Cut Down On Unnecessary Expenses

If you are consistently failing to meet your credit card bill payment obligations then it is time to contemplate your spending habits. You must cut down on your unnecessary expenses including luxury expenses. The credit card shouldnât be your primary payment option for luxury expenses if you are not able to repay your debts in time. Use your credit amount only for necessary expenses and financial emergencies that are indispensable. You should also avoid impulse purchases and think about the utility quotient attached to a product or service being advertised. Cutting down on random purchases will also help you save a good chunk of your income and keep you fiscally prudent.

What Types Of Transactions Arent Eligible For A Grace Period

Credit card grace periods typically apply only to purchases. On other transactions, youâre sometimes charged interest right away. For example, most credit cards donât provide a grace period on cash advances or balance transfers. You may also be charged a fee for these types of transactions.

Keep in mind that a balance transfer could have a 0% APR for a limited time. But after the introductory period ends, your interest rate will usually increase.

Check your cardâs terms and conditions to find out whether you have a grace period and which kinds of transactions it covers. It could be especially important if youâre considering , which involves a balance transfer.

What Is A Grace Period

After your billing cycle ends, your credit card company will prepare your statement. Most credit card providers offer a grace period between when the statement is prepared and your bill is due. During this grace period, you will not incur interest on your purchases.

Not all credit card companies offer a grace period, though most do. Check your terms of service to ensure you have a grace period on your card. If you do not, you may want to switch to a different credit card.

Cards that offer a grace period must ensure that your bill is received no less than 21 days before your bill is due. This period of time ensures that you have time to pay your bill before your credit provider begins charging you interest. Therefore many grace periods include the required 21 days plus an additional two to four days to account for printing and mailing.

Don’t Miss: Usaa New Car Insurance Grace Period

How Can I Raise My Credit Score By 100 Points In 30 Days

How to improve your credit score by 100 points in 30 days

Understand Discover Interest Charges On Purchases

Each day, the daily interest charge for your credit card is calculated for transactions, including purchases, balance transfers and cash advances, using the daily balance plus the applicable daily interest rate.

The daily balance equals the beginning balance plus the daily interest charges on the previous days balance, plus new transactions and fees, less new payments and any credit adjustments. The daily interest rate is simply the rate charged for that transaction category, divided by 365. The daily balance multiplied by the daily interest rate equals the daily interest charge.

All the daily interest charges are added up to get the total interest charges for a billing period. Remember, you may avoid paying this interest on purchases if you pay off the full balance on your account before the due date.

Recommended Reading: 90 Day Probationary Period Template

Do Grace Periods Affect Your Credit

Unlike making a late payment, paying off your current balance during the grace period will, in most cases, not bear any negative effects on your credit report.

In reality, the very opposite is often true. Payments your lender receives during your grace period can actually boost your credit score, even if grace periods dont directly influence your credit report. Payment history makes up 35% of the credit data used to determine your FICO® Score, which means that borrowers who leverage their grace period to pay their bills on time could see an increase in their overall credit score.

Don’t Overspend For The Sake Of Rewards

If you’ve opened a new credit card account to get an intro bonus, you’ll typically need to spend a certain amount before you earn it. With cash back credit cards, the spending requirement is typically fairly lowspend $500 on the card in three months to earn a $200 cash bonus, for instance. But some of the top rewards credit cards require you to spend thousands of dollars in a few months to earn an intro bonus.

You may be tempted to spend extra to make sure you get the bonus before the deadline. But if you end up spending to the point where you can’t pay off what you owe, you’ll lose your grace period and have to pay interest. Depending on how much you spend and how long it takes to pay off the balance, you could end up neutralizing any value you get from the card’s welcome offer.

Also Check: Period Blood Stains On Sheets

How Long Is A Typical Credit Card Grace Period

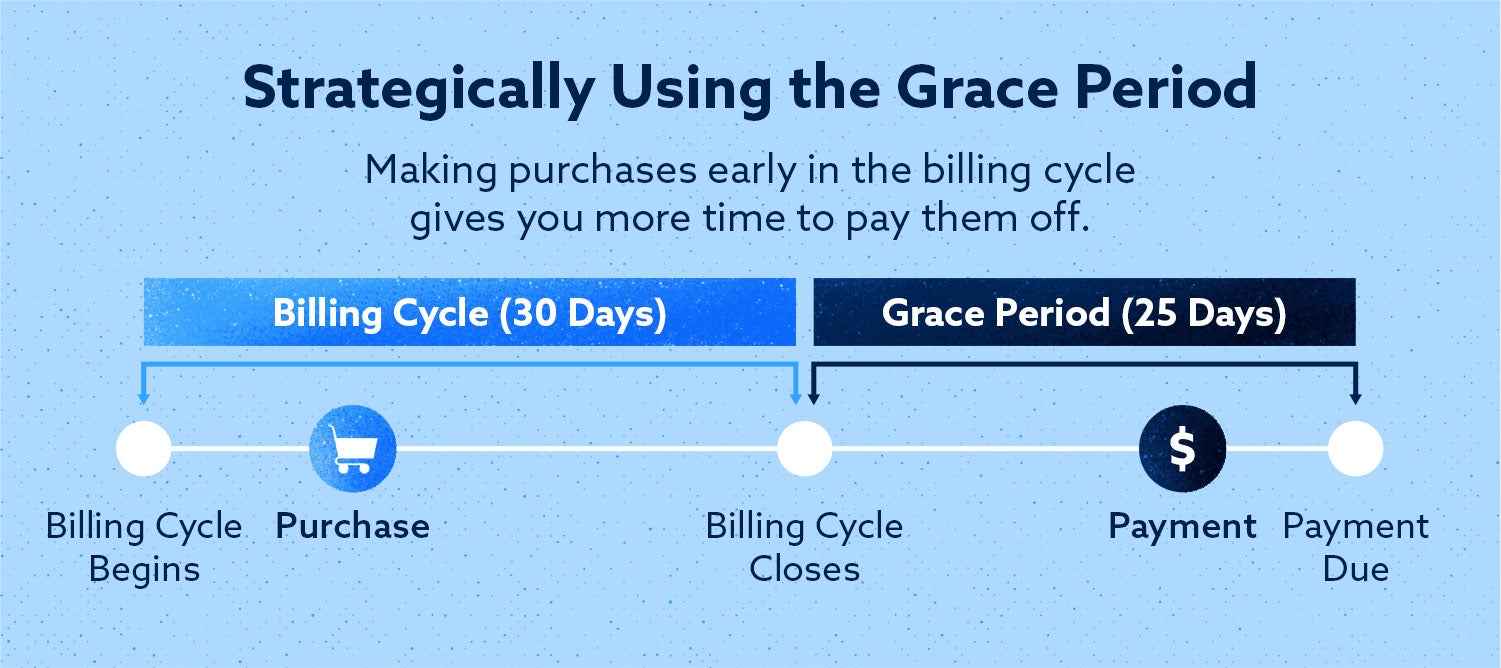

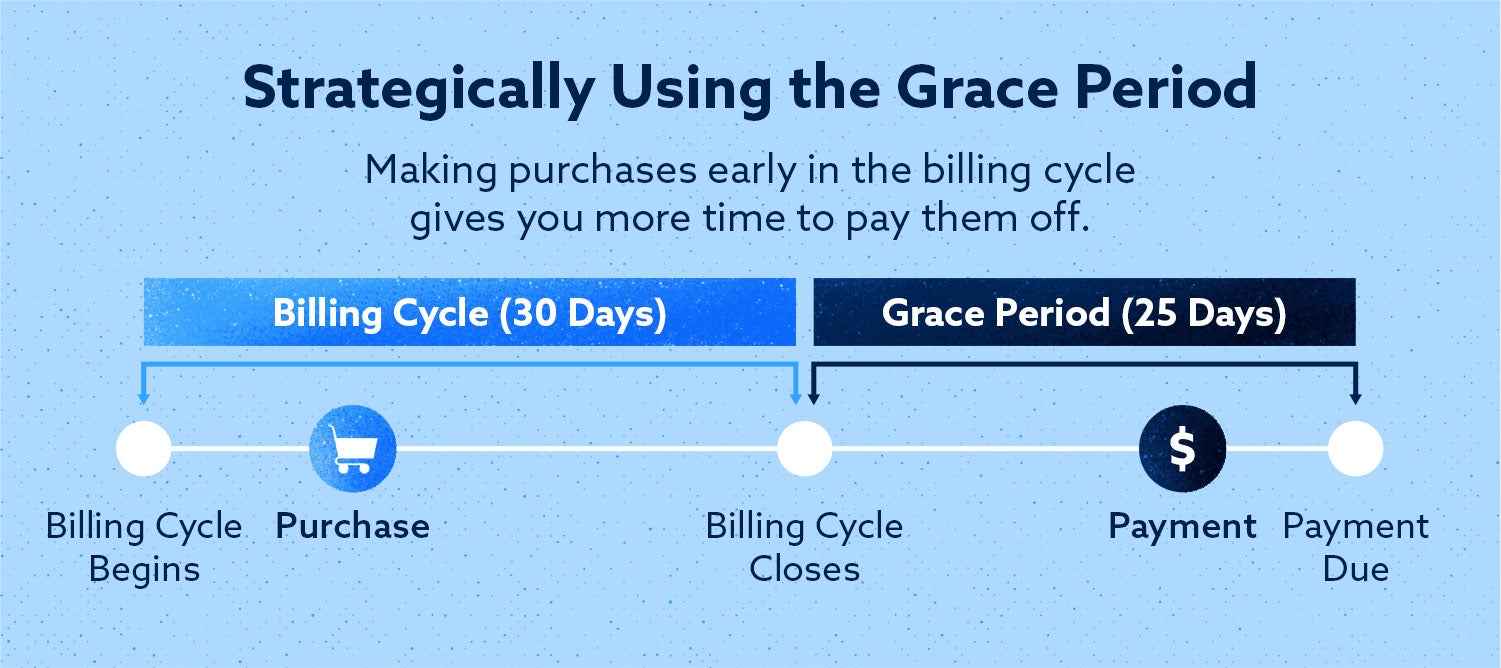

The average grace period — the time from statement close to bill due date — for most is 25 days. Some issuers shorten the grace period to 23 days for February statements. However, grace periods can vary between issuers or even between cards.

At a minimum, your credit card grace period should last 21 days. That’s because credit card companies are legally required to provide your bill at least 21 days before they start charging fees. On the other end, grace periods longer than 25 days are rare. You won’t see any grace periods that last more than 30 days.

Be Careful With Intro 0% Apr Promotions

If you get a new card with an introductory 0% APR promotion, it may offer the benefit on purchases, balance transfers or both. If the promotion applies only to balance transfers, you won’t have a grace period on new purchases you charge to the card.

As a result, if you’re planning on getting a balance transfer credit card, it’s best to avoid putting purchases on the card until after you’ve paid off the transferred balance unless there’s a 0% intro APR that applies to purchases too.

Also, remember that if you don’t make your minimum monthly payment on a card with a 0% intro APR promotion, you may lose the promotional rate and be subject to the card’s regular APR.

Also Check: 90 Day Probation Period Template

Limits On Grace Periods

Credit card companies don’t have to provide you with a grace period. But if your creditor offers you a grace periodand many usually dothen the details of that grace period should be clearly described in your credit card agreement. This includes the length of time you have to pay off the balance before incurring new finance charges.

Many credit card issuers don’t give you a grace period if you don’t pay off the balance each month. If you’re carrying a running balance each month, grace periods are effectively meaningless for you. If you don’t pay off the new balance in full, then interest and finance charges will usually run from the date you first made the charge. Interest charges on new purchases may start to accrue immediately if you have an unpaid balance on your credit card.

Even if the credit card company provides a grace period for credit card charges, it might not provide one for cash advances or balance transfers. In that case, you would need to pay those charges off immediately, and before the due date, to avoid finance charges.

What Happens If I Pay My Credit Card Bill 1 Day Late

Late fee You will have to pay a late fee if you pay your bill after the due date. The late fee would be charged by the bank in your next credit card bill. In a recent move, the Reserve Bank of India has directed banks to charge late fee only if the payment has been due for more than three days after the due date.

You May Like: Employee Probationary Period Template

How Does A Credit Card Grace Period Work

A credit card grace period allows you to buy something but not pay interest on it for a certain amount of timeâas long as youâve been paying your balance in full.

Say you make a purchase with your card. Then, at the end of your billing cycle, you get a statement that shows your payment due date. If you arenât carrying a balance from your previous cycle and you pay your current balance in full on or before the due date, you can avoid triggering an interest charge on your purchase.

Hereâs an example of how that might work:

- You buy a $200 vacuum cleaner with your credit card on April 1.

- Your billing cycle ends on April 3, and your payment is due April 28.

- As long as youâre not carrying a balance and you pay in full on or before April 28, you wonât owe any interest on your vacuum cleaner.

If you plan ahead, you could stretch your interest-free period even longer. Say you purchase that vacuum on April 4 instead. It would be almost a whole month before the transaction shows up on your next statement.

Protect Your Grace Period

Your grace period is not guaranteed. To avoid losing your grace period and paying interest, pay your statement balance in full, on time each month. If you carry a balance, you will not only pay interest on your balance, but you will also begin accruing interest on day one of new purchases.

Additionally, it may take some time to regain your grace period. Once lost, it may take two billing cycles of paying the entire balance off for the grace period to be reinstated.

Recommended Reading: Can You Donate Plasma On Your Period

Do All Credit Cards Have A Grace Period

Most credit cards in Canada have a grace period. Though its not required by law, credit card companies usually give it to you as a courtesy.

The only cards that typically dont have a grace period are those designed for Canadians with bad credit scores. Without the grace period on these cards, your purchases accumulate interest from the moment you make them. As you can guess, that can get expensive fast.

One alternative is to take out a secured credit card, which requires you to put an initial deposit down first. These cards typically come with a grace period, though your cards APR may be significantly higher than a traditional credit card.

When Does The Grace Period On A Credit Card End

Most credit cards have a grace period, which is the amount of time you have to pay your balance in full without paying a finance charge. The grace period usually starts on the first day of the billing cycle and ends a certain number of days after, depending on the credit card issuer. Grace periods are typically between 21 and 25 days.

Recommended Reading: Usaa Grace Period

What Is A Grace Period For A Credit Card

Whats a grace period for a credit card and how do they work, anyway?

No one likes to pay interest, especially on a credit card. The good news if your credit card has an interest-free grace period, you might never have to.

Of course, credit card providers are in the business of making money, meaning they wont extend their graces to you forever. But if you can learn how to master this interest-free benefit, youll save yourself a ton of money over the long haul.

What is a grace period, and how can it benefit you? Lets take a closer look and see.

How To Use A Credit Card Grace Period To Your Advantage

At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our .

In this article:

The grace period on a credit card makes it possible to build credit, earn rewards and get some time to pay off your purchases without interest charges. Generally, a will give you at least 21 days to pay off your monthly bill interest-free, though some cards give you more time. Understanding what types of transactions qualify for the grace period and how to use yours to your benefit can make it easier to manage your money without going into debt.

Read Also: Donating Blood While Menstruating

Take Note Of Your Credit Card Bill Due Date When You Make A Big Purchase

The golden rule of credit cards is to pay your balance in full each month.

“If you’re among the roughly half of credit cardholders to pay your bills in full and avoid interest, the grace period can be a major advantage,” says Ted Rossman, senior industry analyst with Bankrate.

For example, Rossman says he has a credit card that generates monthly statements on the 19th of each month with a due date on the 16th of the following month.

“Let’s say I made a big purchase on August 19, right after receiving my statement. That won’t show up on my bill until September 19, and it will be due October 16. That’s basically two interest-free months without having to jump through any special hoops,” he explains.

When Do I Have To Pay Citibank Finance Charges

Citibank credit cardholders get interest free period on transactions when they pay the outstanding amount by the due date. However, if they fail to pay the amount in full and on time, they will have to pay interest on the outstanding amount. More details on Citibank credit card finance charges are given below.

Also Check: 90 Day Probationary Period Form

Applying For A Credit Card

You must apply to receive a credit card. When you do, the issuer does a to decide whether you are a good that is, whether you can afford the loan and are likely to pay it back. The issuer looks at factors like your income and your history of paying bills on time. If you have a poor , you may be denied the card or you may be charged higher interest on late payments.

Know Your Grace Period Dates And Deadlines

Knowing your grace period and due dates help you plan your payment schedule to avoid late fees and interest charges. Be sure to know the date when your bill is due and pay the full statement balance on time to avoid paying interest on purchases.

Payments made after the due date are late payments, and they may affect your credit score. This could impact your ability to get new credit, and also affect the interest rate youre offered on new credit products.

Also Check: 90 Day Probationary Period Policy Examples