Example Of Semimonthly Payroll

Now let’s assume that another company pays its employees semimonthly on the 15th day and the last day of every month. If it hires a new employee at an annual salary of $52,000 the employee will be earning $2,166.67 during each semimonthly pay period. The employee’s pay records will indicate a gross salary of $2,166.67 each semimonthly payday.

Can A Business Change Pay Periods

While changing your companys pay period is possible, it shouldnt be done without some considerations. Along with any overtime considerations , ask yourself these questions:

Does your company offer direct deposit? If so, youll need to coordinate with all of the various financial institutions and make sure deposits arent interrupted during the transition. Typically, direct deposit funds are transferred one to two days prior to the direct deposit date.

Do you have payday traditions? If you give employees extra time over their lunch hour to deposit paychecks, provide special office hours for workers in the field to collect their checks or have the CEO hand out checks, consider how changing your pay period will affect these traditions. SHRM advises these traditions may be cherished by employees and changing them may cause negative reactions.

How well do you communicate with your employees? Changing the pay period is a big deal. Your employees count on their paychecks being available on payday. If your communication isnt great, not only will there be confusion but there are also likely to be negative employee reactions. Aside from sending emails and placing notices on bulletin boards, SHRM advises making communication more proactive by hosting a new payday fair. Invite your payroll processor or other vendors to participate. Use the opportunity to educate employees about direct deposit, 401 and other financial planning options.

Number Of Paychecks Per Year

With a biweekly pay schedule, there are two months in the year where employees receive three paychecks. Employees who are paid semimonthly always receive two paychecks per month.

Companies that run payroll with a biweekly frequency dole out a total of 26 paychecks per year. Companies that use semimonthly pay give employees 24 paychecks per year.

Recommended Reading: 90 Day Probationary Period Letter

What Is A Semimonthly Pay Schedule

If you are on a semimonthly pay schedule, you will receive a paycheck twice each month. One check will come in the middle of the month, and the other will arrive at the end of that month or the beginning of the next. Typical semimonthly pay schedules are the 1st and the 15th, or the 15th and the last day of the month.

With the semimonthly schedule, you receive 24 paychecks every year. Since months are not all of equal length, some paychecks will be larger or smaller than others. For example, your second paycheck in February would only cover 13 or 14 days. Most other paychecks cover a 15 or 16 day period. However, if youre a permanent, salaried employee, your employer may divide your total yearly salary evenly between 24 checks.

Differences In Payroll Processing: Salaried Workers

MISHKANET.COM” alt=”How many semi monthly pay periods in a year > MISHKANET.COM”>

MISHKANET.COM” alt=”How many semi monthly pay periods in a year > MISHKANET.COM”> Handling the payroll for biweekly salaried employees and semi-monthly salaried employees presents a difference in how they are processed.

Full-time salaried employees are typically paid for 2,080 work hours yearly, and this must be delivered to employees regardless of the pay frequency. The difference is that full-time biweekly salaried employees will be paid for 80 hours each payday. Full-time semi-monthly employees will receive 86.67 hours of pay per paycheck.

The hourly difference occurs because of the distinction in the number of paychecks the employees will receive. For a biweekly employee, you must divide 2,080 by 26 pay periods . For a semi-monthly employee, you have to divide 2,080 by 24 pay periods .

To get the salary for either of the pay groups, you need to divide the annual salary by the number of pay periods.

To give you an example of how this might look in reality, consider the following example.

An employee earns $27,000 a year.

- If he or she gets paid biweekly: $26,000 divided by 26 = $1,000 per pay period, every other Friday.

- If he or she gets paid semi-monthly: $26,000 divided by 24 = $1,083.33 per pay period, on the 10th and 28th of each month.

Also Check: 90 Day Probation Period Template

Fixed Payday For Employee

With Semi Monthly Pay schedule, employees are guaranteed their payday at the same time on the same date every twice a month, giving them a fixed payday number. This takes some of the guesswork out of budgeting and makes it easier to understand. Which is especially useful for employees looking to use their pay stubs as proof of income. Since the semi monthly pay periods have fixed dates everyone can understand

Benefits Of Biweekly Payroll Schedules

Biweekly payroll schedules work best for hourly workers. But there are other benefits as well.

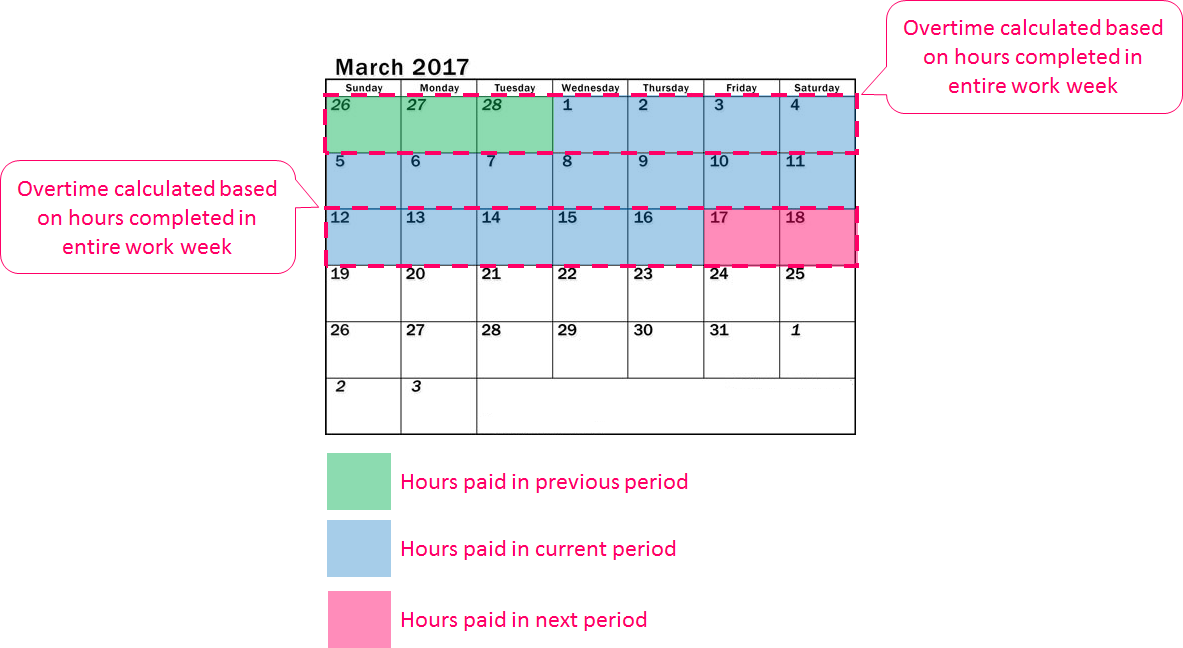

- Overtime pay is easier to calculate when you run payroll every two weeks.

- Payday consistency makes the payroll schedule easier to maintain.

- Biweekly paychecks are smaller, so they have a lighter effect on cash flow.

You May Like: Primosiston To Stop Period

Preferred Industry Pay Schedules

Many industries have pay schedules they prefer to use depending on the type of pay their employees receive, the amount of money included in the average paycheck, and the type of work they perform. Overall, bi-weekly pay is the most commonly used pay schedule, but others, like semi-monthly, are popular as well.

- Manufacturing and construction: Companies in construction, manufacturing, and even mining and natural resources generally prefer a weekly pay schedule to a semi-monthly or bi-weekly one. Often, their employees work irregular hours, predicated on the nature of the project and weather conditions, which could result in fewer hours some weeks and overtime hours other weeks. Administering paychecks every week makes it easier to manage those inconsistencies.

- Financial services: Many financial services companies and other high-paying sectors provide monthly checks, totaling 12 a year, rather than semi-monthly, bi-weekly, or weekly checks. Frequently, the salaried employees earn a substantial amount per year, making it easier for them to live on one check per month, since those checks are generally large.

- Food service: Businesses like fast-food restaurants and others that usually pay their workers a low hourly wage tend to provide weekly paychecks. This helps their employees better budget their money and account for any unpaid time off or overtime that might accrue during the pay period.

Can I Change My Pay Schedule

Once you choose a pay schedule, you may change it, but not frequently and not in a way that reduces your employees’ pay. For example, adjusting a pay period to avoid paying overtime to someone would violate the FLSA.

Changing your company’s pay schedule after several years for a legitimate business reason would be permissible, though.

You May Like: Usaa Grace Period

Payroll Calendar: Biweekly Pay Periods In 2022

7 min read time

As HR prepares for the new year, its key to stay ahead of the curve on important dates and compliance requirements. Unlike last year, 2022 will have the usual 26 pay periods for those being paid bi-weekly. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while others are paid weekly receiving up to 52 paychecks in a given year. Read on to learn about these different pay structures, and which one is best for your organization.

Picking The Perfect Pay Schedule For Your Business

When its time to hire your first employee, youll also be forced to choose a pay schedule. But long-standing business may also want to reconsider their approach to payroll when conditions change or they think a different pay period might be a better fit for their employees. Whether youre a newbie or youre an old hand, we have all the information you need to make the right choice for your team.

From spending more than 30 years in the payroll business, we know theres no single approach that works for everyone. There are advantages and disadvantages to different pay frequencies, and whats easiest for you may not jive with your employees needs. To make sure you make an informed decision, heres a breakdown of common pay periods, along with the pluses and minuses for each.

Also Check: 90 Day Probationary Period Policy Examples

Which Pay Schedule Will You Choose

While its important to spend time thinking about the best pay period for your business, just remember that its not a binding contract. You can always change your pay approach to find a rhythm that works best for you and your employees just make sure they know about any changes in advance.

Erin Ellison is the former Content Marketing Manager for OnPay. She has more than 15 years of writing experience, is a former small business owner, and has managed payroll, scheduling, and HR for more than 75 employees. She lives and works in Atlanta.

LET’S DO THIS

How Is A Pay Period Calculated

Companies decide what pay period length they want to run their payroll on.

This can be based on a variety of factors, like when the company gets paid for its products and services, how often employees need money, and whether you have hourly employees or if your team is on an annual salary schedule. Thereâs also state law to factor in â you may prefer to pay monthly while state law requires bi-weekly payments.

For example, a company that employs mostly hourly workers might find it beneficial to have a week-long pay period. Weekly payments are easier for financial planning and make employees happier by giving them access to more readily available cash flows.

However, a company that bills its clients at the end of the month and has mostly salaried employees may prefer to pay its employees less frequently â a bi-weekly basis is typical.

Also Check: Can You Donate Plasma On Your Period

How Many Pay Periods Are In A Year

There can be as many as 52 pay periods in a year or as few as 12. The number is ultimately determined by the employer unless the workplace or the employees are in a state that has specific payday requirements. Its important for business owners to strike a balance between the cost of running payroll and the financial needs of their staff.

Choosing Between Semimonthly Vs Biweekly Payroll

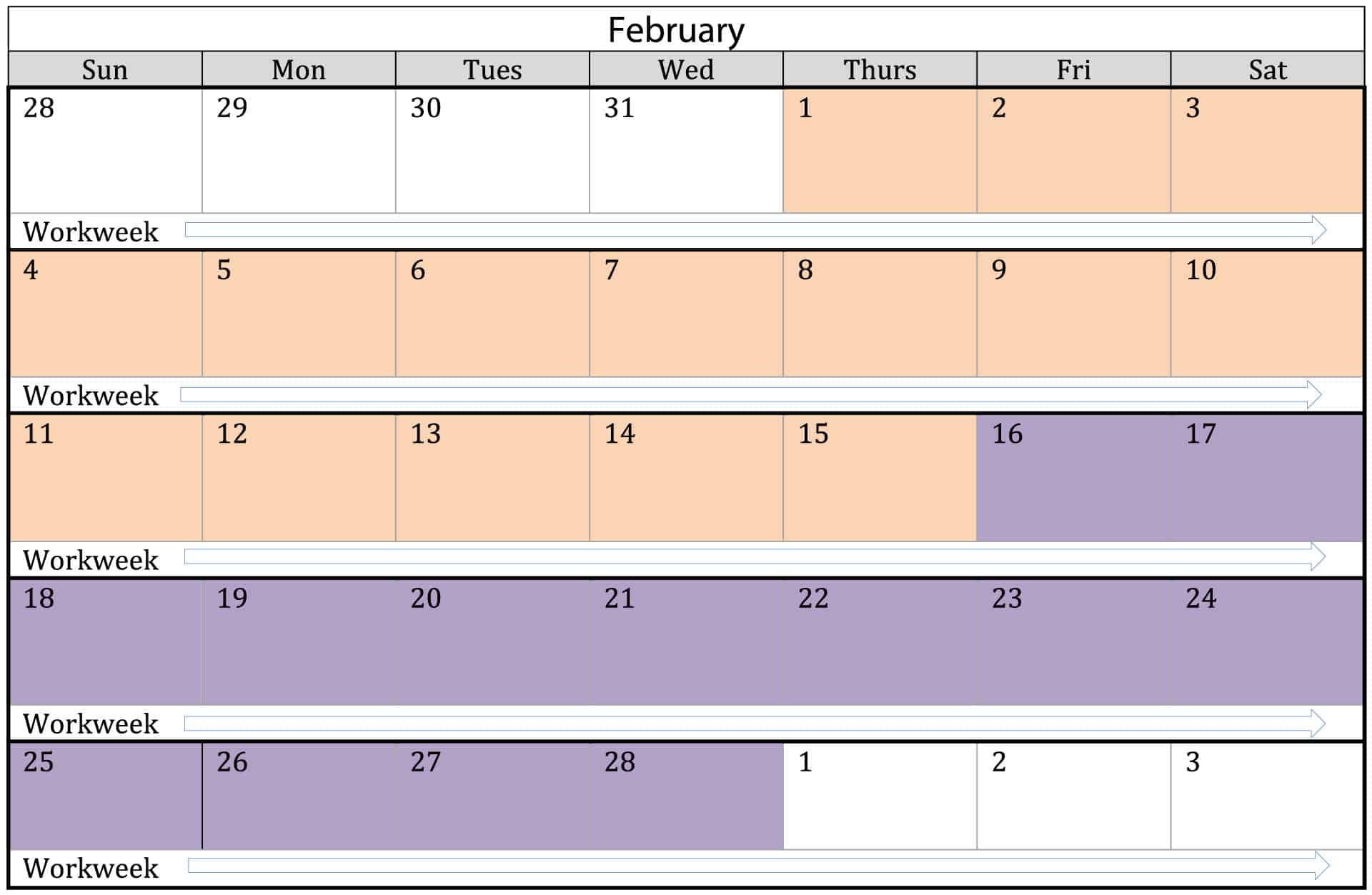

Deciding between biweekly vs. semimonthly payroll can be a difficult decision, especially because federal pay laws state that businesses must keep the same frequency throughout the year. Before choosing, keep in mind that states regulate how often employees must be paid and some states may not allow ceretain pay frequencies. Businesses should check with their state before choosing how often to run payroll.

Also Check: How To Get Period Blood Out Of Sheets

Payroll Can Be A Hassle But It Doesn’t Have To Be

Most business owners will be quick to tell you that they donât look forward to running payroll . Itâs another administrative task that they need to get through.

But, before you can cut any checks, you first need to decide on a payroll schedule for your business.

From biweekly to semi-monthly pay, there are plenty of options out there. Use this as your guide to land on the payment frequency thatâs best for you and all of your hard-working employees.

Is It Possible To Use Different Pay Period Schedules For Each Employee

Yes, it is possible. If it is convenient for the employer, then they can have different pay periods for each employee. For instance, if you have different departments in your company then you can set up semi-monthly for upper management and weekly for salaried employees.

Setting up different pay period schedules for employees is beneficial for larger companies. For companies with less than 100 employees, it is beneficial to stick to a single pay period for all employees to reduce payroll complexities.

You May Like: Brown Stuff Instead Of Period

What Is The Difference Between Pay Period And Pay Date

A pay period is the length of time during which you work, and a pay date is the day on which your team receives their paychecks.

Letâs explore these concepts further.

A pay period is the time frame in which work is being done and paid for. For budgeting purposes, remember this would include any time your team is on the clock, including any onboarding or training time. Pay periods are typically referred to by their number.

Specifically, a bi-weekly payroll schedule has 26 pay periods per year. So the first two weeks of January would be pay period one, and the second two weeks of January would be period two, and so forth.

A pay date is the date on which companies pay employees for their work. Friday is the most common payday.

It can take a few days to process payroll. Therefore, the last day of the pay period is typically not when employees get paid for their work from that pay period. The pay date for the current pay period might be on the last day of the following pay period. If you use payroll software like Hourly, your employees can see their pay stubs even as payroll is processing.

Cons Of Semimonthly Payroll Schedules

However, semimonthly payroll schedules also have their disadvantages.

- If payday falls on a holiday or weekend, you must run payday earlier or later than normal.

- Paydays are inconsistent, so you or your payroll manager may lose track of when to run it.

- The hours and days covered can vary every pay period, which can complicate how you run payroll for hourly employees with overtime.

Recommended Reading: Employee Probationary Period Template

How Should You Decide Which Payroll Schedule Is Right For Your Business

Weâve covered a lot about the different payment frequencies already. But, if youâre still feeling stumped about which choice is right for you, below are a few tips to keep in mind.

1. Check The Rules Of Your State

Business ownership is full of rules and regulations, so you knew that something like this was bound to crop up sooner or later.

States all have different laws that apply to payment frequencies. So, before you make a choice, make sure you use this resource from the Department of Labor to check if a payroll schedule is mandated by your state.

If it is, of course, you need to make sure to comply with that.

2. Consider Your Different Types Of Employees

If you have the flexibility, you might want to use a couple of different payment schedules depending on the types of employees you have on staff.

For example, running semi-monthly payroll for your hourly employees can be challenging, especially if they racked up any overtime pay. However, itâs more straightforward for your salaried employees who are earning consistent amounts.

Unless your state laws tell you otherwise, donât feel like youâre locked into the same system for everyone. You might have some wiggle room to tailor your approach based on employee type.

3. Ask Your Employees For Input