How To Get Pregnancy Insurance

Under the Affordable Care Act, there have been many changes regarding health insurance, including pregnancy insurance. All qualified health plans are now required to provide maternity care and childbirth health benefits.

Prior to the Affordable Care Act, only a handful of insurance plans automatically provided maternity coverage. For some plans, such coverage had to be requested as an addition. Also, if a woman tried to apply for maternity coverage after she became pregnant, coverage was oftentimes either unavailable or more expensive.

Fortunately, now pregnancy coverage is much more accessible. If you do not have medical coverage through an employer, Medicaid, or CHIP , you can find an insurance plan through the Marketplace. For more information on getting health coverage through the Marketplace, visit www.healthcare.gov.

If you already have health insurance, it is important to know if your plan is grandfathered or not. Grandfathered insurance plans are those that were in place on March 23, 2010, and have not been significantly altered to affect consumer benefits or the cost of insurance to consumers.

Individual grandfathered plans that you purchase yourself are not obligated to provide maternity and childbirth benefits. If your plan is grandfathered, contact your insurance company to determine what coverage you have.

If You Have Concerns About Being Able To Pay For Insurance Options For Insurance During Pregnancy Include Medicaid And The Childrens Health Insurance Program

Health insurance helps you pay for medical care. Health insurance is really important for you, especially if youre pregnant.

What health care services are covered for a pregnant woman?

After the Affordable Care Act passed, health care law requires all insurance plans on the Health Insurance Marketplace or Medicaid to cover many services for pregnant women. The Marketplace is an online resource that helps you find and compare health plans in your state. These insurance plans cover services for pregnant women including:

- All prenatal care visits with no co-pay. Prenatal care is medical care you get during pregnancy. No co-pay means you dont have to pay your health care provider each time you go for a prenatal checkup. You can see your prenatal care provider without a referral from a primary care provider . So you dont have to see your primary care provider first to get an OK to see a prenatal care provider, like an obstetrician/gynecologist , nurse-midwife or nurse practitioner.

- Labor and birth services

- Breastfeeding help with no co-pay. This includes visits with a lactation consultant, breastfeeding equipment and breast pumps. A lactation consultant is someone with special training in helping women breastfeed.

Insurance plans in the Marketplace and Medicaid have to cover these services for everyone, including pregnant women:

- Regular health checkups

- Checkups when youre sick

Health care law says that a plan cant:

Is it OK to be pregnant when you sign up for a health plan?

What Exactly Is Maternity Health Insurance

Maternity insurance, in simple words, refers to the insurance coverage that females receive concerning the medical expenses that accompany pregnancy as well as post-pregnancy procedures and treatments. Now, corporate enterprises also offer such facilities for their female employees by subscribing to maternity insurance policies for their benefit. However, these policies generally have a fixed upper limit, and upon exceeding that, the mother will have to pay out of her pocket.

Recommended Reading: How To Swim On Your Period Without Tampon

How Can I Get Health Insurance While I’m Pregnant

First, see if your employer — or your partnerâs employer — offers health insurance. You will probably get the most coverage at the best price from a health plan offered by an employer. That’s partly because most employers share the cost of insurance premiums with employees.

You can also shop for coverage in the health insurance Marketplace, which is also called an exchange. You may also qualify for Medicaid in your state if your income is low.

In the marketplace, you can:

- Compare health plans side by side

- See if your income is in the range to qualify you for financial help from the government, which will lower the cost of your insurance premiums you may also qualify for lower out-of-pocket costs, such as deductibles, copays, and coinsurance.

You must enroll in a health plan during the open enrollment period, set by either the employer for employer coverage or the federal government for Marketplace coverage. You may qualify for a special open enrollment period if you have a âlife eventâ such as losing other health coverage or moving to a new state. Unfortunately, pregnancy is not one of the life events which qualify you for a special open enrollment period. However, having a baby is. So once you give birth, you can shop for insurance and enroll in a plan even if you missed the open enrollment period. If your income qualifies you for Medicaid, you can enroll at any time during the year.

Can A Health Plan Refuse To Let Me Enroll Because I’m Pregnant

No.* In the past, insurance companies could turn you down if you applied for coverage while you were pregnant. At that time, many health plans considered pregnancy a pre-existing condition.

Health plans can no longer deny you coverage if you are pregnant. That’s true whether you get insurance through your employer or buy it on your own.

What’s more, health plans cannot charge you more to have a policy because you are pregnant. An insurance company can’t increase your premium based on your sex or health condition. A premium is the amount you pay each month to have insurance.

You May Like: Can I Go To The Gyno On My Period

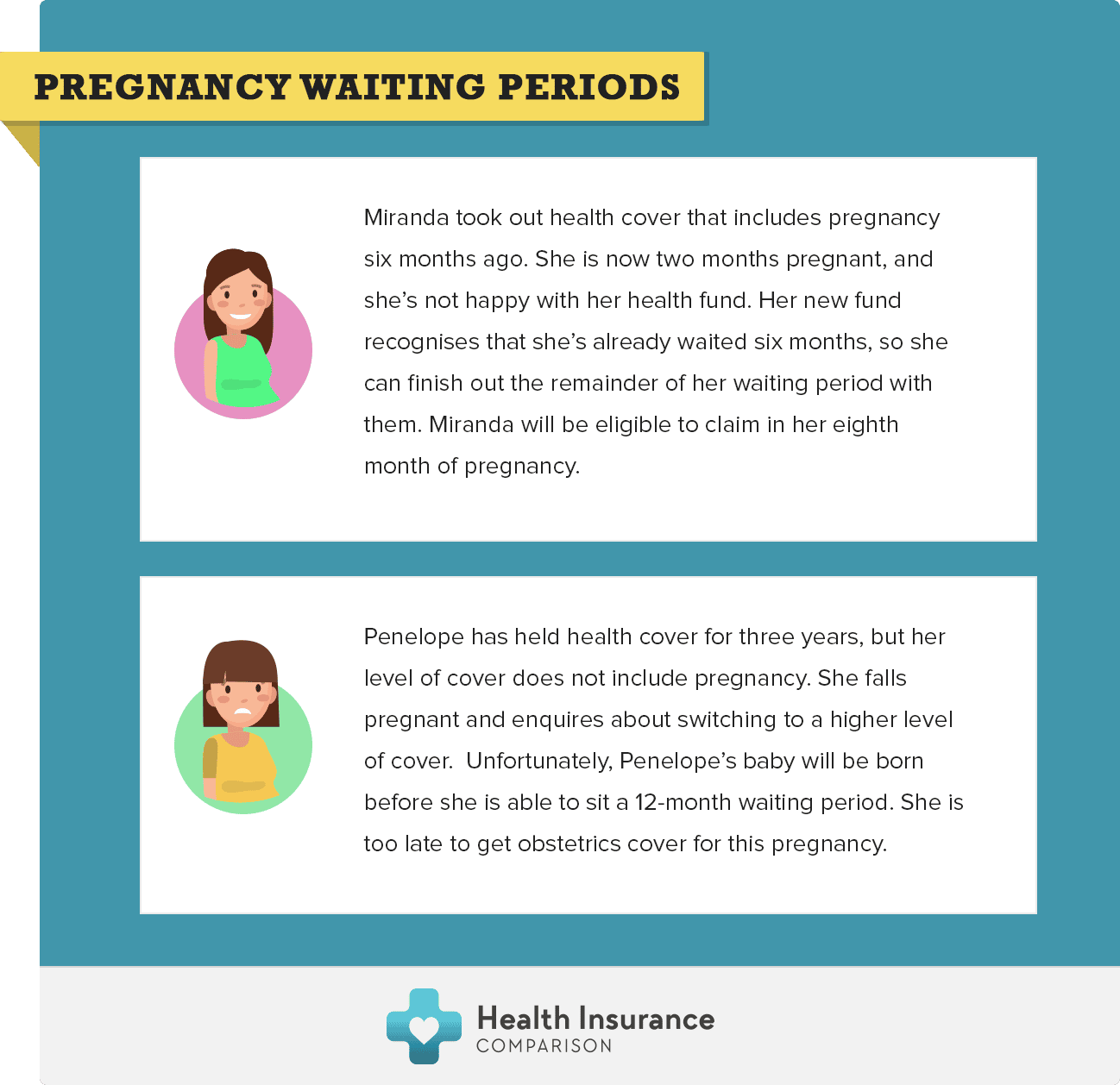

Maternity Health Insurance Plans Usually Have Waiting Periods

One of the most commonly overlooked components of any global health insurance policy is the addition of a waiting period. Waiting periods are commonly found attached to a number of specific coverage benefits, including Dental and Maternity health insurance. Essentially, a waiting period is the specific length of time you must have been enrolled on a policy before you are able to receive coverage for a certain benefit under the plan.

For more information about waiting periods and how they work with maternity insurance please click Maternity Coverage Waiting Periods on Global Health Insurance Plans.

Does Medicare Cover Pregnancy

If you are currently enrolled in Medicare due to a disability or your age, you would be covered for pregnancy or childbirth. Under Medicare Part A, all hospital services would be provided, while Part B of the policy would cover the doctor services and outpatient procedures, including lab tests and blood work. However, after the birth of your child, Medicare would not cover services for your baby at all.

Don’t Miss: How Can I Stop My Period From Coming

Does Insurance Cover Surrogate Pregnancy

If you currently are using a surrogate for pregnancy, then there are health insurance implications that you should be aware of. Intended parents are always required to provide health insurance for a surrogate. Furthermore, the surrogate’s health insurance will not provide pregnancy coverage. Therefore, you would need to use your own health insurance to cover the maternity and newborn expenses during the pregnancy of the surrogate.

There are no limitations or differences in what health insurance policies cover for surrogates. All of the policies highlighted below would offer the same coverage whether you were carrying a child or a surrogate carries the child for you.

Can Waiting Period Be Reduced

Pregnancy is a crucial phase in a womans life, and prior planning is the best way to start healthy motherhood. Since finding pregnancy health insurance with no waiting period policy may not be possible, it is necessary to plan much ahead as there is a waiting period clause.

Yes, the waiting period for pre-existing diseases can be cut short by paying a higher premium. in your individual health insurance or family floater plan. However, it is better to invest much early to avoid any hassle when it comes to maternity policies.

Since getting maternity insurance for already pregnant Indian women is difficult, early financial planning is the only way to prevent any financial crisis during parenthood. It is a crucial step everyone should take for their familys well-being. The maternity health policy will enable the insured to get quality maternity care with benefits like cashless hospitalization, newborn baby cover, and Section 80D tax benefits.

You May Like: What Should Your First Period Look Like

How Do I Access The Program

If youre an eligible member^ heres what you need:

- Obtain a referral from your GP to a participating obstetrician, or visit the Sydney Adventist Hospital website to find a participating obstetrician and contact them to discuss your eligibility.

- To make sure you have no pregnancy out-of-pocket costs, youll need to be accepted into the program by a participating obstetrician.

- Any services or appointments prior to being accepted into the program are not included and you’ll incur these as out-of-pocket costs.

- If youd like to chat about your eligibility, please call HCF on .

Our International Pregnancy Benefit Waiting Period

An 18-month waiting period applies to the pregnancy benefit, which means youll need to be covered by us continuously for this length of time before you can claim for it.

If youd like it this benefit included in your business health insurance, the waiting period is 10 months before your employees can claim for pregnancy.

Which plans cover pregnancy and maternity?

Our Prestige and Prestige Plus plans offer cover for pregnancy. For small businesses, its also available as an upgrade on Comprehensive plans.

For more information on whats included and whats not, see the table below.

Don’t Miss: How To Stop Your Period Quickly

What Services Can I Expect To Be Covered

Maternityservices covered by health plans include:

- Outpatient services These services include prenatal and postnatal doctor visits, gestational diabetes screenings, lab studies, medications, etc.

- Inpatient services such as hospitalization, physician fees, etc.

- Newborn baby care

- Lactation counseling and devices

Its important to keep in mind that your coverage may vary depending on what plan you have since insurers can choose how they cover these benefits. Additionally, out-of-pocket costs are dependent on several factors, such as the metallic tier of coverage you have, deductibles, copayments, and which providers you choose.

Is There Any Health Insurance Plan Available In India With No Waiting Period

Although, most of the companies offering health insurance in India do have a clause of waiting period in their health plans. However, you can expect a no-wait health insurance policy only in two of the below conditions:

- If the insured required urgent hospitalization because of an accident

- If the insured has already opted for an add-on protection for pre-existing disease that covers the individual from day 1.

So, if the insured requires any immediate medical aid like organ transplant due to accident, he/she can avail that under the health plan, but the same will not be provided by the insurer if the insured required it as part of a pre-existing disease. Likewise, if the policyholder buys a health plan with pre-existing diseases coverage, he/she might be able to avail the benefits of the health plan without considering the waiting period. However, you have to add this feature by paying an extra cost.

Besides the above two situations you need to complete the waiting period in health insurance for all the other cases before you could avail the benefits of your insurance.

You May Like: 5 Important Things You Should Avoid During Periods

What Are All The Coverages Available In Maternity Insurance

Different insurance companies provide different benefits when it comes to health insurance for pregnancy. Plans usually include complete maternity health insurance coverage, such as maternity-related hospitalisation bills up to 30 days before birth and 60 days after delivery, delivery expenses, including pre-and post-natal fees, hospitalisation charges, and newborn baby coverage. The coverage is available for normal as well as C-section deliveries.

Disability Insurance For Pregnancy

A short-term disability or maternity leave insurance plan is designed to replace the mother’s income during maternity leave and if her doctor orders bed rest. Some employers will pay the full salary amount when a woman goes on maternity leave, but not every company does. For this reason, you should consult your employer to find out its maternity leave policy. If it does not support maternity leave or only provides a few weeks’ worth of pay, then purchasing a short-term disability plan might be the best option.

Read Also: Why Do I Have My Period Twice A Month

Other Waiting Periods In Health Insurance Plans For Pregnancy

Apart from the maternity waiting period, there are the following waiting periods under health insurance plans for pregnancy:

- Initial Waiting Period

The initial waiting period is the time that the policyholder must wait after purchasing a health insurance policy for pregnancy in order to receive coverage benefits in the event of a claim.It is a precautionary measure that ensures that the policyholders do not buy the policy to misuse it. Usually, the insurance companies have an initial waiting period of 30 days, but it may vary from one insurance company to another.

- Pre-existing conditions waiting period

Usually, there is a waiting period clause for pre-existing diseases in health insurance plans for pregnancy. The coverage benefits cannot be availed of during this period. The waiting period for pre-existing conditions generally varies between 12 months and 48 months, but it depends on the insurance company.

- Disease-specific waiting period:

Every insurance company has a list of diseases that it does not cover for some time after the commencement of the policy. While some diseases may be covered by the insurance company from the beginning of the policy, some may not be covered for 1-2 years. The disease-specific waiting period may vary from one insurance company to another.

How High Is The Maternity Benefit Coverage Limit

CCW Global Insurance Brokers chooses only to work with global health insurance policies which are able to offer extremely high coverage limits, and consequently can provide extensive coverage for your maternity protection. With maternity specific limits ranging from US$ 10,000 to as high as US$ 20,000 we can give you the assurance your pregnancy has the protection you deserve no matter what happens.

More information about the general coverage limits available under a global medical insurance policy can be found by clicking Global Health Insurance Coverage Limits.

Read Also: Pregnancy Test Before Missed Period How Many Days

What Does The Caser Maternity Insurance Cover

Having a baby means lots of jabs, pokes and petroleum jelly. Between the blood tests and scans, prenatal classes and post-natal checkups, it feels like you spend more time at the doctor than at home. With Casers maternity coverage, you have one less thing to remember because of the wide net of services for the same monthly cost.

Prior to childbirth, coverage includes:

- Fertility treatment and assistance, like IUD and implantation

- Scans, bloodwork and prenatal screening, including screening for certain fetal abnormalities

- Prenatal classes

During labor and delivery:

- Access to a midwife, obstetrician, and pediatrician

- Anesthesia and an epidural, if desired

- Hospital stay with a private room and an additional bed for a partner

- Incubator for the newborn, if necessary

After arriving home:

- Digital assessment of the general condition of the mother and newborn, tips of baby care, help and advice

- The ability to add your child to your healthcare coverage without fee

- Pelvic floor rehabilitation assistance

In addition, you will have access to healthcare professionals 24 hours a day via Casers hotline. This will save you trips to the ER!

Getting Affordable Maternity Health Coverage

Sincepregnancy and giving birth are mandatory health benefits under the ACA, gettingaffordable maternity health coverage is as simple as finding the right healthinsurance plan for you and your growing family.

Youcan start shopping for a health insurance plan that fits your budgetary andcoverage needs at any point in the year. However, you can only enroll eitherduring the annual open enrollment period which runs from November 1stthrough December 15th in most states or during a specialenrollment period.

intuitive site and license health insurance agents help you compare your healthinsurance plan options to help you find the plan that suits you best. Keep inmind that eHealths help is completely free, you will not pay more for a planpurchased through eHealth than you would if you were to purchase it anywhereelse. Additionally, eHealths agents are always here to help you with questionseven after youve purchased a plan.

Startshopping for plans available in your area by entering your zip code below.

Don’t Miss: Why Would I Start My Period 5 Days Early

Maternity Health Insurance While Pregnant

When this happens, many patients may inadvertently receive care from an out-of-network provider, assuming they are in the network. The total charge resulting from out-of-pocket expenses is usually called a surprise medical bill. Couples expecting a newborn can prevent with some investigations.

According to Haney, prospective parents should try to choose a switching maternity health insurance while pregnant plan in which the mothers gynecologist. The hospital of their choice, the group of anesthesiologists and the nearest NICU unit participate as providers.

What if you dont go to the doctor during pregnancy?

For moms who skip prenatal care. The risk of a negative result increases when the problem is not treated. Any woman who gets pregnant after age 35 has a high-risk pregnancy. The same is true for any woman with a chronic disease. Who is pregnant with more than one fetus, or at risk of premature delivery.

- Best Pregnancy Health Insurance No Waiting Period and No Exam. Maternity Health Insurance. Get Best Price Compare Quotes.

Does Health Insurance Cover Pregnancy

Allmajor medical/ACA health plans cover pregnancy and childbirth. Under theAffordable Care Act, pregnancy and maternity care are one of the ten essentialhealth benefits that must be covered by health insurance plans offered toindividuals, families, and small groups.

Healthinsurance for pregnancy, labor, delivery, and newborn care became mandatory in2014 under the ACA.

you dont have health insurance, there may be free or discounted services forexpecting mothers in your area. There are also affordable options such ashospital indemnity policies however, these may not cover as many pregnancybenefits like a major medical health insurance plan would.

Read Also: Home Warranty 15 Day Waiting Period