Do I Have To Pay Employees For An Extra Payday In A Year

You’re not required to pay salaried employees more than their annual salary in years when you have extra pay periods. Some employers choose to reduce pay across all paychecks for the year to adjust for the extra payday.

This can be hard to explain to employees, though. Other employers simply absorb the expense of the extra paychecks.

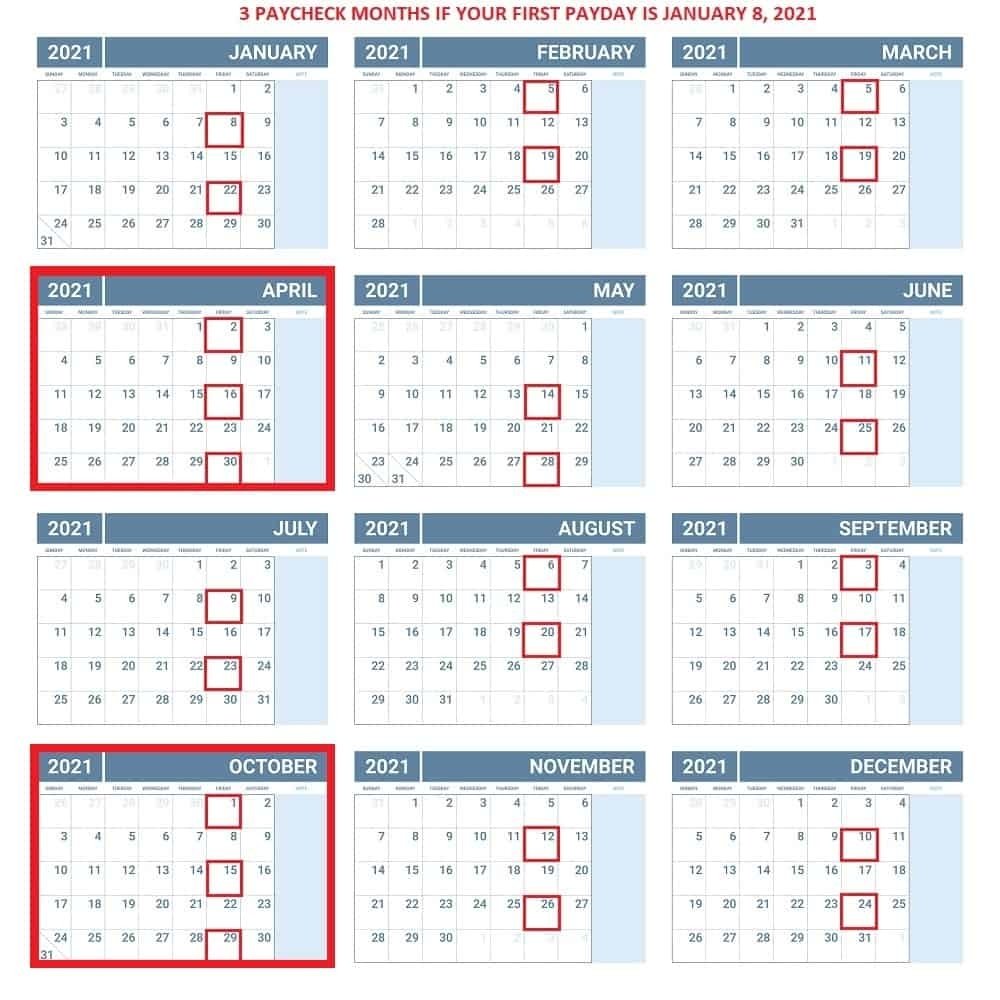

Paycheck Months In 2021 If Youre Paid Every Other Friday

- If your first paycheck of 2021 is Friday, January 1, your three paycheck months are . However, since January 1 is a holiday, some employers may process payroll on December 31, 2020.

- If your first paycheck of 2021 is Friday, January 8, your three paycheck months are.

If you want to plan for next year, see my related article on the three paycheck months for 2022!

With A Biweekly Pay Period An Employee Receives 26 Paychecks Per Year

How Many Paychecks Do You Get in a Year. End of pay period 2021 payroll schedule holidays june september october november march december january april july february. As we enter 2021 it is important to note that some employers will have 27 pay periods this year due to the extra Friday that falls on the payroll calendar.

Depending on the pay frequency the number of pay periods in the tax year is determined. 142011 13416 pm. 2021 payroll how many biweekly paychecks in 2021 2021 pay periods how many biweekly paychecks in 2021 2021 pay schedule 3 how many biweekly paychecks in 2021 gsa opm federal pay.

If so this marks the first of three months where employees can expect three paychecks in a single month. This pay period is used exclusively for salaried employees. Whats Different About the Pay Period Calendar in 2021.

That is two extra paychecks a year. Biweekly Paydays July 2021 October 2021 March 2021 June 2021 April 2021 February 2021 May 2021 August 2021 September 2021 December 2021 January 2021 November 2021. Much of this depends on whether or not your company delivers paychecks to teammates on Friday Jan.

1 which is a holiday. Fortunately this is helpful information for you to have too. But if you get paid biweekly you will get 26 paychecks a year.

Matthew W Smith Created Date. This refers to your base pay only. This will enable you to see many aspects of operating a business ahead as you will know when to process payroll and when to issue paychecks.

Also Check: Cramps And Lower Back Pain No Period

What If I Dont Get Paid On Fridays

Not every company does their payroll on Fridays. If you get paid every two weeks, but not on Fridays, you can see from the pictures above its pretty easy to figure out your three check months.

Grab a calendar and a pen then start circling your paydays starting with the day you got your first paycheck in 2021. Thats all there is to it!

Who Does This Extra Pay Period Affect

Two kinds of pay periods for salaried employees are often confused. The pay for these employees is annual pay, paid monthly, semi-monthly, or bi-weekly. Semi-monthly is twice a month, resulting in 24 payments in a year, while bi-weekly is every other week, resulting in 26 payments in a year.

The extra pay period affects salaried employees who are paid bi-weekly . Here’s an example:

Jerry is a salaried employee paid $28,000 a year, on a bi-weekly pay basis. Each pay period during a “normal” year of 26 pay periods, he receives $1076.92. But if there is an extra pay period in a year, he would receive an extra paycheck, more than his actual salary.

Also Check: When Should You Try For A Baby After Your Period

How Many Paychecks Do You Get In 2022

If you get paid biweekly, there are two months in 2022 in which you will get three paychecks. If you get paid twice a month, you will get 24 paychecks a year usually on the 1st and 15th of the month. But if you get paid biweekly, you will get 26 paychecks a year. That is two extra paychecks a year.

How Many Paychecks Do You Get In 2021

As I mentioned earlier, you normally receive 26 checks a year when youre paid every other week. But there are actually 53 Fridays in 2021, so some people may receive 27 checks instead of 26. When I did more research, I learned that this is called a payroll leap year and it can result in one more payday than normal.

Read Also: My Period Has Been On For 2 Weeks

Can I Change My Pay Schedule

Once you choose a pay schedule, you may change it, but not frequently and not in a way that reduces your employees’ pay. For example, adjusting a pay period to avoid paying overtime to someone would violate the FLSA.

Changing your company’s pay schedule after several years for a legitimate business reason would be permissible, though.

Biweekly Vs Semimonthly Payroll Periods

If you get paid semimonthly, on the 15th and 30th of every month for example, thats twenty-four paychecks a year.

If you get paid biweekly, say every other Friday, that works out to twenty-six checks a year.

Getting twenty-six checks per year means there will be two months each year where you receive three paychecks instead of two.

So which months are the three paycheck months in 2021? That depends on when you receive your first check this year.

Read Also: Can Your Period Cause A Uti

How To Take Advantage Of A 3

Employers arent in the habit of just handing out extra paychecks a couple of times a year, unfortunately. But heres a simple monthly budgeting technique that will make that third check feel like a windfall: create your monthly budget based on your usual two paychecks a month.

If you do that, all your expenses for the month will be covered since you budgeted for them based on a normal, two paycheck month. When that third paycheck arrives, youll find yourself with extra cash. If you havent started budgeting yet, a three paycheck month is a perfect time to create your first budget.

Treat that money like a cash bonus. You can do whatever you want with it, but here are some ideas to get you started:

First Paycheck: January 8 2021

If your first paycheck of 2021 is on Friday, January 8, the payroll leap year will not affect you. Youll only receive two paychecks in January, and your three paycheck months are April and October 2021.

First Paycheck: Friday, January 1, 2021

Paydays for 2021:

First Paycheck: Friday, January 8, 2021

Paydays for 2021:

Of course, not everyone is paid on Fridays. But you can determine your three paycheck months for 2021 by pulling out a calendar, marking your paydays and finding the months with three of them.

You May Like: How To Get Rid Of Period Acne

Hr Calendar: What Else You Need To Know

Theres more to a new year than pay periods. Stay on track from January through December with this comprehensive 2021 HR calendar, featuring everything you need to know about major holidays, key compliance requirements, ACA deadlines, and more.

Additionally, HR needs to adhere to the myriad compliance notices that apply to employee benefits in 2021. For more information about how you can prepare for the new year, follow the BerniePortal blog.

Your Decision Has Other Effects

Payroll TaxesThe amount of pay will affect the total Social Security and Medicare you and your employees pay. Some employees may reach the maximum Social Security contribution earlier and may reach the threshold for the additional Medicare tax if you make an additional payment.

Employee BenefitsPaying additional salary may also result in paying additional benefits. For example, you might be over-funding someone’s 401 with the extra pay period, beyond the maximum allowable amount. If that happens, you would have to give back the money to the employee.

Tax Year for W-2sHaving a pay period extend over the end of a year brings up the issue of which year’s taxes the payment is in. The general rule is that the tax should be on the W-2 for the year when the paycheck is issued, and the employee has use of it.

Don’t Miss: Why Do I Get So Depressed On My Period

Paycheck Months In : What You Need To Know

For most of my career as a salaried employee, Ive been paid biweekly and have received 26 paychecks a year. Thats two more than people who are paid twice a month.

Heres the simple math:

- Biweekly: 52 weeks ÷ 2 = 26 paychecks

- Twice a month: 12 months × 2 = 24 paychecks

Every year, I pull out a calendar and identify the three paycheck months based on my employers pay schedule. But when I reviewed the 2021 calendar for biweekly workers who are paid on Fridays, I realized that its not a typical year for everyone.

Payroll Calendar: 27 Possible Biweekly Pay Periods In 2021

As HR prepares for the new year, its key to stay ahead of the curve on important dates and compliance requirements. One noteworthy takeaway is that in 2021, some employees and employers can expect 27 pay periods during the payroll calendar instead of the typical 26. Heres what you need to know.

Don’t Miss: Why Does My Period So Heavy

First Paycheck: January 1 2021

- If your first paycheck of 2021 is on Friday, January 1, you may receive three paychecks that month. The other two are January 15 and January 29.

- However, since New Years Day is a bank holiday, many employers will schedule payroll on December 31, 2020. If thats the case, December 2020 was a three paycheck month for you and January 2021 isnt.

- are the other three paycheck months for biweekly workers on this schedule.

Whats Different About The Pay Period Calendar In 2021

There are 53 Fridays in 2021, meaning that some employees can expect 27 biweekly paychecks throughout the new year.

Much of this depends on whether or not your company delivers paychecks to teammates on Friday, Jan. 1, which is a holiday. If so, this marks the first of three months where employees can expect three paychecks in a single month. Assuming this is the case, the other three-paycheck months in 2021 will be July and December.

Read Also: How To Make Period Stop Immediately

Getting Three Paychecks In A Month

Three paycheck months offer you many options to better your financial situation. You can pay off debt, get ahead on your bills, take care of a major expense, or make your future a little more secure.

Taking a vacation or buying a new outfit with a portion of the extra check wont wreck your budget. That third check is a good opportunity. When those three paycheck months roll around, be intentional with your money no matter how you decide to use it.

Overview: What Are Pay Periods

Pay periods are recurring time periods for which employee wages are calculated and paid. The Fair Labor Standards Act requires businesses to pay employees on their “regular payday,” but it doesn’t specify how often those paydays must come.

Instead, states have set their own standards through payday frequency laws.

The most common pay periods are weekly, biweekly, semi-monthly, and monthly. No states allow bimonthly pay schedules. In most states, paying at least semi-monthly is acceptable, but some states have more stringent requirements.

In Connecticut, for example, businesses must pay weekly unless they get approval from the labor commission for longer pay periods. Be sure to verify your state’s laws when setting up payroll.

How often you pay employees is an important decision not only because of its effect on recruiting and retention, but because you need to be able to deliver paychecks consistently based on the schedule you create.

Missing your regular payday, even by as little as a day or two, opens you up to FLSA complaints. The cost of a wage violation can be steep, including double back wages and other penalties.

There are also strategic considerations when setting pay frequency. Employees value shorter pay periods, yet each payroll run costs your business in administrative hours or vendor expense. You’ll need to balance the administrative costs with your talent management goals to find the right frequency for your business.

Don’t Miss: Periodic Table Of Elements Shower Curtain

Can A Year Have 27 Pay Periods

We generally calculate employees salaries, contributions and deductions based on a 52-week calendar year, not bothering to count the leap year. In fact, companies with biweekly pay periods will have 27 pay periods only every 11 years, and companies with weekly pay periods will have 53 every 5-6 years.

What Should I Do With An Extra Paycheck

Best Ways to Use Your Extra PaycheckBuild Your Emergency Savings Fund. Experts advise consumers to have at least 9 months worth of income saved in case of an emergency or a period of unemployment. Pay Down Debt. Make an Extra House or Car Payment. Save for Financial Goals. Invest for the Future.

You May Like: When Does A Girl Start Her Period

Pay Period Leap Years

In some years, the calendar calls for an extra pay period for certain employees. This is a pay period leap year, and it affects salaried employees on a bi-weekly pay period. If the calendar lines up properly, the year will include a 27th pay period. Employers who are looking out far in advance can adjust employees paychecks so that their salary is divided equally into 27 payments rather than 26. If you dont plan ahead for a leap year, you have a few different options to deal with the extra pay period. Learn more in this article on pay period leap years.

As mentioned above, pay for salaried employees is typically distributed by dividing an annual salary into the appropriate number of payments for the year. Thus, on a monthly pay period, you would divide an employees annual salary by 12 to determine how much they should be paid in each period. How you time your pay periods does not matter so long as you ensure employees receive their full salary for the year.

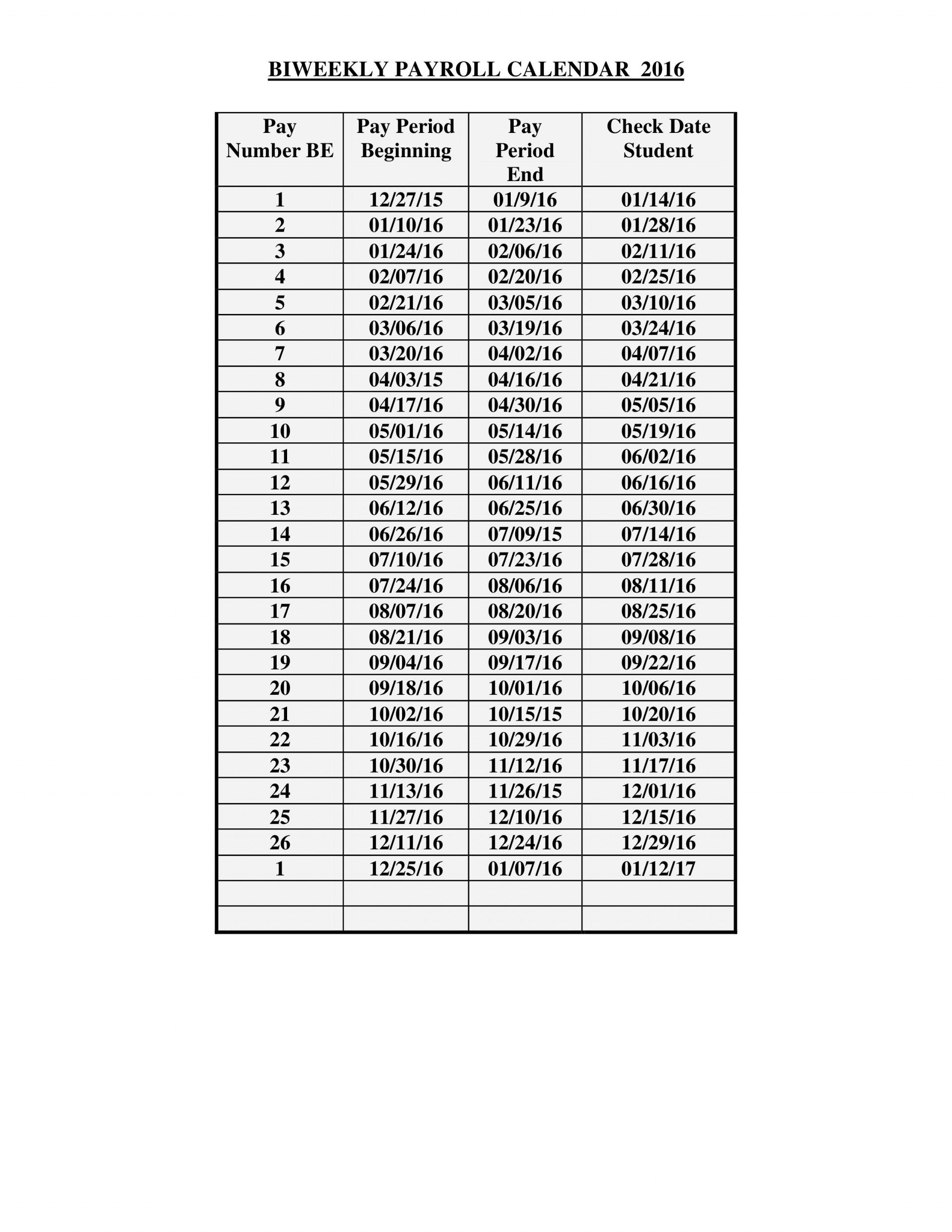

2021 Pay Period Calendar NFC USDA

How Many Pay Periods Are In A Year

There can be as many as 52 pay periods in a year or as few as 12. The number is ultimately determined by the employer unless the workplace or the employees are in a state that has specific payday requirements. Its important for business owners to strike a balance between the cost of running payroll and the financial needs of their staff.

Recommended Reading: Why Do I Have 2 Periods A Month