What Is Apr And How Does It Work

APR, or annual percentage rate, is a little word that packs a big punch. Many Canadians think APR is the same as an interest rate, which isnt exactly right.

So then, what exactly is APR, how does it affect your , and how is it different than an interest rate? Lets take a closer look and see.

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

When Am I Eligible For A Credit Card Grace Period

Every credit card is different. But you typically qualify for a grace period only if youâve been paying your full balance on time every billing cycle. If thatâs the case with your card, you should remain eligible for a credit card grace period unless you start carrying a balance past your payment due date.

Also Check: Positions To Lay In To Relieve Period Cramps

Know Your Card’s Terms

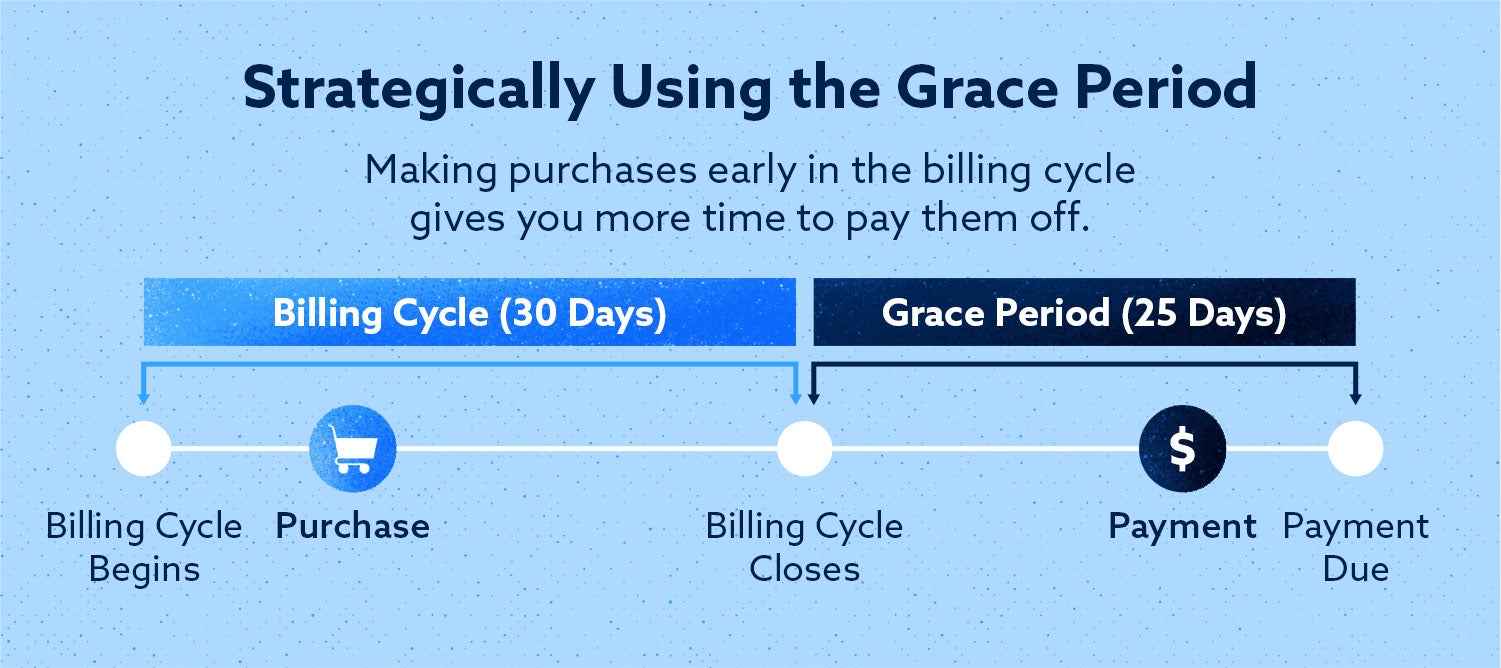

Federal law requires credit card companies to provide cardholders with a statement at least 21 days before their due date. Some card issuers may offer longer grace periods, however, which gives you a greater opportunity to maximize the feature.

You’ll want to figure out when your card’s statement closes and when the due date will be. These dates are typically decided when you open your account, so they may not be the same across all your credit cardseven if they were issued by the same company.

If you have multiple credit cards, some issuers may allow you to change your due date so you can align them all together. This will make it easier to manage your payments and grace periods because you won’t have to memorize multiple dates.

Credit And Cash Limits

a) Your credit limit is the maximum amount you can charge to your card. Cash advances, balance transfers, convenience cheques and Installment Plans are part of your credit limit. The amount you have left to spend is your available credit.

b) Your cash limit is the maximum amount of cash you can withdraw or transfer from your card. It includes cash advances, balance transfers and convenience cheques. Your cash limit is part of your total credit limit not extra money you can spend.

Don’t Miss: What Causes My Period To Be Late

Capital One Grace Periods

Minimum Length of Grace Period: 25 daysWhen It Applies: You must have paid your balance in full for 2 previous billing cycles to be eligible applies to regular purchasesWhen It Doesnt Apply: Revolving balances, cash advances, and balance transfers How Long To Reinstate a Lost Grace Period: Paying off balance for 2 consecutive pay periods

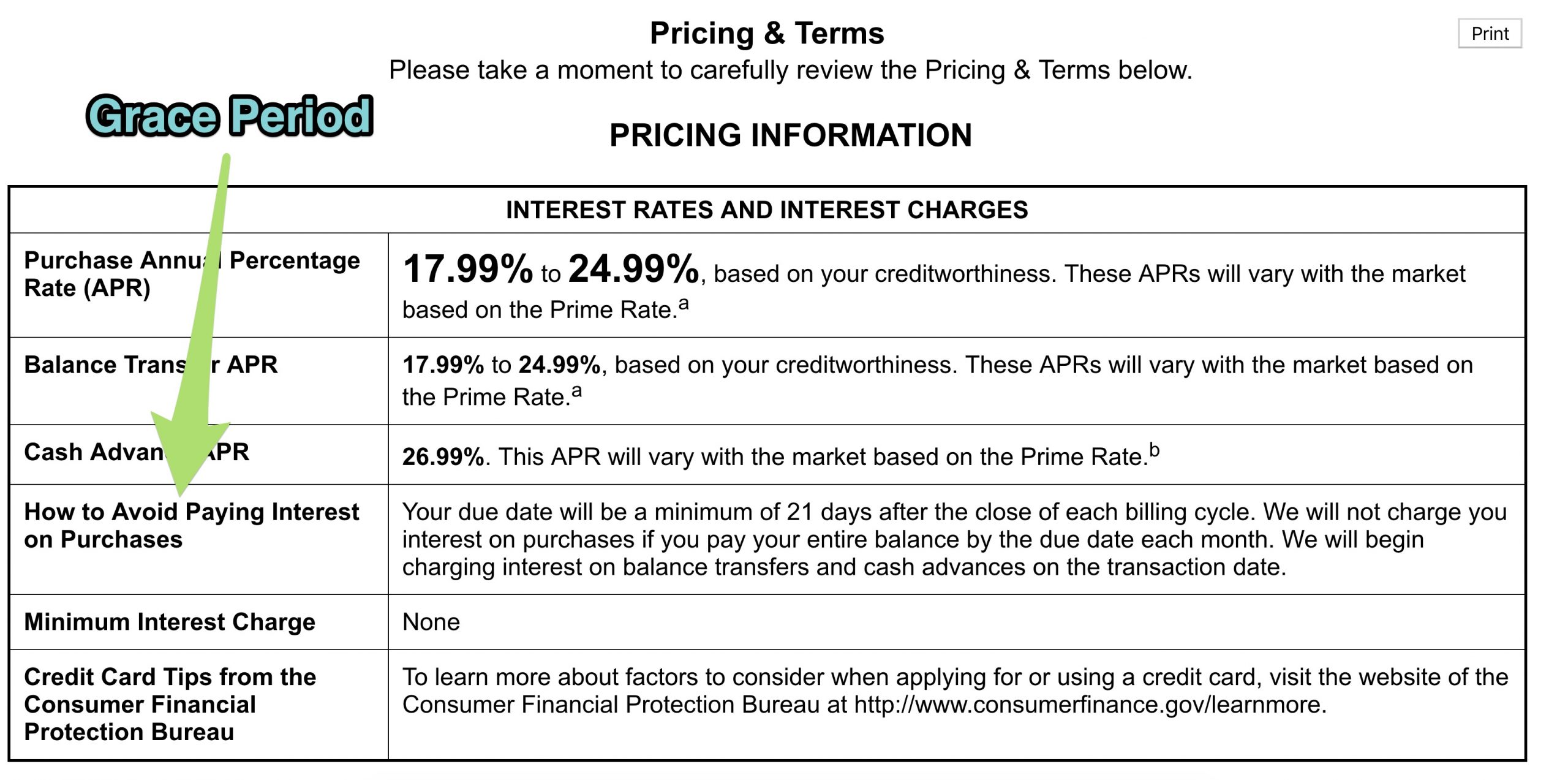

What Types Of Transactions Arent Eligible For A Grace Period

Credit card grace periods typically apply only to purchases. On other transactions, youâre sometimes charged interest right away. For example, most credit cards donât provide a grace period on cash advances or balance transfers. You may also be charged a fee for these types of transactions.

Keep in mind that a balance transfer could have a 0% APR for a limited time. But after the introductory period ends, your interest rate will usually increase.

Check your cardâs terms and conditions to find out whether you have a grace period and which kinds of transactions it covers. It could be especially important if youâre considering , which involves a balance transfer.

Also Check: 9 Year Old Starting Period Symptoms

How To Save On Credit Card Interest

Track your spending

Whether or not you currently carry a balance, keeping track of your credit card spending is crucial.

If you are carrying a balance, youll also want to limit your card spending and opt for cash instead until you clear off your balance.

Schedule regular payments to your credit card

You dont need to wait for your statement to arrive in the mail before paying down what you owe. Instead, make multiple payments per month to chip away at your balance faster.

Arguably the simplest way to do this is by setting up automated payments from your chequing account to your credit card. That way, you wont forget to make payments and youll guarantee that some of your money is being put towards your credit card debt before you spend it on something else.

Dont go overboard here though, because if youre not careful you may end up withdrawing more money than you have and get hit with overdraft fees. So, ensure your payments are consistent but manageable.

Using a balance transfer credit card

If you currently have a large balance on your credit card, youre likely paying an interest rate of upwards of 19.99%. What if you could pay 0.99% or 3.99% instead? By using a balance transfer credit card, thats a possibility.

-

BMO® Preferred Rate MasterCard®

Welcome Offer: Get a 3.99% introductory interest rate on Balance Transfers for 9 months with a 1% transfer fee and we’ll waive the $20 annual fee for the first year*

go to site

Use a low-interest credit card

| Categories |

|---|

Breaking Down Grace Period

Grace periods are usually about three weeks as federal regulations require credit card issuers to mail paper statements or deliver electronic statements at least 21 calendar days before the minimum payment due date. For example, if a statement is issued on January 31st and a payment is due on February 22nd, the grace period is the time between both dates. Cardholders will lose the grace period if they dont pay your entire statement balance by the due date.

The consequences of losing the grace period can be significant. The cardholder will not only have to pay interest on the part of the balance not paid off, but also on new purchases as soon as they make them.

Grace periods usually do not apply to cash advances or balance transfers. Unless eligible for a 0% promotion, cardholders will pay interest on these transactions from the day incurred.

Also Check: Can Ovarian Cyst Cause Missed Period

The Daily Balance Method

For the daily balance method, your credit card company will first divide your APR by 365 to get your daily percentage rate. Your credit card company will then multiply your balance by this rate at the end of each day. Finally, at the end of your billing cycle, theyll add all the daily charges up to calculate the total interest you owe for that month.

How To Avoid Trailing Interest

Paying your full balance on the last day of your billing cycle can help you avoid trailing interest that could unexpectedly cause you to lose your grace period or miss payments. Since interest still accrues on the days between the end of your billing period and the day you pay the bill, you could be under the impression that you’re paying all that you owe the credit card company, but actually still have a small amount left over.

If you stop checking your credit card statementsbecause you’re under the impression that you no longer owe the credit card issuerand miss a payment, then you’ll not only be punished by late fees and damages to your credit, but will also lose your eligibility for a grace period on the following billing cycle.

Don’t Miss: Are Periods Supposed To Be Painful

Limits On Grace Periods

Credit card companies don’t have to provide you with a grace period. But if your creditor offers you a grace periodand many usually dothen the details of that grace period should be clearly described in your credit card agreement. This includes the length of time you have to pay off the balance before incurring new finance charges.

Many credit card issuers don’t give you a grace period if you don’t pay off the balance each month. If you’re carrying a running balance each month, grace periods are effectively meaningless for you. If you don’t pay off the new balance in full, then interest and finance charges will usually run from the date you first made the charge. Interest charges on new purchases may start to accrue immediately if you have an unpaid balance on your credit card.

Even if the credit card company provides a grace period for credit card charges, it might not provide one for cash advances or balance transfers. In that case, you would need to pay those charges off immediately, and before the due date, to avoid finance charges.

How A Grace Period Can Help You Avoid Interest Chargesand How To Get It Back If You Lose It

If youâre looking for ways to avoid unnecessary expenses right now, itâs worth learning about credit card grace periods.

A credit card grace period can give you a little bit of breathing room between when you use your card to make a purchase and when you actually have to pay interest. And if you use it correctly, a grace period could help you avoid paying any interest on your purchases.

Read Also: Can I Go In The Pool With My Period

Can The Banks Really Do That

Unfortunately, you kind of agreed to it when you applied for the credit card and the banks wrote this 21 day grace if payment received in full. If the payment is not received in full, there is no grace period and youre charged interest on the entire value of your transaction from the moment you make your purchase.

Thats not to say the language used by the banks in cardholder agreements is entirely clear. In fact, Canadian banks didnt always charge interest on credit cards this way. Some used to only charge interest on the unpaid portion of your balance from the time of your purchase, if you made a partial payment on the due date. Unfortunately, how the banks apply interest to purchases is fairly ambiguous. We took it upon ourselves to read the disclosure statements from each of the Big 5 banks, and we still couldnt tell which of the interest application methodologies above were being used. In fact, given the ambiguity of the language, either one could be used.

We even called each call center to ask how interest was charged and only 3 out of 5 of the customer service reps from the Big 5 banks got it right themselves! The only time Banks are explicit on when it will apply interest charges is on cash transactions where banks clearly write there is no interest-free period for Cash Advances, Balance Transfers, or Convenience Cheques.

Payment Grace Period On Loans

Loans also have payment grace periods, but they’re not the same as those associated with a credit card. For a loan, the grace period occurs after a payment is due but when it can still be made without penalty. This period of time is typically around 15 days. Make sure to check with your loan provider before assuming that you have a grace period at all.

Student loans have a six-month grace period after you’ve graduated or your enrollment has dropped below half-time. After this six-month grace period, your student loan goes into repayment, and you’re required to make a payment each month.

According to the U.S. Department of Education, most loans will accrue interest during this six-month grace period, and you can choose to pay the interest during that time to prevent it from being added to the principal balance.

Don’t Miss: How To Get Rid Of Period Acne

When Does A Late Credit Card Payment Show Up On Credit Reports

Reading time: 2 minutes

Highlights:

- Even a single late or missed payment may impact credit reports and credit scores

- Late payments generally won’t end up on your credit reports for at least 30 days after you miss the payment

- Late fees may quickly be applied after the payment due date

If you are facing financial hardship because of a job loss or furlough, and having trouble paying credit card bills on time or if you just missed the due date by accident you may want to know when a late payment will appear on your credit reports, and if there is any kind of grace period.

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally wont end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

If youre only a few days or a couple of weeks late on the payment, and you make the full late payment before that 30 days is up, lenders and creditors may not report it to the credit bureaus as a late payment. Keep in mind, if you arent able to make the full payment, and only make a partial payment, it generally will be reported as late.

Heres how the process generally works:

On the account closing date, your statement or bill is generated.

A third date is the reporting date, which is usually the date your account information is reported to the nationwide .

At The End Of Every Billing Period Credit Card Statements Are Sent By Banks To Its Users That Includes A Summary Of Credit Card Transactions For A Certain Period

- FOLLOW US ON:

At the end of every billing period, credit card statements are sent by banks to its users that includes a summary of credit card transactions for a certain period. It is important to understand the fine prints of the statement to avoid getting overcharged by the bank and ending up with more debt. Apart from errors in your name, address and transactions, one should be able to spot things like unauthorised charges, billing errors, due dates, among others on the statement before paying the bill.

The statement date on the credit card bill is helpful to calculate late payment fee. In case you miss out on paying your dues within a stipulated time, then interest will be levied on the amount due and the interest calculation takes the statement date into account.

Another important thing on the credit card bill is the due date. This is the date by which the bank expects to receive payment without any additional charges. However, it is not the date on which payment needs to be made. For instance, if someone makes a credit card payment using a cheque, he/she must deposit cheque at least a week in advance to avoid delay in payments due to unforeseen circumstances.

Read Also: How To Count Next Period Date