Get A Free Medicare Quote

There are usually only two specific times during the year when a person can change their Medicare plan. A Special Enrollment Period is available when qualifying events or other circumstances apply.

During a Special Enrollment Period , you can change your Medicare insurance. Depending on your situation, you may choose to join a plan for the first time, switch policies, or drop a policy.

You may be eligible for a Special Enrollment Period and not even know it.

Loss Of Current Coverage

This could be from leaving a job and losing a group health plan, leaving insurance through employer or union, or involuntary loss of creditable drug coverage. This also includes dropping a drug plan via the Medicare Cost Plus or Program of All-inclusive Care for the Elderly plan. Note: COBRA ending is not a valid election period to enroll in Medicare Part B. People need to discuss COBRA prior to enrolling if they are 65 and eligible for Medicare. This could cause penalties.

In most cases, youll be able to join a Medicare Advantage Plan with drug coverage or a Medicare Prescription Drug Plan. You can make these changes for up to two full months after notification of lost insurance, except in the case of lost Medicaid. If losing Medicaid, you will have up to three full months to join a Medicare Advantage Plan or Medicare Prescription Drug Plan.

Can I Change Plans If I Have The Chance To Get Other Coverage

A good instance when changing plans for a better policy makes sense would be if you have a Medicare Advantage plan but, a five-star Medicare Advantage plan is available in your area.

If you decide to go back to work and employer coverage becomes available to you, you may decide to leave Medicare and enroll in your employer plan. However, in many cases, Medicare makes more sense.

Read Also: Dark Brown Discharge Instead Of Period

Losing Creditable Drug Coverage Through No Fault Of Your Own

If you had a Medicare Advantage plan with prescription drug coverage which met Medicares standards of creditable coverage and you were to lose that coverage through no fault of your own, you may enroll in a new Medicare Advantage plan with creditable drug coverage beginning the month you received notice of your coverage change and lasting for two months after the loss of coverage .

Additionally, if you wish to disenroll from a Medicare Advantage plan with drug coverage and enroll in another form of creditable coverage such as VA, TRICARE or a state pharmaceutical assistance program, you may do so whenever you become eligible for enrollment in the new coverage.

When Is Medicare Sep For Ma And Medicare Drug Plans

Rules for the Special Enrollment Periods are driven by the special circumstances that determine your eligibility, regardless of whether you have Medicare Advantage or a Prescription Drug plan.

For example, lets say you move to an area that is still in your plans service area, but new choices are available in your destination. If you advise your plan before you move, you have from the month prior to the moving month through two months after relocation to switch to a new MA or Part D plan.

If you enrolled in a PACE plan, you can terminate your MA or prescription drug plan anytime. If Medicare ends your plans contract, your SEP begins two months before and ends one month after the contract termination date.

Don’t Miss: Usaa New Car Insurance Grace Period

Encounter Changes In Medicare Plans Contract

Below is a list of circumstances that qualify you for a SEP due to changes with your plans contract with Medicare.

Sanctions and Medicare

If Medicare ends up taking official action because of an issue with your plan, and this affects you, you can switch your Medicare plan. Medicare may review making this switch for you, depending on the situation at hand.

Contract ends early

Those that have a health plan coming to an end in the middle of the contract year can switch to another Medicare plan two months before the contract ending and up to one full month after it ends if the policy isnt for another contract year.

How Do I Sign Up For Medicare Part B If I Already Have Part A

If you are already enrolled in Medicare Part A and you would like to enroll in Part B under the Special Enrollment Period , you can apply online at Apply for Medicare Part B Online during a Special Enrollment Period. You can upload your application and documents that verify your group health plan coverage through your employer.

You can also fax or mail your completed CMS-40B, Application for Enrollment in Medicare Part B and the CMS-L564, Request for Employment Information enrollment forms and evidence of employment to your local Social Security office. If you have questions, please contact Social Security at 1-800-772-1213 .

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employer’s signature.

- Also submit one of the following forms of secondary evidence:

- Income tax returns that show health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Don’t Miss: Can You Donate Plasma On Your Period

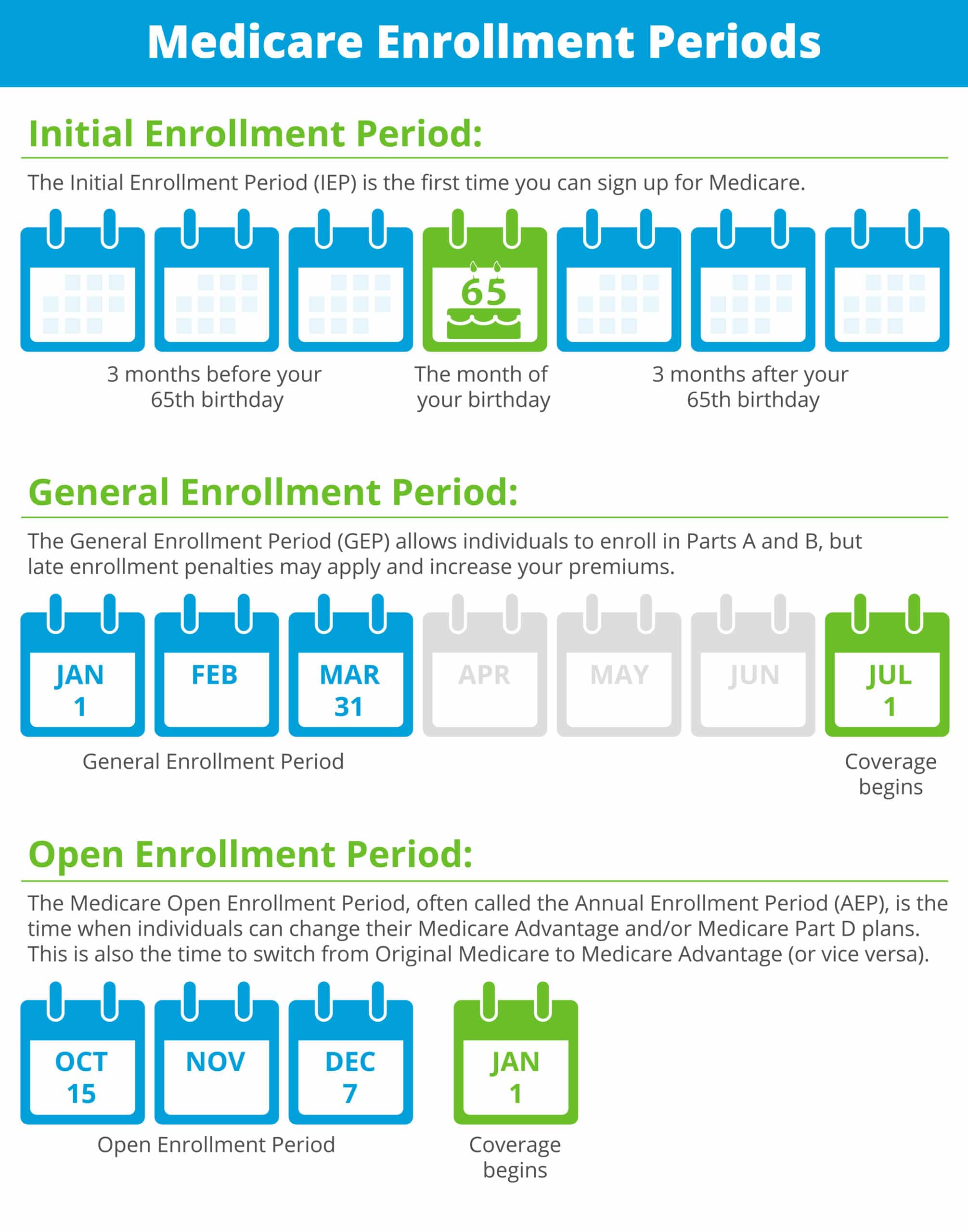

Signing Up Late: General Enrollment Period

Part A. If you didn’t sign up for Medicare Part A when you were first eligible, you can sign up for Part A anytime, without penalty.

When coverage begins. Your Part A coverage will go back to six months before the date you signed up .

Part B, C and D. If you didn’t sign up for Medicare Part B when you were first eligible, you can sign up for Part B during a General Enrollment Period, which happens between January 1 through March 31 each year. You will also have from April 1 through June 30 of that year to add a Medicare Advantage plan or Medicare Part D plan.

When coverage begins. When you sign up for Part B, C, or D during a General Enrollment Period, your coverage will start July 1.

Late sign-up penalty. Individuals who did not sign up for Medicare Part B when they turned 65 might face a penalty of higher lifetime premiums when they do sign up. However, most individuals who were covered by a group health plan through an employer are not subject to the penalty. If you didn’t sign up for Part B because you had group health benefits through work, you should be able to sign up during your Special Enrollment Period.

Types Of Special Enrollment Periods

Certain situations qualify you for a special enrollment period. For a full list of situations, visit Medicare.gov.

Common Types of Special Enrollment Periods

- Change of Residence

- If youre enrolled in a Medicare Advantage or Part D drug plan and move to an area outside your plans network, you qualify for a special enrollment period. During this time, you may return to Original Medicare or you can switch to a new Medicare Advantage or Part D plan. Your enrollment window begins the month you tell your plan provider and lasts two more full months after that.

- Loss of Employer Health Insurance

- If you receive health insurance through an employers group health plan , you can delay Medicare Part A and/or Part B. To delay coverage, your employer must have at least 20 employees. Ask your benefits manager at work whether you have group health plan coverage as defined by the Internal Revenue Service. Once you leave your job or lose your health insurance , you have an eight-month special enrollment period when you can sign up for Medicare without facing a late enrollment penalty.

- Other Coverage Losses

- You may be able to drop your current Medicare coverage during a special enrollment period if you have a choice to enroll in other coverage through your employer or union. You can also drop Medicare anytime if you choose to enroll in coverage from the U.S. Department of Veteran Affairs or a Program for All-Inclusive Care for the Elderly plan.

Don’t Miss: Usaa Grace Period Auto Insurance New Car

Disenrollment From Your First Medicare Advantage Plan

If you enrolled in a Medicare Advantage plan when you first became eligible for Medicare, you have 12 months to disenroll from the plan and transition back to Original Medicare.

If you dropped a Medicare Supplement Insurance plan to enroll in a Medicare Advantage plan but wish to revert back again, you have 12 months to do so .

What Happens With Part C Or Part D If I Move

With Part C or Part D, if you move to a new state or region that is outside your plans service area you will be able to change your plan. You can decide if you want a switch back to Original Medicare or enroll in a similar plan.

You may even decide to enroll in a Medigap policy, especially if Medicare Advantage plans are not competitive in your new residence.

Also Check: Can You Donate Blood While Menstruating

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

What Types Of Enrollment Periods Does Medicare Use

Medicare’s standard enrollment periods are:

Special Enrollment Periods are available to people experiencing what Medicare calls special circumstances, such as losing your employer coverage or moving. The full list is available on Medicare.gov here.

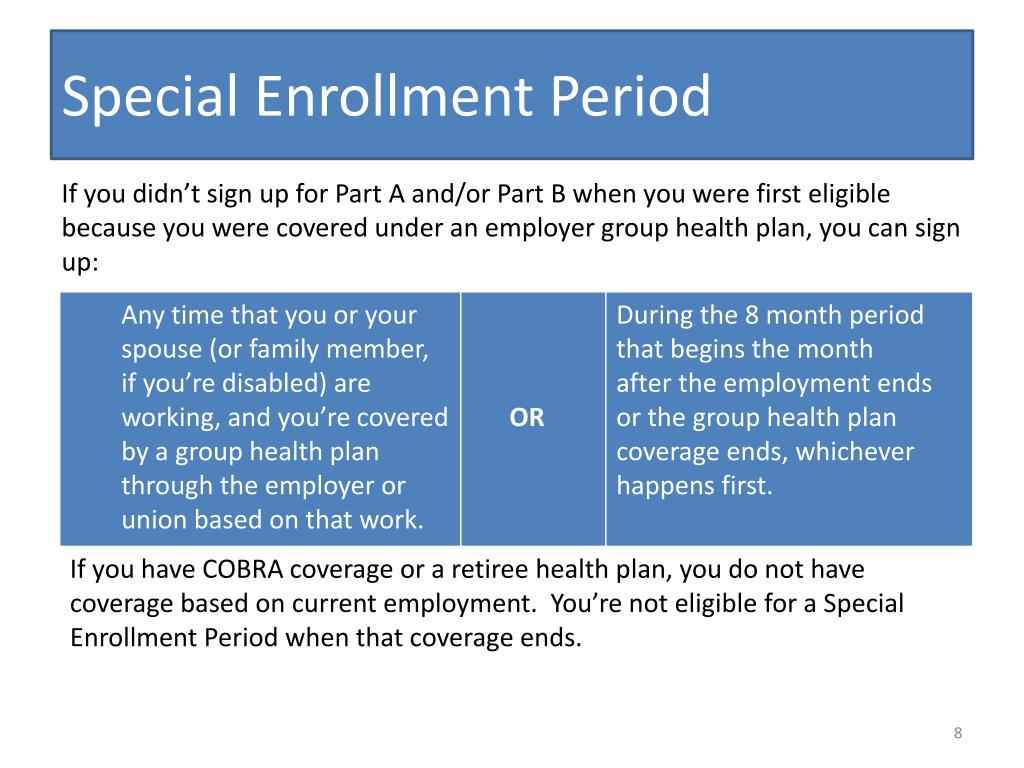

The Medicare Part B Special Enrollment Period is available to those who delay signing up for Part B because they have coverage through an employer . Once that coverage ends, they qualify for an SEP that lasts for eight months. It begins either the day coverage ends or the day employment ends whichever comes first.

Please note that, to qualify for the Part B SEP, you must have been actively employed. Health insurance through a retirement plan or COBRA does not qualify as you are not “actively” employed. The same is true if the insurance is through a spouse’s employment. Once you or your spouse is no longer actively employed, the Part B Special Enrollment Period begins. Full details are available from the Social Security Administration here.

Also Check: New Hire 90 Day-probationary Period Template

How To Apply For Medicare Through Social Security

Apply online: The easiest way to complete the Medicare enrollment application is online at ssa.gov. Its convenient to sign up from home. You can start and stop the application and save your information. After you submit your application, youll get a receipt to print and keep. You can also check the status of your application.

Apply in person: Visit your local Social Security office. You can find the nearest office with the Social Security office locator. They recommend that you make an appointment.

Apply by phone: Call Social Security at 800-772-1213 .

Contract Violations Or Enrollment Errors

If you are enrolled in a Medicare Advantage plan that failed to provide benefits in accordance with the plans terms or provided misleading information about coverage or other circumstances, you may be given an opportunity to disenroll from or switch to a new Medicare Advantage plan.

The timeframe in which you may do so will depend on the situation.

Read Also: Usaa Grace Period

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

Moving To Another State With Medicare Advantage Or Part D

Your new home address isnt in your plans service region

If you end up moving to a different state that happens to fall outside the service region, you can change to a new plan. Those with a Medicare Advantage Plan can switch back to Medicare. Tell the plan before the move then, the SEP begins the month you move and extends two months. However, tell the company after the move, and the SEP begins the month you notify them plus two months.

Your new home is still within your plans service area, but new plan options are available

If your new zip code is within the service area but with new plan options, you can select a new plan. Your SEP starts the month the company knows of the move and lasts for two months after.

Youve recently moved back to the United States

If you were living in another country and move back to the U.S., you can enroll in a new plan for up to two months.

Youve moved into or out of a health facility

If you recently moved into, currently reside in, or recently moved out of a nursing facility, you have several options. You can choose to join a plan if you dont have one, or switch your current policy. Also, you may choose to drop your Advantage plan and return to Medicare, or you can drop Part D. If you are continuing to live within the nursing facility, you can join, switch plans, or even drop your coverage. You can do this for up to two months after you move out of the health facility.

You May Like: 90 Day Employment Probationary Period Template

Medicare Special Enrollment Period For The Working Aged

If you are still working when you turn 65 and have group coverage through an employer or union, you can generally delay Part A and/or Part B. When that employment or your health coverage ends, you can typically enroll in Part A and Part B with a Medicare Special Enrollment Period. You have eight months to enroll, beginning the month that employment or employment-based coverage ends whichever happens first. You may not have to pay a late enrollment penalty for not enrolling when you were first eligible.

The health coverage must be based on current employment . You can either enroll in Part A and/or Part B while youre still covered through the group plan, or during the eight-month Medicare Special Enrollment Period . This SEP starts the month that your insurance ends, whichever happens first. This Special Enrollment Period occurs regardless of whether you decide to get COBRA coverage.

Keep in mind that COBRA and retiree health insurance dont count as coverage based on current employment and wont qualify you for a Medicare Special Enrollment Period when it ends. You also wont get a Medicare Special Enrollment Period if your group coverage or employment ends during your Medicare Initial Enrollment Period. In that case, youd join Part A and/or Part B during your Initial Enrollment Period.