Consider Additional Repayment Options

Paying off the HELOC in full before the draw period ends is the best option, leaving you with zero balance at the end of the loan. Review your budget looking for places you can cut costs and save money to put toward the HELOC balance.

If that’s not possible, you have several options for refinancing or closing your HELOC before the draw period ends.

Whichever refinancing option you’re considering, carefully weigh the costs against the potential savings to see if it makes sense for you.

What if your financial situation has changed for the worse since you got the HELOC, and you’re having trouble making payments? If you begin missing payments, your credit score may suffer, making it difficult to qualify for loan refinancing. If you find yourself in this predicament, see if your lender is open to some type of loan modification.

What Is A Heloc Draw Period

The draw period of a HELOC works like an open line of credit. Youre given a set line amount from which you can draw funds, based on the homes equity. You can borrow up to the limit, pay it back and then borrow more money as many times as you want until the draw period comes to a close. The money from your HELOC can be used to pay off other higher-interest debt, make home improvements, remodel or almost any other purpose.

This draw period typically lasts between five and 10 years. During this period of the HELOC, only interest is due on the money youre borrowing, although you may be charged minimum monthly payments.

To illustrate how minimum monthly payments work during the draw period, lets say you withdraw $50,000 at a five percent interest rate using a HELOC with a 10-year draw period and a 15-year repayment period. Your minimum monthly payment during this draw period would be $208.33, representing only the monthly interest.

Once the draw period is over, you cannot borrow from the loan again without refinancing it first.

How To Make Heloc Payments

Youll be making interest payments on your HELOC from the time the draw period begins. Once it ends, youll need to start paying back the principal you owe as well.

Youll work with your lender to set up payments for your HELOC, which is similar to setting up payments for other types of loans. It can often be done online.

Also Check: How To Know Your Ovulation Day With Irregular Period

What Are The Minimum Payments During The Heloc Draw Period

Most lenders only require you to make interest-only payments during the HELOC draw period. But some lenders will require you to make a minimum monthly payment that includes some of the principal. Once the draw period is over, you must start paying back the principal and interest with each monthly payment.

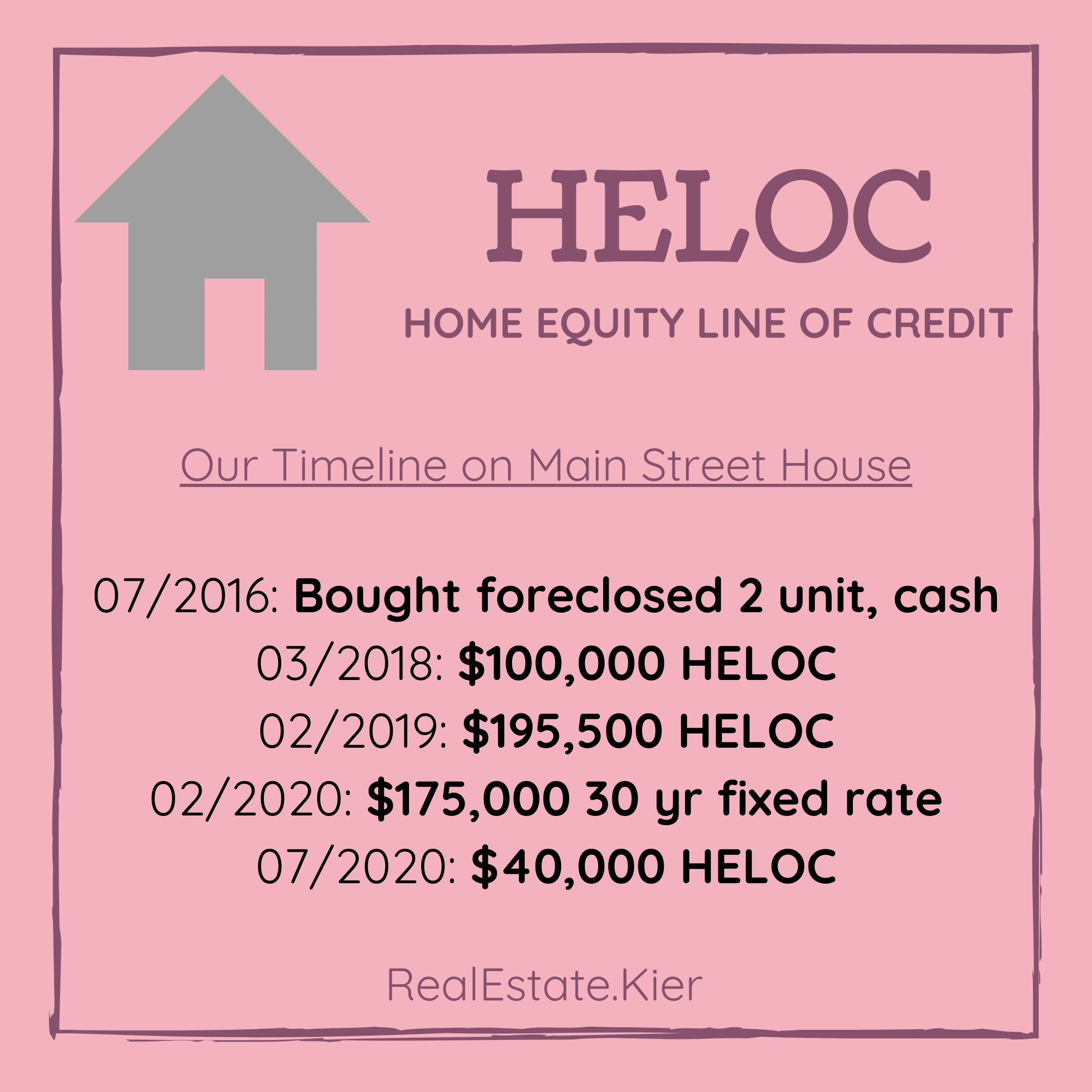

Using A Heloc For Mortgage Payoff

Paying off a mortgage with a HELOC is a method of refinancing a home loan. To do this, the homeowner has to get approved for a HELOC with a credit limit as high as the amount required to pay off the mortgage.

Once approved for the HELOC, the homeowner can draw on the credit limit to pay off the mortgage. Then the homeowner makes the payments to the HELOC rather than to the mortgage. This can boost cash flow thanks to lower payments, while also saving on total interest.

Heres an example: A homeowner with a home valued at $400,000 has an existing mortgage with an interest rate of 4%, an outstanding balance of $100,000 and 10 years to go. The monthly principal and interest payment on the loan is $1,432. If the homeowner pays off the loan as scheduled, the remaining interest will total $30,040. The homeowner qualifies for a $100,000 HELOC with an interest rate of 3.75%, a five-year draw period and a 15-year payback period. The homeowner draws $100,000 from the HELOC and pays off the mortgage.

However, if the borrower made interest-only payments the first year and then began adding enough principle to pay off the HELOC within nine years, total interest comes to $17,977. Thats $12,063 less than the $30,040 in interest remaining on the original mortgage. The loan is paid off in the same 10-year time frame. And the monthly payment the last nine years would be only $1,092, or $340 less than the original mortgage payment.

Read Also: Do Girls Stop Growing When They Get Their Period

Do Helocs Have Prepayment Penalties

HELOCs that are considered “high-cost mortgages” are subject to federal regulations under the Home Ownership and Equity Protection Act , which includes restrictions on prepayment penalties. A HELOC falls into the high-cost category if the APR as of the date when the interest rate is set exceeds the Average Prime Offer Rate for comparable transactions on the same date by over 8.5 percentage points. Prepayment penalties for a HELOC meeting this definition can’t be charged a prepayment penalty more than 36 months after account opening or for more than 2% of the amount that is prepaid.

When you pay off your credit line early, lenders lose the profit they would have made had you paid off the HELOC over time, with interest. To recoup these losses, lenders sometimes assess an early termination or early closure fee if you pay off your HELOC and close the account within a certain time frame, such as 24 months or 30 months after opening your credit line. A lender may offer HELOCs with no closing costs, but if you terminate the HELOC early, you’ll be charged a fee equal to the closing costs waived when you opened your credit line. Some lenders charge a percentage of your credit line, while others charge a flat fee. For example, US Bank charges an early closure fee of 1% of your original credit line for accounts closed within the first 30 months.

How Can A Heloc Affect Your Credit

When you apply for a HELOC, the lender will perform a hard inquiry into your credit, which can cause a small, temporary dip in your credit score. After you’re approved, a HELOC can negatively or positively affect your credit depending on how you use and repay the loan.

For example, if you have lots of high-interest credit card debt, you probably have a high , which can lower your credit score. Drawing from your HELOC to pay off your credit card balances could reduce your credit utilization ratio and improve your credit score, as long as you don’t run up the credit card bills again. Because HELOCs are secured by your home, your FICO® Score won’t reflect them in your credit utilization.

Making on-time payments both during and after the draw period on your HELOC can also help to boost your credit score. Just be aware your monthly payments will increase when your HELOC closes. If you’re not prepared to handle them and miss a payment, it could damage your credit score.

You May Like: Why Can Your Period Be Late

Consider Your Loan To Value Ratio

After youve determined your home equity, you need to figure out whether its actually sensible to borrow from it. You can get a better idea of this by using your LTV ratio.

This is a percentage found by dividing your mortgage value by your appraised home value. For the example mentioned above, this would be:

$300,000/$500,000 = 0.6

The higher an LTV is, the more risk it represents for the lender. CLTV includes your mortgage as well as any other home loans you have, including the one youre currently applying for. Most lenders generally have a CLTV limit of 85%, and wont consider anything over this.

How Long Is The Draw Period On A Heloc

The draw period for HELOCs will vary based on your lender and your needs. However, the two most standard draw periods are 5 to 10 years. Some lenders will offer longer draw periods if you happen to have a large amount of equity in your home.

Once your HELOC draw period ends, you will no longer be able to draw from it.

Read Also: How To Delay Period For Wedding

Take Out A Personal Loan

A personal loan could be another option to help you refinance your HELOC and manage your HELOC payments. These loans come with some benefits, including the fact that theyre unsecured, meaning you dont have to use your home as collateral.

But personal loans also have some downsides. First, like a HELOC, your loan could have either a fixed or variable payment. A fixed rate would allow you to lock in your monthly payments, but a variable rate would mean your payments could increase in the future.

Another thing to consider with personal loans is that like other unsecured debts, they tend to have higher interest rates than secured loans. A higher interest rate could also drastically increase your monthly payment.

Is It Cheaper To Repay My Heloc During The Draw Period

When repaying debt, a rule of thumb is: The sooner you can clear out the balance, the less youll accrue in interest. So its often cheaper to repay your HELOC during the draw period than to wait for the repayment period.

Paying off your balance limits the interest that can accrue. Having a variable interest rate can also help ensure rates dont rise before you tackle the debt.

Of course, it can make more sense to wait in certain situations. For example, say you would save $350 in interest by repaying your HELOC during the draw period, but youd also have to pay a $500 prepayment fee. It could make more sense to wait until that penalty period ends.

Keeping a small outstanding balance on your HELOC can help ensure your lender doesnt close it unexpectedly due to inactivity.

Read Also: How To Deal With Period Cramps Without Medicine

How Can I Use My Home Equity

Once you have a good chunk of equity built up, you can let it sit and continue to grow, or you can utilize it if you have a need for a large sum of money, like for an expensive home renovation project or paying off student loans.

With HELOCs and home equity loans, youll likely be able to get a lower interest rate than you would with an unsecured personal loan. Depending on how much equity you have in your home, you may be able to borrow significantly more money than you could with a personal loan.

Keep in mind that your home is used as collateral for this type of loan, so if youre unable to pay off the loans, you may lose your home as a consequence.

Alternatives To Heloc Repayment

If youre having a difficult time balancing your HELOC payments with your other financial obligations, it can quickly feel overwhelming. But the last thing you want to do is simply ignore the problem. Not only will your debt continue to rack up, but you could also do serious damage to your credit score. Instead, consider these alternatives to help you manage your payment.

Read Also: How To Stop Your Period For A Day

Refinance Into A New Heloc

Refinancing your HELOC may be an option. If you can find one with a low introductory APR, then it can help keep your monthly payments manageable and give you more time before your principal repayments begin. Similarly, a new HELOC with a fixed-rate option could keep your payments from fluctuating month to month.

Whats The Difference Between A Heloc And A Home Improvement Loan

The biggest difference between a HELOC and a home improvement loan is that a HELOC borrows against the existing equity in your home, while the latter does not. Because of this, home improvement loans have a lower limit that you can borrow. These loans can also carry higher interest rates than HELOCs.

The money from HELOCs also doesnt have to be used for home improvement. It can be used in other ways, from debt consolidation to making major purchases.

Don’t Miss: What Does Bleeding Between Periods Mean

Home Improvement Or Repairs

If youre going to be using the money to improve or even increase the value of your home, it can make sense to tap into your homes existing equity using a HELOC.

Some improvements are more valuable than others. While you may think that a full kitchen renovation will give you a dollar-for-dollar return on your investment, thats not always the case. Youll likely get more bang for your buck with something that increases your homes square footage, such as finishing your basement.

You can also see good returns by making changes to your homes exterior to increase its curb appeal, such as upgrading your landscaping.

How Much Can You Borrow

The maximum amount of your home equity line of credit will vary based on the value of your home, what percentage of that value the lender will allow you to borrow against and how much you still owe on your mortgage. Two quick calculations can give you an idea of what you might be able to borrow with a HELOC.

Your home’s current value x Percentage of value lender allows you to borrow = Maximum amount of equity that could be borrowed

Maximum amount of equity that could be borrowed – Remaining balance on your mortgage = Total amount you can borrow

Say you have a home currently worth $300,000 with a balance of $200,000 on your first mortgage, and your lender will allow you to access up to 85% of your homes value. Multiplying the home’s value by the percentage the lender will allow you to borrow gives you a maximum amount of $255,000 in equity that could be borrowed. Subtract the amount you still owe on your mortgage to get the total amount you can borrow with a HELOC $55,000.

Or skip doing the math, and use the HELOC calculator below to see how much you might be able to borrow.

Don’t Miss: How To Take Birth Control Pills To Stop Period

How Does A Heloc Draw Period Work

When choosing a lender for a HELOC, read the fine print. There may be rules around minimum borrowing requirements, like additional fees that apply if you don’t take out at least some of the money, or if you close the line of credit early. During a HELOC draw period, borrowers typically pay only the interest on their outstanding balance. Once the draw period expires, the repayment period begins, when monthly payments of interest and principal are due until the balance is paid off.

“It’s very important to understand when that door closes on your ability to draw against the amount of the loan,” says Bruce McClary, senior vice president of membership and communications for the National Foundation for Credit Counseling. “You don’t want to find yourself short of the money you need when that draw period closes.”

A HELOC can be great for borrowers who are using the funds to add value to their home through a renovation project. But consumers who are using a HELOC for debt consolidation need to be especially careful, says Katie Bossler, quality assurance specialist with GreenPath, a nonprofit that offers financial counseling services.

Payments will be low during the draw period, Bossler says. “But you still owe that principal balance, and then you’re going to have to face the music when that 10 years ends, and that can be really tough,” she adds.

How Often Can The Interest Rate Change On A Heloc

With a variable rate loan, the interest rate you pay will change periodically based on overall market conditions. How often this resets varies depending on the lender, so be sure to note how often your rate will change. Your lender may also offer a low introductory rate for a short time.

The interest rate you pay on a HELOC is often tied to the prime rate set by the nations major banks and influenced by the Federal Reserve. Your rate could change frequently, such as every month, or potentially stay the same for years.

Your HELOC will typically also have a maximum interest rate you can face, called a cap. Some HELOCs also have caps on how high your monthly payment can increase, and minimum interest rates you can pay if rates fall.

Recommended Reading: What To Put In A Period Kit

Are There Any Requirements Or Restrictions During The Draw Period

Many lenders have rules and restrictions during the draw period. For example, you may need to make an initial withdrawal as soon as you open your HELOC, or the lender might set minimum amounts for payments or withdrawals.

Some lenders may also charge fees for withdrawals or annual maintenance. In some cases, you may be limited to a maximum number of draws.

What Is A Home Equity Line Of Credit Or Heloc

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Recommended Reading: How To Masturbate While On Your Period

If You Need To Update Your Budget

Depending on how high your remaining balance is before the draw period ends, your monthly payments in the repayment period could be a financial shock. As a result, you may have to adjust your budget. You may have to eliminate or reduce certain expenses to free up some cash to put toward repaying your debt.

Draw Period In A Heloc Explained

fizkes / Getty Images

A draw period in a home equity line of credit is the amount of time you have to tap into the available credit.

You can use a home equity line of credit to fund just about any expense as long as you have equity in your home, including home renovations, college, or even a vacation. Lets take a closer look at what a draw period is and how it works, so you can determine if a HELOC is a good option for your needs.

Recommended Reading: Best Time To Get Pregnant After Period