What Are Pay Periods

Pay periods are the recurring time frames used to calculate earned wages and determine when employees get paid. They are fixed and based on the schedule payroll departments use to compensate employees.

Pay periods occur weekly, bi-weekly, semi-monthly, or monthly. Youâll need to calculate payroll hours with these periods in mind.

Pay periods differ from pay dates because they represent the duration of time an employee has worked and when payment is due. The pay date is the day when the worker receives the paycheck for hours worked.

In most cases, the pay date comes a few days after the end of a pay period.

The pay period affects how an employer calculates the total gross pay for salaried and hourly workers. Gross pay for hourly staff varies because it depends on the work hours. Its the product of the hours worked and the hourly rate.

When hourly employees earn overtime, employers must apply that overtime to the pay period in which employees earned it. The Fair Labor Standards Act has stringent overtime requirements and regulations for businesses to follow.

The pay cycle determines payroll frequency and the specific day team members get paid. Staff on a monthly payment schedule receive payment on the last day of the month. While bi-weekly pay periods are the most popular structure in the US, they often result in pay period leap periods â its just something youll want to keep in mind as you consider your salary budget.

Payroll Can Be A Hassle But It Doesnt Have To Be

Most business owners will be quick to tell you that they donât look forward to running payroll . Itâs another administrative task that they need to get through.

But, before you can cut any checks, you first need to decide on a payroll schedule for your business.

From biweekly to semi-monthly pay, there are plenty of options out there. Use this as your guide to land on the payment frequency thatâs best for you and all of your hard-working employees.

What Is A Pay Schedule

A pay schedule, sometimes called a pay period, is the time worked between a set amount of dates. Organizations use several standard pay schedules, including weekly, biweekly, monthly, and semimonthly. Here is a brief introduction to these four common types:

-

Weekly: A company pays their employees every week on the same day. For example, they pay you every Friday.

-

Biweekly: A company pays their employees every other week on the same day. For example, they pay you every other Friday.

-

Monthly: A company pays their employees every month on the same date. For example, they pay you on the 1st of every month.

-

Semimonthly: A company pays their employees twice a month on the same dates. For example, they pay you on the 1st and 15th of every month.

Companies choose a specific pay schedule based on several factors, including industry, type of employee work and accounting costs. The two most common pay schedules for businesses across every sector are biweekly and semimonthly.

Read Also: How To Know If You Got Your Period

Being Paid On A Date Versus A Day Of The Week

Being paid semimonthly means that the company pays on specific dates, such as the 1st and 15th or the 15th and end of the month. Conversely, you will receive a paycheque on a particular day if they operate a biweekly pay schedule. Employers usually organize to release biweekly payments every other Friday, but they can set it up however they prefer.

What Is Semi Monthly Pay Pros & Cons

Semi monthly pay is a schedule of regular payments, twice a month, on specified days. Typically on the 1st and 15th of the month. You would get paid 2 times per month for work or services performed. Since there are 12 months in a year, that would make 24 semi-monthly pay periods.

According to US Bureau of Labor Statistics, the semi-monthly pay period is the third most common pay period in the US behind weekly and bi-weekly pay periods respectively.

Read Also: Can Periods Stop Suddenly In Menopause

Semimonthly Vs Biweekly Payroll Pay Schedules

As a business owner, payroll can be your highest expense. And determining your pay frequency can impact your businesss financial health. A semimonthly payroll schedule occurs twice a month. A biweekly payroll schedule occurs every two weeks. With that in mind, heres what you need to know to choose a payroll schedule thats right for your business.

Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic.

Cons Of Weekly Pay Period

The cons to having weekly pay include being given a smaller paycheck then if you had bi-weekly or semi-monthly pay. Therefore, its harder to plan just because life happens, and you may not be able to save all your money. It is easy to lose track of your spending, because it happened over a few days instead of the same day.

Also Check: How To Stop Your Period With Nexplanon

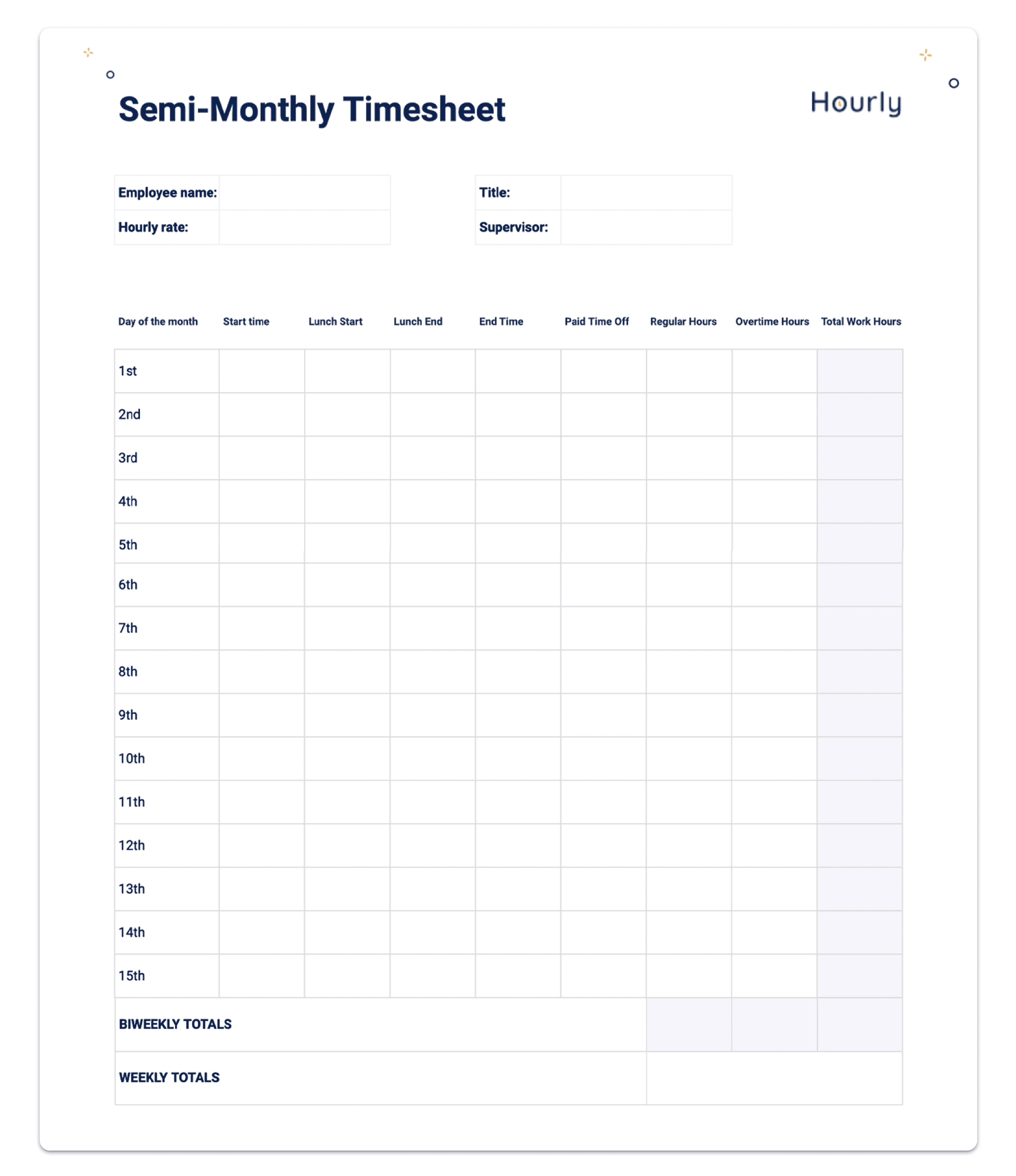

Calculating Overtime With Semi

Overtime is calculated based on a workweek which is a 7-day period established by your employer. However, semi-monthly pay periods can be confusing when determining overtime pay, due to the way the pay period cuts across workweeks.

Since most months have more than just 4 weeks, or 28 days, a semi-monthly pay period will often include days in 3 separate workweeks.

Heres an example, as illustrated in the video:

The workweek is Monday to Sunday. Pay Periods run from 1st to the 15th and 16th to the 31st.

During the first workweek covered by the pay period, you worked a total of 50 hours. The first 30 hours were paid on the previous paycheck covering the pay period from the 1st to the 15th. On this paycheck, you will be paid for 10 regular hours and 10 overtime hours for this week.

In the second and third workweek, you worked 45 hours. You will be paid for 40 regular hours and 5 overtime hours. On this paycheck, you will be paid for a total of 110 hours 90 regular hours and 20 overtime hours.

If you have any doubts as to your entitlement to overtime, you should to find out more about your rights its your time and your money. The review of your circumstances by our overtime pay lawyers is FREE and CONFIDENTIAL and cases are handled on a contingent fee basis, meaning there are no upfront costs and no fees if there is no recovery.

Cons Of Quarterly Pay Period

The cons of having quarterly pay include you cannot plan around an annual event such as vacations without risking running out of funds mid-way through one payday versus biweekly pay periods which already come back two weeks those employees who feel that receiving four payments instead of twelve over the year is very beneficial

You May Like: How Did Women Deal With Periods

The Art Of Calculating Overtime On A Semi

If you are an organization that employs nonexempt or hourly employees, you may be familiar with the overtime regulations mandated by the Fair Labor Standards Act . According to the law, nonexempt employees must receive overtime pay for hours worked in excess of 40 in a workweek, and at a rate not less than time and one-half their regular rate of pay. On the surface, calculating overtime appears to be straight forward, even if math isnt your strong suit. Calculating overtime when you pay your employees on a semi-monthly pay schedule, however, introduces a far more complex calculation than other pay schedules. Lets break it down.

How To Calculate A Semi

The schedule of your payroll directly impacts your business accounting and the personal budgets of your employees. Semi-monthly employees are paid twice a month, usually on the 15th and the last day of the month. Unlike a bi-weekly payroll, which has 26 payments in a year, a semi-monthly pay schedule has only 24 pay periods. This affects the size of employees’ paychecks. It can also factor into overtime calculation, external billing of employee time and deductions for benefits.

You May Like: Why Am I Cramping After My Period

Impact On Benefits And Deductions

With bi-weekly pay, there are 26 pays per year.

Flexible benefits and parking

Deductions with flat rate premiums include benefits where you pay a set amount each month. They include health insurance, dental, parking, etc. There will be no change to these flat rate monthly premiums because the total number of deductions in the payroll is 24 per year, meaning two per month. Because there are 26 pay periods in a year, you will end up with two “benefit holidays” — two payrolls where your flat rate deductions are not withheld.

The first benefit holiday will occur on December 30th, 2022. That means you will receive three paychecks in December, the third of which will not include these flat rate premium deductions.

Retirement

Voluntary retirement deductions can be percentage based or flat rate. It is your choice.

Regardless of which option you have chosen, these are taken in all 26 pay periods.

If the amount deducted is a percentage of your earnings, you will contribute the same amount over the course of a year on a bi-weekly basis as you would have on a semi-monthly basis.

With bi-weekly pay, there are 26 pays per year. This means that there are two months in a year where you will receive a third paycheck.

A benefit holiday occurs twice a year when there are three paychecks in a month. In these paychecks, there will be no deduction for flexible benefit flat rate premiums.

Taxes are a percentage of earnings and thus will be deducted over 26 pay periods each year.

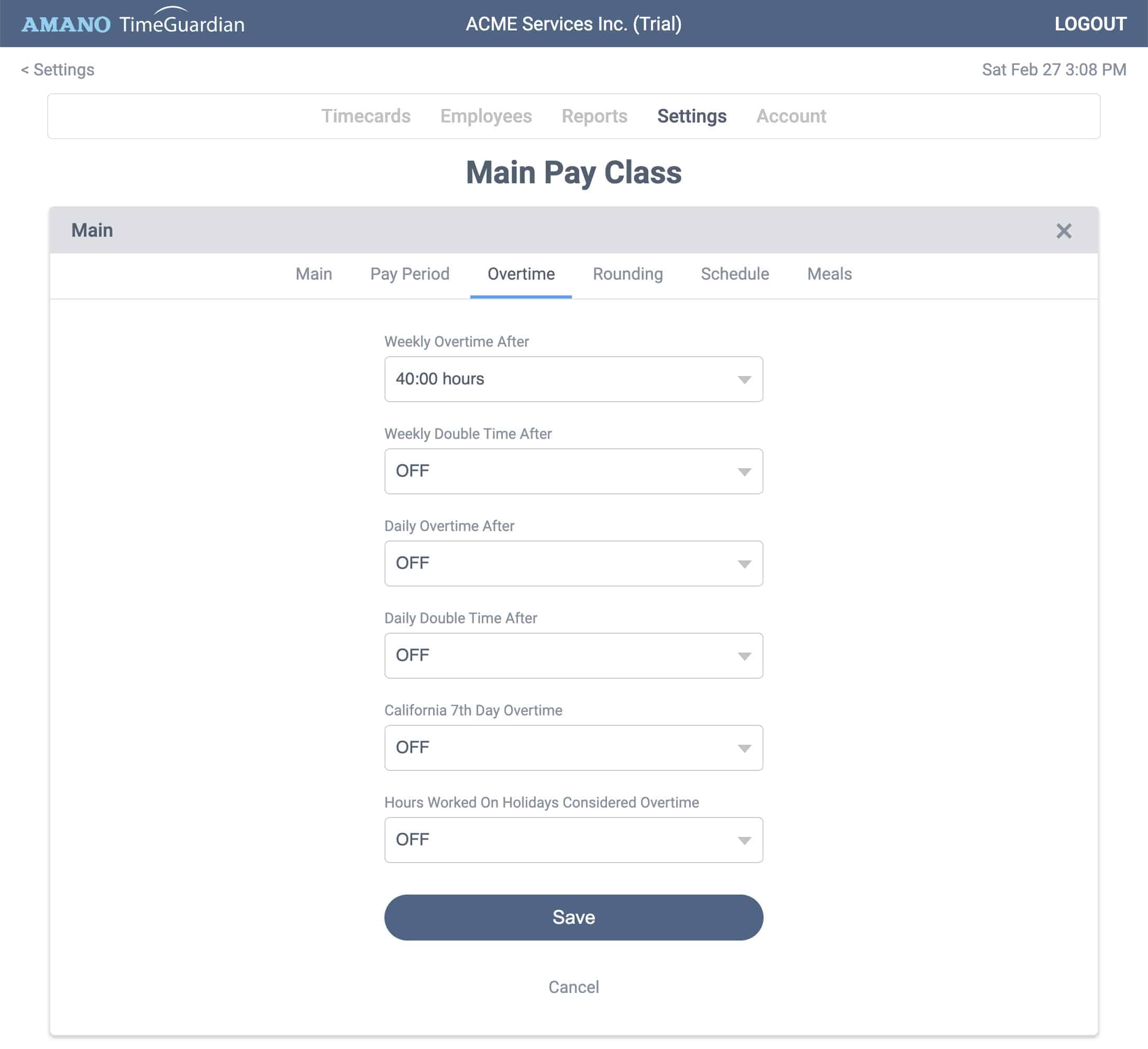

What Is A Biweekly Pay Schedule

Pay Classes” alt=”Settings > Pay Classes”>

Pay Classes” alt=”Settings > Pay Classes”> If you’re on a biweekly pay schedule, you’ll receive a paycheque every two weeks for a total of 26 paycheques throughout the year. Your employer will pay you every two weeks, typically on a Friday.

If you are a salaried employee on a biweekly pay schedule, your employer will probably choose to divide your compensation equally over the 26 pay periods. This is the same as being on a semimonthly pay schedule.

For example, if your annual salary is $50,000, your employer may choose to split up your payments equally between 26 paycheques. This would provide $1,923 per paycheque before deductions.

If you’re an hourly paid employee, your employer will compensate you according to the hours you work, including overtime, every two weeks.

Related:

Don’t Miss: Calculate Due Date Based On Last Period

Can I Change My Pay Schedule

Once you choose a pay schedule, you may change it, but not frequently and not in a way that reduces your employees pay. For example, adjusting a pay period to avoid paying overtime to someone would violate the FLSA.

Changing your companys pay schedule after several years for a legitimate business reason would be permissible, though.

You May Like: Usaa Grace Period

Calculating The Semi Monthly Pay Of A Salaried Employee

The semi-monthly salary of a salaried employee can be calculated in a very simple manner. Firstly, you need to know the annual salary of the employee. Let us assume that an employee earns a gross of $100,000 annually.

Now we already know that a semi-monthly payment regime has 24 pay periods. So now we simply need to divide the annual gross income by the number of pay periods.

100,000/24 = $4,166.6 we shall round this off to $4,167.

Therefore the gross income of an employee working $100,000 annually would be $4,167 if paid semi-monthly.

It is of course, not so simple in reality. Employees do not usually start working on the first day of each month. Furthermore, organizations may have different payment methods for a single employee.

For instance, an employee who is paid semi-monthly may also undertake a separate project that requires payment and therefore the organization will then need to find the pay rate for that employee.

We have already established that a semi-monthly payment system has 24 pay periods. In order to find the pay rate, we need to find the number of days in each pay period.

Months having 30 days have two pay periods of 15 days each, whereas months having 31 days have two paydays with one payday having 15 days and the other payday having 16 days. February can have pay periods with 13 or 14 days depending on whether it is a leap year or not.

Once the number of days in a pay period is known, the daily rate or pay rate can be easily calculated.

| Pay Period |

Don’t Miss: How To Get Rid Of Period Stomach Cramps

The Number Of Paycheques Per Year

When your company’s pay schedule is semimonthly, you will receive 24 paycheques per year. However, if they run a biweekly pay schedule, you will receive 26 paycheques per year. You make the same amount of money, but your employer divides the payments slightly differently.

Related: Where and How to Get Pay Stubs if You Need a Replacement

What Is A Semi

With a semi-monthly pay schedule, your company issues your paycheck twice a month, every month. Youll receive a total of 24 paychecks a year.

How do I calculate my weekly semi-monthly pay?

Multiply gross pay for one bi-weekly pay period by 26 to get the annual salary. Divide the annual salary by 24 to get the gross pay for one semi-monthly period.

Recommended Reading: When Will My Next Period Start

What Is Weekly Pay

Weekly pay is when you get paid every 7 days. If your pay period starts on Monday, you usually get paid on Friday at the end of the day.

The weekly pay schedule is a common pay schedule in the US and has grown popular over the years. Since there are 52 weeks in a year, there are 52 weekly pay periods as well.

While not used in all industries, weekly pay is the standard schedule in retail, retail, wholesale, and food service workplaces.

Fixed Payday For Employee

With Semi Monthly Pay schedule, employees are guaranteed their payday at the same time on the same date every twice a month, giving them a fixed payday number. This takes some of the guesswork out of budgeting and makes it easier to understand. Which is especially useful for employees looking to use their pay stubs as proof of income. Since the semi monthly pay periods have fixed dates everyone can understand

Recommended Reading: Norethindrone Acetate And Ethinyl Estradiol No Period

Differences In Payroll Processing: Hourly Workers

Moreover, calculating the salary for hourly biweekly employees is the easiest payroll process. It is the easiest because you can simply pay the employee according to the number of hours that they worked in the preceding two weeks. So say, for example, a member of staff worked 37 hours over the past two weeks, they would get paid for 37 hours in their biweekly paycheck. If in the next two weeks they work 45 hours, they would get paid for 45 hours.

On the other hand, semi-monthly hourly payroll processing can be a little more confusing. You may need to specify that the pay period ends earlier for semi-monthly payments than biweekly payments. You may even want to issue your employees a payment calendar so that they understand which pay period their paycheck is covering.

If your employee worked 12 days for the first pay period, and then 13 days for the next period, each paycheck would be for different amounts.

Some employees may choose to pay hourly semi-monthly employees for 86.67 hours, and then make adjustments on the next pay period. This, however, can be risky for example, if an employee leaves your company without making adjustments, they will not pay back the estimated hours. It should be avoided as much as possible to prevent such mistakes from happening.

Think About Who Is Running Payroll

If youre running payroll yourself, youll want to consider if you can run payroll weekly, biweekly, semimonthly, or monthly. If youre outsourcing to a payroll provider or accountant, they may charge a service fee for every payroll run. But if youre using a payroll service for your small business, you may not have to pay extra for every payroll run. Some online solutions may even let you automate payroll.

Also Check: Can I Go To The Gynecologist On My Period

How To Calculate Semi Monthly Pay

Most businesses pay their employees on a weekly, biweekly or semi-monthly basis. Each pay period is calculated differently. However, calculating semi-monthly pay is not as straightforward as calculating weekly or a biweekly payrolls. With the latter two, the employee is paid every week or every other week, respectively. A semi-monthly payroll means that he gets paid twice per month, usually on the 15th and the last day of the month. An hourly semi-monthly employees pay may fluctuate each pay period but a salaried employees tends to stay the same.

Payroll Calendar: Biweekly Pay Periods In 2022

7 min read time

As HR prepares for the new year, its key to stay ahead of the curve on important dates and compliance requirements. Unlike last year, 2022 will have the usual 26 pay periods for those being paid bi-weekly. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while others are paid weekly receiving up to 52 paychecks in a given year. Read on to learn about these different pay structures, and which one is best for your organization.

Don’t Miss: How To Get Rid Of Period Acne

Pros And Cons Of Semi

Pros:

- Larger Paychecks. Paychecks will be larger, which can help employees feel valued for their work, however theyâll be less frequent than on a biweekly pay schedule, so check with your staff on which option they prefer.

- Simplifies Deductions. Since youâll always be running payroll twice a month, the semi-monthly payroll schedule makes it easy for your team to track payroll expenses and calculate deductions.

- Consistency. Your employees will know when to expect their paycheck, every month, of every year. That can make it easier for them to plan their own personal budgets.

Cons:

- Calculating Overtime. When you run payroll on one specific date, some pay periods might have fewer or extra days. It can be an extra challenge to keep track of how much overtime is owed to your hourly staff when the number of working days included in a pay period varies.

- Scheduling Snafus. Since your payroll will be tied to an actual date on the calendar, your pay period may end on a Saturday or even Sunday. Youâll have to remember to either pay your staff the Friday before or the Monday after the weekendâ¦or run payroll over the weekend.