Uses Of Revocable Living Trusts

People often use revocable living trusts to help their family members avoid probate court. With a revocable trust, you can remain in control of what happens to your assets. You can add and remove assets, make changes, and even close the trust without having to consult anyone else.

Your assets are not protected from Medicaid in a revocable trust because you retain control of them. The primary benefit of a revocable trust is that you can name a beneficiary who will receive payouts from the trust after your death. This allows them to avoid entering the assets in the trust into probate in New Jersey.

For a legal consultation, call

What Is A Medicaid Asset Protection Trust

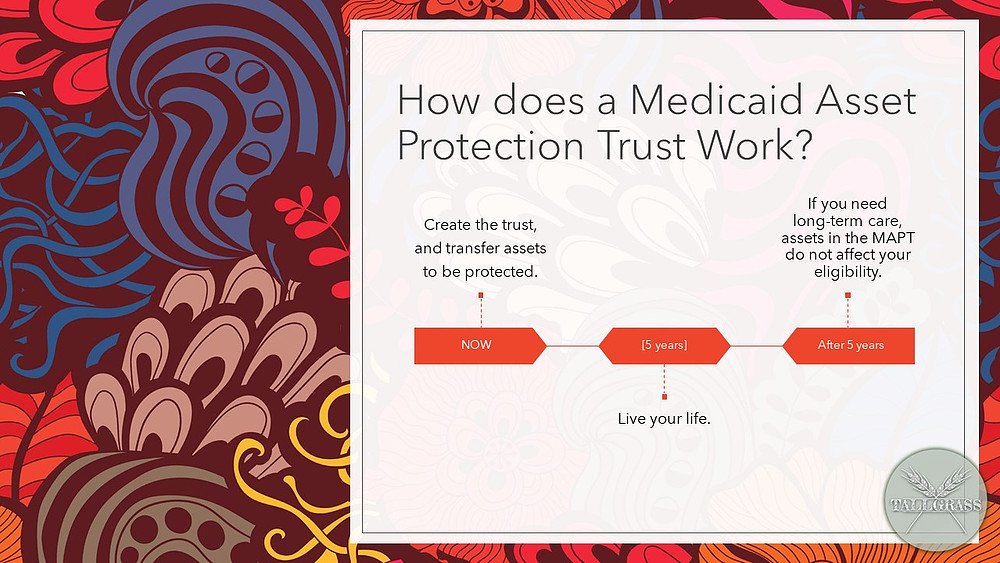

Medicaid Asset Protection Trusts, sometimes called Irrevocable Income Only Trusts or Medicaid Trusts, are used to protect assets and allow people to qualify for Medicaid long-term care. In order to protect the assets, the trust must be created 2.5 years before home care Medicaid is needed or 5 years before nursing home care is needed.

Transfers To A Medicaid Irrevocable Trust

A Medicaid irrevocable trust, also known as an asset protection trust, may allow you to qualify for Medicaid benefits while preserving assets for family members or other beneficiaries. It is a legally enforceable arrangement that allows you to transfer property to someone else who holds the property for family members, typically children.

You and your spouse are not beneficiaries of this trust. Typically, one or more of your children would be the trustee. The trust is irrevocable meaning that you cannot amend or revoke it.

At the time of asset transfers to the trust, the gift is subject to the transfer of asset rules — in most cases this is a five-year look back period.

Under federal law, a state may not look back more than 60 months from the Medicaid application date in an attempt to find disqualifying asset transfers. In month 61, a Medicaid applicant is financially eligible for Medicaid because the gift made 61 months ago does not have to be disclosed to the State.

There are many benefits to establishing a Medicaid irrevocable trust:

The transfer of your assets to the trust for the benefit of children or other family members is not a completed gift for gift tax purposes . A gift tax return is required to be filed for the calendar year when assets are transferred to the trust.

Finally, the trust assets are eligible for a stepped-up tax cost basis to the fair market value on the donors date of death.

Un-funding the Trust

You May Like: How Can You Track Your Period

What Other Options Exist If We Want To Protect Our Assets From The Nursing Home

If you do not want to lose control of your money five years before you get sick, we have more on Medicaid planning options on this webpage. The basic answer is that you can:

How Does The Medicaid Look

One area that causes a lot of confusion with regard to Medicaid is the look-back period. Medicaid, unlike Medicare, is a means-based program, which means that you are only eligible for it if you have very few assets. The government does not want you to transfer all your assets on Monday in order to qualify for Medicaid on Tuesday, so it has imposed a penalty on people who transfer assets without receiving fair value in return.

In order to identify who has transferred assets, states require a person applying for Medicaid to disclose all financial transactions he or she was involved in during the five years before the Medicaid application. This five-year period is known as the “look-back period.” The state Medicaid agency then determines whether the Medicaid applicant transferred any assets for less than fair market value during this period.

Local Elder Law Attorneys in Your City

City, State

Any transfer can be scrutinized, no matter how small. There is no exception for charitable giving or gifts to grandchildren. Informal payments to a caregiver may be considered a transfer for less than fair market value if there is no . Similarly, loans to family members can trigger a penalty period if there is no written documentation. The burden of proof is on the Medicaid applicant to prove that the transfer was not made in order to qualify for Medicaid.

For more information on Medicaid asset transfer rules, .

Recommended Reading: Negative Pregnancy Test But No Period

Factors That Make An Irrevocable Asset Protection Trust A Good Choice

- The size of your estate your assets should probably exceed $150,000 in creating an irrevocable trust to protect your assets from the high cost of nursing home care.

- Trusted and responsible family member to serve as trustee – very important!

- A desire to leave or preserve a legacy to your family – we would not recommend this type of planning for people who are not trying to protect assets for future generations, for instance

How To Legally Protect Your Assets Before The Look Back Period

If you are healthy and not immediately looking to receive long-term care in the immediate future, there are several steps that you can take now to better prepare yourself for the future:

Reach out to us to receive the proper advice and guidance from an elder law attorney, we are here to help you!

Contact us today

Also Check: Can I Get Pregnant 6 Days After My Period

What Is The Medicaid Five Year Look Back Period

When one applies to Medicaid’s institutional care program, the file will be assigned to a Medicaid caseworker. The Medicaid case worker will review all transactions for the prior five years to determine whether any assets were given to any individual or entity for less than fair-market value . This review by the Medicaid case worker is referred to as the “look back period.”

If the caseworker finds transfers without value/gifts within that five-year period, a penalty period is assessed. The purpose of the Medicaid penalty periods to dissuade Medicaid applicants from giving away their assets for the sole purpose of qualifying for Medicaid. During the penalty period, Medicaid will not pay for the long-term care.

The DRA also amended the date when the Medicaid penalty period starts. Prior to the DRA, the penalty period began with the month in which the gifted asset was transferred. Now, the penalty period begins with the date of the asset transfer or the date the medicaid applicant enters the nursing home and otherwise qualifies for Medicaid, whichever is later!

Exceptions And Exemptions To Medicaid Gifting Rules

Not all gifts trigger Medicaid penalties.

Continuing with the previous example, say your daughter lived in the aforementioned house while taking care of you for at least two full years before you applied for Medicaid. If your daughters care enabled you to delay the move into a nursing home, then the transfer of your house into her name for less than FMV would not result in any kind of penalty. This child caregiver exemption is valid even if a senior applies for Medicaid within five years of the transfer.

Another exception to the general rule is a gift for a child who is blind or disabled under the Social Security Administrations rules. No penalty will be attached to such a gift, no matter how large.

Finally, there is never any penalty imposed on gifts between spouses. Since the total assets of both spouses are counted when one spouse applies for long-term care Medicaid, there is no reason to impose a penalty on such transfers, and that is exactly how the law reads.

Also Check: How To Make Your Period Stop For A Day

What The Future Holds

The crisis in healthcare and long-term care will shape public policy for years to come. It has become clear that long-term care, such as nursing home and home healthcare, will not be a part of any new universal health insurance program. The Deficit Reduction Act of 2005 is just the beginning. There will be continuing pressure to limit expenditures on existing programs, including Medicare and Medicaid. Within the past year, reform of Medicare, Social Security and Medicaid has risen to the top of the governments agenda, in Washington DC, New Hampshire and Vermont.

It is imperative that seniors, those approaching retirement age, and the families of those needing long-term care, take advantage of the planning opportunities that exist today.

Everyones situation is unique. It is impossible to discuss all of the planning opportunities in this report. As with any planning, a good way to begin is to seek competent advice from a qualified professional. We at Caldwell Law are dedicated to helping people find solutions to their long-term care needs.

Means testing is an examination into the financial state of a person to determine eligibility for public assistance.

Get the facts. Find out what you need to know. Contact Caldwell Law for a free consultation or browse our website to learn more. We offer many free workshops, free resources, and monthly newsletters.

Practice Areas

What Happens After The 5

At this time, please contact me and we will schedule a meeting to determine if now is the appropriate time to put in a Medicaid application or spend down assets which were left out of the Trust. Remember, laws can change, so it is important to contact your attorney at the end of 5 years to determine what, if any, law changes may affect your plan.

Read Also: How To Know When Your Period Is Coming Again

How To Spend Down Assets

A valuable planning strategy after a person has already entered the nursing home is to spend down resources to purchase allowable items before applying for vendor MO HealthNet benefits. If a person has not yet purchased an irrevocable pre-need funeral/burial plan or irrevocably assigned a life insurance policy to a funeral/burial plan agreement, they can do so without penalty by following special Medicaid guidelines. The purchase of an automobile may be made. It is possible that a wheelchair accessible automobile would be necessary for transportation to and from medical appointments. If a healthy spouse will remain in the home, money may be used on home improvements and upgrades. Payment of debts is an additional way to spend down assets.

Financial Eligibility Requirements For Long

Many seniors with limited resources find that their countable assets and/or income exceed their states Medicaid limits. To meet the financial requirements, they must carefully minimize or spend down excess funds on things like medical expenses, home improvements, a prepaid funeral plan, etc. Gifting cannot be part of an applicants spend-down strategy for Medicaid.

Read:Assets You Can Have and Still Qualify for Medicaid

To prevent seniors from simply giving all their assets away to family and friends and then relying on Medicaid to pay for their long-term care, the Centers for Medicare and Medicaid Services created a system for reviewing all applicants financial histories. The following sections detail the ins and out of the notorious Medicaid look-back period and what happens if a senior transfers assets for less than fair market value .

Also Check: Birth Control Pills To Stop Period

Is There A Way In An Emergency To Access Principal

Yes. Sometimes principal is needed to save the day. If this occurs, I will advise you or your trustee how to legally access principal without violating the terms of the trust. This should not be done without an attorneys assistance and it is imperative that all records and receipts be kept. NEVER pay providers directly from the Medicaid Irrevocable Trust. This will corrupt your Medicaid Irrevocable Trust and that money will not be protected. There is a special way the Trust can be accessed in emergencies we advise all of our clients to contact us if they EVER need to access principle. Moreover, your children should not take money out of your Medicaid Irrevocable Trust for themselves.

Medicaid Five Year Lookback Period

Additionally, Medicaid has a five-year look-back window. This timeframe is for assets that you transfer to a trust or sell. People who do this typically sell them for below market value. And then sell them family members and/or friends before applying for long-term care. Transfers of certain assets may be disallowed if they are made less than five years before you enter a nursing care or assisted living facility. If they are disallowed, that means you still own them. Therefore, you have to spend them down before you can qualify for Medicaid long-term assistance.

You May Like: How To Know When Your First Period Is Coming

More Information On Asset Protection Trusts

We recently created our free guide to Irrevocable Asset Protection Trusts. The information presented here is given with a more detailed explanation of Medicaid and VA benefits, among other matters.

Most trusts created by attorneys are revocable living trusts. These trusts enable you to control your assets during your lifetime but also avoid probate upon your death. But standard revocable trusts do not protect your assets from the high cost of nursing home care. This blog post has more on revocable and irrevocable trusts for your consideration, which also includes special needs trusts in Florida as well.

Protecting Assets For A Single Person

Nursing home planning for the single person consists of balancing gifting with the 5-year look-back period. It is not that a person is prohibited from gifting, but rather that the gifting creates a penalty period preventing immediate qualification for nursing home Medicaid . By balancing the gifting away of some assets with converting other assets into an income stream, the nursing home can be paid for by a persons own money while also waiting for a penalty period to expire. These are complicated techniques used by Elder Law attorneys, but strategies can usually be utilized at the last minute to save at least some portion of the assets.

Our Mission is to inspire, educate, and motivate our clients to control their future by empowering them to make the best decisions for their businesses and their families resulting in peace of mond.

Sativa Boatman-Sloan, Attorney at Law Law Office of Sativa Boatman-Sloan, LLC& 417 Elder Law 4905 S National Suite A112 Springfield, MO 65810

Don’t Miss: Birth Control To Stop Period For Vacation