How Many Payrolls Are In Biweekly 2019

. Similarly, it is asked, are there 27 pay periods in 2019?

Tuesday, November 05, 2019 – Hannah Woolsey, JDIn fact, companies with biweekly pay periods will have 27 pay periods only every 11 years, and companies with weekly pay periods will have 53 every 5-6 years.

Subsequently, question is, how many payrolls are there in 2020? 1 payday back into 2020, you’d still have 27 biweekly pay periods, this time in 2021.

Beside this, how many pay periods remain in 2019?

With a bi-weekly payroll system, employees are paid every other week resulting in 26 paychecks in a year. Bi-weekly pay is usually scheduled on a specific day, every two weeks.

How many times will I get paid biweekly in 2020?

If you’re paid every other week, you’ll receive two paychecks a month, except for the two months of the year when you’ll get three paychecks. January and July may be your 3-paycheck months for 2020, but it all depends on your pay calendar.

Leap Years: What An Extra Pay Period Means For Your Payroll

Payroll Checklist

Key points about managing payroll with an extra pay period:

- Leap years increasethe chance of an extra pay period, but this change isnt exclusive to leap years! The number of pay periods you have can actually vary each year depending on your pay date and frequency.

- You have 4 options when it comes to dealing with an extra pay period. Depending on your decision, an extra pay period can also affect deductions, special wage payments, and income tax withholdings.

- Our checklist will help you keep track of everything affected by an extra pay period, whether its a leap year or not.

Leap years add an extra day of pay to the year. This increases the chance of an extra pay period, bumping the number from 26 to 27 for salaried employees paid biweekly .

While leap years increase the probability of an extra pay period, the number of pay periods you have could actually fluctuate every year depending on your pay date and frequency. In any year that isnt a leap year, theres still one day of the week that occurs 53 times, instead of the normal 52. If your pay date falls on this day, youll have an additional pay period.

Because of this, you should count the number of pay periods youll have each year, regardless of whether its a leap year or not. If you have an extra pay period, you may need to adjust employee paychecks and deductions. See our table below for the number of days in 2022, 2023, and 2024 to help you plan accordingly.

Calculating Monthly Pay From Bi

Your most recent pay stub should show your gross pay amount for that pay period. The gross pay amount is the amount of money you make before any taxes or other deductions, like insurance, are taken out. The pay stub will frequently indicate that a particular amount is your gross pay.

Once you determine your gross pay for that pay period, multiply that figure by 26, because there are 26 two-week periods in 52 weeks, or one year. For example, if your gross pay is listed at $2,500, you will multiply 2,500 by 26, which equals $65,000. This is how much you gross in one year. Because there are 12 months in one year, you can divide this number by 12 to find out your gross monthly wages. $65,000 divided by 12 is $5,416.67. That figure is your monthly gross pay.

Read More:How to Check Your Paycheck

Rarely, such as in a leap year or if your pay is issued on in a normal year, you may end up having 27 pay periods that year instead of 26. However, if this is the case, you can use the same formula but substitute 27 in the calculation instead of 26. So in the example above, if there are 27 pay periods, you would multiply your gross income for the pay period, $2,500, by 27 and then divide the answer by 12. Multiplying 2,500 by 27 results in $67,500, which divided by 12 is $5,625.

You can also use these formulas to calculate your monthly net income , by using your take-home pay for that paycheck as the starting number instead of the gross pay.

Recommended Reading: Why Do I Have My Period For 2 Weeks

Salary Specifics Documented In Offer Letters Contracts And Collective Bargaining Agreements

Before you decide how to compensate employees in a year with an extra pay period, review offer letters and other documents regarding compensation. Collective bargaining agreements are especially specific about pay periods and wages, so check them carefully. If these documents only state an annual salary, you can choose any of the above options to reach that amount. However, if the documents state that employees will be paid in weekly or biweekly checks of equal amounts, you must comply and choose Option 1 above.

Why Is A Pay Period Important To Employers

Payroll processing is expensive. For employers to have set pay periods means better use of time management and personnel. An organized and efficient payroll system is beneficial to the overall running of the company by keeping controlled records for tax purposes.

Other benefits of having designated pay periods include:

Running payroll software and using an online payroll system, especially if payroll is being manually prepared, is a time-consuming task. All areas must be accounted for when calculating employee payrolls such as vacation and sick time, PTO, holiday pay, bonuses, and overtime.

For employers using the services of a payroll provider, the cost can be exorbitant as payroll services charge per transaction. Payrolls that are run weekly can become a significant expense. For this reason, employers prefer less frequent pay periods to keep payroll costs lower.

As it now stands, employers tend to use the monthly and semi-monthly pay periods for salaried employees and prefer to use hourly and bi-weekly pay periods when calculating pay for hourly employees.

If you need help with determining how many pay periods you should have in a year, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Don’t Miss: First Signs Of Pregnancy Before Missed Period

Overview: What Are Pay Periods

Pay periods are recurring time periods for which employee wages are calculated and paid. The Fair Labor Standards Act requires businesses to pay employees on their “regular payday,” but it doesn’t specify how often those paydays must come.

Instead, states have set their own standards through payday frequency laws.

The most common pay periods are weekly, biweekly, semi-monthly, and monthly. No states allow bimonthly pay schedules. In most states, paying at least semi-monthly is acceptable, but some states have more stringent requirements.

In Connecticut, for example, businesses must pay weekly unless they get approval from the labor commission for longer pay periods. Be sure to verify your state’s laws when setting up payroll.

How often you pay employees is an important decision not only because of its effect on recruiting and retention, but because you need to be able to deliver paychecks consistently based on the schedule you create.

Missing your regular payday, even by as little as a day or two, opens you up to FLSA complaints. The cost of a wage violation can be steep, including double back wages and other penalties.

There are also strategic considerations when setting pay frequency. Employees value shorter pay periods, yet each payroll run costs your business in administrative hours or vendor expense. You’ll need to balance the administrative costs with your talent management goals to find the right frequency for your business.

Withholding & Reporting Requirements

Employers are required to withhold the appropriate amount of federal, state and local taxes from each employee paycheck. The more often you run payroll the more accounting must be managed to ensure monthly and quarterly payroll tax payments and reports are submitted accurately. Failure to do so can result in substantial fines and penalties.

Read Also: What’s The Chances Of Getting Pregnant On Your Period

The Best Payroll Software For Your Pay Schedule

As a busy business owner, do you really have the time to manually calculate employee payroll? Maybe you’re still not sure exactly how payroll works and could use a virtual hand.

There are numerous payroll service and software applications on the market today that automate the entire process from beginning to end. Here are just a few choices to consider.

What Is A Pay Period

A pay period is the specific number of working hours for which an employee will earn a paycheck. Pay periods help determine other factors as well, such as payroll schedules, how many paychecks employees get each month and how much money gets taken out of each paycheck to go toward employee benefits.

Don’t Miss: Skipping Period With Birth Control Pills

Cons Of Biweekly Pay:

- If you use biweekly pay, your business must be prepared for the months with three paychecks, and budget accordingly to ensure the payroll account has enough money for those extra expenses.

- Your payroll provider might charge your business for each payroll run, which results in higher annual fees than if you opt for semimonthly.

- Your employees might want to get paid every week, so they have more consistent money coming into their accounts.

- If your industry operates on contract work, where projects can stall for periods of time, employees might appreciate weekly pay for a sense of security.

Ultimately, it’s critical you consider what your competitors are doing, and what makes the most sense for your employees, when choosing a pay period. Your decision might vary depending on the size of your HR team, whether you can find a payroll provider with fair payroll fees, and whether your employees are salaried or hourly workers.

How To Calculate Biweekly Pay

You May Like: How Do I Slow Down My Period Bleeding

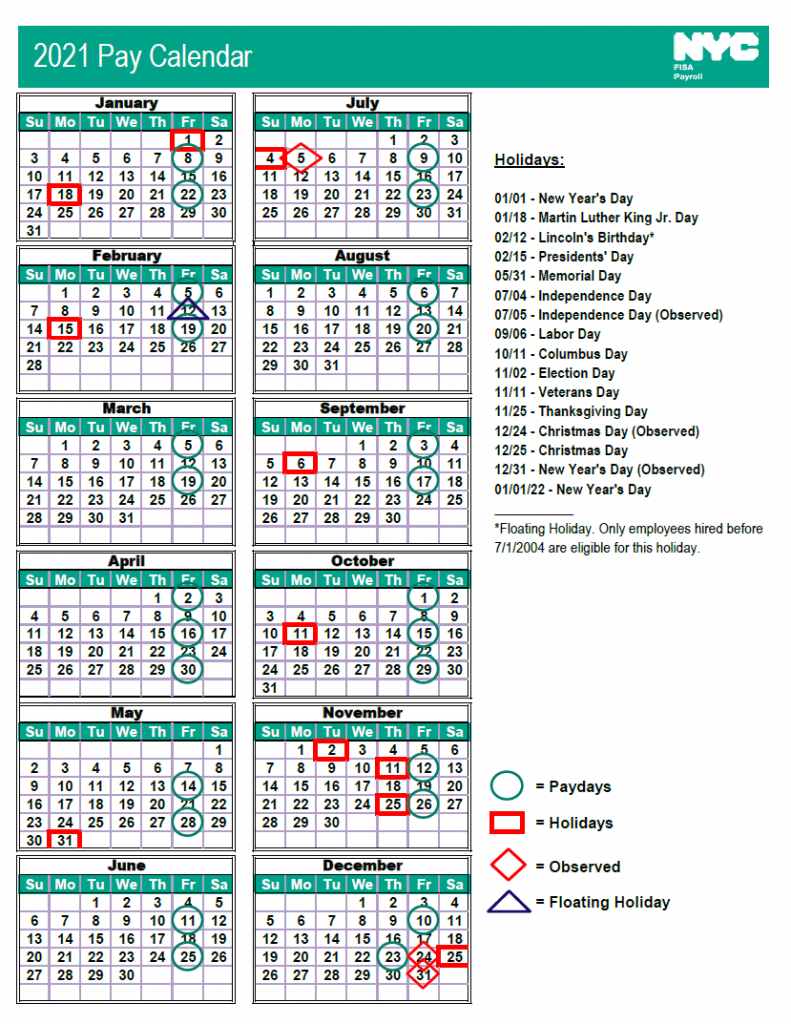

First Paycheck: January 8 2021

If your first paycheck of 2021 is on Friday, January 8, the payroll leap year will not affect you. Youll only receive two paychecks in January, and your three paycheck months are April and October 2021.

First Paycheck: Friday, January 1, 2021

Paydays for 2021:

First Paycheck: Friday, January 8, 2021

Paydays for 2021:

Of course, not everyone is paid on Fridays. But you can determine your three paycheck months for 2021 by pulling out a calendar, marking your paydays and finding the months with three of them.

Who Does This Extra Pay Period Affect

Two kinds of pay periods for salaried employees are often confused. The pay for these employees is annual pay, paid monthly, semi-monthly, or bi-weekly. Semi-monthly is twice a month, resulting in 24 payments in a year, while bi-weekly is every other week, resulting in 26 payments in a year.

The extra pay period affects salaried employees who are paid bi-weekly . Here’s an example:

Jerry is a salaried employee paid $28,000 a year, on a bi-weekly pay basis. Each pay period during a “normal” year of 26 pay periods, he receives $1076.92. But if there is an extra pay period in a year, he would receive an extra paycheck, more than his actual salary.

Recommended Reading: Why Does My Period So Heavy

What Is Biweekly Pay

Biweekly pay means you pay your employees once every two weeks, on a set day you choose.

For instance, let’s say you choose to pay your employees once every two weeks, on Friday.

Take a look at the following calendar for the months of January and February, 2019:

Calendar courtesy of Towncalendars.com

As you can see, it doesn’t matter which day of the month you pay your employees — you can pay them on the 4th one month, and then the 1st another. It’s only important you pay once every two weeks.

Once you start the year, you’ll pay your employees once every two weeks. This might sound simple, but that means for two months out of the year, you’ll have three pay periods instead of two.

The Difference Between Semimonthly And Biweekly

At first glance, these two terms sound awfully similar — once every two weeks or twice a month are the same thing, aren’t they?

Actually, they’re not. Semimonthly means your employees get paid on two specific days of the month, regardless of when they fall. For instance, you might choose to pay your employees on the 15th and 30th of every month. Biweekly, on the other hand, promises employees a paycheck once every two weeks regardless of what day of the month it is — hence, in the calendars above, employees receive paychecks on the 4th, 18th, 1st, and 15th of the month.

Semimonthly means employees receive 24 paychecks per year, instead of 26. Additionally, the 15th and 30th of each month could fall on a holiday or weekend depending on the month, so your HR team needs to ensure they’re on-top of processing deadlines and pay dates to ensure your employees still receive a paycheck.

You May Like: How Much Period Bleeding Is Too Much

How Is A Pay Period Calculated

Companies decide what pay period length they want to run their payroll on.

This can be based on a variety of factors, like when the company gets paid for its products and services, how often employees need money, and whether you have hourly employees or if your team is on an annual salary schedule. Thereâs also state law to factor in â you may prefer to pay monthly while state law requires bi-weekly payments.

For example, a company that employs mostly hourly workers might find it beneficial to have a week-long pay period. Weekly payments are easier for financial planning and make employees happier by giving them access to more readily available cash flows.

However, a company that bills its clients at the end of the month and has mostly salaried employees may prefer to pay its employees less frequently â a bi-weekly basis is typical.

Number Of Paychecks Per Year

With a biweekly pay schedule, there are two months in the year where employees receive three paychecks. Employees who are paid semimonthly always receive two paychecks per month.

Companies that run payroll with a biweekly frequency dole out a total of 26 paychecks per year. Companies that use semimonthly pay give employees 24 paychecks per year.

Recommended Reading: When On Birth Control How Long Is A Period