Why Is Understanding Your Ytd Amount Useful

Regularly calculating your YTD earnings is helpful as an earnings benchmark as well as a tool for planning your taxes. If you’re like most people, you strive to improve yourself each and every year. This includes increasing your personal income.When you calculate your YTD earnings and compare them with the same time vs. the prior year, you can accurately gauge how your income is changing without waiting an entire year to see the data. You can also use your YTD earnings amount to gauge your savings plan , and your overall spending .

Pros Of Semi Monthly Pay Period

The pros to the Semi Monthly Pay include having twice as many checks as bi-weekly pay, but without extra accounting paperwork because those check would match up with your paycheck from the previous month its convenient for people who get paid bi-weekly sometimes their employer will only give them two whole weeks worth of paychecks in one month, making it harder for them to manage their finances correctly.

What Is A Pay Period

A pay period is a recurring length of time over which employee time is recorded and paid for. Examples of pay periods are weekly, biweekly, semimonthly, and monthly.

- Weekly: A weekly pay period results in 52 paychecks in a year. Hourly employees are often paid weekly. Sometimes these employees are paid a week in arrears. That is, they record and turn in their time sheets at the end of one week, and are paid for that time a week later. That gives the payroll clerk time to calculate pay for these employees.

- Biweekly: A biweekly pay period results in 26 paychecks in a year. Some hourly employees are paid biweekly, as are some salaried employees.

- Semimonthly: A semimonthly pay period results in 24 paychecks in a year. Salaried employees are typically paid semimonthly.

- Monthly: A monthly pay period results in 12 paychecks in a year. Almost all monthly pay periods are for salaried employees.

Since the span of a year doesn’t perfectly contain a set number of weeks, a biweekly payroll system might result in an additional pay period, which can lead to overpaying employees.

Don’t Miss: 90 Day Probationary Period Letter

Help Your Employees Plan For Their Future

Reporting YTD numbers on paystub can be incredibly useful for your employees to keep track of their earnings in the long run. It can also be extremely gratifying for them to see how much they’ve earned and worked for the year. It is a testament to their hard work.If you would like to get started in setting up paystubs or have any questions, be sure to let us know, and don’t forget to share this article with your employees when they ask you “What does YTD mean?”Let’s get started on your paystubs today with the paystub generator!

Create Your Pay Stub Now!

It takes an average of less than 5 minutes.

Cons Of Weekly Pay Period

The cons to having weekly pay include being given a smaller paycheck then if you had bi-weekly or semi-monthly pay. Therefore, its harder to plan just because life happens, and you may not be able to save all your money. It is easy to lose track of your spending, because it happened over a few days instead of the same day.

Read Also: 90 Day Probationary Period Form

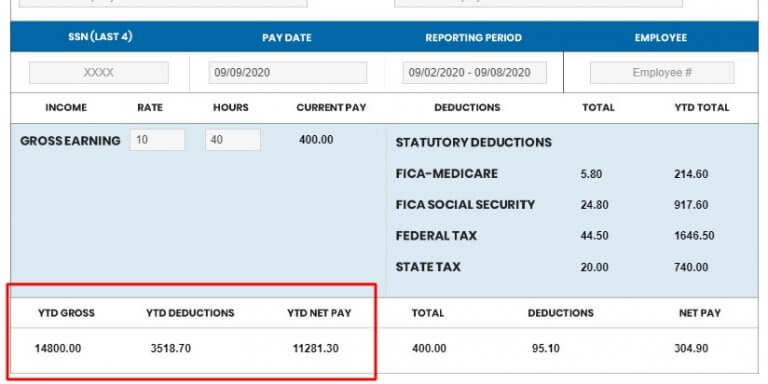

Heres What The Different Ytds Mean:

- YTD Gross Pay: This is the total amount an employee has earned from the start of their work to date before taking out all required and voluntary deductions.

- YTD Taxes: This is the year-to-date amount of the deductions taken from employee’s YTD Gross Pay for federal income taxes and FICA taxes .

- YTD Net Pay: This is the total amount an employee has earned from the start of their work to date after taking out all required and voluntary deductions.

- YTD Hours: The total number of hours the employee worked for the year to date.

The YTD not just tells how much employees have earned but can also help them plan for their future. Employees can check the YTD amount on pay stubs and see whether they are on track or not. Furthermore, YTD is useful for tax purposes.

accurate YTD values

Here’s a helpful video on calculating YTD values:

Put Ytd Earnings Metrics To Work For You

Now that you have an understanding of what the YTD amount is on your pay stub, it’s time to put it to work. If you’re an employer, you should use a paystub generator that includes YTD amounts on every check. If you’re not, get started here. Your employees will be thankful!

- 1. Enter Your Information

- 2. Select Your Favorite Theme

- 3. Download Your Stub!

Read Also: Usaa New Car Insurance Grace Period

Why Does Ytd In Payroll Matter To Your Company

Your company’s year-to-date payroll gives you an easy way to compare your employee payroll expenses to the overall annual budget for those costs. By having the two side-by-side, you can determine the amount paid for payroll versus your total business expenses.

Having a clear understanding of your YTD in payroll enables you to know if your company is on track to meet its projected results. Based on these YTD payroll numbers, you can easily make decisions like hiring and budget cuts.

Beyond helping with essential tax slips, year-to-date payroll provides you a way to predict your potential tax liability. Business owners must know their quarterly and yearly tax liabilities to manage purchases and overall cash flow.

What Employees Should Know

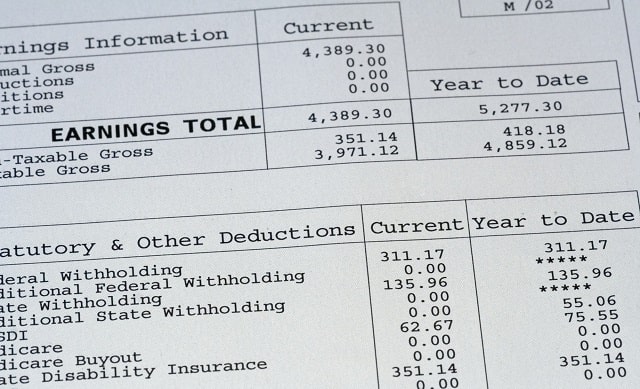

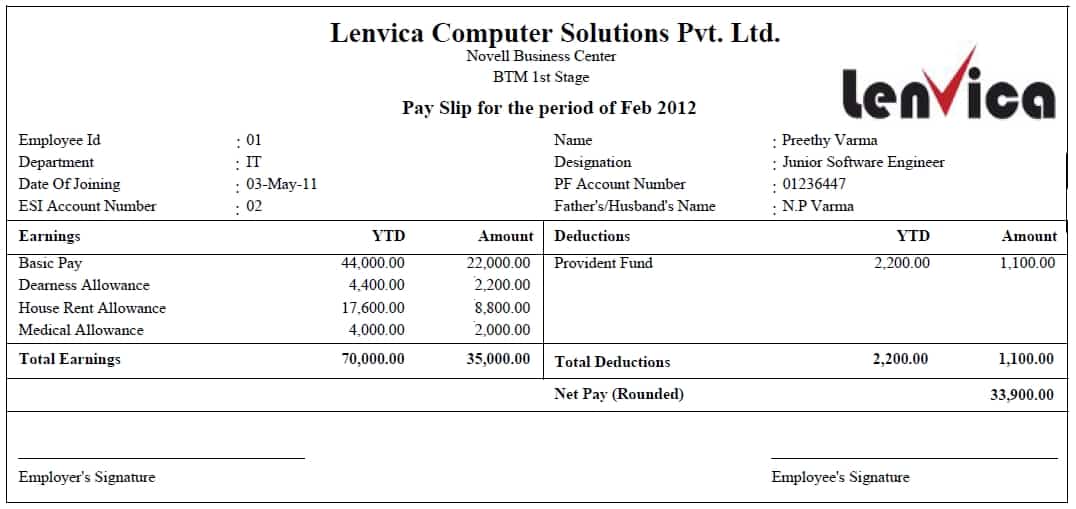

- Employees should pay attention to the YTD numbers on their paystubs to see how much they earned year to date, how much they have paid towards taxes and other deductions.

- A proper paystub will have all the earnings broken down as regular earnings, holiday pay, overtime, etc. The taxes and deductions include Federal and State Withholdings, FICA , Health Insurance, and other benefit deductions. Many a time, the paystub will also have employer only payments like FUTA and SUTA.

- The employees can compare the YTD values to the annual W2 they receive from their employer. For example, the total earnings reported on Box 1 on W2 must match the total YTD of the earnings on the last paystub for the year.

Read Also: 90 Day Probationary Period Policy Examples

How To Calculate Ytd Payroll Without Pay Stubs

Some employers are not required to give employees pay stubs. If you do not give pay stubs, multiply each employees gross income per pay period by the number of paychecks they have received

For example, you have two employees: Joe and Linda. They each received wages for 10 pay periods. Linda earned $2,000 per pay period in gross wages, and Joe earned $1,500 per pay period. Lindas year-to-date payroll is $20,000 and Joes is $15,000. Your businesss total year-to-date payroll is $35,000.

Looking for an easy way to keep track of your year-to-date payroll? Patriots online payroll software lets you run payroll in three easy steps and maintain records. You can view all your payroll information and select the pay date range. Never lose track of your year-to-date payroll again. Try it for free today!

This is not intended as legal advice for more information, please

A Short Guide To Payslip Year To Date Meanings

- YTD Hours.

The number of hours worked, not in that pay period, but from January 1st up until the last day of the pay period.

- YTD Wages.

All wages paid from either salary or hourly pay. Typically does not include bonuses and commissions.

- YTD Earnings.

This number refers to all earnings, usually gross, that includes bonuses, commissions, tips, and other forms of income.

- YTD Gross.

Recommended Reading: Primosiston To Stop Period

What Is The Year

Your company’s year-to-date payroll is the amount of money your company has spent on the payroll since the beginning of the calendar or fiscal year, up to the current payroll date. To calculate YTD, you must consider your employees’ gross incomes, which an employee earns before subtracting taxes and deductions.

In some cases, YTD may also include the amount of money paid to freelance or independent contractors. This is important to note as independent contractors and freelancers are not your employeesâthey are self-employed people hired for a specific job, but are essential for you to include in your YTD.

For full-time employees, YTD payroll represents their gross income. This is different than what it means for a business, where year-to-date represents the overall earnings all employees earned. It also includes payments paid in this current fiscal or calendar year, but not necessarily received this year. This amount could consist of a sales commission sale made at the end of last year but not paid out until this year.

How Do You Calculate Year To Date Returns

Consider an investor who bought shares in a company on January 1 at $200 per share. In March, they are worth $220. To calculate the year-to-date return on these shares, take / $200 then multiply this by 100 to arrive at 10%. The same process applies to an entire portfolio, where the prices of each share would be cumulatively added together, and then compared to their prices at the beginning of the year. For instance, consider an investor allocated $10,000 in five investments at the beginning of the year. In March, their value is now $15,000. In turn, the year-to-date dollar return of the five investments would equal $5,000.

Don’t Miss: Can You Donate Blood While Menstruating

Why Are My Pay Slips Not Showing Ytd

It has been established that this issue is caused by entering a pay in a new financial year, then rolling back into the previous year, creating and finalising a pay, then rolling back into the new year. By re-printing the pay slips from the employees Pay History tab, the YTD totals will display correctly.

Understanding Your Ytd Amount

Calculating your YTD earnings amount can be done at any time, provided that you have access to your earnings data. When it comes to your personal income, YTD amounts can be calculated every time you get your pay stub. Generally speaking, most pay stubs will show a running total of YTD earnings that are pre-calculated for you. They may be shown after taxes, investments and insurance are deducted, or before.Even if a calculation isn’t provided on your pay stubs, you can easily figure it out. Simply take all of your stubs for the year and add them together. Decide whether you want to make your calculations based on gross income, or net income. Either way, be consistent as the year goes on. Keeping consistent numbers will benefit you in several ways, as you’ll soon see.

You May Like: 90 Day Probation Period Template

Ytd Meaning For Individuals And Small Businesses

YTD means Year To Date. It simply means everything from the beginning of this year until now, and can be found on all kinds of financial documents whether its an official pay stub or a company revenue report.

YTD also has some important counterparts: MTD and QTD, Month to Date and Quarter to Date respectively. They mean exactly what they sound like, everything from the beginning of the month or quarter up to that point in time. All of these to-date terms seem self-explanatory and they are but they have a lot of importance both in personal finances and in setting and achieving company goals.

Before we jump into the uses of month, quarter, and year to date, its important to have a clear understanding of how they are calculated. Public companies are required to prepare financial statements each quarter and yearly reports ending December 31st. At midnight, when the clock and calendar switch to January, new totals start adding up. Even if a company operates 24/7, if a purchase is made December 31st at 11:59 it goes on the previous years statements. January 1st at 12:00 AM? The new year gets the purchase. Its a simple line but a fine one.

Comparing Apples To Apples Pays Off In The Long Run

YTD earnings enable you to compare your earnings over the exact same period, from one year to the next. If you compare how your earnings have performed during 6 months this year to how they performed for the entire year last year, you’re comparing apples to oranges.But if you compare your financial performance this year to the same exact time period from past years, that’s comparing apples to apples. Your personal finances and investments will thank you for staying on top of this analysis.

Also Check: Usaa Grace Period

Cons Of Annual Pay Period

One con to Annual Pay is if any income changes midyear, you will need to wait until next year for final settlement. Another con to annual pay is you have to budget for every paycheck. Annual Pay businesses can be very diverse such as medical doctors and dentists, tax accountants and attorneys etc.

Annual pay schedule is common for people that get bonuses and commissions, since their earnings arent always varying amounts.

Pros Of Annual Pay Period

The main pro to Annual Pay is you get paid a large sum amount. Which can make it easier to make big purchases. For example, a $6,000 annual bonus sounds like a big bonus, but it is only $500 a month .

If you were given an extra $500 a month, you may spend it on smaller purchases, whereas if you were given $6000, you may consider a larger purchase.

You May Like: New Hire 90 Day-probationary Period Template

What Is A Pay Period Everything You Need To Know

A pay period is a time frame in which you receive your earnings from a company. Pay periods are used by businesses of all sizes to manage their accounting for payroll. If you have pay stubs, your pay period will be on your pay stubs. There are several pay periods businesses will choose based on their needs.

Formula For Year To Date Returns On A Portfolio

The formula for calculating the YTD return on a portfolio with reference to the calendar year is as follows:

Note: The YTD formula can be applied to any situation in which an individual wants to measure the change in value from the beginning of the year to a specified date. For example, instead of calculating the YTD on a portfolio, the formula can be used to calculate the YTD on sales figuresSales RevenueSales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms “sales” and, company costs, earningsRetained EarningsThe Retained Earnings formula represents all accumulated net income netted by all dividends paid to shareholders. Retained Earnings are part, stock returns, bond returns, etc.

Read Also: Can You Donate Plasma On Your Period