How Do I Choose An Individual Health Plan

Once you know you qualify for an SEP, it is time to consider your coverage options. Careful thought should be taken when considering a health plan. Evaluate the coverage options that support the needs of you and your family.

The federal Health Insurance Marketplace at healthcare.gov is a great option if you may qualify for financial assistance. See if you qualify, as this will help lower your monthly premiums and potentially reduce your out-of-pocket costs. The federal Health Insurance Marketplace does count loss of coverage as a qualifying life event for an SEP, but documentation proving loss of employer coverage is required.

Should you or your dependents qualify for Medicaid or the Childrens Health Insurance Program , you can enroll in both programs year round.

If you would rather select coverage through a local provider-owned health plan, Sanford Health Plan offers multiple options to meet your needs, lifestyle and budget, with:

- Affordable monthly premiums

- Savings on dental, vision and hearing services

- A team dedicated to your whole health

Are you an employer? Download the Sanford Health Plan Employer Guide for resources and support to help you maintain coverage for your employees or to assist your employees in finding covered due to an SEP.

Changing Medicare Advantage Plans Or Part D Plans Outside Of Open Enrollment

Many Medicare beneficiaries enroll in a Medicare Advantage plan or a Medicare Part D prescription drug plan during the Medicare Open Enrollment Period for Medicare Advantage and prescription drug plans.

During this period , you can make a number of coverage changes:

- You can change from one Medicare Advantage plan to another, whether or not either plan includes prescription drug coverage.

- You can disenroll from your Medicare Advantage plan and switch back to Original Medicare .

- If you switch back to Original Medicare during this period, you can join a Medicare Part D prescription drug plan.

If you dont enroll in a Medicare plan during this annual period, you may qualify for a Special Enrollment Period.

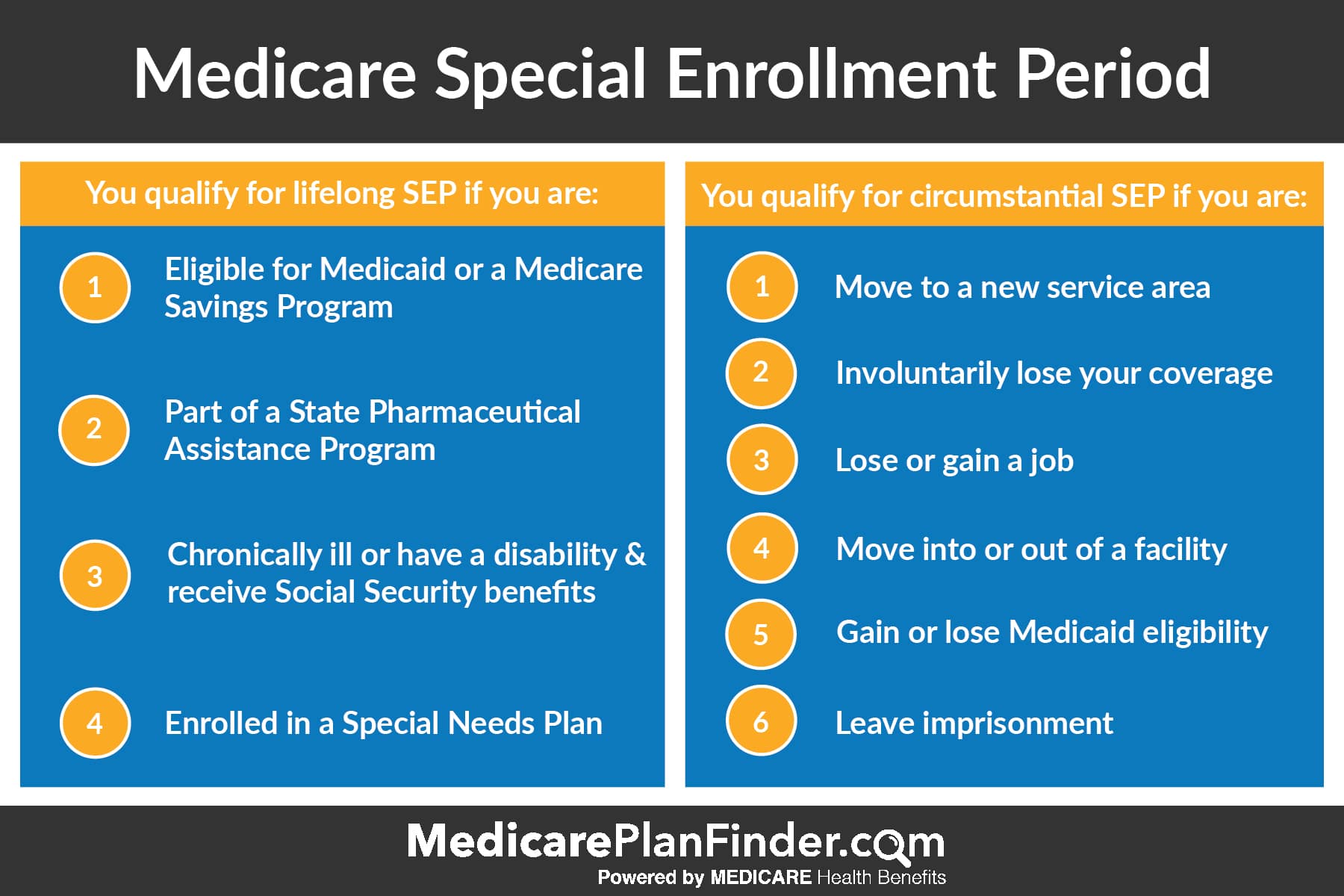

There are many ways to qualify for a Medicare Advantage Special Enrollment Period or a Medicare Part D Special Enrollment Period.

Some of the situations that may qualify you for one of these types of Special Enrollment Periods include:

The above list does not necessarily include every and all qualifications for a Special Enrollment Period.

Is There A Special Enrollment Period For Part D Of Medicare

With trial rights for Medicare Advantage, the 12 months also serve as a Special Enrollment Period for Part D. Thus, if you arent satisfied with your Advantage plan and choose to drop the coverage for Original Medicare during your 12 months of trial rights, you have this opportunity to pair it with a Part D plan. You may pick up the Part D plan regardless of whether you choose to enroll in a new Medigap plan.

Don’t Miss: 90 Day Probationary Period Letter

How Do I Enroll During A Special Enrollment Period In 2019

To apply for a health insurance plan during a Special Enrollment Period in 2019, you must first verify that you have a Qualifying Life Event. Then, you can apply for health insurance on the Health Insurance Marketplace either through HealthSherpa, HealthCare.gov or your state based Marketplace. If youre looking for help over the phone, the HealthSherpa Consumer Advocate team is well-trained to help you assess your Special Enrollment Period eligibility. They can also compare your Marketplace plan options and get you enrolled in a plan that best serves your health and financial needs.

You Have A Chance To Get Other Coverage

- I have a chance to enroll in other coverage offered by my employer or union.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan to enroll in the private plan offered by your employer or union.

When?

Whenever your employer or union allows you to make changes in your plan.

- I have or am enrolling in other drug coverage as good as Medicare prescription drug coverage .

-

What can I do?

Drop your current Medicare Advantage Plan with drug coverage or your Medicare Prescription Drug Plan.

When?

- I enrolled in a Program of All-inclusive Care for the Elderly plan.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan.

When?

Anytime.

Also Check: Usaa New Car Insurance Grace Period

Changes Due To Other Circumstances

You may find yourself in a position where you face a different set of circumstances that qualify you for a SEP.

No Longer Qualify for Extra Help

Those no longer eligible for Extra Help in the upcoming year have several options. You can choose to join a new plan or switch your plan. Further, you can drop your Advantage plan and return to Medicare, or you can choose to decline your drug coverage. You can make changes to your policy for three months from the date in which youre no longer eligible, or the notification date.

Ineligible for Medicaid

Those no longer eligible for Medicaid coverage can enroll in a new plan, switch plans, drop advantage plan and return to Medicare, or even drop Part D. You can make these changes up to three months from the date that youre no longer eligible for Medicaid, or when you get a notification.

What Is The Medicare Low

Id like to give you a quick rundown on the Medicare Low-Income Subsidy program. This is a government assistance program for low-income Medicare beneficiaries that helps with prescription drug costs. If you qualify for Extra Help, the government looks at information such as your annual income and resources and tells you whether youll qualify for the following year. This article provides more details on eligibility for the Low-Income Subsidy.

Don’t Miss: Usaa Grace Period Auto Insurance New Car

Can States Ban Obamacare

When the Affordable Care Act , or Obamacare, was first enacted, many states attempted to fight the law, or at least specific provisions. Several states attempted to ban Obamacare within their borders, but being a federal law, this proved impossible. This didnt stop some states from doing all they could to sabotage

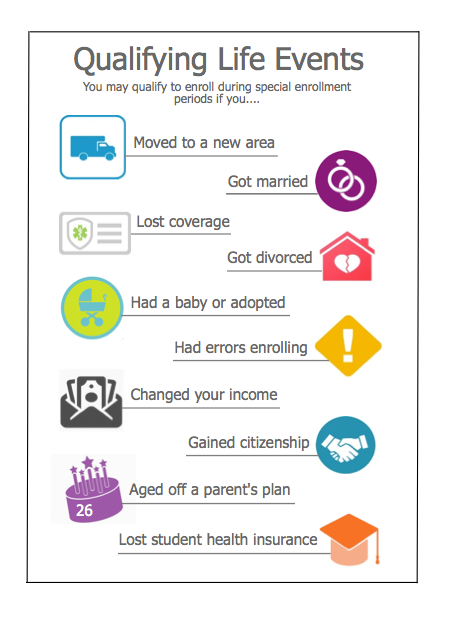

Common Qualifying Life Events

Qualifying Life Events open a Special Enrollment Period to enroll in health insurance anytime of year. Typically, you have 60 days from the date of your Qualifying Life Event to begin an application. You will also be required to verify your qualifying life event in order for your coverage to begin.

What you need to complete an application

Have this information for yourself and anyone in your household applying for coverage:

Dates of Birth Visa, green card or immigration documents Most recent W2 and/or Form 1040, Form 1099 Current insurance coverage Paystubs, Profit & Loss statements, or other employment information to confirm income for everyone in your tax household

Don’t Miss: 90 Day Employment Probationary Period Template

What Is An Sep

Through the Affordable Care Act, you may be eligible for an SEP if you experience a qualifying life event. This means you and your family can enroll or change your health insurance outside of the open enrollment period.

Typically, the open enrollment period for individual health insurance occurs from November 1 to December 15, with an effective date of January the following year. Once open enrollment ends, you are unable to enroll in a new health plan until the next open enrollment period.

If you qualify for an SEP, you have 60 days from the day of your qualifying life event to change or enroll in another health plan. If you fail to take action within 60 days, you are without coverage until the next open enrollment period.

When Working Past : 8

For people who work past 65 and qualify to delay Medicare with creditable employer coverage, there is an 8-month Special Enrollment Period that allows you to enroll in Part A , Part B , Part C and Part D without late penalties.

This Special Enrollment Period is tricky though. Why? Because while you have the whole 8 months to get Parts A & B, you only get the first 2 monthsto enroll in Part C or Part D without penalty. If you enroll after the two-month mark, youll face late enrollment penalties for Part D .

To qualify for the Part B Special Enrollment Period, you must have creditable employer or union health coverage based on current employment. Your Special Enrollment Period will begin eight months after your employer coverage ends or you leave your job, whichever happens first.

Recommended Reading: Period Blood Stains On Sheets

Countdown Begins On The Day

Your Special Enrollment Period is a 60-day health insurance enrollment window. It begins on the day your qualifying life event takes place.

This means that if you get married on May 31, you must enroll in a new health insurance plan before the end of July. If you quit your job to form your own business, you have 60 days from the last day of employment to get new healthcare coverage. Once the 60-day window has passed, you have to wait until the regular Open Enrollment Period to obtain health insurance coverage or update your current coverage.

New Special Enrollment Period Changes

New changes to the special enrollment period, grant year-round enrollment in ACA-compliant health insurance to some applicants if household income does not exceed 150% of the federal poverty level . Coverage will take effect the first of the following month.

There are no restrictions on how often this special enrollment period can be used or the type of health plan that can be chosen. A person with an eligible household income who is already enrolled in an exchange plan can utilize this SEP to switch plans, albeit the deductible and out-of-pocket expenditure for the year will be reset to $0 when the new plan begins.

Federal Poverty Level Adjusted to 150%

In Florida, 150 percent of the poverty threshold equates to an annual salary of no more than $19,320 for a single person enrolling in coverage for 2022.

- $19,320 for individuals

- $26,130 for a family of 2

- $32,940 for a family of 3

- $39,750 for a family of 4

- $46,560 for a family of 5

- $53,370 for a family of 6

- $60,180 for a family of 7

- $66,990 for a family of 8

You May Like: 90 Day Probation Period Template

If You Dont Use Your Special Enrollment Period

You dont have to change your health insurance if you dont want to. If you lost your plan, however, you may be able to sign up for temporary health insurance. If you were incapacitated for part of the 60 days, you may be able to claim an additional SEP with the help of a health insurance agent.

Affordable Care Act administrators have specified that a lack of knowledge about COBRA is not a qualifying life event. In general, you cannot claim a Special Enrollment Period solely because you were not aware of your SEP. Its still possible to get health insurance after open enrollment, even without a qualifying life event.

Experience With Expanded Seps

Despite these concerns, people eligible for the low-income SEP are likely to be young and healthy. With no- or low-premium options, there is no cost-related incentive to delay enrollment. In addition, marketplace coverage would not become effective immediately, which means individuals cannot enroll to cover immediate health needs. If plan-switching is a concern, CMS could limit the ability to switch plans once enrolled.

States experience suggests this policy will not lead to adverse selection. Some states already offer broader enrollment for low-income people. Data from recent COVID-19 SEPs show that expanded enrollment could improve the ACA risk pool.

In Massachusetts, for example, low-income individuals qualify for a 60-day SEP if they are determined newly eligible for subsidized ConnectorCare coverage or have not previously applied for it. Massachusetts policy has been in place since 2014 with no evidence of adverse selection. To the contrary, Massachusetts officials cite their efforts to encourage year-round enrollment and reduce administrative burdens as key to boosting the health and stability of the marketplace.

Minnesota and New York also allow year-round enrollment for some low-income people through their Basic Health Programs . Adverse selection has not been reported since no- or low-cost premium plans mean consumers have little incentive to delay enrollment until they need health care. Enrollment in these programs has increased over time.

NOTES

You May Like: Employee Probationary Period Template

Before You Choose One Or The Other Though You Should Know A Little More About Each Option

Lets start with using the event as a trigger to a Special Enrollment Period. Some examples of job loss or job change that could be a qualifying life event that would trigger a Special Enrollment Period:

- Reduction of hours that leads to your health benefits being cut

- Being laid off

- Quitting your job for any reason or

- Losing your job for any reason

If youve experienced any of these and as a result, lost your employers group health coverage, you are in a Special Enrollment Period. That means you have 60 days from your termination date to enroll in a qualified health plan.

COBRA is different.

COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. It is a law that gives employees the right to pay premiums for and keep the group health insurance that they would otherwise lose when their employment is terminated, by either the employer or the employee for reasons other than gross misconduct. Remember that this only applies to employers who offered group health plans and have more than 20 employees. COBRA information is usually mailed to you by your previous employer and should arrive within 45 days of the termination date.

You or your spouse and dependents can elect for COBRA in any of the following situations:

BUT, before you elect COBRA, you need to keep two things in mind:

Keep in mind too that these plans can decline coverage based on your medical history, pre-existing conditions or other risk factors because they are not qualified health plans.

My Employer Offered Me Something Called Cobra Should I Use This

COBRA, short for the Consolidated Omnibus Budget Reconciliation Act, generally lets workers at companies of 20 or more employees extend their health coverage for up to 18 months after losing their jobs. It is important to note that you would now be responsible for paying both your portion and your employers portion of the premium plus a 2% administrative fee. Electing to use COBRA allows you to keep your accumulators for deductible/OPM cost-share. It is an important to consider this option.

Don’t Miss: Brown Stuff Instead Of Period