What Is An Insurance Grace Period

In certain cases, your insurance company may give you a grace period between seven and thirty days, to have your new vehicle included in your auto insurance policy. This only applies to those who already have an insurance policy or an insured vehicle. If you are replacing your old car, you need to remove it from your policy as soon as possible before you add your newly purchased vehicle. As long as you have proof of an existing auto insurance policy, you will be able to take your car home and insure it within the grace period. This holds true regardless of whether you are purchasing the vehicle from a dealership or from a private seller. Failing to complete the necessary paperwork will result in a lapse in coverage and bring along serious ramifications, including higher cost of premiums and liability for damages caused in case of a crash or collision.

Not all insurance companies offer a grace period. Before you complete the purchase of a vehicle, it is recommended that you consult your insurance provider to find out if you need to have the car included in your policy before you bring it home. Also, if your car is being financed, you most certainly have to provide proof of insurance to the lender, and in many cases, you may also be required to carry more than the minimum liability coverage.

Our Recommended Car Insurance Providers

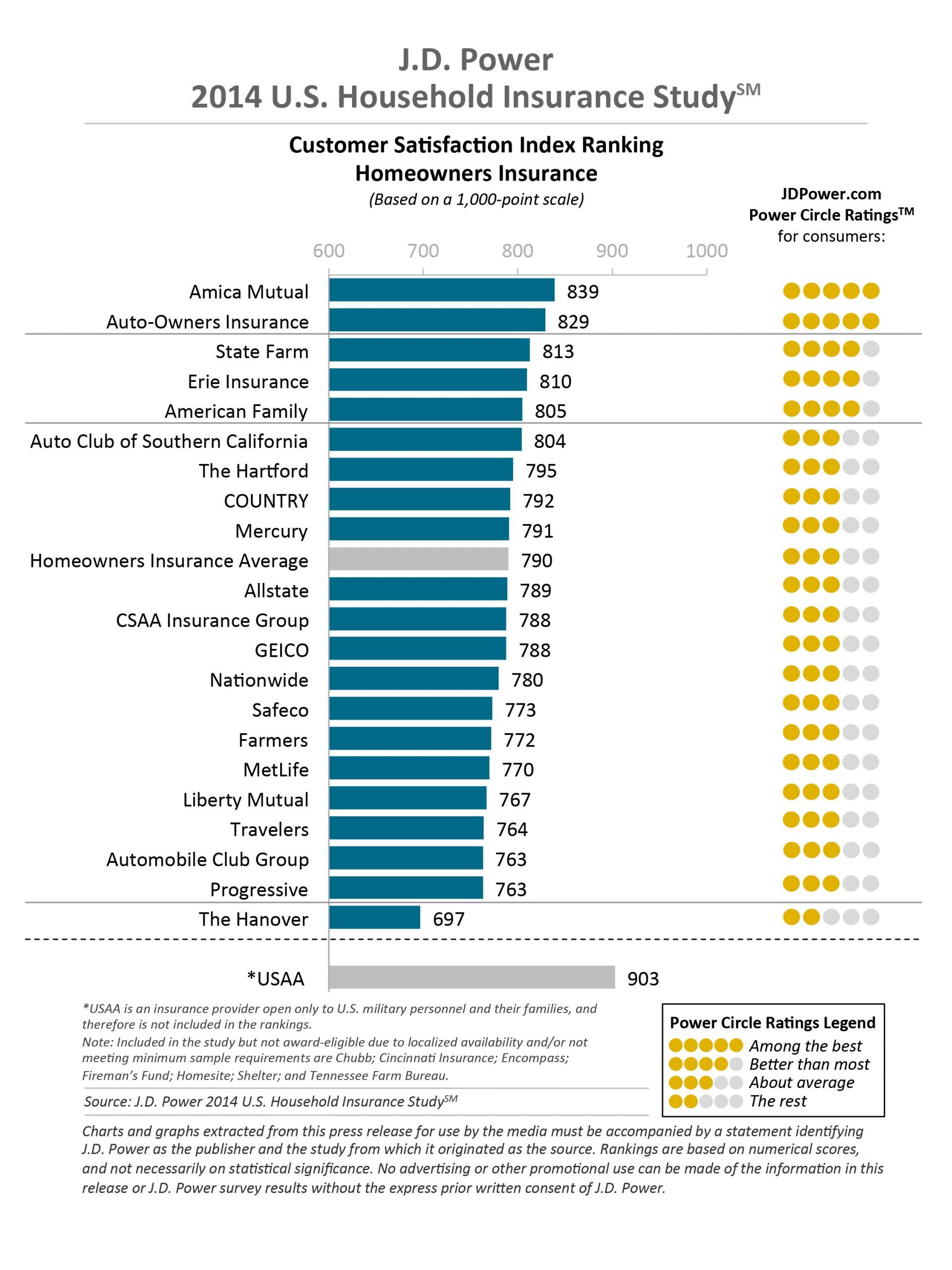

When shopping for new car insurance, its smart to compare quotes. When we researched insurance industry leaders, Progressive and State Farm were two providers that stood out for extensive coverage and reasonable rates.

If youre ready to start comparing car insurance quotes, enter your zip code below or give our team a call at . Along with the providers you choose, factors like your age, vehicle make and model, and driving history can affect the car insurance rates you see.

What Is The Minimum Liability Insurance You Need In Georgia

- Bodily injury liability: $25,000 per person, $50,000 per incident

- Property damage liability: $25,000 per incident

These limits are often abbreviated as $25,000/$50,000/$25,000, or 25/50/25.

Bodily injury liability covers medical bills and other costs if someone is injured or killed in an accident and youre at fault. In Georgia, the minimum liability coverage will pay up to $25,000 per person. If there are multiple people injured in an accident for example, passengers then the minimum liability coverage in Georgia will pay up to $50,000 in total for all medical bills.

Property damage liability covers repair costs to the other drivers car and other property damage in an accident for example, to buildings or fences.

Don’t Miss: Irregular Periods Can I Still Get Pregnant

Know The Law About Georgia Liability Insurance

In Georgia, even if youre not at fault for an accident, then you may still not be entitled to compensation from the other driver. According to Georgia law, if a driver could have avoided an accident by the use of ordinary care, then the driver is not entitled to financial compensation, regardless of whos at fault.

Also, keep in mind that Georgia takes liability insurance very seriously. If you are caught driving without valid insurance, then your license could be suspended for up to three months, and youll face a fine of at least $200 as well. Depending on the circumstances, you could even face jail time. Youll also be charged with a misdemeanor, which will stay on your record permanently.

That said, Georgia does offer a grace period if you simply forgot to renew your liability insurance policy. As soon as your old policy expires, your auto insurance company is required by law to notify the DMV. If you can show that there was no lapse in coverage for example, because you switched car insurance companies then all you need to do is send the new policy to the DMV. But if there are more than ten days in between coverage periods, then youll need to pay a $25 lapse fee. If you dont show the DMV proof of liability insurance coverage within 30 days, your vehicle registration will be suspended.

Follow These Steps To Avoid A No Proof Of Insurance Charge In Georgia

To ensure this does not happen to you, here is a list of best practices:

- Stay up to date on your insurance information. Make sure you make your insurance payments on time and that there is never a lapse in coverage.

- Make sure all of your vehicles are covered by your policy. If you get a new vehicle, you must add it to your policy as soon as possible.

- Put all of your insurance information in your car in an easily accessible place. You need to be able to find your insurance information if pulled over by a police officer.

- Be polite to the officer. If you know you have car insurance but can’t find your card for some reason, being respectful to the officer may convince him not to write you a ticket. He may just give you a warning instead.

Recommended Reading: When Is A Woman Fertile After Period

If You Buy A New Car Is It Insured

When purchasing a new vehicle, you’re sure to have several questions regarding your purchase. One of those questions is if you buy a new car is it insured.

When purchasing a new vehicle, you’re sure to have several questions regarding your purchase. One of those questions is if you buy a new car is it insured.

Do I Have Insurance When I Drive My New Car Off The Lot

Can you drive a new car without insurance? You must be aware by now that the answer is no. However, suppose you already have a policy that is in effect, meaning you already have a vehicle. In that case, that policy will provide automatic coverage for up to four days in most insurance companies. The coverage will be identical to the one of your existing car.

Many people think that the car dealership will notify their insurance company about purchasing a new car, but this is solely the customers responsibility.

So, do you need insurance to buy a car? Technically, you can buy a car without insurance. However, no matter whether its a new or a used vehicle, youll need car insurance to drive it off the lot. If you possess an insurance policy, you will be covered the second you drive off the lot. But if you dont own one, you may end up getting stuck at the dealership. Note that you will violate several laws and regulations even by driving the car just to your house.

Don’t Miss: How Early Can You Get Your Period

Is There A Grace Period For Getting Insurance On A New Car

According to CarInsurance.com, many insurance companies will give you a grace period for adding your new car to your current policy. Still, again, it’s up to the individual company whether to grant such a period. If you’re an existing customer with an active policy, you may receive up to two weeks to add the new vehicle. Depending on your particular situation, your insurance company may be willing to extend that grace period even further. Loyal customers can receive up to a month-long grace period. However, some insurance companies don’t offer any sort of grace period, so be sure to check with your company. Even if they do provide you a grace period, it’s always better to add your new car to your policy as soon as possible instead of waiting.

The Zebra notes that if you’re in an accident and you are still within your insurance company’s grace period, your current policy will cover the accident. Your previous car’s coverage limits will apply. If you had collision coverage on your old car, you’ll have the same coverage on your new vehicle. Do keep in mind that your insurance rates will rise if you choose to file a claim.

How Does Insurance Work When Buying A New Car

You don’t have to switch your insurance to your new car right off the bat. Since most insurers offer a grace period for updating your policy with your new vehicle, your dealer will typically just need proof of insurance before they throw you the keys. Even if you don’t have auto insurance, you can start a policy before buying your car if you know the vehicle identification number.

Don’t Miss: Tips For When Your On Your Period

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and reviewed by subject matter experts, who ensure everything we publish is objective, accurate and worthy of your trust.

Our insurance team is composed of agents, data analysts, and customers like you. They focus on the points consumers care about most price, customer service, policy features and savings opportunities so you can feel confident about which provider is right for you.

- We guide you throughout your search and help you understand your coverage options.

- We provide up-to-date, reliable market information to help you make confident decisions.

- We reduce industry jargon so you get the clearest form of information possible.

All providers discussed on our site are vetted based on the value they provide. And we constantly review our criteria to ensure were putting accuracy first.

Auto Insurance Cancellation Policies

Since the state of Georgia has this system in place, they will soon find out if you cancel your auto insurance policy or if it is terminated by the insurer. If you fail to pay your premiums your insurance will lapse and since there is no grace period your coverage will end immediately. The cancellation policies for your vehicle consist of you either immediately obtaining coverage from another carrier or voluntarily canceling your registration if the vehicle is not being driven. You are not allowed to operate a vehicle in Georgia without liability insurance coverage and your vehicle’s registration will be suspended by the state if you do not maintain it.

References

You May Like: How Do You Know Your Period Cycle Length

How Long Is A New Car Insurance Grace Period

The new car insurance grace period can vary by state law and insurer, so check with your insurance company to understand the rules. However, the typical new car insurance grace period is seven to 30 days.

For example, Progressive and Allstate have 30-day grace periods, whereas State Farm has a 14-day grace period.

You can safely drive your vehicle during this time, knowing it has the same coverage as your previous vehicle.

Keep in mind that not every insurance company offers this grace period, so always check your car insurance policy for specifics. If you cant find the details in your policy documents, you can always call your insurance company and ask a representative what the companys new car insurance grace period is. They should have this information readily available.

Factors That Can Impact Your Car Insurance Rates In Georgia

In addition to selecting the coverages, limits and deductibles thats right for you, these factors could also affect your car insurance rates in Georgia:

- The type of car youre insuring

- Your driving habits and annual mileage

- Demographic factors, like zip code

- Any discounts you may qualify for

Learn more about these factors that could impact your car insurance premium.

Recommended Reading: Can Birth Control Stop Your Period Completely

Are There Any Penalties

If your insurance policy has lapsed or, in other words, is no longer in effect, you wont have financial protection if you get into an accident.

Moreover, due to the lapse in coverage, your insurance company might increase your rates. The drivers with a coverage lapse of more than 30 days will have a premium increase of 35%, while those with a coverage lapse of 30 days or less will see an average 8% car insurance rate increase. These numbers show the importance of getting back to your policy as fast as you can. No matter the percentage in your state, the longer you wait before reinstating your insurance policy, the higher your future rates will be.

Additionally, depending on your state, driving an uninsured car can lead to serious lapse fees, fines, or penalties.

Buying A Car From A Private Seller

Even if you purchase a used or new car from a private seller, you must follow state laws and policy regulations before driving home.

We also recommend taking care when you test drive a car from a private dealer. Ask the seller to show proof of insurance before your loop around the block to avoid breaking the law.

Take a look at your states required insurance minimums when checking the insurance in place, since there are still a significant number of drivers that slip by without the required amount.

You May Like: What Does Birth Control Do To Your Period

What Is A Grace Period When Buying A New Car

So, what about car insurance grace periods when youre adding a new car to your policy or buying a car without an existing plan? There are three things that come into play in this case:

For example, some companies will allow you to drive off the lot with your new car if you have insurance for another vehicle. As long as you call the auto insurance company within a specific number of days typically up to 30 to order new coverage, you may be covered under the existing plan.

However, many car dealerships simply require a driver’s license and proof of insurance to buy a car. In this case, what the dealer says goes.

Above all else, you should also consult state laws about car insurance grace periods. Some states may allow you to extend your current coverage from another vehicle to the new car for several days.

If you do not have any form of insurance in a state that requires coverage, you typically need to purchase a new policy before you drive for the first time.

Be aware that even if your state, dealership, and car insurance company allow a grace period, its helpful to get the grace period details in writing before you drive away from the dealer. If you get pulled over or are involved in an accident during this time, it will be easier to prove grace period regulations to the police.

How Long Do I Have To Add A New Car To My Insurance Policy

When buying a new car, your insurance carrier will provide a grace period between seven to 30 days to update your policy with your new ride. For example, Progressive allows 30 days, which means if you have a claim within that period, your new car is still covered in the same way your previous vehicle was.

With Progressive, you have a 30-day grace period to add your new car.

Recommended Reading: 90 Day Trial Period Contract Template

Auto Lenderinsurance Requirements Matter Too

When buying a car, you must carry auto insurance coverage that meets two minimums. First is the state minimum requirement, which is generally just liability coverage and a minimum amount of personal injury and property protection coverage. Second, if the car is financed, you must meet the lenders minimum insurance requirements.

The latter will usually be a combination of comprehensive coverage and collision coverage. They may also require a maximum deductible amount and more. If your current policy doesnt meet all the lenders coverage option requirements, the lender may force-place an insurance policy meeting its needs and add the premium to your monthly car payment.

You can find the minimum auto insurance requirements in your loan documents. If you dont see it, the dealership can guide you, or you can call the lender to ask a representative about the companys minimum insurance requirements.

Our Recommendations For A Car Insurance Grace Period

In our industry review, we highlighted car insurance providers that put customers first through comprehensive coverage plans, affordable rates, and assistance during the quotes and claims processes. High customer care ratings are also generally a sign that a company will be easy to work with in the event of a payment slip-up.

Here are a few top contenders for auto insurance. Enter your zip code or call to start comparing free car insurance quotes in your area.

Also Check: How To Calculate Due Date With Irregular Periods

Buying Car Insurance For Your New Car

Find Cheap Auto Insurance Quotes in Your Area

Auto insurance is required in nearly every state, and new cars are no exception.

Before you drive off the dealership’s lot, you’ll need to show you have insurance coverage that meets your state’s minimum requirements.

If you’re already insured, whether on your own policy or that of a family member, you’ll still need to update your coverage shortly after buying a new car to ensure the vehicle information is up to date.

The cost of insurance for a new car is a bit higher than for an older model, usually due to increased comprehensive and collision coverages. Planning ahead and looking for discounts can save you a lot of time and help you find an affordable policy.

Which New Car Models Are The Cheapest To Insure

Auto insurance for a new car may vary depending on the model. New car models that are worth less money also tend to be cheaper to insure.

Based on MoneyGeeks analysis, the cheapest new car models to insure are:

- Subaru Forester: $1,150 per year

- Honda CR-V: $1,172 per year

Top 20 Cheapest 2020 Car Models to Insure

Scroll for more

If your new car has advanced safety features, you may be able to receive money off your premium. Insurance companies may offer discounts for collision warning features, anti-lock brakes, airbags, rearview cameras and anti-theft devices.

Recommended Reading: Signs Of Starting Your First Period