFreed M, Koma W, Cubanski J, Fuglesten BJ, Neuman T. More Than Half of All People on Medicare Do Not Compare Their Coverage Options Annually. Kaiser Family Foundation. Accessed 09/22/2021. . Older enrollees are even less likely to review their plan choices, with 66% of those 85 and older not taking advantage of open enrollment at all.

If you are past the initial open enrollment period and are interested in a Medigap plan, Jacobson provides a warning: Medigap insurers dont have to sell you a plan that you want and can charge you higher premiums if they do choose to sell you a plan depending upon where you live, your health status and your age.

There are also scenariossuch as if youre already enrolled in Medicaid or have a Medicare Advantage planin which it might actually be illegal for an insurance company to sell you a Medigap policy, according to the Centers for Medicare and Medicaid Services.

Different insurance companies may charge you different premiums for the same exact Medigap policy, the center also notes, so be sure to shop around and compare policies under the same plan type, and focus on what matters most to you and your situation.

You Can Move From A Medicare Supplement To A Medicare Advantage Plan

Unless you are just starting Medicare, or you qualify for a special enrollment period, the only time you can move to a Medicare Advantage plan is during AEP.

Like we mentioned above, Medicare Advantage plans, or Part C plans, are where you elect to receive your Part A and Part B from a private insurance company.

There are many reasons why you might choose an Advantage plan over a Medicare

Supplement, including a lower monthly premium. Many Advantage plans come with a $0 monthly cost. They also can include extra benefits, such as vision, dental, and hearing coverage.

Advantage plans almost always include drug coverage as well, so you do not need a separate Part D drug plan.

Advantage plans are able to offer lower prices and extra benefits since they limit their customers to using networks. You must go to their doctors and their hospitals in order to get coverage.

For many people, this works out very well, as you are used to networks from your work coverage. If you would like to look at Advantage plans during this Annual Enrollment Period, make sure you work with a broker so you can see all your options.

Advantage plans vary by zip code, doctors, and the prescriptions you take, so the plan and company that works for someone else might not work for you.

Also Check: How To Lose Weight On Your Period

What If You Continued Working Past 65

If youre still working past 65 and you or your spouse get health insurance through an employer or union with 20 or more employees or members, you may already have coverage thats similar to Part B. In this case, you can postpone Part B enrollment and you wont face a penalty when you enroll later.12 Part B has a standard monthly premium , so you can save money by not enrolling until you really need it.9

Your Medigap Open Enrollment Period will start once you sign up for Part B. Youll have six months to buy any plan sold in your state at the lowest possible rate with no medical questions asked.

Can You Get A Medigap Policy Under 65

Depending on the state, you may be able to apply when first eligible and get a policy. But the premiums you pay may be more. Then as you get closer to 65, you can enroll in a Medigap policy of your choice at the best price during the Initial Enrollment Period. The IEP begins three months before you turn 65.

Don’t Miss: Period Started Then Stopped Am I Pregnant

Buy A Policy When You’re First Eligible

The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first month you have

and you’re 65 or older. It can’t be changed or repeated. After this enrollment period, you may not be able to buy a Medigap policy. If you’re able to buy one, it may cost more due to past or present health problems.

Medicare Select Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

It differs from Medicare Supplement insurance because you are expected to use a network of hospitals associated with the insurance company. In return, you will usually pay lower premiums. Also, in order to enroll in a Medicare SELECT plan, you must live within the service area of a network facility.

Recommended Reading: Why Do You Get Headaches On Your Period

Is Medicare Open Enrollment Still Open

No, the fall Medicare Open Enrollment Period for Medicare Advantage plans and Medicare prescription drug coverage is closed. The next fall Medicare Open Enrollment Period begins October 15, 2022, during which you may be able to drop, switch or enroll in a Medicare Advantage or Medicare Part D prescription drug plan for the 2023 plan year.

Tips For Filling Out Your Application

- Fill out the application carefully and completely, including medical questions. The answers you give will determine your eligibility for open enrollment or guaranteed issue rights .

- If your insurance agent fills out the application, check to make sure it’s correct.

- Remember that the insurance company can’t ask you any questions about your family history or require you to take a genetic test.

- If you buy a Medigap policy during yourMedigap Open Enrollment Period, the insurance company cant use any medical answers you give to deny you a Medigap policy or change the price.

- If you provide evidence that you’re entitled to a guaranteed issue right, the insurance company can’t use any medical answers you give to deny you a Medigap policy or change the price.

Don’t Miss: Does Birth Control Make Your Period Stop

Medigap Plan C And Plan F Changed In 2020

A slight but important change was made to the selection of standardized Medigap plans available in most states.

Plan C and Plan F are no longer available to new Medicare beneficiaries who became eligible for Medicare after January 1, 2020.

If you were already eligible for Medicare before January 1, 2020, you may still purchase Plan C or Plan F in 2020 and beyond if either plan is available where you live.

But anyone who became eligible for Medicare after January 1, 2020, will not be allowed to enroll in either of those two plans.

Anyone currently enrolled in Plan C or Plan F will be allowed to keep their plan going forward.

This 2020 Medigap plans change came as a result of federal legislation that prohibits full coverage for the Medicare Part B deductible. Plan C and Plan F are the only standardized Medigap plans that provide this benefit.

And This Year Isnt Just Shorter

Several other changes were made over the past few years that will magnify the impact of a shorter health insurance Open Enrollment Period.

No More Individual Mandate: The tax penalty for going without health insurance no longer exists starting in 2019. This will remove one incentive to get health insurance in a timely manner, as stragglers can now rely on short-term insurance plans to fill coverage gaps instead. To date, only 4 states have added a local individual mandate.

Stricter Special Enrollment Requirements: Previously, the federal government would take your word for it if you tried to join a plan outside of open enrollment due to a special circumstance. As of this year, there are strict verification standards that involve sending the documents in a short period of time.

Removal of Non-Payment Loophole: Some consumers had also learned to stop paying their premiums in the months leading up to open enrollment. They bet that it would take a while for their coverage to be canceled, or even decided to lose coverage since they no longer needed it. This five-finger discount loophole was closed for 2018. Now, youll only be able to switch to new coverage if your old coverage is paid in full. Consumers especially those who are behind on payments by accident may not be able to learn about the issue, reconcile their bills, and sign up in time.

Don’t Miss: If I M Not Pregnant Why Is My Period Late

Medicare 2020 And 2021 Enrollment Dates: Key Takeaways

- The plan-year 2020 Medicare open enrollment period has ended. The next open enrollment period will run from October 15, 2020 to December 7, 2020, for coverage effective in 2021.

If youre enrolling in Medicare for the first time, theres a fairly straightforward process and timeline

But beyond that first opportunity to enroll in Medicare plans, the federal government provides other windows for enrollment: annual opportunities to enroll if youve delayed your enrollment for some reason, or to change your coverage if youve already enrolled.

Heres a quick guide to the times when you can enroll in or change Medicare coverage during the course of the year.

Whats The Difference Between The Annual Enrollment Period And Medigap Open Enrollment Period

Your Medicare Supplement Open Enrollment Period is not the same as the Annual Election Period in the fall. The latter pertains to Medicare Advantage and Medicare Part D plans and the dates are the same every year. Your Medigap Open Enrollment Period is unique to you, only happens once in your lifetime, and only concerns Medicare Supplement selection.

Many new beneficiaries think they can enroll in a Medigap plan and bypass health questions during the Annual Enrollment Period. However, this isnt the case.

This is one of the biggest misconceptions and causes the most problems for beneficiaries. Its also why its so important to know about enrollment periods. One option during the Annual Enrollment Period is to disenroll from a Medicare Advantage plan and return to Original Medicare. This allows the beneficiary to enroll in prescription drug plan coverage and Medigap.

Read Also: Is It Normal To Have Two Periods In A Month

Medicare Supplement Medigap Insurance

Medicare Supplement insurance is health insurance sold by private insurance companies to cover some of the “gaps” in expenses not covered by Medicare.

For policies sold before June 01, 2010, there are fourteen standardized plans A through L. For policies sold on or after June 01, 2010, there are 11 standardized plans A through N. Each standardized Medigap policy must provide the same basic core benefits such as covering the cost of some Medicare copayments and deductibles. Some of the standardized Medigap policies also provide additional benefits such as skilled nursing facility coinsurance and foreign travel emergency care. However, in order to be eligible for Medigap coverage, you must be enrolled in both Part A and Part B of Medicare.

As of June 1, 2010, changes to Medigap resulted in modifications to the previously standardized plans offered by insurers. Medigap plans H, I, and J, which contained prescription drug benefits prior to the Medicare Modernization Act, were eliminated. Plan E was also eliminated as it is identical to an already available plan. Two new plan options were added and are now available to beneficiaries, which have higher cost-sharing responsibility and lower estimated premiums:

- Plan M includes 50 percent coverage of the Medicare Part A deductible and does not cover the Part B deductible

- Plan N does not cover the Part B deductible and adds a new co-payment structure of $20 for each physician visit and $50 for each emergency room visit