Paycheck Months In : What You Need To Know

For most of my career as a salaried employee, Ive been paid biweekly and have received 26 paychecks a year. Thats two more than people who are paid twice a month.

Heres the simple math:

- Biweekly: 52 weeks ÷ 2 = 26 paychecks

- Twice a month: 12 months × 2 = 24 paychecks

Every year, I pull out a calendar and identify the three paycheck months based on my employers pay schedule. But when I reviewed the 2021 calendar for biweekly workers who are paid on Fridays, I realized that its not a typical year for everyone.

Hr Calendar: What Else You Need To Know

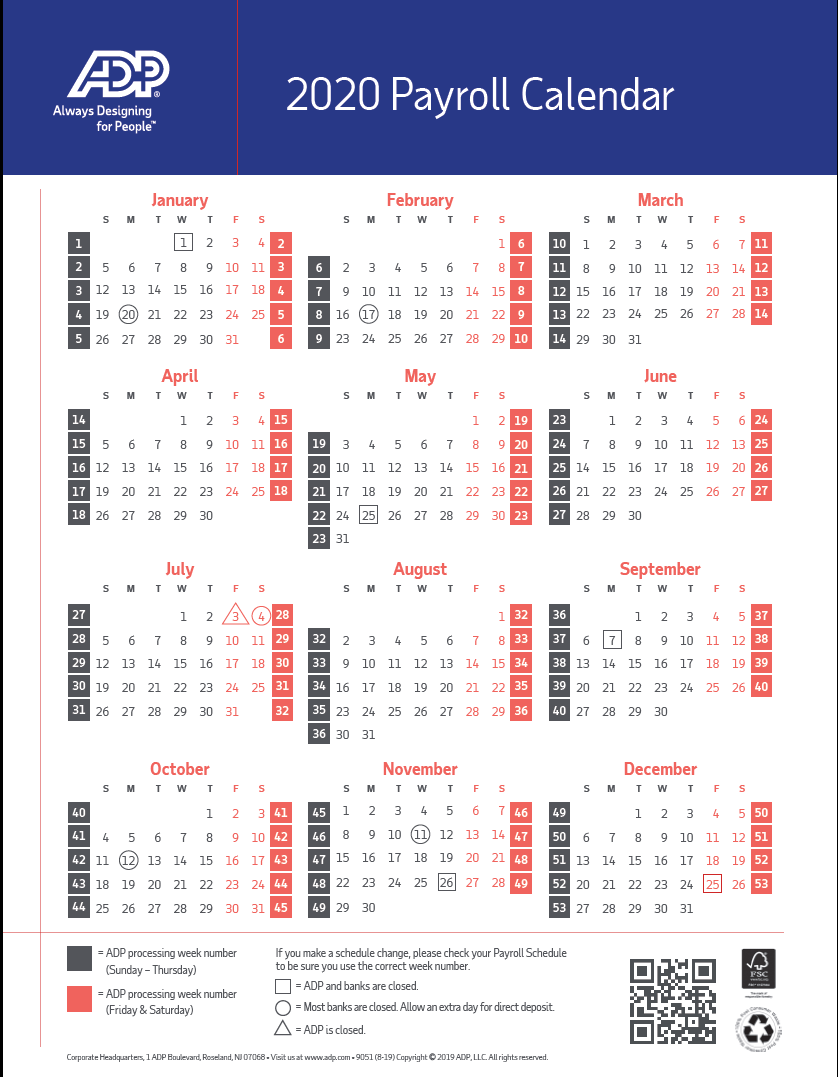

Theres more to a new year than pay periods. Stay on track from January through December with this comprehensive 2021 HR calendar, featuring everything you need to know about major holidays, key compliance requirements, ACA deadlines, and more.

Additionally, HR needs to adhere to the myriad compliance notices that apply to employee benefits in 2021. For more information about how you can prepare for the new year, follow the BerniePortal blog.

Can I Change My Pay Schedule

Once you choose a pay schedule, you may change it, but not frequently and not in a way that reduces your employees’ pay. For example, adjusting a pay period to avoid paying overtime to someone would violate the FLSA.

Changing your company’s pay schedule after several years for a legitimate business reason would be permissible, though.

Recommended Reading: Can You Have A Period During Pregnancy

How Many Pay Periods In A Year Is Right For Your Company

How many pay periods in a year?

This seems like a fairly straightforward question but the right one for your company is the one you can make payroll on comfortably.

Every pay period has its own pros and cons and choosing one of them is essentially based on your business needs and team size. The pay period you choose isnt that important.

The only thing that matters is that every payroll is accurate and on time.

But in case you do have issues with payroll and want to solve them retroactively, here is a guide on retro pay for employers.

Semimonthly Pay Period Length

A semimonthly pay period lasts half of a calendar month. The number of days in a semimonthly pay period depends on how many days there are in the month in question, which is why a semimonthly pay period may involve a different number of calendar days than a bi-weekly pay period.

Employees are only paid twice each month on a semimonthly payroll schedule.

Example of a semimonthly pay period: June 1 – June 15, or February 1 – February 14

Recommended Reading: Painkiller For Stomach Pain During Periods

Final Thoughts: Pay Period Faqs

Pay period schedules may be one of the most confusing parts of payroll processing and your overall payroll system.

Who decides that employees should be paid every two weeks? Why do employees get paid more often one month than another? Why are there extra pay periods from time to time?

With Hourly’s payroll services, you can stop worrying about pay periods and focus on the things that move the needle forward in your business. Get started with a 14-day free trial.

Many People Dream Of Working From Home But Think It’s Simply Not Practical

Employers set up payroll schedules in a variety of ways. This is the amount of money you can use for your normal expenses, such as rent, groceries, utilities and discretionary purchases. Depending on your employer’s policies, you might see your vacation pay shown separately on your pay stub. After any paycheck deductions are removed, what remains is your take home pay. While it can be difficul. A home equity loan is a financial product that lets you borrow against your home’s value. Keep reading to learn how to calculate your house value. Well, you might be surprised. Fortunately, there are multiple ways you can purchase things online with relatively little risk. It’s helpful when refinancing and when tapping into the home’s equity, as well. Consumer debt stood at almost $14 trillion in the second quarter of 2019. The thought of purchasing items online using your bank information can seem scary, especially with the rise of security breaches and hacking. Many people dream of working from home but think it’s simply not practical.

After any paycheck deductions are removed, what remains is your take home pay. Your take home pay amount is the amount of money you earn each pay period after taxes. To get more specific, mortgages, auto costs, credit cards and student loans are the four main areas of debt that h. Well, you might be surprised. Many people dream of working from home but think it’s simply not practical.

Recommended Reading: Will I Have A Period With An Iud

What Is A Monthly Pay Period

Using a monthly pay period system, employees are generally paid one time at the end of the month for a total of 12 paychecks in a year.

- This method is most often used for salaried employees.

- For payroll departments, monthly pay is less time-consuming and frees up payroll personnel for other work.

- It is a faster method, has less chance of creating errors, and it’s less costly.

- Monthly pay periods are the least popular option as they make planning personal finances more difficult.

Whats Different About The Pay Period Calendar In 2021

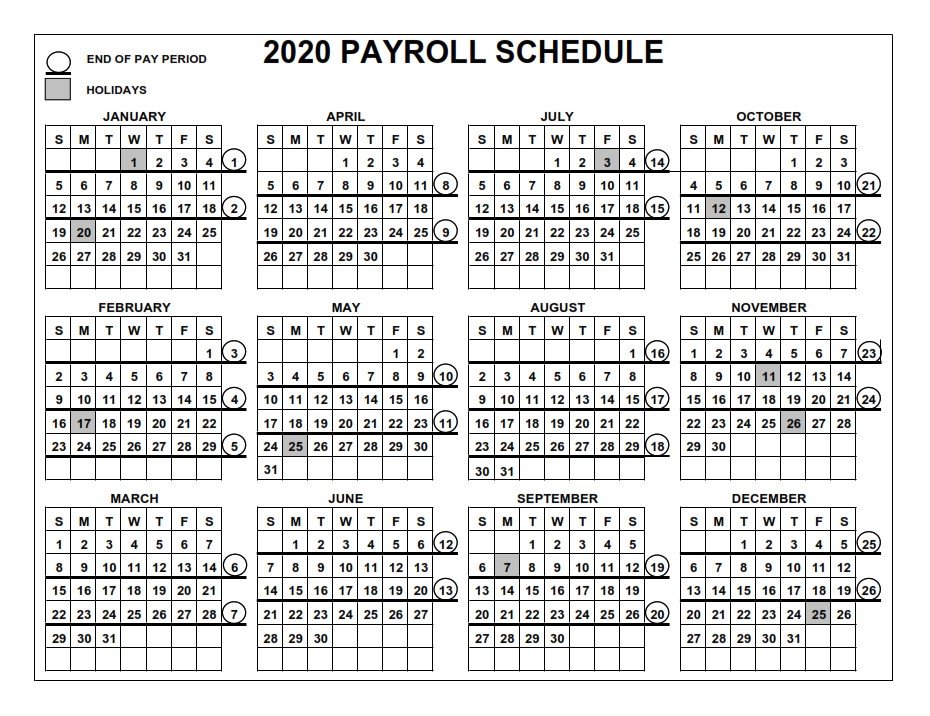

There are 53 Fridays in 2021, meaning that some employees can expect 27 biweekly paychecks throughout the new year.

Much of this depends on whether or not your company delivers paychecks to teammates on Friday, Jan. 1, which is a holiday. If so, this marks the first of three months where employees can expect three paychecks in a single month. Assuming this is the case, the other three-paycheck months in 2021 will be July and December.

Also Check: How To Make Your Period Flow Heavier

How Are Hourly Wages Calculated

To find the hourly rate of pay, the gross salary for a specific period, such as one week, is divided by the number of hours worked for that week. For example, the gross salary of an employee’s paycheck is $600. The $600 is divided by 40 resulting in an hourly rate of pay of $15.00.

To find the hourly rate of a salaried employee, the yearly gross salary is divided by 2,080. For example, an employee who is paid monthly has a monthly gross salary of $3,000, resulting in $36,000 yearly salary. This figure is then divided by 2,080 resulting in an hourly pay rate of $17.31.

Is It Possible To Have 27 Pay Periods In A Year

Yes, it is possible to have 27 pay periods in a year. If you run the payroll on a bi-weekly basis, you could have 27 pay periods whenever there is an extra day in a leap year.

If you run the payroll weekly, you could have 53 pay periods in one year even when it isnât a leap year. The number of pay periods depends on which specific day of the week you pay employees.

Recommended Reading: How Do I Slow Down My Period Bleeding

Fridays: The 2021 Pay Period Leap Year

We have reached the first non-holiday Friday of 2021, which means today is the first payday for many employers . 2021 is one of those years that come along every 5, 6 or 11 years, depending on your exact pay period and payroll calendar.

The Pay Period Leap Year

The Pay Period Leap Year doesnt really exist. Its just the phrase Ive coined to explain a phenomenon that is critically important for large employers or employers with largely salaried workforces, in particular, because it can have a substantial impact on your bottom line and it only happens roughly once per decade.

What is a Pay Period Leap Year? Put simply, Pay Period Leap Years are years with an extra payroll period. Like the Gregorian calendar created by Pope Gregory XIII in 1582, the bi-weekly payroll calendar doesnt fit evenly into a single, 365-day year. The Gregorian calendar addresses this problem by adding 1 day every four years at the end of February, just as we did in 2020. The bi-weekly payroll calendar adjusts by adding a 27th pay period every 11 years. For employers on a weekly payroll cycle, it happens twice as often. 2021 has 53 Fridays which means that, for many employers, 2021 will be a Pay Period Leap Year .

Determining if 2021 is a Pay Period Leap Year for Your Business

If the year starts on a Friday in a non-leap year, like 2021, you end up with 53 Fridays. . For the majority of employers who pay employees on Fridays, this means that 2021 will be a Pay Period Leap Year !

Payroll Calendar: 27 Possible Biweekly Pay Periods In 2021

As HR prepares for the new year, its key to stay ahead of the curve on important dates and compliance requirements. One noteworthy takeaway is that in 2021, some employees and employers can expect 27 pay periods during the payroll calendar instead of the typical 26. Heres what you need to know.

Read Also: Can You Get Your Period While Pregnant

Do I Have To Pay Employees For An Extra Payday In A Year

You’re not required to pay salaried employees more than their annual salary in years when you have extra pay periods. Some employers choose to reduce pay across all paychecks for the year to adjust for the extra payday.

This can be hard to explain to employees, though. Other employers simply absorb the expense of the extra paychecks.

How Many Pay Periods Are In A Year

There can be as many as 52 pay periods in a year or as few as 12. The number is ultimately determined by the employer unless the workplace or the employees are in a state that has specific payday requirements. Its important for business owners to strike a balance between the cost of running payroll and the financial needs of their staff.

Read Also: How Do You Get Rid Of Period Cramps Fast

How Can I Keep Track Of My Employees Pay Periods

A popular choice, especially for small businesses, is to enlist the help of a payroll service. These payroll services help you navigate payroll in accordance with employee rights. You can set up an automatic payment system for your employees, which directly deposits their payment into their bank account.

Whats more, some payroll services even have HR and accounting specialists who can provide you with specialized expertise in matters such as employee onboarding, taxes, benefits, paid time off and other factors that affect payroll. This is especially helpful for small businesses with limited-to-no HR or accounting departments.

What Is The Difference Between Pay Period And Pay Date

A pay period is the length of time during which you work, and a pay date is the day on which your team receives their paychecks.

Letâs explore these concepts further.

A pay period is the time frame in which work is being done and paid for. For budgeting purposes, remember this would include any time your team is on the clock, including any onboarding or training time. Pay periods are typically referred to by their number.

Specifically, a bi-weekly payroll schedule has 26 pay periods per year. So the first two weeks of January would be pay period one, and the second two weeks of January would be period two, and so forth.

A pay date is the date on which companies pay employees for their work. Friday is the most common payday.

It can take a few days to process payroll. Therefore, the last day of the pay period is typically not when employees get paid for their work from that pay period. The pay date for the current pay period might be on the last day of the following pay period. If you use payroll software like Hourly, your employees can see their pay stubs even as payroll is processing.

Also Check: Does Pickle Juice Help With Period Cramps

Verify Your Number Of Crb Periods

You can review your application history in CRA My Account, under “COVID-19 Support Payment Application Details”.

You can also confirm the number of CRB periods by selecting all the periods you applied for. Based on the periods you’ve selected, you can find out how much you can receive.

Select the CRB periods you applied for

- Select all periods to date

- Period 1: September 27 to October 10, 2020

- Period 2: October 11 to October 24, 2020

- Period 3: October 25 to November 7, 2020

- Period 4: November 8 to November 21, 2020

- Period 5: November 22 to December 5, 2020

- Period 6: December 6 to December 19, 2020

- Period 7: December 20 to January 2, 2021

- Period 8: January 3 to January 16, 2021

- Period 9: January 17 to January 30, 2021

- Period 10: January 31 to February 13, 2021

- Period 11: February 14 to February 27, 2021

- Period 12: February 28 to March 13, 2021

- Period 13: March 14 to March 27, 2021

- Period 14: March 28 to April 10, 2021

- Period 15: April 11 to April 24, 2021

- Period 16: April 25 to May 8, 2021

- Period 17: May 9 to May 22, 2021

- Period 18: May 23 to June 5, 2021

- Period 19: June 6 to June 19, 2021

- Period 20: June 20 to July 3, 2021

- Period 21: July 4 to July 17, 2021

- Period 22: July 18 to July 31, 2021

- Period 23: August 1 to August 14, 2021

- Period 24: August 15 to August 28, 2021

- Period 25: August 29 to September 11, 2021

- Period 26: September 12 to September 25, 2021

- Period 27: September 26 to October 9, 2021

- Period 28: October 10 to October 23, 2021

Number of CRB periods selected:

Biweekly Vs Semimonthly Payroll Periods

If you get paid semimonthly, on the 15th and 30th of every month for example, thats twenty-four paychecks a year.

If you get paid biweekly, say every other Friday, that works out to twenty-six checks a year.

Getting twenty-six checks per year means there will be two months each year where you receive three paychecks instead of two.

So which months are the three paycheck months in 2021? That depends on when you receive your first check this year.

Also Check: Why Am I Still Spotting After My Period

How Many Semi

Employers who choose this schedule may either pay their employees on the first and 15th of the month or on the 16th and last day of the month. The pay date is ultimately determined by the employer unless the workplace or the employees are in a province or territory that has specific pay day requirements. Semimonthly pay has 24 pay periods and is most often used with salaried workers.

Many employers choose to use payroll software or work with a payroll service provider to help automate paying their employees.

View other payroll calendars: