Use The Heloc Draw Period Wisely

A HELOC can give you the financial cushion you need to handle a major expense. However, taking out a HELOC is a major decision that could affect your finances for decades to come. Carefully consider the pros and cons, and investigate other alternatives for managing a financial emergency or funding a major project, such as home equity loans, personal loans or credit cards.

If you decide a HELOC is right for you, check your credit report and credit score before you apply. You’ll generally need a FICO® Score of at least 680 to qualify for a HELOC. If you’re not quite there yet, taking the time to improve your credit score can help you qualify for a loan with better loan terms and a larger credit line, giving you more financial power to achieve your goals.

Need More Buying Power With Your Home Equity Line Of Credit

Do more with your home equity line of credit . If you’re in need of extra buying power and are looking for additional home equity financing, there are no fees to apply for a new line of credit with a higher credit limit and no closing costs. When you apply to refinance your home equity line of credit you’ll receive :

- A new HELOC account with a larger line to suit your ongoing needs

- A new 10-year draw period

- No application fees or closing costs

Use your line of credit to make home improvements, pay for education expenses or consolidate your higher-interest-rate debt.

Get started today

Apply now to refinance with a new HELOC.

Please note: Upon approval and completion of a HELOC refinance, your new account will require variable-rate monthly minimum payments that include principal and interest during both the draw and the repayment period . Your account will also have an updated term of 30 years and your existing line of credit interest rate will adjust to current interest rates.

Servicing Your Home Equity Line Of Credit Account

You already know that your home equity line of credit allows you to access funds when and where you need them, but what if you need more? What happens at the end of the borrowing period?

Keep reading to discover:

- How to request a larger credit limit

- How to transfer funds to consolidate debt

- What happens to your account at the end of your draw period

Also Check: 90 Day Employee Probationary Period Template

Pay Off The Balance In Full

If your HELOC requires a balloon payment, or if you simply want to pay off your HELOC as quickly as possible, another option is to pay off the remaining balance in full.

If you have the money stashed away in savings, using it to pay off your HELOC can be a smart way to save money on interest charges.

How To Weigh Your Options

Before your HELOC draw period ends, have a repayment plan in place if you owe money. Check with your lender to see exactly how much your monthly payments will change once the principal portion is due.

If you cant afford the change in monthly payments, need to borrow more money or dont like having a variable interest rate, explore alternatives. Weigh the pros and cons of each option before making a decision. For example, when you refinance into another HELOC, you could incur additional costs, such as early closure fees, annual fees and application fees.

In addition, its best to compare rates and fees from various lenders if you choose to refinance.

Recommended Reading: How To Get Period Blood Out Of Sheets

How The Draw Period Works

When youre approved for a HELOC, the lender will outline the HELOCs terms, including the terms of the draw period the amount of time you have to withdraw money from the HELOC.

Every lender has their own requirements, but some lenders may require you to make minimum draws during the draw period.

You can opt to take out the minimum required during the draw period, or you can take out the maximum offered.

Its up to you.

The money is available if you need it, and youll only pay interest on the amount that you actually draw.

For example, if youre approved for a $85,000 HELOC but you only take out $25,000, youll pay interest on the $25,000 you use not the $85,000 you were approved for originally.

To access your HELOC funds, you can usually do a bank transfer, or you can even use a HELOC account card which functions like a debit card.

During the draw period, you usually do have to make some form of loan payment each month.

Typically, you just have to make interest-only payments, so the monthly payments are quite low during the draw period.

Heloc: What Are The Drawbacks

Your home as collateral.

As with any home loan, if you default on your payments, you could lose your home. This can be avoided by doing the math and making sure you can afford your mortgage, other bills, and HELOC repayments.

Loan-to-value increase.

Itâs all about balance. Taking out a HELOC causes your loan-to-value ratio to increase. On one hand, your home value could rise over time. Thatâs great. In other cases, you could end up owing more than your home is worth if the value decreases. Thatâs called being underwater on your mortgage. Looking at the home value trends in your area with the help of your real estate agent can help you decide.

Unpredictable interest rates.

While most HELOCs have comparably low interest rates to credit cards and personal loans, that rate may also be variable. Depending on the market, you could end up paying more than you would if you had a home equity loan.

With a HELOC, you only pay interest on what you borrow, not what youâve been approved to borrow. As long as you donât need the full amount right away, a HELOC can help you to not over-borrow.

You May Like: Dark Brown Discharge Instead Of Period

How Will I Access My Heloc Funds

Most banks and other HELOC lenders will give you more than one way to access the equity in your home. Some lenders will give you a book of checks or a checking account deposit, while others may give you a debit or credit card. And many lenders are able to do all three of these things. Be sure to find out what methods you will have available to access your equity when you apply for it.

What Rates Can Be Expected With A Heloc

The interest rate youll get for any debt you take on will vary depending on your own financial situation and what the economy is doing at the time. But in general, rates for second mortgages will be slightly higher than the rate you pay on your main mortgage because the lender takes on more risk with a second mortgage and lower than the average credit card rate .

You should also be aware that most HELOCs have variable rates, meaning the interest rate you pay will change with fluctuations in the market. You may be able to get a HELOC with a fixed rate, or a hybrid that allows you to convert to a fixed rate from a variable rate, but these loans may come with restrictions on how many times you can withdraw money and the maximum amount you can withdraw each time.

Depending on your lender, you may also have to pay certain fees, such as an annual fee for the cost of having the account or an origination fee that covers the cost of setting up your loan.

If you decide to get a HELOC, be sure to shop around and compare costs among multiple lenders to make sure youre getting the best deal. If you cant find a lender that offers an attractive rate, it may be a good idea to work on your credit first, and then shop around again once youve improved your score.

According to NerdWallet, the average HELOC rate was around 4.418% as of October 18, 2021.

Get approved to refinance.

Recommended Reading: New Hire 90 Day-probationary Period Template

Tax Implications Of Second Mortgages

Prior to the passage of the 2017 Tax Cuts and Jobs Act homeowners could deduct from their income taxes the interest paid on up to $1,000,000 of first mortgage debt and up to $100,000 of second mortgage debt. The law changed the maximum deductible limit to the interest on up to $750,000 of total mortgage debt for married couples filing jointly & $375,000 for people who are single or maried filing separate returns.

The big change for second mortgages is what debt is considered qualifying. Prior to the 2017 TCJA virtually all second mortgages qualified. Now the tax code takes into consideration the usage of the funds. If a loan is used to build or substantially improve a dwelling it qualifies, whereas if the money is used to buy a car, pay for a vacation, or pay off other debts then it does not qualify.

When Its Time To Consider An Alternative To A Heloc

Many debt-adverse homeowners, particularly those looking to reduce existing debt, opt not to use a HELOC because the monthly payments and unpredictable interest rates threaten to dig them deeper into debt. A 2019 study of U.S. homeowners found that 73% of people want financing solutions that dont create more debt. A home equity investment is debt-free, and there are no penalties for early repayment.

If your expenses are a little unpredictable, an equity investment might also be preferable to a line of credit. Home renovations, for example, can often go over the original budget, and a lump sum of cash makes it easy for homeowners to make adjustments as a project progresses, versus drawing more funds as needed.

Homeowners that dont fit into the typical box often find that a home equity investment is the better option, as well. For example, entrepreneurs that dont have a typical W2 or high credit score may not qualify for a HELOC despite having the equity and the financial standing to pay it back.

Theres no one-size-fits-all when it comes to tapping into your home equity. Comparing a home equity line of credit and a home equity investment with your specific goals and financial situation in mind is the best way to determine which one makes most sense for you.

Read Also: 90 Day Employee Probationary Period Template

Helocs Vs Traditional Loans

When you take out a traditional loan, you typically receive a lump-sum payment immediately after the appropriate paperwork is signed and processed. With a HELOC, however, you don’t receive a lump-sum payment. Rather, your lender provides you with a line of credit from which you can access funds on an as-needed basis during the HELOC’s draw period.

Home Equity Line Of Credit

A home equity line of credit is a revolving credit line. A HELOC allows the borrower to take out money against the credit line up to a preset limit, make payments, and then take money out again.

With a home equity loan, the borrower receives the loan proceeds all at once, while a HELOC allows a borrower to tap into the line as needed. The line of credit remains open until its term ends. Because the amount borrowed can change, the borrower’s minimum payments can also change, depending on the credit line’s usage.

Read Also: Usaa New Car Insurance Grace Period

What Is The Heloc Draw Period How To Prepare For The Draw Period End

If you have equity in your home meaning the current market value of your home exceeds what you owe on your mortgage you have a powerful borrowing tool.

Because you have equity in your house, you can tap into it with a home equity line of credit , giving you access to a revolving line of credit.

HELOCs often have low interest rates, and you can use the money you borrow for home renovations, to pay for your childs college education, or even to pay for a dream vacation.

But before you submit your HELOC application and start borrowing money, its important to understand how HELOCs work, particularly with draw and repayment periods.

Heres what you need to know about these two phases and how to prepare for the HELOC draw period end date.

Dont Trip Over The Second Step

During the repayment phase, the borrower can no longer tap the credit line, and the balance must be repaid. The payment depends on the balance, interest rate, and remaining loan term.

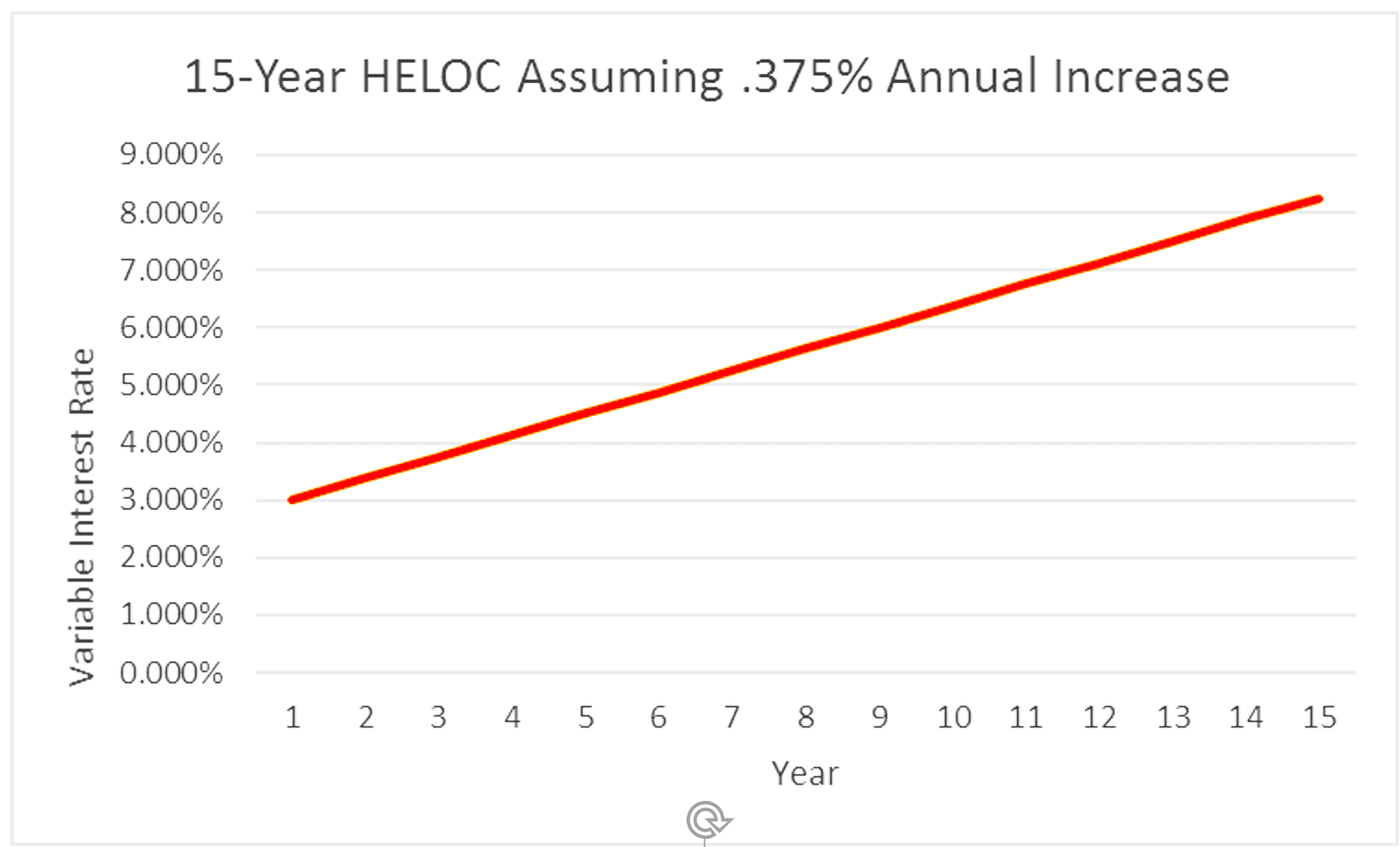

Look what happens in Year Six, when there are ten years left to repay the balance. The borrower has continued to spend $2,500 a year, and in this case, the interest rate has risen.

That cute little $6.25 payment in our example is now about $125 a month. And thats assuming interest rates stay relatively low under five percent by Year Six if they only rise slightly each year.

This chart shows what could happen over time with even modest interest rate increases .375 percent each year in this example.

You May Like: Usaa New Car Insurance Grace Period

Payments And Interest Rate

The repayment process and interest rates for a home equity loan are determined by the borrowers creditworthiness. Lenders are more willing to provide lower interest rates to borrowers they view as more trustworthy.

The main factors that lenders usually take into consideration are borrower credit scores and debt-to-income ratios. Other factors such as income and the value of the collateralized equity will also influence their offers.

Once a borrower agrees to a loans terms and accepts the home equity loan, the interest rate is fixed. The amount the borrower repays is fixed, as is the interest rate. The borrowers repayments go to both the interest and principal balance of the loan. A greater portion goes towards the interest, then more goes towards the principal after the interest is paid back.

Tap Into Your Home Equity

Borrowers who set up automatic payments from a PNC Bank checking account are accorded a discount on their interest rate.

Borrowers also have the option to convert some or all of their outstanding HELOC balance into a fixed rate option. This can protect the borrower from rising interest rates.

Recommended Reading: Can You Donate Plasma On Your Period

Know Exactly When Your Draw Period Expires

Typically, a HELOCs draw period is between five and 10 years. Once the HELOC transitions into the repayment period, you arent allowed to withdraw any more money, and your monthly payment will include principal and interest.

Know when the draw period ends to adequately prepare yourself for the next phase. This will help you plan for necessary expenses and ensure that you have the funds available to help you with your lifes priorities, including those that may be in the future, says Michelle McLellan, senior product management executive at Bank of America.

Keeping track of your draw period can also help you determine whether you want to refinance the HELOC or begin putting money into savings to use toward paying down the principal during the repayment period.

However, if your HELOC balance is already at zero at the end of the draw period, your account will typically close automatically, McLellan says.