Is Paying For Dental Implant Insurance Worth It

Paying for dental insurance with the hope of getting coverage for dental implants can be worth it, but it all depends on your unique situation and how much dental work you need. With annual maximums on policies coming in as low as $1,000 in some cases, its important to make sure you select a dental insurance plan that offers enough coverage to actually help with the cost of dental implants. Many policies only cover a percentage of major services, so youll need to be prepared to pay for the rest of your implant surgery yourself.

Having some coverage is usually better than having none. Plus, dental insurance can kick in to pay for preventative care like cleanings and X-rays, as well as any fillings work you need to be done over the course of the year.

Before you pay for a dental insurance plan, make sure to shop around among plans to find the best deal. You should generally look for a plan with a high annual maximum coverage amount, low copayments and out-of-pocket costs, and a monthly premium you can afford.

Best Affordable Coverage: Delta Dental

Delta Dental

- Coverage Limit: $1,000 to $1,500

- States Available: 50

DeltaCare® USA is an extremely affordable plan making its provider Delta Dental our choice for best affordable coverage. Copays are just $5 for up to two cleanings per year, and theres no charge for exams and X-rays.

-

HMO option with no deductibles or annual maximums

-

Copays by procedure

-

Relatively low premiums

-

Only one plan with no waiting period on everything

-

Premiums must be paid for the year upfront

-

Doesnt cover some procedures like implants

Delta Dental is one of the largest dental providers in the country, serving more than 80 million people and maintaining a network of over 152,000 dentists. By focusing exclusively on dental insurance, Delta Dental can offer lower prices than many competitors. A variety of plans is available for both individuals and companies.

Delta Dental only offers one policy with no waiting periods, but with a low monthly premium, it is incredibly affordable. This HMO plan, named DeltaCare® USA, works with a copay structure instead of the coinsurance rates associated with PPO plans. Copays are listed by procedure and are fairly reasonable youll only pay $5 out of pocket for cleanings, with exams and X-rays free of charge, while fillings cost $15 to $60, and root canals are $230 to $340. There are no deductibles or annual maximums.

Types Of Dental Coverage

There are several types of dental coverage plans. When youre shopping for dental insurance, youll need to first decide what type of plan you are looking for. The difference between these plans is generally associated with which dental services are available in your network.

Lets see some of the types of dental plans that youll likely come across.

Read Also: Why Are My Period Cramps So Bad

Diastasis Recti Surgery Covered By Insurance

Category: Insurance 1. How to Pay for Diastasis Recti Surgery Money Fit Moms Jul 22, 2020 Diastasis recti surgery is sometimes covered by some insurance companies but is often not covered. Diastasis Recti repair, despite the Oct 25, 2017 Diastastis recti is not typically covered by insurance.

Cbiz Benefits And Insurance Services

Category: Insurance 1. CBIZ Benefits & Insurance Services Inc Company Profile and CBIZ Benefits & Insurance Services, Inc. provides professional services. The Company offers auditing, taxation, and accounting services, as well as employee ADDRESS: 6050 Oak Tree Blvd Suite 500 ClePHONE: 1-216-447-9000 CBIZ provides its clients with financial services

You May Like: Medicare Supplement Policy Free Look Period

What Is The Purpose Of Life Insurance

Category: Insurance 1. Life Insurance, Purposes and Basic Policies | MU Extension The major purpose of life insurance is protection the instant estate to meet survivor needs. Some policies include a savings feature, but there are many other Life insurance is a contract between an insurer and a policyholder.

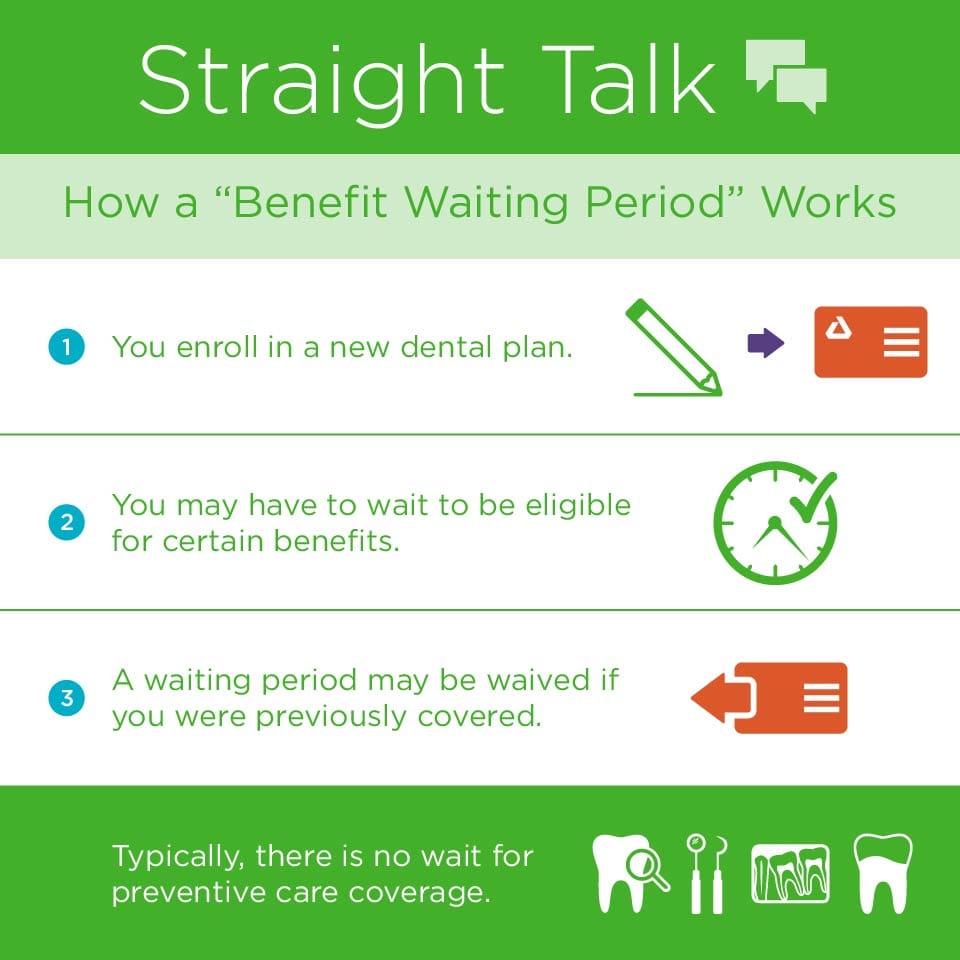

Examples Of How The Dental Insurance Waiting Period Works

If you decide to buy a dental benefits insurance plan because you just found out that you need a crown, the insurance waiting period could prevent you from being able to cover the procedure immediately when you purchase your dental insurance. Waiting periods can last up to a year on certain major procedures.

- Example 1: Joan needed a crown. She contacted her dental insurance company to see what coverage she had for the procedure. Her insurance company said that she did not have any coverage for the procedure since she only had her dental insurance for 3 months and any crown procedures had a 6-month dental insurance waiting period. Once the waiting period has elapsed, then dental benefits will be fully accessible.

- Example 2: Anna wants to visit a dentist for a checkup and cleaning, but her dental plan waiting period is not over yet. She is worried that the dentist will need to take x-rays and charge her a lot for these services. She calls her dental benefits plan administrator and finds out that although she has a 1 year waiting period for “Major” work like crowns, and bridges, that all the basic coverages are included. She is delighted to find out that her x-rays will be covered, as well as her cleaning, and if they find any cavities, her plan will cover that too. Since every plan is different, she was happy she called as was able to get access to some of her benefits right away.

Recommended Reading: Pregnancy Symptoms 1 Week Before Period

Usually Only Applies To Certain Benefits

Typically, the dental plan will not apply the waiting period to all benefits, as it is understood that the plan will pay out on certain basic coverages every year for dental benefits plan members anyway.

Understanding which coverages fall into the waiting period is important. Your dental insurance plan likely categorizes coverages in three groups:

- Basic: Basic procedures may have a three to 6 month waiting period, and “Major” procedures may have a 6 month to a 1-year waiting period.

- Preventative: Preventative procedures may not have any waiting period. Therefore some benefits may be accessible despite a waiting period, such as X-rays, cleanings, fluoride treatments.

- Major Work: Major work should be defined in your policy wording and may vary from company to company. Beware of taking on major work without consulting with your plan first.

Dental Insurance Waiting Period And Dental Insurance Maximum Benefits Example

Edward needs to have “major work” done on a tooth, as defined by his plan, it is not covered under his dental insurance because he is still under the waiting period. The cost of the procedure is $1500 and the dental plan would have only paid 50%.

Also, the maximum payable for Edward’s plan per year is $1,500. He decides to get an estimate from his dentist of all the other basic work to be done, like having several cavities filled, x-rays, cleaning, and other basic and preventative treatments, Once he reviews everything, and calculates the deductibles, he realizes that he would hit the maximum of his plan even if the waiting period wasn’t in place. He decides to go ahead with the work and get a payment plan with the dentist, and use the insurance to do preventative treatment covered by the plan to prevent this from happening again in the future. He could also consider a dental savings plan to supplement his insurance coverage.

Don’t Miss: Why Do I Have Painful Periods

Insurance Capital Of The World

Category: Insurance 1. Hartford, Connecticut Wikipedia Nicknamed the Insurance Capital of the World, Hartford holds high sufficiency as a global city, as home to the headquarters of many insurance companies, Incorporated : May 29, 1784Area code: 860/959Population : 121,054Named: February 21, 1637History · List of people from Hartford · West

Do You Need Dental Insurance For Implants

Its always a good idea to explore your options to determine if dental insurance for implants is the way to go for you. First, assess your needs and determine if implants are the best choice or if you should consider some other options such as dentures. Then, get some prices for implants with and without insurance.

Typically, having dental insurance is advisable if youre going to get implants because it can save you money. Even if dental insurance covers 50% or more of your implants, it may save you thousands of dollars.

Read Also: How Many 2 Week Pay Periods In A Year

Does Delta Dental Cover Work In Progress

Any dental treatment in progress when your coverage begins such as root canals, crowns and bridgework is not covered under your Delta Dental plan, and your former dental plan should assume responsibility. Delta Dental will cover treatment started and completed after your plans effective date of coverage.

Delta Dental Ppo Plan Cost Comparison

From the variety of different Delta Dental plans, I selected those that were most similar. Delta Dental has two different dental networks, the PPO and the Premier network. All these plans use the less expensive PPO network. One of the big drivers of dental insurance is the maximum annual dollar benefit the plan will pay on behalf of a member. Two of the plans have $1,500 maximums and the third has a $1,000 maximum. The rates are based on a Sacramento County residency and may vary depending on your location.

The first Delta Dental PPO plan is offered through Covered California. You must be enrolled in a Covered California health plan in order to enroll in this plan. It has a $50 deductible, $1,500 max. benefit, and a six-month waiting period before Delta Dental will pay any of the costs of the dental services, excluding cleanings, exams, and x-rays. If you have a minor restorative service, like having a cavity filled, before the six-month waiting period, you pay the full negotiated rate for the service. After the waiting period the plan cost sharing becomes effective.

After the six-month waiting period, and after the $50 deductible, you will pay 20% of the contracted rate for minor restoration and 50% for major dental work. Preventive services such as cleanings, x-rays, and exams have an immediate 0% member cost-sharing. The adult monthly premium is $52 and each child is $32.

Don’t Miss: Can I Go In The Pool With My Period

What To Do If A Dental Procedure Is Not Covered

If a dental procedure is required but is excluded due to the dental insurance waiting period, ask your dentist if there is anything they can do to help you manage the cost. Sometimes the dentist may consider giving you a discount or consider payment plans. Waiting for the waiting period to be over to do major dental work may not be a good idea. Your dentist will be able to give you their professional opinion. However, if you do the math, most coverages that are limited by a dental insurance waiting period may only be covered up to 50%. If you let a problem get worse over several months to wait it out may cost you a lot more than your dental insurance would even be paying out. Your health has to take priority.

Also, remember that different dental benefit plans also include maximum amounts payable and deductibles so you will want to check these numbers out as well to understand if the waiting period is costing you anything.

Dental Coverage Benefits Are Essential And Getting Them When Youre In Need For Dental Care This Is When Its Best To Consider Dental Insurance With No Waiting Period

Dental care is expensive and comes about at a most unexpected time. More and more adults have been putting dental care aside due to the costs attached to it. Dental insurance is a huge help in allowing you to prepare yourself for any form of dental emergency that may arise.

However, your dental emergency is not going to wait for six months or even a year for your dental insurance coverage benefits to kick in and wait for your waiting period to end. This will likely create further complications if your dental insurance has a lengthy waiting period.

Fortunately, this doesnt mean that youre completely out of luck or helpless when it comes to dental insurance. There are a number of dental insurance plans out there that have NO waiting period.

If youre looking to purchase dental insurance that offers immediate benefits, keep reading to know your options of dental insurance that have no waiting periods.

Don’t Miss: Pregnancy Calculator Based On Last Menstrual Period

The 7 Best Dental Insurance Plans With No Waiting Period Of 2021

- Best Preventive Care: Denali Dental

- Best Basic Coverage: UnitedHealthcare

- Best Major Coverage: Spirit Dental

- Best for Orthodontics: Ameritas

- Best Affordable Coverage: Delta Dental

- Coverage Limit: $1,000 to $1,500

- States Available: 48

Humana offers the most diverse dental insurance options with no waiting period, with three different plan types to choose from. Factor that in with affordable premiums, low deductibles, and a huge network of providers, and this insurer easily comes out on top as best overall option in our review.

-

No waiting period for all covered services on some plans

-

Choose from three different plan types

-

270,000 in-network dentists

-

Higher coinsurance than some competitors

Not only does health insurance provider Humana offer no waiting periods with four of its seven dental plans, but the options and benefits available are also some of the best in the industry. Those who want coverage to begin immediately can choose from a PPO, a HMO plan, or a dental discount plan with some of the lowest premiums we were able to find from any provider.

Runner Up Best Overall: Denali Dental

Denali Dental

Denali Dental plans can be tailored to cover your needs, are available in many states, and the coverage amounts increase each year.

-

Secure a higher level of coverage the longer you wait

-

Major services like implants are covered in many plans

-

Tailor your dental insurance coverage

-

$6,000 maximum applies to individual and family plans

-

Prices vary around the country

-

Not available in 15 states

Denali Dental has been insuring people for dental care for more than 60 years. This coverage is underwritten by Renaissance Life & Health Insurance Company of America which boasts an “A” rating for fiancial strength from AM Best.

This company offers coverage that varies nationwide yet comes in three variations for dental implants coverage:

Implants are included in the major procedures category, which means youll only have limited coverage for this area of your dental health each year. Also, note that an annual maximum applies for individual and family plans and that a one-time lifetime deductible of $100 to $200 will apply as well .

The amount youll pay for a plan varies widely depending on who youre buying coverage for, the plan you select, and where you live. However, a Denali Summit Plan with a maximum benefit of $6,000 starts around $70 per month for an individual seeking coverage.

Recommended Reading: What Age Does A Woman Stop Having Her Period