Cigna Dental Vision Hearing 3500

Cost: $61.95 average monthly premium4

$2500 in dental benefits per calendar year$0 dental check-ups, including cleanings and routine x-rays 5Covers basic and major restorative services 7,8Vision exams covered at 90%, or up to $100$300 to use for lenses, frames, contactsHearing exams covered up to $50Hearing aids covered up to $700

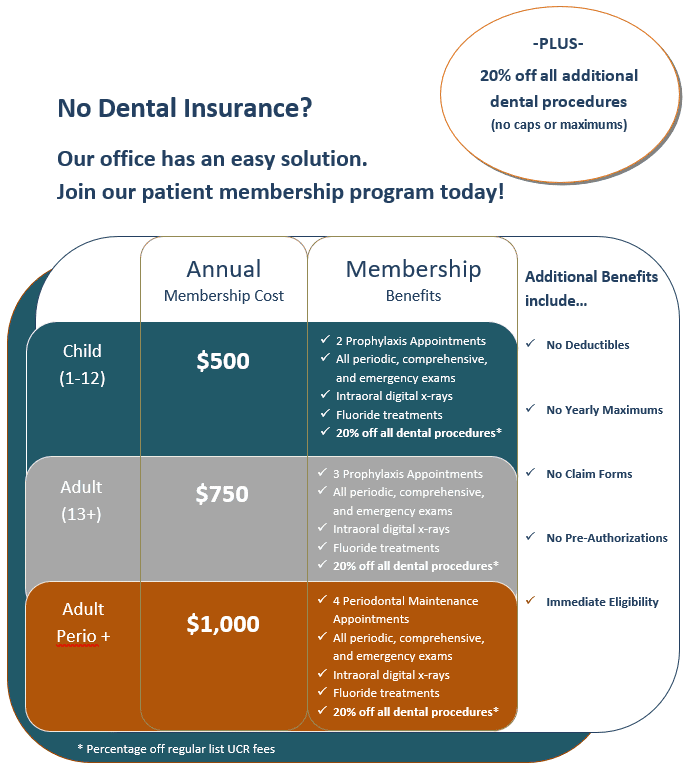

Looking for additional savings on your dental care? Learn more about our discount plans

Waiting Periods: If youve recently had prior dental coverage, waiting periods may be waived for select procedures. Review details for your state and plan by going to plan documents. View Dental Plan Documents

View State Policy Disclosures, Exclusions, Limitations, and Reductions

Best Basic Coverage: Unitedhealthcare

- Coverage Limit: $1,000 to $3,000

- States Available: 47

UnitedHealthcare is our review’s best for basic coverage with several affordable choices that cover all of your basic dental needs, and most of UnitedHealthcares dental insurance policies impose no waiting period for these basic services, accompanied by low coinsurance rates that decrease every year you stay with the provider.

-

Low coinsurance fees for basic services

-

No wait for preventive coverage and often basic too

-

Six-month waiting period for major services on some plans

-

Only one plan to cover orthodontics

-

Poor coverage for major services

Even with good oral hygiene and routine preventive care, most people need basic dental services such as fillings at some point. If youre looking for insurance to cover these treatments and you dont want to wait six months to a year for the policy to take effect, we recommend UnitedHealthcare. Seven of the providers 10 dental plans have no waiting period for either preventive and basic services.

UnitedHealthcare offers a wide array of dental policies. Many cover major services, but usually with a six-month wait. However, just one plan covers orthodontics, but coverage wont begin until 12 months after the policy start date.

How To Get Dental Implants Covered By Insurance

Dental implants are eligible for coverage if tooth loss results from injury, trauma, or a medical condition. Congenitally missing teeth are not covered. Additionally, coverage only applies to the root replacement . The actual missing tooth may be excluded.

Dental discount plans could help save on implants by reimbursing a portion of the payment. You can combine discount plans with your insurance coverage as long as your doctor accepts them.

Don’t Miss: How To Stop Getting Bv After Period

Can You Get Full Coverage Dental Insurance Without A Waiting Period

Yes, there are full coverage dental plans without a waiting period. A waiting period is the period of time between your plan start date and when you are actually covered to receive certain kinds of care.

Often a plan will cover you for preventive care right away, but ask you to wait a certain amount of time before it will cover you for more complex and costly care. So, for example, you may be able to get your teeth cleaned once your plan begins, but you may have a waiting period before you can get something like a crown.

Is Dental Insurance Worth Purchasing

Yes, as it can both help you save money on dental procedures and it can be a strong incentive to keep those preventive-care appointments. If youve already spent money for the insurance, youre more likely to go to the dentist. In the long run, a smaller amount spent on cleanings and X-rays can help prevent more money needed for more time-consuming and costly dental procedures.

Don’t Miss: How Do You Know If You Missed Your Period

What Is Not Covered By Dental Insurance

This depends on the type of dental insurance plan you choose. For example, dental services like bridges, crowns, dentures, and root canals may not be covered if you only buy a preventive dental plan. Here are some kinds of dental treatments that may not be covered:

- Anything cosmetic, such as teeth whitening and veneers.

- Orthodontic appliances such as braces, removable teeth aligners, or retainers may not be included in all types of dental plans. If you are looking for dental insurance with orthodontic benefits, be sure you understand the details of any plan youre considering. For example, there could be differences in coverage for the orthodontists services versus the coverage for the actual orthodontic appliances, like braces or retainers.

The key to making sure your dental plan covers certain types of treatment is to plan ahead for the dental care you and your family expect to need.

Best Major Coverage: Spirit Dental

Spirit Dental

- Coverage Limit: $750 to $5,000

- States Available: 50

Spirit Dental is our best for major coverage, as it offers eight policies with no waiting period and competitive coinsurance rates for major services. Diverse coverage options allow you to find the right balance between monthly premiums, annual maximums, and out-of-network flexibility.

-

No waiting periods for any covered procedures

-

One-time deductible of $100

-

Annual limits up to $5,000

-

High out-of-pocket costs for orthodontics

-

Expensive monthly premiums

-

Less favorable terms in the first year

No one wants to think about undergoing major dental work like crowns, implants, and procedures that require anesthesia. But when these expensive treatments come up, having an insurance policy that covers them can provide some financial peace of mind.

Spirit Dental is one of the few dental insurance companies that doesnt impose a waiting period for major services on any of its policies.

You can get a quote quickly on Spirit’s website to see what your premiums would be. Each plan has a single lifetime deductible of just $100 per person, and plans are distinguished by annual maximums, which range from $750 to $5,000. You can choose between in-network and out-of-network coverage, although the latter will result in higher monthly premiums.

Don’t Miss: How To Have Sex On Your Period

Best For Orthodontics: Delta Dental

Delta Dental

- Coverage Limit: $1,000 to unlimited

- States Available: 50

Delta Dental has several dental insurance plans that include orthodontic care for both children and adults, whereas most other providers don’t have multiple, affordable orthodontia choices.

-

Some plans include orthodontic care.

-

There are no out-of-pocket cost for preventive care on most plans.

-

There is a large network of providers.

-

Annual maximum benefit amounts are low.

-

Orthodontic care is covered at only 50%.

Delta Dental belongs to one of the nations largest dental provider networks, which makes it easy to choose from more than 152,000 dentists in its networks. Delta Dental also boasts an A rating from AM Besta testament to the financial strength of the company.

While plan details vary from state to state, Delta Dental offers several different types of insurance, including options that cover orthodontic care. With its individual PPO plans, for example, orthodontics are covered at 50% for children and adults. A $50 deductible applies, as does a $1,500 annual maximum for care.

Preventive care like cleanings and X-rays is covered at 100%, and all basic and major services, including root canals, implants, and crowns, are covered at 50%.

Pricing and plan options vary between states. Head to Delta Dental’s website to see what they offer in your locality.

What Does Dental Insurance Cover

What your dental insurance covers depends on the plan you choose. Here are the types of coverage you may consider when shopping for a dental plan:

- Preventive dental care:Most dental plans cover you for certain preventive care at $0 cost. This often includes a dental exam and cleaning every six months, as well as certain types of mouth x-rays. There may also be coverage for sealants, fluoride, and more for children.

- Restorative care:This includes everything from fillings for cavities and tooth extractions, to root canals, crowns, bridges, dentures, and more. Treatments like these range from basic to major. The more complex and specialized your dental care, the more costly it may be. If you expect to need dental care that goes beyond your preventive dental exams, you may want to explore dental plans that offer you more coverage for restorative services like these.

- Orthodontic care:This area of dental specialization is focused on correcting teeth and bite alignment. If you or a family member expect to need this type of dental care, look for dental insurance that includes coverage for orthodontic services.

Read Also: What Is The Gestation Period Of An Elephant

Our Top Picks For Best Dental Insurance Plans

- Ranks below industry average in J.D Power’s 2021 Dental Plan Satisfaction Study

- No orthodontic coverage for adults

Why we chose it: Guardian Direct stands out because it includes 50% major work coverage on every policy except the Starter, its preventive-only plan option.

Starting at $23.62, Guardian Direct‘s Core plan covers procedures such as crowns, oral surgery, implants and dentures. Annual maximum limits start at $500 and go up to $1,000 by year three, while dental implants have a separate lifetime maximum of $700.

The middle tier, the Achiever plan, adds orthodontic benefits for people under 19 years of age and increases the annual maximum limits. The plan starts with a $1,000 limit and goes up to $1,500 by the third year.

Finally, the Diamond plan starts with a maximum payout limit of $1,500 for the first year, and adds coverage for teeth whitening .

| Plan type |

- No waiting period on preventive services

- Available on state and federal exchanges

- Some plans include teeth whitening

- Available plans vary significantly per state

Why we chose it: Delta Dentals nationwide availability, comprehensive dental benefits and no upper age limit for braces make it an excellent choice for families and individuals in need of orthodontic care.

Delta Dental is one of the few providers that extends orthodontic benefits to children and people over 19 years of age. Sample quotes from California, Florida and New York returned three plan options, two of which include orthodontic coverage.

Supplementary Health And Dental Insurance Faqs

Follow us

Don’t Miss: Light Period On Birth Control Pills

Class Iii: Major Restorative Services

| Privacy Notice Statement | Privacy PolicyTrout Insurance is an Independent Insurance Agency Based in WNC. |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or call 1.800.Medicare to get information on all of your options.

Does Cigna Dental Insurance Have A Waiting Period

Your body does a pretty good job healing minor injuries such as scrapes and bruises. But dental damage is different. Minor dental problems wont heal on their own. Instead, if left untreated, theyll always grow worse over time. Youll want to visit a dentist at the first sign of a dental problem but dental insurance wait periods can limit your treatment options.

Heres a closer look at Cigna dental waiting periods, how they might affect treatment and what other options you have for treating dental problems quickly:

Recommended Reading: Could You Be Pregnant And Have Your Period

What Is Full Coverage Dental Insurance

Full coverage dental insurance includes plans that help cover you for preventive care, as well as basic and major restorative care, and in some cases orthodontic treatment. The term, full coverage means youre getting benefits for a lot of different types of dental treatments and procedures. For example, you may have coverage for more costly things like root canals, bridges, and implants, as well as coverage for your preventive dental care . Full coverage does not mean your plan covers 100% of all costs, however.

Dental Deductible Copay And Coinsurance

Here are the basic costs associated with most dental plans. Youll want to make sure you understand them when choosing a plan:

- A dental deductibleis a set dollar amount you are required to pay before your dental plan starts to help pay. You will pay your dentist for any non-preventive dental care until you meet this plan deductible. Preventive dental care is covered 100% by most dental plans, so the deductible doesnt apply to these plans.

- Dental copaysare fees you may have to pay when you visit a dentist. Usually you pay the copay at the time of the visit. It may count toward meeting your deductible.

- Coinsuranceis the term used to describe how you and your dental plan share costs, once you meet your deductible. In your dental plan details, coinsurance is often shown as a percentage of what you will pay versus what your plan will pay. For example, a coinsurance of 80%/20% means the plan pays 80% of the costs and you pay 20%.

Don’t Miss: When Your Period Is Heavier Than Usual

What Are The Benefits Of Having Dental Insurance

The benefits of dental insurance can include:

- Lower out-of-pocket costs for non-preventive dental care:Without dental insurance, you end up paying the full cost for dental treatments and procedures. Your insurance company negotiates with the dentists in its network to offer you lower costs. This is how a dental plan helps protect you from the high cost of dental care.

- $0 preventive dental care:Most dental plans cover you 100% for routine preventive dental care. These plans include a dental exam, cleaning, and some x-rays every six months. For children it may also include fluoride and other pediatric preventive dental care.

- Good dental health impacts other health, too:Good dental health can help you identify health problems before they become major. During your regular oral exam, your dentist not only cleans and polishes your teeth, but they also check your whole mouth, throat, and tongue for cancer and other potentially serious issues. Keeping teeth and gums healthy can also help avoid serious health problems like heart disease. For existing health problems, poor oral health can actually worsen things like diabetes and coronary artery disease1.

Affordable Cigna Dental Insurance Plans

If you are buying dental insurance on your own, we make it easy to find an affordable plan, including options that bundle vision and hearing coverage. Our plans start from less than a $1 day.1 Shop year-round, 24/7/365, and join the over 18 million customers who choose Cigna Dental.2

Shop and compare Dental plans now

Find in-network dentists, too, in a few short steps.

Or, you can call for a free quote, Mon-Fri, 8 am – 8 pm, ET

Recommended Reading: Taking A Pregnancy Test Before Missed Period

Best For Veterans: Metlife

- Coverage Limit: $1,000 to $3,500

- States Available: 50

If youre receiving VA health benefits, MetLifes VADIP dental insurance plans offer no waiting periods alongside other perks for veterans and is the best we found here for veterans.

-

Affordable coverage for veterans and their dependents

-

500,000 provider network access locations

-

Annual maximums as high as $3,500

-

Must be enrolled in the VA health care program for the veterans dental plan

-

Only two policy options available

-

24-month waiting period for orthodontics

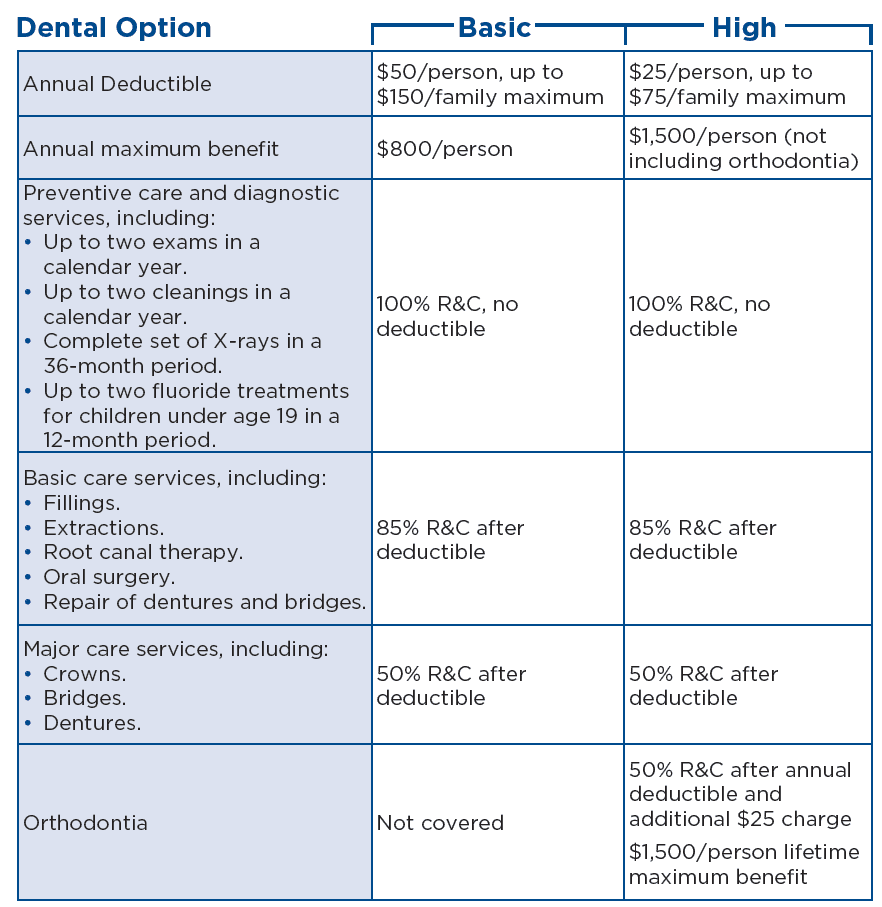

Insurance provider MetLife enforces waiting periods for most of its policies, but these are waived for retired service members through the Veterans Affairs Dental Insurance Program . Open to any veteran enrolled in the VA health care program, these dental policies are available at two coverage levels: Basic and High. For the standard plan, a single veteran will be charged between $28.89 and $33.80 a month. For the high plan, a single veteran will be charged between $61.14 and $71.53 a month.

MetLife is a global insurance provider offering insurance in many lines and has been doing business since 1868. The company holds an A+ rating from AM Best, indicating solid financial strength. MetLifes dental network for veterans includes over 500,000 participating locations, one of the largest in the country.

Find Out What Treatments Have A Waiting Period

Your insurance plan wont have a waiting period on everything. Ask your dentist if theres another treatment option available. One may have a waiting period, while another does not. Or, the waiting period might be shorter for a less-expensive treatment than one that is more complex.

For example, if your dental insurance has a waiting period clause, you may only need to wait for three months to have a tooth filled, but two or three times that if youre getting a crown. Its best to treat the tooth sooner when the cavity is least invasive.

Fortunately, preventive treatments like exams, cleanings, sealants, etc. usually do not have any type of a waiting period. In fact, theyre typically covered at 100%, regardless of the type of insurance company that youre going through. But once your oral health needs expand into restorative or major services, you need someone who understands the fine print. Otherwise, you wont realize theres a problem until its too late.

Read Also: Why Am I Not Having My Period