Educate Yourself About The Market

Before you purchase a home, you want to have a firm understanding of the real estate market. Will you be buying during a sellers market or a buyers market? Understanding the market will help you determine how much you might have to spend to get into your desired neighborhood. You dont want to overpay for your house, of course, but you also want to make a competitive offer out of the gate so that your offer is considered.

To educate yourself about the market, spend some time looking at homes that are for sale and homes that have recently sold. Pay attention to the list-to-sales-price ratio so you get a sense of whether other buyers are paying more or less than asking price.

Based on what you learn, talk to your agent about where you should focus your search in order to fit your budget. Look at your whole life, advises Sweet, in order to determine what you can truly afford.

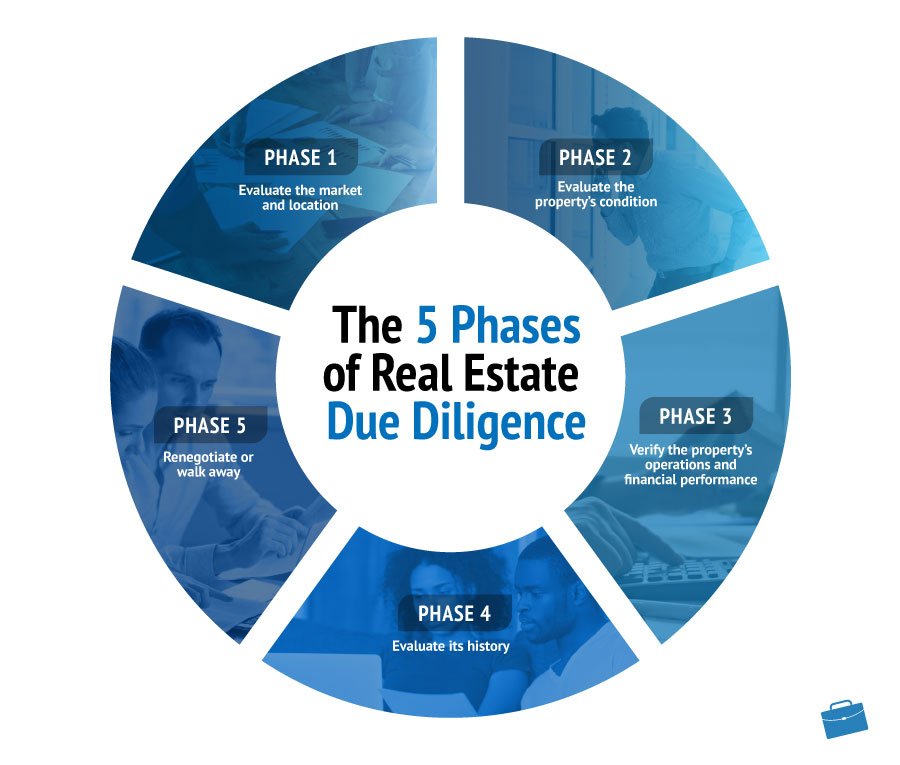

Why Is Due Diligence Important

Due Diligence is important because both Buyers and Sellers are free to ask any and all questions to try to complete a home sale. One of the most important things about this time period is the earnest money deposit paid by the Buyer at contract time.

In the event that the Buyer finds the home no longer meets their needs, because of inspection findings or any other reason at all, they are able to terminate the contract without penalty of loosing their earnest money deposit.

This period also protects the Seller. Once the Due Diligence period is over, if the Buyer decides they no longer want to buy the home for whatever reason, the Seller is able to claim the earnest money deposit while the Buyer forfeits their deposit.

Now Lets Talk About Sellers:

Sellers, I know this can be a nerve-wracking time for you. Youre worried that Buyer could find something that makes them walk away or that theyll pick apart every little detail of your home. My best advice to you, is to try and relax during this time. There is very little you can do. You should keep your home in show ready condition, ensure you give the Buyer reasonable access to your home to conduct any necessary inspections, and answer any questions to the best of your ability. You also want to ensure that your agent continues to market the home during this time, just in case the buyer elects to cancel the contract.

So, there you have it! I hope this video has shed some light on the importance of the due diligence period and what you can do to successfully navigate it. As promised, if you would like your copy of the Buyer Advisory, simply !

If you enjoyed this post let me know in the form below! See YOU, next Thursday!

Recommended Reading: What Happens If You Miss Your Period

Zoning And Property Codes

Investors also must ensure compliance with current zoning rules and property codes. With regard to the former, a smart tactic is to solicit documentation from the relevant municipality to ensure the current and anticipated use of the property is compliant with existing zoning regulations and land use classifications. For buildings that are relatively new, a review of the certificates of occupancy can indicate compliance with relevant property codes. With regard to the assessed valuation of a property, this information can be obtained through the tax certificates. The latter will also indicate the standing of property tax payments. As a precaution, buyers should consider reaching out to an outside zoning specialist to independently confirm the received information is accurate and up-to-date.

Be aware of the time frame for city approvals

If problems are uncovered, or if the buyer plans on making any changes to the property, including its use, then additional permits and business licenses may be required. Prospective property buyers need to be cognizant of time frame issues associated with city approvals. Depending on various factors, it can take a monthor even yearsbefore building permits are secured.

This means that it’s imperative to arrange meetings with local authorities to determine which approvals are necessary. This includes planning and zoning, site plans, city council and other approvals.

Environmental Investigations In The Due Diligence Process

Another important area for due diligence during the study period is the purchasers environmental investigations. The purchaser will need to consider obtaining what is commonly known as Phase I Environmental Assessments. These types of environmental assessments can give certain federal and state protections and defenses against claims for environmental liability.

Hiring the right environmental company to perform these assessments is crucial and a purchaser should not overlook this aspect of due diligence. Some of these assessments can take significant time to compile and complete. Therefore, a purchaser should order environmental assessments as soon as possible after contract signing.

In addition, if the Phase I assessment discloses areas of concern, the purchaser may be required to conduct follow-up invasive testing which can require the sellers prior written consent.

Don’t Miss: Creative Ways To Tell Your Mom You Got Your Period

Get Multiple Bids For Your Mortgage Financing

If youre financing a property, apply the same idea discussed in tip #1 and compare multiple interest rates. As few as 20 percent of buyers get just two bids for financing and have no idea if competitors could offer a better deal. By taking a little extra time on your due diligence and getting multiple bids for mortgage financing, youll know youre getting the best deal out there.

Asking For An Extension

If a homebuyer is unable to complete real estate due diligence within the period signified in the real estate contract, he or she may ask for an extension from the seller. In response, the seller does not have to agree to an extension. Instead, he or she may request that the buyer go ahead with the purchase without the required data.

Due diligence is designed to safeguard the seller and buyer, by permitting both parties to engage in the discovery of the facts. Once the contingencies are removed, the parties can confidently proceed with the closing.

Again, due diligence permits the buyer to work with his or her lender. You should already be pre-approved for financing at this point. Therefore, if a lender has any questions about a property, you can use the due diligence process to answer those inquiries.

You May Like: How Many Days Before Missed Period Can I Test

Expert Consulting On Real Estate Due Diligence

Xpera Group is San Diego-based real estate consulting company dedicated to ensuring that our clients interests are fully protected against risks associated with their real estate matters. We conduct thorough examinations and analyses of your real estate assets and related real estate matters. We report our findings to you in a timely manner, allowing you to make informed decisions related to your real estate acquisitions.

Get in touch with Xpera Groups experienced real estate professionals for reliable assistance with your Due Diligence. Protect your financial interests by partnering with the leading consulting experts in the industry.

What Is A Due Diligence Period Buying Business

The due diligence period is an opportunity to dig deeper into a company’s legal, financial, and operational aspects before you commit to a final purchase.3 min read

What is a due diligence period? Buying business assets or stock is a big undertaking. The due diligence period is an opportunity to dig deeper into a company’s legal, financial, and operational aspects before you commit to a final purchase. This is your chance to confirm the accuracy of the seller’s representations, as well as to discover any important information the seller might not have disclosed.

You May Like: Likelihood Of Getting Pregnant On Period

Sellers Requirements During The Due Diligence Process

A seller should be required to deliver to the purchaser or their attorney all relevant property information, including:

- tax bills

- approvals and certifications

- and disclose the existence of any property or building-related litigation

The contract should specify when the seller must deliver the property information, and the purchasers due diligence period should not begin to run until the seller has completed delivery of the contract. A purchaser must not, however, rely solely on reviewing these seller documents and information, but must conduct their own independent investigation to confirm the reliability and accuracy of the information turned over by the seller.

Almost all contracts will have numerous disclaimers which provide, among other things, that a seller makes no warranties or representations concerning the truth or accuracy of the information that she gives a purchaser, and that the property is being sold as is with all faults.

Reviewing The Potential For A Commercial Property

Due diligence makes you cognizant of the state of a property before it is purchased. Therefore, real estate due diligence is particularly helpful in the purchase of commercial real estate because it allows developers to assess their options. For example, performing due diligence allows an investor to see what fits on a property after considering the following:

- Building setbacks

- Landscape requirements

- Taking Time Out to Assess a Property

Due diligence also enables you to calculate the leasable area, if applicable. Additionally, you need to assess what it will cost to build. What kind of site improvements need to be made in order to develop the project? The zoning ordinances can also affect the cost of the landscaping and buildings.

Also Check: How Do You Know When Your Period Is Coming

Due Diligence: What Is It

Introduced in 2011, due diligence money is a fee that is paid directly to the seller in a real estate transaction and is due immediately though sometimes it is paid a few hours after the execution of the contract. This is part of what happens next when you go under contract on a home. This is not a set fee, but rather one that is decided upon with guidance from your real estate agent based on the number of funds you have readily available. Typically, the amount ranges anywhere from three to five percent of the offer price of a home.

Sometimes you may hear someone refer to this fee as good faith money, as it is a fee that you are giving the buyer directly to let them know that you are serious about buying the property. It can also be thought of as a down payment towards the purchase price of the home, as the due diligence money will be credited back to the buyer at closing. Due diligence fees are most frequently paid in the form of a wire transfer or personal check. Your real estate agent will be the one to pick up the check from you and deliver it to the listing agent, who will then pass it along to the seller.

Getting The Basics Down

Due diligence on a commercial real estate opportunity begins with understanding the transactions objectives. The investment goals in pursuing a commercial real estate transaction serve as the foundation for the due diligence that follows. For instance, the purchase of an income-producing property like an apartment building will require the investor to verify the existing tenant leases and examine each tenants rental payment history. Otherwise, the investor cannot ensure the financial stability of the anticipated income stream. On the other hand, the initial focus of a commercial real estate developer is on the intended use of a building and whether or not the property can be permitted to achieve this intent.

Acquisitive parties should never engage in a commercial real estate transaction without personally visiting, walking through, and inspecting the premises. During the walk-through, buyers must analyze the property or building in terms of the intended use. Concerns that arise will affect the negotiations. For example, a property that a buyer plans to turn into an office complex with ample parking may be hilly and expensive to grade to accommodate the anticipated volume of vehicles.

Recommended Reading: Negative Pregnancy Test But No Period

What Beginning Investors Need To Know

Beginning investors of single-family homes and condos need to know that even though due diligence can be intimidating and stressful, there are ways to mitigate becoming completely overwhelmed. For one, it definitely helps to learn from experienced investors and glean from their experiences.

Heres what you need to do if youre a beginning investor. You need to have a process in place, an organized strategy to navigate each step prior to going into contract for a prospective property. Its not uncommon for experienced investors to streamline the process by having a due diligence binder or digital folders ready at the outset, prepped with blank forms, documents, and checklists organized by area of investigation .

The reason its important to have a process is that due diligence moves quickly immediately after going into contract. The last thing an investor should be doing is scrambling for a due diligence strategy in the middle of the process. A due diligence strategy will save you time, energy, and spare your wallet in the long run.

Whats the timeline, you ask? It varies by state requirements and according to agreements made between the buyer and seller. But, generally, due diligence takes two to three weeks. Be sure to work with your real estate agent or broker and determine your states exact laws surrounding due diligence timelines.

What Is Due Diligence Period Is It Important

WHAT IS DUE DILIGENCE PERIOD? IS IT IMPORTANT? As we are now approaching summer, more and more buyers are in the market looking to purchase a house. The real estate market is getting very competitive. Sellers and Agents are bragging about getting not 10, not 20, but as much as 50 to 80 offers on their property over a weekend. Yes, over ONE weekend! We are starting to notice requests from Sellers asking Buyers to waive their due diligence period in the offer. Frustrated by bidding wars and the lack of inventory, desperate Buyers are getting ready to throw in the towel and bow to any requests from Sellers, all for the sake of being able to purchase their dream house. It would have been very easy for everyone to agree and move forward, but is it a wise decision for Buyers to exclude the due diligence period in their offer?

My name is Ken and my wife is Bee. Im a Civil Engineer turned real estate investor and my wife is an IT Professional turned Realtor. Feel free to drop us your real estate questions at .

DISCLAIMER: This article is written based on our personal and professional opinions. We are not certified financial advisors and are not qualified to provide financial or legal advice.

Don’t Miss: What Age Does A Woman Stop Having Her Period

What Is Due Diligence For Real Estate

The chief aims of real estate due diligence are to thoroughly inspect the fundamentals of the property, seller, financing, and compliance obligations to reduce and mitigate financial uncertainties. The effort is not for the fainthearted. Prospective buyers must scrupulously examine zoning restrictions, potential liens, and possible encroachments on the property. Existing structures must be fully inspected to discern needed repairs and their costs. They must determine whether or not they will absorb legacy liabilities from prior owners legal and regulatory violations. If the property is largely financed, they need to address their ongoing ability to make required payments to the lender.

Many sophisticated commercial real estate investors consider it a best practice to commence detailed due diligence before the purchase contract is signed. The alternative is to carefully lay out in the contract for sale the items of due diligence that the buyer must undertake and the time this will take. This also serves to compel the seller to deliver required documents on an expeditious basis. Certain findings may adversely affect the acquirers anticipated financial return, giving buyers a stronger hand in the transaction negotiations to ensure a fair and accurate property valuation, given the risks that have been unearthed.