You Can Sign Up For Medicare Part D During The Medicare Advantage Open Enrollment Period

If you want to get your Medicare Part D coverage through a Medicare Advantage plan, you may be able to use this enrollment period. But be aware that not every Medicare Advantage plan covers prescription drugs.

You can switch from one Medicare Advantage plan to another during the Medicare Advantage Open Enrollment Period . For example, if you have a Medicare Advantage plan that doesnât include prescription drug coverage, you can switch to a Medicare Advantage prescription drug plan.

The Medicare Advantage OEP runs January 1 â March 31 each year.

You can:

- Switch Medicare Advantage plans

- Drop your Medicare Advantage plan, return to Original Medicare, and sign up for a stand-alone Medicare Part D prescription drug plan

But you canât:

- Sign up for a Medicare Advantage plan unless youâre already enrolled in one and you want to switch

- Sign up for a stand-alone Medicare Part D prescription drug plan (unless you drop your Medicare Advantage plan during this OEP and return to Original Medicare

If one of these events arise, you can usually enroll in a Medicare prescription drug plan promptly to avoid going without prescription drug coverage.

Second Enrollment Period For Part D

The second chance to enroll in Part D coverage is during the Medicare Fall Open Enrollment Period. Medicare has times you may enroll in or make changes to your Part D coverage. You dont have to sign up for a Part D plan every year, but every year youll have another opportunity to make changes or enroll in a prescription drug plan.

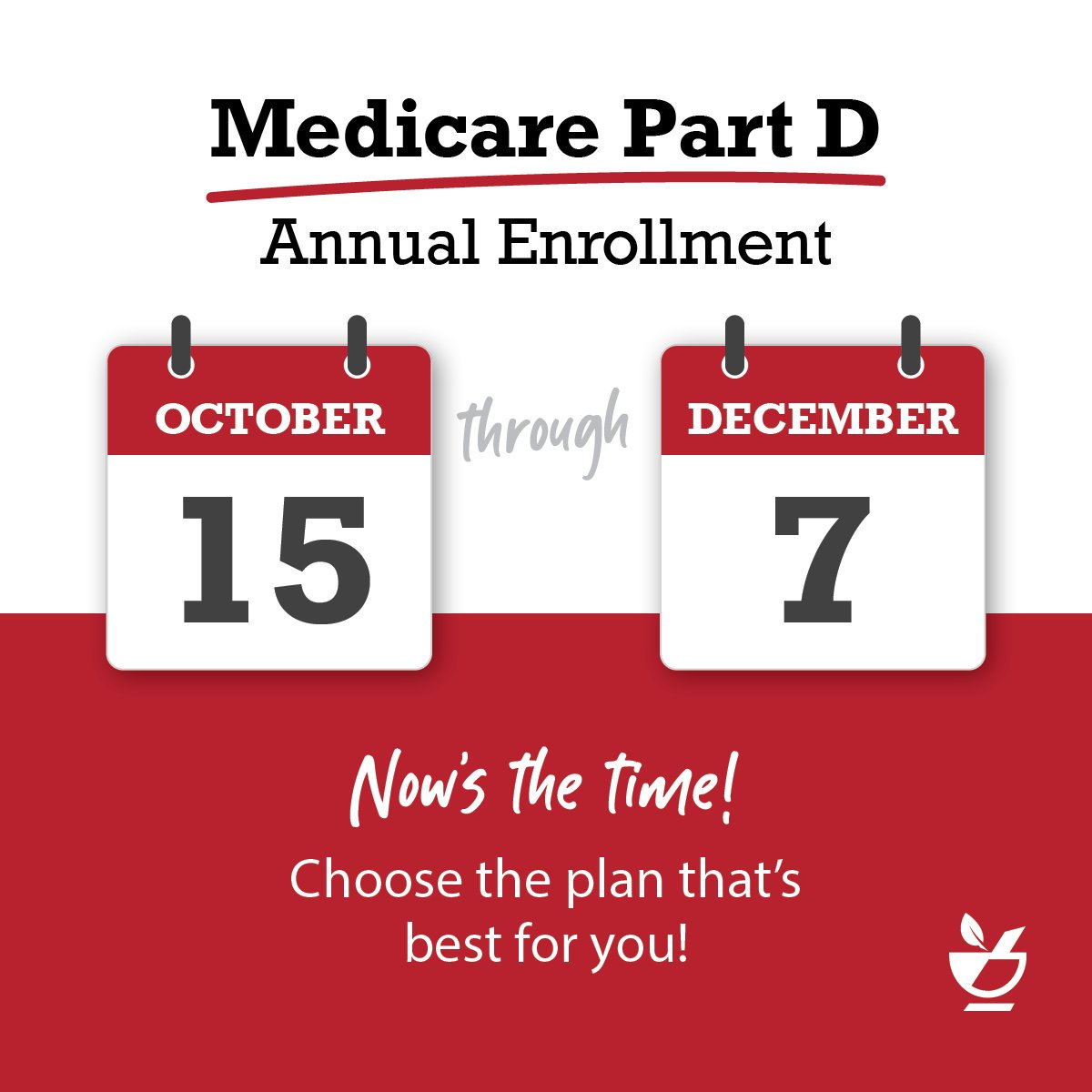

Each fall the Annual Election Period runs from October 15th through December 7th. AEP is commonly mistaken for the Open Enrollment Period.

During AEP, members can openly make changes to their current coverage. This includes enrolling in a Part D drug plan or switching from one Part D plan to another Part D plan that better suits your medical needs.

Beneficiaries may also use this time to drop their drug coverage altogether. Once changes are made, coverage will start on January 1st the following year.

How To Sign Up For And Change Medicare Plans

Once youre enrolled in Medicare, youll have various opportunities to change certain aspects of your coverage. Heres an overview:

- During the annual open enrollment period , you can make a variety of changes, none of which involve medical underwriting:

- Switch from Medicare Advantage to Original Medicare or vice versa.

- Switch from one Medicare Advantage plan to another.

- Switch from one Part D prescription plan to another. Its highly recommended that all beneficiaries use Medicares plan finder tool each year to compare the available Part D plans, as opposed to simply letting an existing drug plan auto-renew.

- Join a Medicare Part D plan.

- Drop your Part D coverage altogether.

Also Check: 90 Probationary Period Employment Form

Change From A Medicare Advantage Plan To Original Medicare Part A And Part B

You may decide to disenroll from a Medicare Advantage Plan and instead sign up for Original Medicare during AEP. One of the main reasons people change their Medicare Advantage plans is when their preferred physicians, hospitals and pharmacies are no longer within their network. Unlike Original Medicare, Medicare Advantage plans have network restrictions that offer covered care only under a specific network of providers. Since private health insurance companies offer Medicare Advantage plans, contract changes may occur and your preferred health provider may no longer participate in your network. If your doctor is no longer within your Medicare Advantage plan network, you may disenroll from your current Medicare Advantage plan during AEP and either enroll in Original Medicare or find another plan your providers participate in.

Medicare Enrollment 2022 Important Dates You Shouldnt Miss

When you first become eligible for Medicare , you will automatically be enrolled in original Medicare Part A and Part B if you are receiving benefits from Social Security or the Railroad Retirement Board . You have an Initial Enrollment Period of seven months to add additional Medicare health care coverage with an Advantage plan, or Supplemental Insurance and/or a Prescription Drug plan.

Medicare enrollment or changes to plans you are already enrolled in are limited to specific times.

Important dates to enroll in, switch or cancel a Medicare plan for 2022 are:

Visit www.medicare.gov to get detailed and current information about your Medicare eligibility and enrollment options, or call 1-800-MEDICARE or TTY 1-877-486-2048.

Also Check: Primosiston To Stop Period

The Part D Standard Benefit

At a minimum, plan sponsors must offer a standard benefit package mandated by law. The standard benefit includes an annual deductible and a gap in coverage, previously referred to as the Donut Hole. Sponsors may also offer plans that differ from but are actuarially equivalent to the standard benefit. Finally, they may also offer enhanced plans that provide benefits in addition to the standard benefit. Typically, the enhanced plans offer some coverage during the Donut Hole.

The Standard Benefit is defined in terms of the financial structure of the cost-sharing, not the drugs that must be covered under the plan.

Medicare does not establish premium amounts for plans. Instead, premiums are established through an annual competitive bidding process and evaluated by CMS. Premiums vary from plan to plan and from region to region. Medicare does establish the maximum deductible amount, the Initial Coverage Limit, the TrOOP threshold, and Catastrophic Coverage levels every year. The table below shows the standard benefit for this year .

Standard Part D Benefit 2020-2021

Alternatives to the Standard Benefit

Income-Related Monthly Adjustment Amount Part D

Income-Related Adjustments 2021

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $77.10 |

Drug Tiers

| Tier 1 | |

| $65 | 33% |

The Donut Hole

TrOOP

Once beneficiaries reach their out-of-pocket threshold costs), they move out of the Donut Hole and into Catastrophic Coverage.

EOBs

The Donut Hole Discount

| 63% | 75% |

Penalty If You Dont Sign Up For Medicare Part D

Even if you donât take medications now, if youâre at risk for health problems as you get older, you might need medications later. If you delay enrollment in Medicare Part D at the Medicare age of 65, you might have to pay a Part D late enrollment penalty.

If you go for 63 days or more without prescription drug coverage after your Initial Enrollment Period , thatâs when you could face a Part D late enrollment penalty. Your penalty is added to your monthly premium amount.

Recommended Reading: Donating Blood While Menstruating

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Initial Enrollment Period 2

Another enrollment period that is also 7-months is the Initial Enrollment Period 2. The IEP2 is for people who were already eligible for Part A and B before they turned 65.

During the IEP2, you can sign up for a Medicare Advantage or Part D plan. The IEP2 runs for the same seven-month period as the IEP.

Also Check: Can You Donate Blood While Menstruating

How To Enroll In Medicare Part D

Once you decide if you want to enroll into a Medicare Prescription Drug Plan or a Medicare Advantage plan that includes drug coverage, you can apply directly through the insurance company.

Generally, you should be able to enroll by submitting a paper application, calling the plan, or enrolling online. You may also enroll through a licensed insurance agent such as eHealth. Medicare Part D Prescription Drug Plans arenât allowed to call and ask you to enroll into their plan.

When you enroll in prescription drug coverage, you will have to provide your Medicare number and the date your Medicare Part A and/or Medicare Part B coverage started. You can find this information on your Medicare card.

What Can You Doduring The Medicare Oep

What Medicare OEP allows you to do depends on what plan youre referring to. For instance, Medicare Advantage OEP allows you to make changes only if you are already enrolled in Medicare Part C .

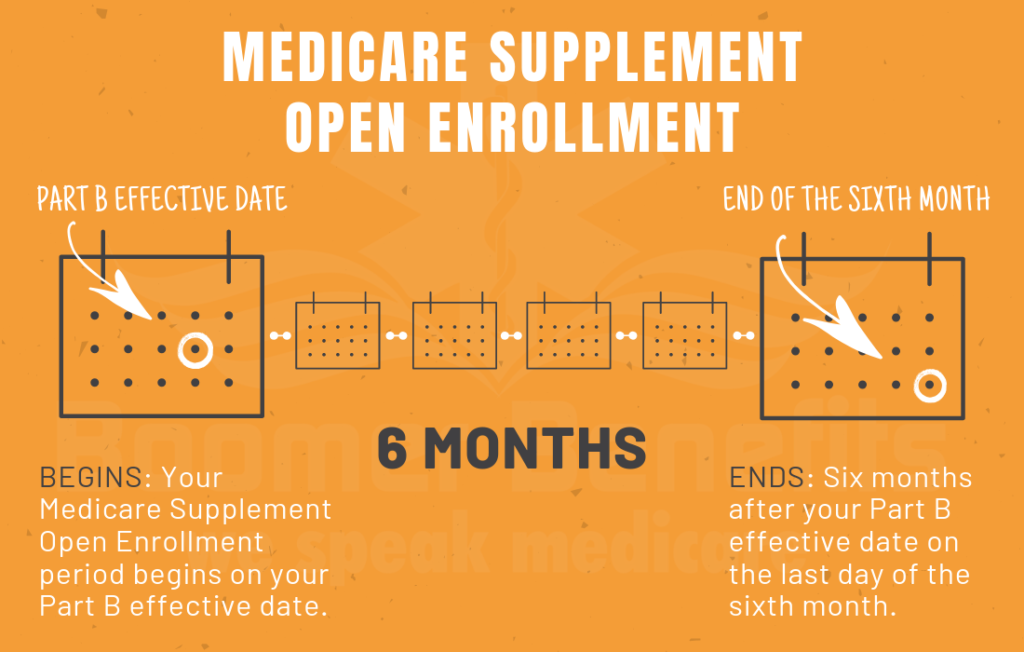

Medigap allows you to enroll at any point of time in a year. However, you have to answer a few health questions first. Medigap OEP allows you to enroll in Medicare Supplements without the need to answer any of those questions.

Also Check: Usaa New Car Insurance Grace Period

I Only Need Medicare Part D If I Take Medication False

Part D can be included in Medicare Advantage plans, but be sure to check the medications you require to be sure they are covered by the plan at the best prices. Drug coverage costs can vary based on the tier the drug is categorized in and where you live. If youre on a Medicare Supplement plan, you will need a separate Part D plan to cover medicines.

Youre Automatically Signed Up For Medicare When You Turn 65 True/false

If you are enrolled or are enrolling for Social Security, then you will be automatically enrolled in Medicare. However, if you are not enrolled in Social Security, you must proactively sign up for Medicare.

You can do that during your Initial Enrollment Period , which starts three months before your 65th birthday, includes the month of your birth, and lasts for another three months.

Are there exceptions to this schedule? Yes. If you have certain physical or other limitations, you could qualify to sign up for Medicare before the seven-month IEP that surrounds your 65th birthday. Talk to a qualified Medicare consultant to learn more.

Recommended Reading: Employee Probationary Period Template

Need Help We Are Here For You

If you or your family member need help with your Medicare this open enrollment period, we are eager to provide you with all the help you need. Our Medicare Insurance Agents do not cost you anything to use and we have made it our business to be your Medicare Insurance expert so you dont have to be.

Medicare plans are constantly changing. Let us help you find the right Medicare Advantage Plan or Part D plan that is right for you.

Integrity Now Insurance Brokers, inc.

562-735-3553

Original Medicare Vs Medicare Advantage

One popular way for enrollees to use their AEP is to switch from Original Medicare to a Medicare Advantage plan, and vice versa. And while you may think you understand what that means, when was the last time you really examined Original Medicare and Medicare Advantage? Do you know the differences between the two, or whats changed since last AEP?

Nows the time to learn.

Depending on your needs, youll want to evaluate the pros and cons of each option. Heres an example:

Recommended Reading: Brown Stuff Instead Of Period

I Currently Have Just Original Medicare

- Join a Medicare Advantage plan with or without built-in drug coverage. Note that you may be charged a penalty if you do not currently have other creditable drug coverage.

- Join a stand-alone Medicare prescription drug plan . A penalty may apply here as well if you do not currently have other creditable drug coverage.

- Make no changes and your current coverage will renew as is.

Medicare Advantage Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Advantage plan. You need to enroll in Original Medicare before you enroll in Medicare Advantage. Before enrolling in a plan, it may be a good idea to compare Medicare Advantage quotes.

To be eligible for Medicare Part C, you must already be enrolled in Part A and Part B.

If you are interested in joining a Medicare Advantage plan, you typically can only do so during specific times of the year.

The first time you may be able to enroll is during your Medicare Initial Enrollment Period, as outlined above.

If you sign up for a Medicare Advantage plan during your Initial Enrollment Period, you can change to another Medicare Advantage plan or switch back to Original Medicare within the first 3 months that you have Medicare.

Also Check: 90 Day Probationary Period Template

That Is Everything You Need To Know About Medicare In All Its Forms False

This article has given you a motherlode of information on many aspects of Medicare, and I hope you have learned a lot.

But has this article given you everything you need to know? Has it prepared you to move ahead and enroll without fear of making any mistakes? Unfortunately, no.

Your success enrolling in Medicare in all its shapes and sizes will be greatly improved if you work with a licensed Medicare advisor, like one of the Medicare Concierges at CoverRight.

CoverRight is on a mission to make the Medicare plan selection process easy to understand and help you find the best Medicare plans suited to your specific situation. Try our self-guided quiz to see for yourself.

Free Medicare Resources

All Medicare Part D Plans Cover All Drugs The Same Way False

In fact, there are important differences in how competing Part D plans cover different medications. First of all, the amount of coverage can differ in different states, and you could even discover that the medication you most need will not be fully paid for in your state.

Then we come to the issue of tiers, which is the way that insurance companies classify drugs and how much you will be reimbursed for them. In general . . .

- Tier 1 drugs are generic and cost the least. Therefore, it is likely that your Part D plan will pay for them.

- Tier 2 drugs are also generic, but they cost more than Tier 1 drugs. You could find out that you can still save money with the plan you choose because it covers all or most of the cost of drugs in this category.

- Tier 3 preferred drugs are brand-name medications that dont have generic equivalents. They cost more and there is a possibility that your Part D plan will not pay for them.

- Tier 4 drugs are high-priced brand-name drugs. You will find that most Part D plans will pay only about half their cost.

- Tier 5 drugs are in most cases brand-name drugs that are used to treat cancer and other serious conditions. In many cases, you will have to pay the full cost of them, even if you have a Part D plan.

You May Like: Period Blood Stains On Sheets