First Paycheck: January 1 2021

- If your first paycheck of 2021 is on Friday, January 1, you may receive three paychecks that month. The other two are January 15 and January 29.

- However, since New Years Day is a bank holiday, many employers will schedule payroll on December 31, 2020. If thats the case, December 2020 was a three paycheck month for you and January 2021 isnt.

- are the other three paycheck months for biweekly workers on this schedule.

What Is The Difference Between Pay Period And Pay Date

A pay period is the length of time during which you work, and a pay date is the day on which your team receives their paychecks.

Letâs explore these concepts further.

A pay period is the time frame in which work is being done and paid for. For budgeting purposes, remember this would include any time your team is on the clock, including any onboarding or training time. Pay periods are typically referred to by their number.

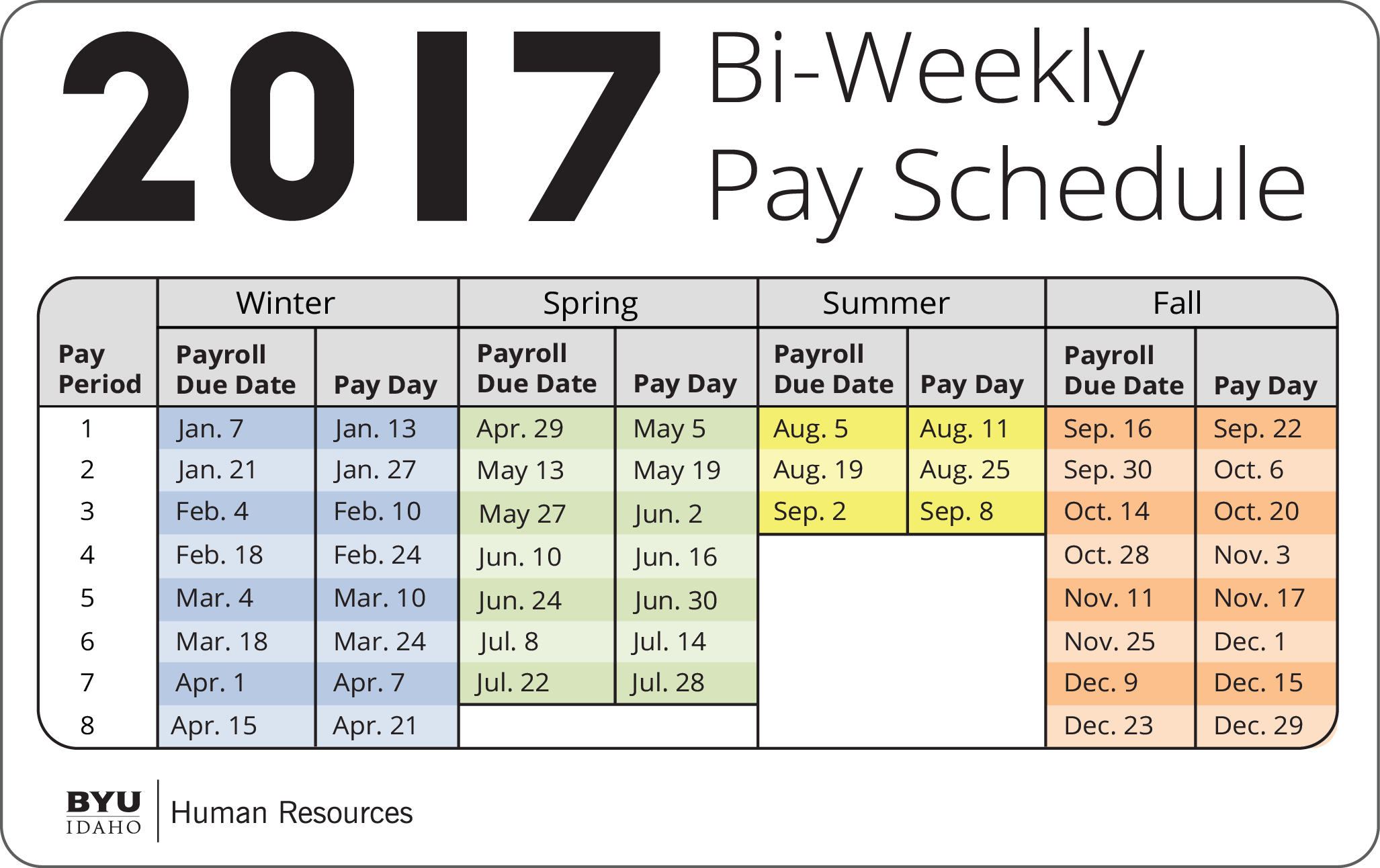

Specifically, a bi-weekly payroll schedule has 26 pay periods per year. So the first two weeks of January would be pay period one, and the second two weeks of January would be period two, and so forth.

A pay date is the date on which companies pay employees for their work. Friday is the most common payday.

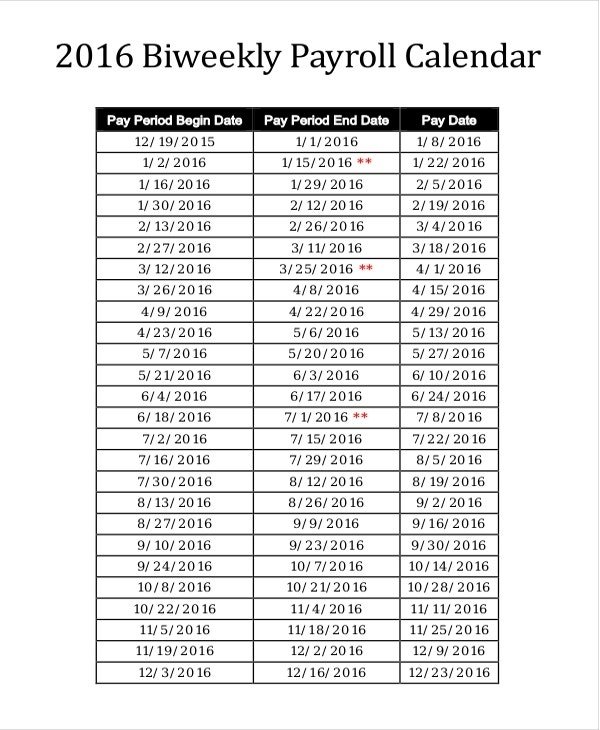

It can take a few days to process payroll. Therefore, the last day of the pay period is typically not when employees get paid for their work from that pay period. The pay date for the current pay period might be on the last day of the following pay period. If you use payroll software like Hourly, your employees can see their pay stubs even as payroll is processing.

The Phenomenon Of 27 Biweekly Payrolls Or 53 Weekly Payrolls In A Year

There is a phenomenon that can occur about once every 5 to 11 years, depending upon whether you pay your employees weekly or biweekly. It is that instance of an extra pay day within the calendar year. For many companies, we find that it passes without a second thought, but should it?

First off, why does it happen? The root of the problem is that 365 days in the year is not divisible by a 7 day work week. There is a remainder, and over time, that remainder will add up to a whole number, thus another pay period. 365 days in the year, divided by 7 days is equal to 52.142857 weeks. Dont forget leap year, where every four years there are 52.285714 weeks in the year. Six years with one leap year in between, and that remainder adds up to one, and your 53rd pay period in the year.

For companies that have salaried employees, here is where the biggest concern is. If you have a salaried employee who is to receive $52,000 per year, I will say that you take that salary amount and divide it by 26 , and come up with $2,000 per week. For those years with 26 pay periods, his W-2 will reflect $52,000, but in the year with 27 pay periods, they will earn $54,000. This is where the panic starts, and the question becomes why the employee was overpaid. As the employer, you can either accept this, or here are some other options.

You May Like: Brown Stuff Instead Of Period

What Is A Pay Schedule

A pay schedule, or sometimes called a pay period, is the time worked between a set amount of dates. There are several standard pay schedules that organizations use, including weekly, biweekly, monthly, and semimonthly. Here is a brief introduction to these four common types:

-

Weekly, in which a company pays their employees every week on the same day. For example, they pay you every Friday.

-

Biweekly, in which a company pays their employees every other week on the same day. For example, they pay you every other Friday.

-

Monthly, in which a company pays their employees every month on the same date. For example, they pay you on the 1st of every month.

-

Semimonthly, in which a company pays their employees twice a month on the same dates. For example, they pay you on the 1st and 15th of every month.

Companies choose a specific pay schedule based on several factors, including industry, type of employee work and accounting costs. The two most common pay schedules for businesses across every industry are biweekly and semimonthly.

Frequently Asked Questions About The Biweekly Pay Cycle Conversion

1. Im now paid monthly. Will I convert to the bi-weekly pay schedule?

Not all employees will convert to the bi-weekly pay schedule only if your job is defined as nonexempt under the Fair Labor Standards Act will you convert to bi-weekly. Employees whose job titles are exempt will continue to be paid monthly.2. What do nonexempt and exempt mean?

Nonexempt employees are eligible for overtime under the Fair Labor Standards Act and record their actual time worked. Exempt employees are not eligible for overtime. If you are unsure of your exemption status, please check with your supervisor.3. Why are exempt employees remaining monthly?

Exempt employees receive a predetermined salary each pay period, regardless of the amount of time worked, and are not eligible for overtime. Exempt employees are required to report only non-productive time, such as vacation or sick time.4. Why do nonexempt employees report time?

FLSA regulations require nonexempt employees to track their hours worked so they can be paid overtime for work in excess of 40 hours per week. To ensure that the university meets these regulations, nonexempt employees report their actual time worked each day. The bi-weekly pay cycle is designed specifically to track hours worked and overtime.5. Can I choose not to go to the biweekly pay schedule?

7. Why is UC making this change?

8. What is the advantage to me?

9. Im currently paid on the first of the month — what will my new payday be?

You May Like: 90 Day Probation Period Template

Biweekly Vs Bimonthly Pay

Even if you have a pay schedule you’re accustomed to, you can always change it to fit your particular needs. Keep in mind that regardless of the pay schedule you choose, employees get paid the same amount each year. To help you determine which to follow, consider the following pros and cons for both a biweekly and bimonthly pay schedule:

Are There Disadvantages To Biweekly Pay

A biweekly pay period is generally a good option for businesses, especially those with a mix of hourly and salaried employees. However, its beneficial for any company to consider all the angles before deciding on a payroll schedule. The following are several drawbacks to a biweekly pay period:

-

Bookkeeping can be complicated because two months each year have three pay periods.

-

Company budget must account for these three-period months.

-

Costs can be higher if the payroll provider charges per payroll run.

Recommended Reading: 90 Day Probationary Period Policy Examples

Biweekly Pay Benefits For The Hr:

- Efficiently manages a large number of hourly employees. The shorter the duration of a payment cycle, the less complicated the payment calculation, in case it is an hourly pay structure.

- Reduces the scope of errors in payroll processing. The fewer the micro-calculation cycles for a payment cycle, the lesser is the error scope. Its only human to err.

- Accounts for a more optimised calculation process of overtime pay.

Can A Business Change Pay Periods

While changing your companys pay period is possible, it shouldnt be done without some considerations. Along with any overtime considerations , ask yourself these questions:

Does your company offer direct deposit? If so, youll need to coordinate with all of the various financial institutions and make sure deposits arent interrupted during the transition. Typically, direct deposit funds are transferred one to two days prior to the direct deposit date.

Do you have payday traditions? If you give employees extra time over their lunch hour to deposit paychecks, provide special office hours for workers in the field to collect their checks or have the CEO hand out checks, consider how changing your pay period will affect these traditions. SHRM advises these traditions may be cherished by employees and changing them may cause negative reactions.

How well do you communicate with your employees? Changing the pay period is a big deal. Your employees count on their paychecks being available on payday. If your communication isnt great, not only will there be confusion but there are also likely to be negative employee reactions. Aside from sending emails and placing notices on bulletin boards, SHRM advises making communication more proactive by hosting a new payday fair. Invite your payroll processor or other vendors to participate. Use the opportunity to educate employees about direct deposit, 401 and other financial planning options.

Read Also: Donating Blood While Menstruating

Harder To Assess Performance:

A biweekly payday means that its harder to get performance feedback since there are fewer opportunities over the year. Its important that you still get feedback, try to set it up for once per month. This is especially true for employers that pay commissions and bonuses. Compared to a weekly pay schedule of 52 paychecks a year. That is twice as many opportunities to assess an employees commission and bonus performance.

A Biweekly Pay Schedule Is The Most Common Pay Frequency Here’s How Your Small Business Can Implement It

- Biweekly pay describes paychecks that arrive every two weeks, resulting in 26 paychecks per year.

- Biweekly pay differs from semimonthly pay, which is issued twice per month and 24 times per year.

- Whether or not you should use biweekly pay varies based on many factors, but a payroll software is always the best way to implement it.

- This article is for small business owners interested in setting up a biweekly pay schedule.

Think back to when you were an employee rather than a small business owner. As you toiled away at your tasks, you might have occasionally reminded yourself that it was all worth it to get paid every two weeks. That last part is key every two weeks. Many small businesses pay their employees every other week, on a biweekly pay schedule. Read on to learn how you can implement and administer this schedule for your business.

Also Check: Primosiston To Stop Period

The Beginners Guide To Pay Periods

Published on – Written By: Lars Lofgren

How do you figure out whether weekly, bi-weekly, semi-weeklyor even a combination of the threewould be the most optimal pay period schedule for your business?

Factors like employee preferences and labor laws are obvious considerations. But you also want a frequency that attracts and retains top performers and balances administrative costs with talent management goals.

Dont worry, it isnt as complicated as it sounds. Read on as I discuss the basics of pay periods, as well as tools and tips to help you improve your payroll.

More Straightforward Calculation Of Overtime Pay

There are benefits to bimonthly payments for both employees and the organization. For example, the payroll department often finds it easier to calculate overtime pay when employees are on a biweekly pay schedule. Because they typically calculate overtime based on an entire workweek, there’s never a need to split overtime between two pay periods. This can often occur with semimonthly pay schedules, which adds some minor complications to the payroll process.

Recommended Reading: 90 Probationary Period Employment Form

Is Being Paid Bi

It is not. People who are paid on the biweekly schedule will get a paycheck every other Wednesday, for two weeks of work.

Being paid semi-monthly means receiving a paycheck twice a month, no matter how many weeks there are in a month.

Please refer to the Bi-weekly Payroll Calendar for a complete list of pay dates for 2021.

If you have set your pay earnings to be delivered through direct deposit, you will automaticallycontinue to receive them via direct deposit.

If you have a flat amount scheduled to be direct deposited each paycheck, you may want to consider changing the amount deposited each paycheck. Please see What can employees do to prepare for bi-weekly payroll?

Bimonthly Pay Schedule Disadvantages

While a bimonthly pay schedule comes with several advantages, it also comes with many disadvantages for both employees and employers. Here are some of the cons that come from this type of pay schedule:

-

Difficult to calculate for hourly employees: Calculating pay for hourly employees comes with some difficultyâespecially if they earn overtime pay. To avoid this, you can offer semimonthly pay to salaried employees and biweekly pay for hourly workers, though running on two different pay schedules can make it harder for the human resources department to handle.

-

Lack of consistency: With a bimonthly pay schedule, the day employees get paid differs each pay period. This makes it hard for employees to keep track of when they get paid. It can also cause a hindrance to the person running payroll and cause them to lose track of which day to process the payroll.

-

Difficult to calculate for holidays and weekends: If a payday falls on a holiday or on the weekend, the human resources department needs to pay employees in advance or delay their paychecks after the weekend or the holiday. This adds another element to their payroll processing duties and may cause confusion for both the payroll department and the employees themselves.

Recommended Reading: Usaa Grace Period Auto Insurance New Car

The Difference Between Bi

Semi-monthly involves paychecks being distributed on the 15th and the 30th of every month. However, there is a caveat to this. Should either of those dates fall on the weekend, the paycheck is then paid out on the preceding Friday. The upside to this pay period is that typically the paychecks are slightly higher due to there being 2 fewer paychecks throughout the year.

Bi-weekly involves being paid every other Friday. This provides employees with 26 paychecks per year as opposed to the 24 with semi-monthly. Payday is very consistent and allows for a more balanced pay schedule throughout the year.

Biweekly Pay Benefits For The Employees:

- When employees get paid every other week, they have regular income flow throughout the month. This reduces their chance for a rough month-end.

- With an incoming paycheck biweekly, employees will be better able to manage their finances.

- A biweekly plan is much preferred over a monthly plan due to its consistency. Since employees get paid much frequently, they dont have to budget finances for an entire month. This recurrent salary structure contributes to elevated levels of workplace productivity, punctuality, happiness and a healthy employer-employee relationship.

Recommended Reading: Can You Donate Blood While Menstruating