Medicare General Enrollment Period

If you don’t sign up during your Initial Enrollment Period and if you aren’t eligible for a Special Enrollment Period, the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

The General Enrollment Period lasts from each year.

You can only sign up for Part A and/or Part B during this period, and your coverage starts on July 1. You may have to pay a late enrollment period for Part A and/or Part B, as detailed below.

|

Part B Late Enrollment Penalty: If you do not enroll in Medicare Part B during your Initial Enrollment Period but decide to enroll later in life, you will have to pay a late enrollment penalty. Your Part B monthly premium could go up 10 percent for each 12-month period that you were eligible for Part B but didn’t sign up. You pay the Part B late enrollment penalty for the rest of your life as long as you remain enrolled in Part B. |

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

How To Enroll In Medicare

Medicare open enrollment is for people who are already enrolled in Medicare. If youre signing up for Medicare for the first time, thats your initial enrollment window.

The steps you need to take during your initial enrollment will depend on how you become eligible for Medicare.

For example, youll need to apply directly to Medicare if youre not already receiving benefits from Social Security or the Railroad Retirement Board. People who are receiving these benefits will be enrolled in Medicare automatically when they become eligible.

You can apply for Medicare in a few different ways:

You dont need to take these steps if youre already enrolled in Medicare. Instead, you can use the open enrollment window to change your coverage.

You can do this by visiting the Medicare website and shopping for new plans. You can then select a plan you want and join.

You dont need to take any extra steps. As long as you join the new plan during open enrollment, you can just select your new plan. Remember, youre selecting coverage for the next plan year which means your plan will change in January, not right away.

Recommended Reading: Is My Period Late Or Am I Pregnant

Should You Change Coverage During The Annual Enrollment Period

You should consider changing your coverage during the Annual Enrollment Period because plans change annually and a new option may fit your needs better than your current plan. The only way to know is by reviewing your options each year.

Some changes that occur to Medicare Advantage and Medicare Part D plans include:

- Premium increases

- Changes in benefits

- Changes in preferred pharmacies

To avoid any unexpected surprises, you should do your due diligence to review your plan and others in your area during the Annual Enrollment Period.

Your Medicare Annual Enrollment Period Checklist

It is crucial to have a plan when approaching the Annual Enrollment Period. It is never too early to prepare. If you wait too long, contacting an agent may be difficult, and you may lose your chance to change plans.

To have a successful Annual Enrollment Period, you should:

1. Make sure you are eligible to make coverage changes

If you are newly eligible for Medicare or delayed coverage for any reason and do not yet have Medicare Part A and Part B, this is NOT the enrollment period for you. You will not be eligible to make changes during this enrollment period unless you are within your Initial Enrollment period or are eligible for a Special Enrollment Period. In this case, you will need to wait until the General Enrollment Period.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

2. Decide if your current coverage is still best for you

When deciding on your coverage during the Medicare Annual Enrollment Period, you must take a deeper look at your current coverage and determine if there are any changes you would like to make. If you can find a plan with these changes, it may be best to enroll in this new plan. However, no changes are necessary if your current plan is still the best for you.

3. Contact a licensed Medicare agent before December 7 to enroll

Recommended Reading: Why Are My Periods Getting Shorter

What Can I Do About Part D If I Miss Open Enrollment

If you discover that another Part D plan has better coverage for your medications, or if your doctor prescribes a new drug that isnt covered in your plans formulary, you could have opportunities to change plans after Dec. 7 if you:

- Have diabetes. If you take a covered insulin product, youre eligible to add, change or drop your Part D plan one time from Dec. 8, 2022, to Dec. 31, 2023, because of problems updating insulin copay information in Medicares Plan Finder.

- Receive financial assistance. If your income is low and you qualify for the Extra Help program that helps pay Part D premiums and out-of-pocket costs, you can change Part D plans as often as once a quarter.

- Have a five-star plan in your area. If a locally available Part D plan has an overall five-star rating for quality from the federal government, you can switch to that plan once any time of the year. Coverage begins the first day of the month after the plan receives your enrollment request. You can search for plans with a five-star rating using the Medicare Plan Finder, where you also can see how the plans cover your medications.

- Move outside your current plans service area. When you relocate, you usually have two months to get a new Part D or Medicare Advantage plan.

Original Medicare Vs Medicare Advantage

Unfortunately, there is no one-size-fits-all policy. The main factors you may want to weigh are how much you can afford to pay monthly, your age and overall health, and your risk threshold are you proactive or reactive when it comes to your health?

Whether you opt for Original Medicare and Supplemental Coverage or Medicare Advantage, these are some additional considerations you can use to help you determine which Medicare Plan is best for you:

Get Started Now Comparing Quotes

Personalized quotes in less than 2 minutes.

No signup required.

You May Like: What To Do On Your Period

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Medicare Open Enrollment Period Allows You To Adjust Your Medicare Options

Healthcare needs can changeovernight or over timeso its good to know your plan can change, too. If you already have a Medicare plan but its not checking all your boxes, or if you just want to see if youre missing out on any new coverage or benefits, the Medicare open enrollment period allows you to explore your options.

If you decide you , you can use Medicares annual enrollment period each year to make changes.

Recommended Reading: What To Do When Your Daughter Starts Her Period

How To Get Ready For Medicare Advantage Open Enrollment

Whether you recently enrolled or have had your Medicare Advantage plan for years, you can take this opportunity to confirm – or change – your plan choice. Think about your experiences using your plan and review your plan benefits. How does your plan stack up in the following areas?

- Your doctor and other providers are in the plan network.

- Your prescription drugs are on the plan formulary.

- You are comfortable with your costs, including premiums, deductibles, copays, and coinsurance.

- You have the additional coverage that you want for things like dental, vision, and hearing care.

- You are happy with your plan’s additional benefits such as fitness programs, mail-order pharmacy, nurse line, and other wellness services.

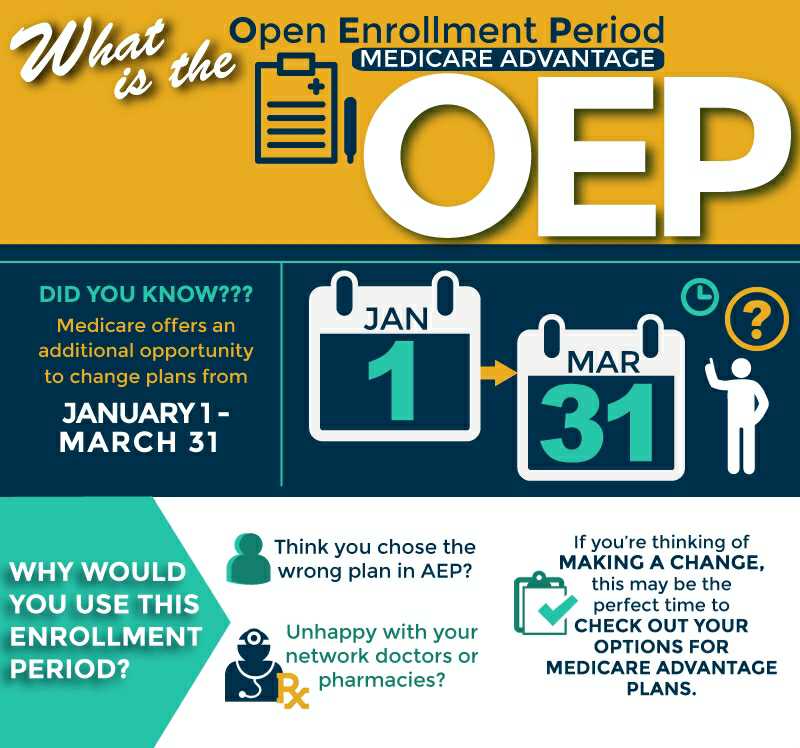

If you decide to make a change, you have from January 1 – March 31 to do it. You can explore other plan options. Your new plan benefits will be in effect for the rest of the year.

Open Enrollment For Different Types Of Health Insurance

There are different Open Enrollment dates for all major types of health insurance. Enrollment on the federal exchange for an ACA plan lasts 10 weeks and begins on November 1, 2022, while Open Enrollment for the various Medicare Parts depends on which Part youre trying to obtain. Last, but not least, enrollment through an employer depends on the time of the month you enroll.

Recommended Reading: Online Pregnancy Test Before Missed Period

Try To Avoid The General Enrollment Period

The General Enrollment Period is for individuals who didnât sign up for Medicare Part B when they were first eligible. For most people, this is when you turn 65.

Many individuals still have group insurance through their employer or through their spouseâs employer at age 65. If thatâs the case, you wonât be penalized for not signing up for Medicare when youâre first eligible.

However, if you donât have any other credible coverage and donât sign up for Part B of Medicare when youâre first eligible, youâll have to wait until the GEP â and youâll be penalized for life.

Try to avoid the GEP at all costs!

Medicare Special Election Periods

Special Enrollment Periods are a little hard to describe. They can happen anytime during the year if your life circumstances change and you suddenly lose or need to change your healthcare coverage.

Here are a few examples of when you may be eligible for a SEP:

- Moving to a new zip code

- Losing existing creditable insurance coverage

- Switching from employer coverage to Medicare

If you currently have coverage and want to switch to Medicare, you can qualify for a SEP. Regardless of the circumstances, you will have 60 days to make the changes you need to make. If you feel like youll need more time, be sure to contact your local Centers for Medicare & Medicaid Services office right away.

Also Check: Can Plan B Make Your Period Early

Medicare Open Enrollment Period Happens Annually

Medicares open enrollment period, also known as annual election period or annual enrollment period, takes place each year from . During Medicare open enrollment, you can change your plan, purchase additional coverage, or disenroll from a Medicare plan for the upcoming year

Most people begins 3 months before the month of your 65th birthday, includes your birthday month, and continues through the 3 months that follow.

Because there is a delay from the date of your enrollment to the activation of your plan, try to enroll during the 3-month period before your birthday to avoid a gap in your coverage.

If you miss your 7-month ICEP, youll need to wait for the Medicare Open Enrollment Period to enroll in a Medicare Advantage or prescription drug plan.

Advantage Plans Are Offering More Benefits

If you shop for Advantage Plans, you may find they generally are offering more in the way of extra benefits, said Danielle Roberts, co-founder of insurance firm Boomer Benefits. Many plans also have no premium, although you would still be responsible for your Part B premium.

In addition to dental, vision and hearing or gym membership, extras could include things such as a credit say, $200 or $400 per year for over-the-counter medicines and other health-care supplies a Part B premium “buyback,” meaning your plan refunds you a portion or all of your Part B premium, which is $164.90 for 2023 and transportation to and from doctor’s appointments or other providers.

However, while the added benefits can be appealing, it’s important to know that those extras can change from year to year, Roberts said. And, she said, you should make sure the plan meets your medical needs before considering additional benefits.

Don’t Miss: How To Slow Down Period Bleeding

Medicare Open Enrollment Period To Soon Begin

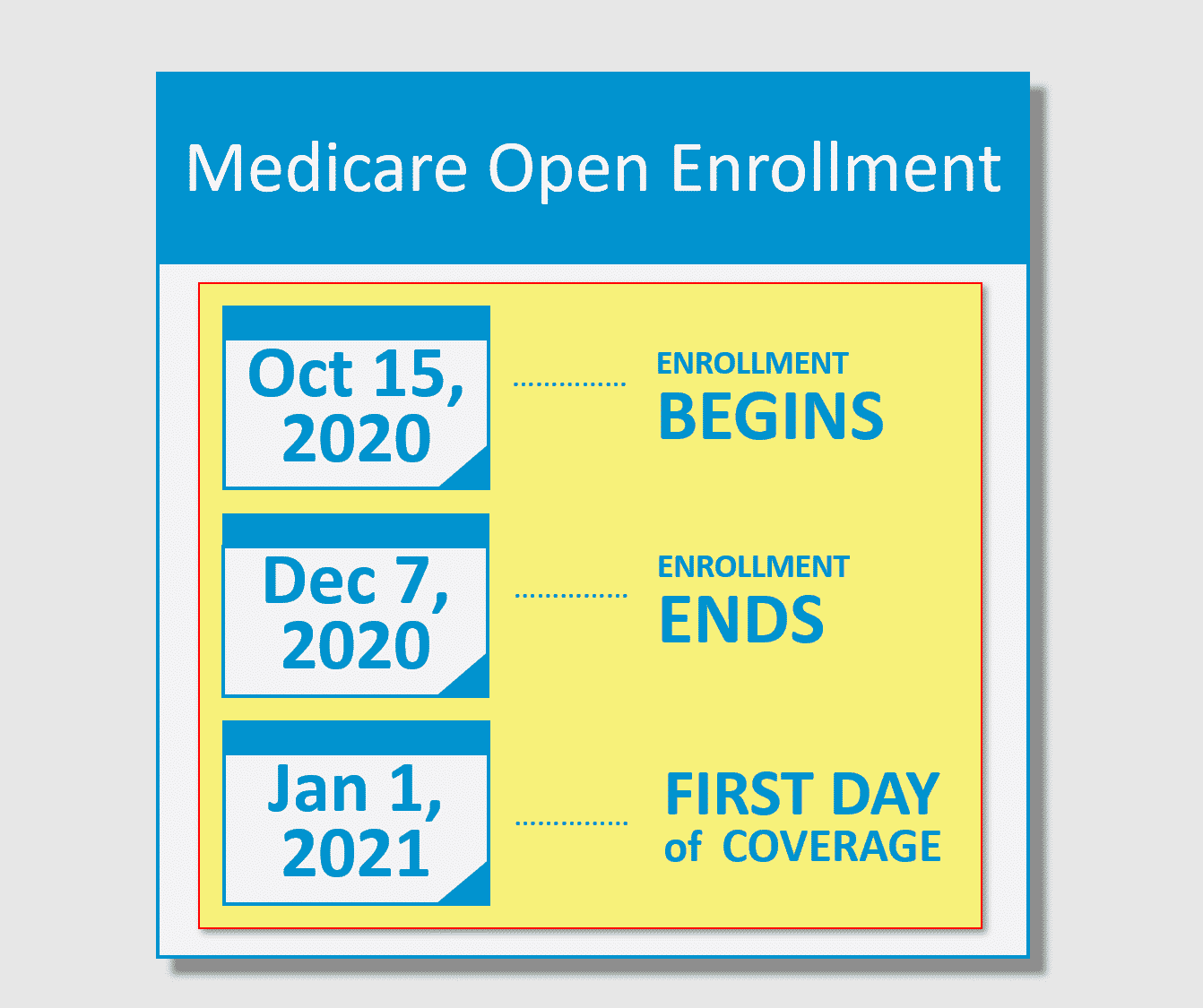

The open enrollment period begins on Saturday, Oct. 15 and runs for eight weeks to give individuals enough time to review and make changes to their Medicare coverage. Changes must be made by Wednesday, Dec. 7 to guarantee that coverage will begin without interruption on Jan. 1, 2023.

“Medicare plans and prices change,” Causey said. “It is important for Medicare beneficiaries to take advantage of the open enrollment period by contacting local Seniors’ Health Insurance Information Program counselors to save money, improve your coverage, or both.”

Make sure to contact the local SHIIP counselor before deciding about coverage. Individuals may be able to receive more affordable and better Medicare health and/or drug plan options in their local area. For example, even if beneficiaries are satisfied with their current Medicare Advantage or Part D plan, there may be another plan in their area that covers health care and/or drugs at a better price.

SHIIP is a division of the North Carolina Department of Insurance and offers free, unbiased information about Medicare, Medicare prescription drug coverage, Medicare Advantage, long-term care insurance, and other health insurance issues. In addition to helping Medicare beneficiaries compare and enroll in plans during the open enrollment period, SHIIP counselors can help people find out if they are eligible for Medicare cost savings programs.

The 3 Life Changes That Allow A Change Of Medicare Plans Outside Open Enrollment

In case of a major life event, your health plan should not be the cause of your worrying. Read on to learn more about instances in which you may be able to change your plans outside the Open Enrollment Period.

The loss of coverage is one of the QLEs that can make you eligible for the Special Enrollment Period. There are three ways in which you can lose coverage:

- if you are a dependant on your parents plan when you turn 26

- losing existing coverage, such as those offered through an employer, student program, or independent market policy

- losing eligibility for Medicare, CHIP, or Medicaid

Most commonly for Medicare beneficiaries, the loss of health coverage from an employer group health insurance plan is a common SEP that allows the enrollment into a Medicare plan.

Medicare Advantage and Drug plans are only available in select Service Areas, so moving out of the service area is an approved reason to switch plans at any time of the year. If you recently returned from abroad or are moving to a different ZIP Code, you will automatically qualify for a Special Enrollment Period. These situations allow you to change your health plans to suit your new coverage needs.

Additionally, you will qualify for the Special Enrollment Period if you are a seasonal worker and have to move to or from the place you work and live. This QLE also applies to you if you are moving from or to a new residential area.

Read Also: Why Am I Having Heavy Periods With Blood Clots

Medicare Open Enrollment Made Easier

In all the fun of fall, dont forget your important to-dos for the seasonlike signing up for Medicare. In 2019, open enrollment for Medicare coverage in 2020 is from Oct. 15 through Dec. 7. During this time, you can make changes to your Medicare coverage. With the variety of plans, new updates for 2020 and general enrollment questions, it can all be a little overwhelming. But heres an easy way to get a general understanding of what to consider during Medicare open enrollment for 2020.

Also Check: Regular Periods But Not Getting Pregnant

How To Manage The Medicare Open Enrollment Marketing Overload

Medicare Advantage, Medigap and Medicare Part D prescription drug plans are all provided by private insurers. There are thousands of these plans available across the United States, though not all plans are necessarily available in all states or counties.

Because of this, advertising for changing Medicare plans tends to pick up around the annual Medicare and Medicare Advantage open enrollment periods typically in the early fall to the end of March.

Medicare enrollees can be bombarded with television ads, direct mail fliers or phone calls urging them to switch Medicare coverage.

Before you make any changes to your Medicare coverage, you should review your options. Your State Health Insurance Assistance Program provides free, unbiased counselors to help you compare your Medicare options.

You can use the SHIP locator tool to find your nearest counselor.

Read Also: Can I Get Pregnant During My Period