Learn More About Medicare Enrollment

1 Every year, Medicare evaluates plans based on a 5-star rating system.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Recent Articles And Updates

For older articles, please see our article archive.

References

The 2010 Medicare Part D $250 Donut Hole Rebate. Q1Group LLC, .

2020 Part D Income-Related Monthly Premium Adjustment. . .

2021 Medicare Part D Outlook.Q1Group LLC, .

2021 Part D Income-Related Monthly Premium Adjustment. . .

How Do Medicare Advantage Ppo Plans Work? Healthline Media, May 5, 2021, .

Analysis of Part D Beneficiary Access to Preferred Cost Sharing Pharmacies . . .

Announcement of Calendar Year 2021 Medicare Advantage Capitation Rates and Part C and Part D Payment Policies. . .

Assistance with Paying for Prescription Drugs. Center for Medicare Advocacy, November 30, 2015, .

How Medicare Part D Works. AARP, October 2016, .

Medicare Advantage Special Needs Plans . Healthline Media, May 3, 2021, .

Kirchhoff, Suzanne M. Medicare Coverage of End-Stage Renal Disease . . .

In Brief: Medicare Part D Coverage Plans

Medicare Part D coverage plans are designed to help ensure more people have affordable prescription drug coverage. For many, prescription medication can be the difference between life and death, and so having the right coverage in place helps protect us all. And with negotiated drug prices and premiums, coverage can be affordable and accessible, no matter where you live.

Questions?

You May Like: Can You Get Pregnant 5 Days After Your Period

Can I Delay Enrollment In Part D Coverage

If you didnt enroll in prescription drug coverage either through a PDP or a Medicare Advantage plan during your initial open enrollment window and then you enroll during an open enrollment period in a future year, theres a late enrollment penalty that will be added to your premium .

The Part D late enrollment penalty would also apply if you drop your prescription coverage for more than 63 days and then re-enroll during the open enrollment period. Its important to maintain continuous drug coverage from the time youre first eligible, both to protect against significant prescription costs, and also to avoid higher premiums when you ultimately re-enroll.

D Appeals And Grievances

Coverage Determinations and Exceptions

All Part D plans must have an appeal process through which members can challenge a denial of drug coverage. The Part D appeals process is based on and similar to the Part C appeals process.

Denials of drug coverage by a PDP or MA-PD are called coverage determinations. For example, a coverage determination may be issued by the plan if the drug is not considered medically necessary or if the drug was obtained from a non-network pharmacy. It is necessary to have a coverage determination in order to initiate an appeal. A doctors supporting statement is not required for this type of appeal, but it may be helpful to submit one. If the request for coverage is denied, the member may proceed to further levels of appeal, including redetermination by the plan, reconsideration by an Independent Review Entity , Administrative Law Judge review, the Medicare Appeals Council , or federal district court.

One type of coverage determination is called an exception request. An exception request is a coverage determination that requires a medical statement of support in order to proceed to appeal. There are two types of exceptions that may be requested:

Formulary Exceptions This type of exception is requested because the member:

- needs a drug that is not on the plans formulary,

- requests to have a utilization management requirement waived for a formulary drug).

What to do When a Drug is Denied at the Pharmacy

The Medical Statement

Grievances

Read Also: Foods Not To Eat On Your Period

Moving To Another State With Medigap

With Medicare Supplements, as long as youre moving within the United States, and not outside the country, you wont have to change your coverage as long as that same plan is available at your new location. This is the case regardless if youre moving to another county within the same state, or moving to a new state. Youll still want to notify your Medigap carrier that you moved to they can update their records.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

The exception to the above is if youre moving to one of the states that have their own version of standardized Medigap plans. This includes Minnesota, Massachusetts, and Wisconsin. Youll want to look into enrolling in one of their state-specific letter plans. Do not drop your current Medigap plan without consulting with your agent first, otherwise, theres a high probability that you may not be able to enroll back into it.

You Have A Chance To Get Other Coverage

- I have a chance to enroll in other coverage offered by my employer or union.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan to enroll in the private plan offered by your employer or union.

When?

Whenever your employer or union allows you to make changes in your plan.

- I have or am enrolling in other drug coverage as good as Medicare prescription drug coverage .

-

What can I do?

Drop your current Medicare Advantage Plan with drug coverage or your Medicare Prescription Drug Plan.

When?

- I enrolled in a Program of All-inclusive Care for the Elderly plan.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan.

When?

Anytime.

Don’t Miss: What To Do To Stop Period Cramps

Eligibility Or Loss Of Eligibility For A Special Needs Plan

If you are eligible to enroll in a Special Needs Plan , you may leave a Medicare Advantage plan at any time in order to do so.

If you are already enrolled in an SNP but are losing your eligibility, you may join a Medicare Advantage plan beginning the month that you are no longer eligible for the SNP and lasting for three months.

Other Medicare Special Enrollment Periods

There are some additional circumstances that could trigger a special enrollment period for you. One relates to Medicare Star Ratings, which are released by CMS.

Star ratings are a way to compare how good different Medicare Advantage plans are. The lowest rating a plan can earn is one star, with the highest rating being five stars. The rating is based on how effective the plan is in serving its beneficiaries.

You may be eligible for a special enrollment period to switch to a five-star plan if one is available in your area. This period lasts from Dec. 8 to Nov. 30 each year and can only be used once.

You also can be eligible for a special enrollment period if you qualify for Extra Help to pay for drug coverage or if youre eligible for both Medicare and Medicaid.

If you have Extra Help or Medicaid, you can make changes to your coverage one time from January to March, April to June or July to September.

Read Also: Is It Possible To Skip A Period

Medicare Part D Annual Enrollment Period

The Annual Enrollment Period occurs each fall from October 15 to December 7. If you delay Medicare Part D coverage and do not have , this is your chance to enroll in a prescription drug plan for the following year. During this time, you may also make a change to your prescription drug plan or drop prescription drug coverage altogether.

Each year Medicare Part D plan formulary changes are released on October 1. It is important to review the changes to your plans formulary and compare it to other plans in your area. Doing so will ensure you receive the best coverage year after year.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

You can make multiple changes during this time, but the last change you make will go into effect. Once you make your final change, your new coverage will start on January 1 of the following year.

Whats The Special Enrollment Period For Part B

If you have coverage through your own or a spouses employer, the Medicare Part B SEP allows you to delay taking Part B without facing a penalty. When your employer coverage ends, youll have eight months to enroll in part B.

To be eligible for the Part B Special Enrollment Period you must have had credible employer group coverage when you first became eligible for Medicare or, youre eligible for Medicare due to a disability.

If more than eight months passed since your employer group coverage was canceled, youll no longer be eligible for this Special Enrollment Period.

You May Like: Can You Have A Period During Menopause

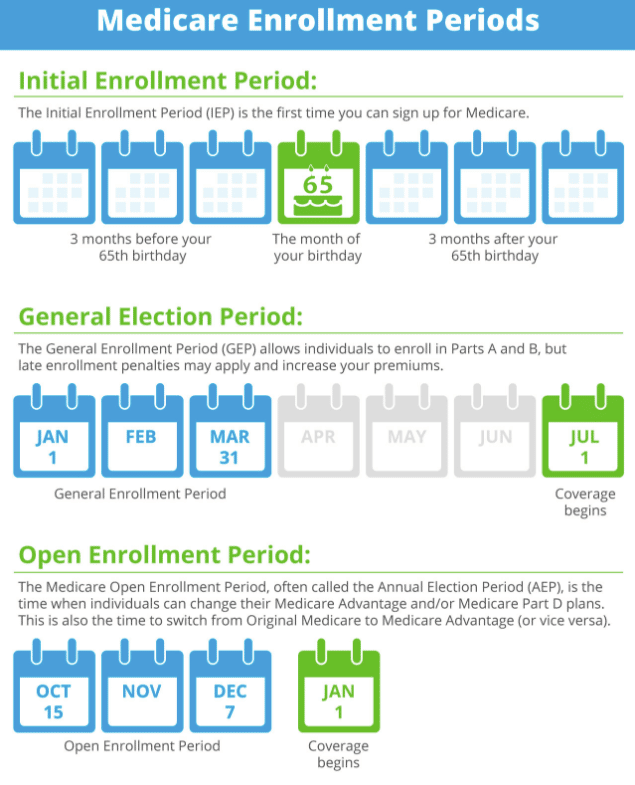

Signing Up Late: General Enrollment Period

Part A. If you didn’t sign up for Medicare Part A when you were first eligible, you can sign up for Part A anytime, without penalty.

When coverage begins. Your Part A coverage will go back to six months before the date you signed up .

Part B, C and D. If you didn’t sign up for Medicare Part B when you were first eligible, you can sign up for Part B during a General Enrollment Period, which happens between January 1 through March 31 each year. You will also have from April 1 through June 30 of that year to add a Medicare Advantage plan or Medicare Part D plan.

When coverage begins. When you sign up for Part B, C, or D during a General Enrollment Period, your coverage will start July 1.

Late sign-up penalty. Individuals who did not sign up for Medicare Part B when they turned 65 might face a penalty of higher lifetime premiums when they do sign up. However, most individuals who were covered by a group health plan through an employer are not subject to the penalty. If you didn’t sign up for Part B because you had group health benefits through work, you should be able to sign up during your Special Enrollment Period.

What Is The Late Enrollment Penalty

The Late Enrollment Penalty is a fee that is meant to encourage enrollment in a prescription drug plan at the point of eligibility. If you are enrolled in a Medicare prescription drug plan, you may owe a Late Enrollment Penalty, if for any 63 days or more after the Initial Enrollment Period, you went without 1 of these:

- A Medicare Part D Prescription Plan

- A Medicare Advantage Plan

- Another Medicare health plan that offers Medicare prescription drug coverage

The Late Enrollment Penalty is added to your monthly Part D premium for as long as you have Part D coverage, even if you change your Medicare Part D plan. The Late Enrollment Penalty amount changes each year. You may also have this penalty if you have a Medicare Advantage plan that includes prescription drug coverage . You can avoid the late enrollment penalty by making sure you enroll when you are eligible and keeping your coverage.

If you qualify for Extra Help due to a lack of income or resources, you can enroll late without a penalty. However, if you lose Extra Help, you may be charged a penalty if you have a break in coverage.

Medicare, not the Cigna Part D Plan, will determine the penalty amount. You will receive a letter from the plan notifying you of any penalty. For further questions or concerns about the Late Enrollment Penalty, call Medicare at 1 MEDICARE or visit www.medicare.gov

We were unable to load Plan finder tool, please try again later.

Medicare Advantage Policy Disclaimers

Exclusions and Limitations:

Recommended Reading: How To Help With Cramps Period

How Do I Enroll In A Medicare Advantage Plan During My Special Enrollment Period

If you are unsure about whether you qualify for a Medicare Special Enrollment Period, or if you qualify and want to compare plans in your area, you can speak with a licensed insurance agent for help.

A licensed insurance agent can answer any questions you have and help you compare benefits, costs, coverage and other details of Medicare Advantage plans that may be available in your area.

Compare Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Encounter Changes In Medicare Plans Contract

Below is a list of circumstances that qualify you for a SEP due to changes with your plans contract with Medicare.

Sanctions and Medicare

If Medicare ends up taking official action because of an issue with your plan, and this affects you, you can switch your Medicare plan. Medicare may review making this switch for you, depending on the situation at hand.

Contract ends early

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Those that have a health plan coming to an end in the middle of the contract year can switch to another Medicare plan two months before the contract ending and up to one full month after it ends if the policy isnt for another contract year.

Recommended Reading: Idk When My Last Period Was

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

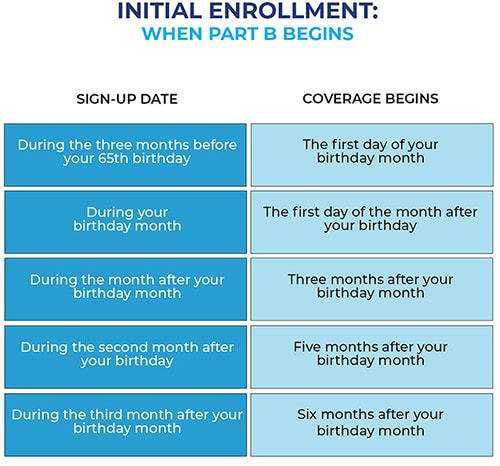

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Delaying Medicare Due To Work: Special Enrollment Period

If you didn’t enroll in Medicare because you were still working, and you were covered under a group health plan based on employment, you have a Special Enrollment Period during which you can sign up for Part A and/or Part B. While you or your spouse are still working and you’re still covered under a group health plan, you can sign up anytime.

After your or your spouse’s employment ends, your Special Enrollment Period lasts eight months, starting the month after the employment or group health plan ends . However, you have only two months after the employment or group health plan ends to sign up for a Medicare Advantage plan or Part D prescription drug plan . You can enroll in a Medicare Advantage plan starting three months before your Medicare Part B enrollment is due to take effect up to the day before your Part B coverage startsbut again, enrollment must take place within two months of your employment or group health plan ending.

Example:

Judy’s last day of work is July 1 and her group health plan ends July 31. She has eight months, until April 30, to sign up for Part B without a penalty. But if she wants to join a Medicare Advantage plan, she needs to do so by September 30 . Instead, on June 15, Judy signs up for Part B coverage to begin on August 1, so that she won’t have a gap in coverage. She has only until July 31 to add a Medicare Advantage plan . Her Medicare Advantage plan will start August 1.

You May Like: How To Stop Binge Eating Before Period

How To Get Medicare Part D Prescription Coverage

Medicare Part D coverage is available to you in two ways:

Its worthwhile to note that you cant get Medicare Part D coverage without also having Parts A and B.

Get Started Now Comparing Quotes

Personalized quotes in less than 2 minutes.

No signup required.

Recommended Reading: I Had Protected Sex And My Period Is Late

Can I Change Plans If I Have The Chance To Get Other Coverage

A good instance when changing plans for a better policy makes sense would be if you have a Medicare Advantage plan but, a five-star Medicare Advantage plan is available in your area.

If you decide to go back to work and employer coverage becomes available to you, you may decide to leave Medicare and enroll in your employer plan. However, in many cases, Medicare makes more sense.

Recommended Reading: How Late Can A Period Be