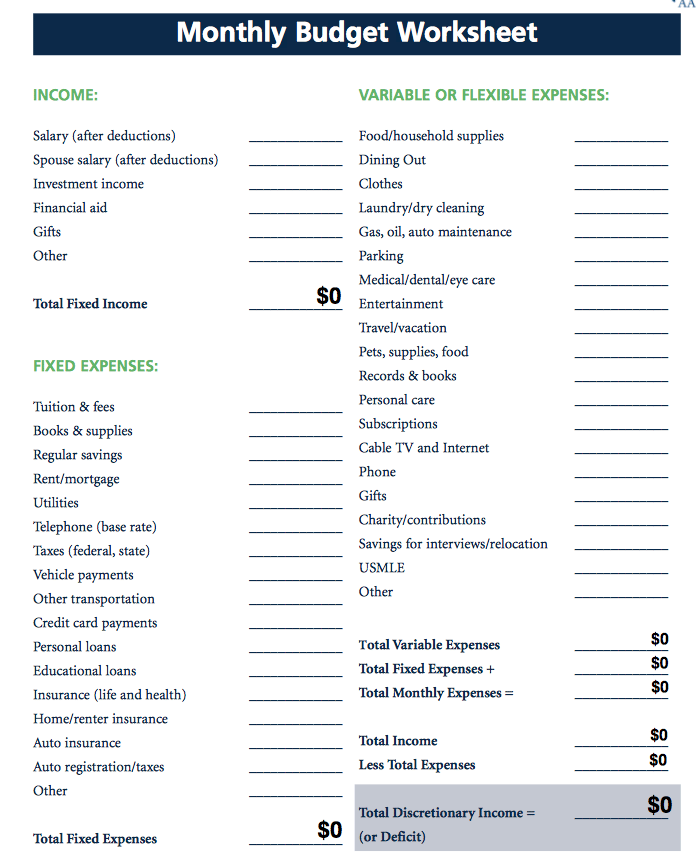

Types Of Expenses In A Budget

An expense is an amount you part with for products and services that you use each day. Aside from periodic expenses, you also have to understand how fixed expenses and flexible or variable expenses affect your budget.

Fixed Expenses Definition

As the name implies, a fixed expense is that which remains constant and predictable over time. It doesnt fluctuate, meaning you dont have to take a wild guess on your next months fixed expenses. You also have little or no control over your fixed costs. And the amounts are predictable because you always know how much youre expected to pay.

Fixed expenses may change occasionally, but the change does not occur regularly. For example, your landlord might raise your rental fees or you might choose to switch to a new internet service provider.

Fixed expenses should be the first thing to include in your budget. This is because theyre paid in similar amounts at recurrent monthly intervals and take up the lions share of your budget.

From a planning standpoint, the more fixed expenses you have, the better. Your budgeting process becomes easier and more predictable. This is because the expenses remain more or less the same. For this reason, you can easily apply specific budgeting techniques like the 50/20/30 budget or zero-based budgeting.

What Are Examples of Fixed Expenses?

Here are some of the common examples of fixed payments:

- Rental fees or mortgage payments

- Car loan payments

What Is A Fixed Expense

For household budgeting, fixed expenses are predictable costs with amounts and due dates that dont change. Fixed expenses will probably take up the largest percentage of your budget since rent, insurance, and car payments are fixed expenses. You often have limited control and a legal obligation to pay your fixed expenses.

Fixed expenses are consistent and usually paid monthly. When youre setting up your budget, your fixed expenses will be the first entries you make. Youll see they take up a large percentage of your budget.

You might struggle to afford your fixed expenses, but they wont surprise you.

Four Ways To Prepare For Periodic Fixed Expenses

Periodic fixed expenses are easy to prepare for because they arrive in predictable intervals and consistent amounts.

Due to the nature of periodic fixed expenses, most of them are essential, making it difficult to cut them from your budget. It would not make sense to cut your car service or oil change. Similarly, you cannot avoid financial obligations like paying your taxes if you own a business.

Instead, you need to be very diligent while budgeting and preparing for your periodic expenses so they dont sneak up on you when youre not financially ready to pay for them. Managing your recurring costs involves treating them like the fixed expenses.

If you have to pay $100 every three months for your car service, then you need to save $34 every month, so you have enough money available when the periodic fixed expense arrives.

Read Also: How Early Can A Girl Get Her Period

No More Dreading Large Expected Annual Expenses

Before we started to budget like this, I used to dread Novembers budget. Not only is it typically a more expensive month because of the holidays, but its also when our annual life insurance premiums are due. Since we never saved up for either of these significant expenses, they had to come from our regular monthly spending categories, which meant that money was always tight in November.

Our family spends $810 each year on life insurance. Divided over 12 months, thats $67. If we set aside $67 each month, we have $810 in November to pay our life insurance premiums. Its much less daunting to save $67 a month than to come up with the entire sum in one months budget.

We do the same with the money we spend during the holiday season. By taking the amount that we usually spend on Christmas and dividing it out over the year, we arent financially strained during the most wonderful time of the year.

Even if you face a periodic expense and dont have the full amount saved, youll be so much better off with something saved than if youd set aside nothing at all!

Read: Do More, Not Less With a Budget

Why Your Budget Keeps Failing

When you create a budget, you naturally start by recording your income and expenses. After listing out your monthly income, you move on to your monthly payments. Adding up your monthly payments is pretty straightforward. Its hard to forget the bills youre continually paying !

Next, subtract your monthly expenses from your total monthly income. So far, so good. You have money left over, and you seem to be living within your means. Boom! Budgeted.

As the month plays out though, you realize that your Amazon Prime membership is up for renewal. Whoops! Forgot about that one. Then your mechanic tells you that not only does your car need new brakes, it also needs a timing belt, and you may as well replace the water pump while hes working on that. That month, your budget goes out the window.

If you have a lot of cushion in your budget, then maybe you have the flexibility to cover these types of nasty surprises. But if youre like most of us, you dont have that kind of flexibility.

Hello periodic expenses!

Related:Why Venmo Is Disrupting Your Budget

You can easily see the problem: because less frequent expenses dont fit in your monthly budget, looking at your list of monthly expenses is deceiving.

You can also probably see that budgeting for periodic expenses is key to budgeting success. Awesome news: fixing this problem is pretty dang easy.

You May Like: Can You Come On Your Period And Still Be Pregnant

Common Examples Of Fixed Expenses

- Rent or mortgage payments

- Gym memberships

- Cell phone bills

- Cable, streaming, and other subscription services

Despite these expenses being fixed, theres still a good opportunity for you to save money on them. By refinancing your loans and shopping for less expensive service providers, youll likely save money. Also, since they consume such a large portion of your income, a small reduction in them can significantly decrease your burn rate!

How Do Flexible Expenses Work

Chances are youre aware of how much income you earn every month. Its just as crucial to know how much money youre spending and what youre spending it on. Generally, every budget should consist of both fixed and flexible expenses.

Flexible expenses represent the variable spending you make on a daily, weekly, or monthly basis. They can be categorized into needs and wants.

Necessary flexible expenses include things like electricity and groceries. In contrast, flexible expenses that are considered wants or discretionary include things like recreation, new clothing, and entertainment.

Lets say you frequent a movie theater and always purchase popcorn. This is something you may want to do, but you dont need to. Since both of these expenses are discretionary and flexible, you could save money by choosing not to go to the movies, and instead, watch a film at home with homemade popcorn.

You May Like: Can You Lose Weight On Your Period

Dont Neglect Your Savings Account

One common spending plan failure is neglecting your savings account. A financially disciplined person should have significant savings to avoid debt when an unexpected monetary need arises. Your monthly savings payments should be stable each month by paying yourself first.

Savings are essential in case you lose your job or want to move from corporate employment to self-employment. Savings will help you maintain the same lifestyle for a period before you can get back on your feet or fully adjust to the new normal.

For example, when the pandemic struck early in 2020, the people who had invested in savings knew they could fall back to their savings accounts to help them stay afloat if they lost their job.

During the pandemic, many peoples salaries decreased while others lost their jobs. Stimulus checks alone have not been enough to keep people above water if they didnt have a healthy savings account. Savings as an expense help you avoid problems from borrowing money and paying for necessities with credit cards.

How To Budget For Fixed Flexible And Periodic Expenses

The zero-based budget is a brilliant budgeting method for your personal finance. The name sounds somewhat creepy but dont fret. Zero-based budgeting means that when you subtract your expenses from your income, it equals zero.

That does not mean youre left with nothing in your bank account. It simply means budgeting for every dollar of your salary. Lets say you earn $4000 a month. After budgeting for all your expenses including savings, it should total $4000. That means no dollar is left in the bank account without a purpose.

Here is the process of creating a zero-based budget:

Recommended Reading: How Fertile Are You At The End Of Your Period

Shop For Cheaper Insurance Premiums

It doesnt matter what insurance payment you make, whether monthly, semi-annually or annually. This periodic fixed expense can slowly increase over time, and its necessary to regularly shop around for cheaper insurance premiums.

If you can reduce your home and vehicle insurance premiums, you can reduce your periodic and monthly expenses. Cutting down on these costs will allow you to save and have more cash at your disposal for emergencies and other financial goals.

Dont cut down on essential items.

For instance, health insurance is critical because buying medicine or seeking medical care without a plan is very expensive. For this, you need to look for a suitable deal that covers your whole family instead of picking out insurance coverage based solely on the monthly expense.

How Stampli Helps Track Business Spending Categories

It isnt always easy for companies to track, manage, and control their business spending categories, though using an expense management solution such as Stampli can make it so that businesses arent going it alone.

Here are a few ways that Stampli helps companies monitor their business spending categories:

Also Check: Why Is There So Much Blood On My Period

Deduct All Your Expenses From Your Monthly Income

Your expenses should gobble up all your income, leaving you with zero balance. If you get a negative number after subtracting your planned expenses, its a sign that youre spending above your means.

Its time to cut down that budget. Look at areas where you can reduce your spending. For example, check how you can reduce your food costs or your entertainment expenditure.

What Are The 3 Types Of Expenses In Your Budget

If you want to learn to budget properly, there are 3 types of expenses you should familiarize yourself with.

The 3 types of expenses most people need to budget for are fixed, variable, and periodic.

Fixed expenses are consistent and predictable amounts, and often paid monthly. Variable expenses are irregular costs that can usually be adjusted within a budget. Finally, periodic expenses are expected but infrequent, and typically occur on a quarterly, semi-annual or annual basis.

In this post, Ill go into detail about what each one is, give some examples, and teach you how to manage them in your spending plan.

Don’t Miss: Can You Still Be Pregnant If You Had Your Period

Take Advantage Of Company Benefits

Some companies offer benefits employees are unaware of. If you work in an office where they provide snacks and meals, you can save on lunch expenses by scaling back how much you are spending by eating out.

Some companies also negotiate good insurance deals for their employees, making it easier and cheaper for you to get your health and life insurance through your workplace.

For instance, my current employer offers term life insurance to employees at a discounted rate compared to what I can buy it for from an insurance company.

In other cases, some offices offer mileage and tuition reimbursements employees may not be aware of. Be sure to look through your employee benefits package information to see if any hidden benefits can save you money.

Payments Integrated Directly Into Stamplis Platform

As we noted earlier, it can be a challenge to have adequate records of business expense categories, if a company processes invoices in one system and makes payments in another place.

For this reason, subsequent to launching our AP automation platform, we developed Stampli Direct Pay. This allows companies to process invoices end-to-end in our system and to make payments. With this application, companies can schedule ACH payments from directly within Stampli and even print checks. With Stampli Direct Pay, all business spend and invoice processing data will be in one place.

You May Like: How To Deal With Your Period

What Are Periodic Expenses

I like to call periodic expenses the sneaky expenses. Even though they are expected, they can creep up on you because its easy to forget about them.

Some examples of this type of expense include:

- annual registration fees

- annual HOA dues

- semi-annual/annual insurance payments

Any non-recurring expense that pops up once in a while, and isnt something you pay monthly, is periodic.

The biggest problem with periodic expenses is they get forgotten. When they come up, it can throw even the perfect budget out the window.

With a little planning, its possible to manage even the most unexpected periodic expenses.

Define Your Needs And Wants

Variable expenses are either a necessity or a luxury. For example, food and gas are absolute necessities. However, maid services or car washes are deemed as luxuries. You dont necessarily need them, but you want to have them.

The trick is to get rid of less important expenses from your monthly budget. Go through your bank statements to see the amount youre spending on the products or services you buy. Then identify the wants or luxuries in your past spending habits. By removing a significant number of your luxury items, you can free up a sizeable amount each month.

Recommended Reading: Why Do I Get Back Pain On My Period

Reducing Your Periodic And Fixed Expenses

If you are trying to reduce your periodic financial outflow, you need to evaluate your recurring expenses and how necessary they are in your life. Unlike eliminating and reducing variable costs, which have a minimal effect on your monthly budget, if you can find a way to reduce your periodic fixed expenses, you can make significant long-term changes to your financial future.

One of the tips savvy financial experts use is to shop around for vehicle insurance every couple of years to ensure you are still getting the best rate. Establishing financial habits that constantly look to reduce overall expenses can create long-term wealth due to sound spending discipline principles.

When you reduce your periodic fixed expenses, you end up reducing your overall cost of living.

Here are some of the ways you can manage your expenses and improve your financial health.

What Are The 3 Types Of Expenses In A Budget

The three types of expenses in a budget are fixed, periodic, and variable. Fixed expenses are recurring expenses that dont change and are usually paid monthly. Periodic expenses are less frequent and occur in predictable amounts. Variable expenses are often discretionary and can often be changed or eliminated by behavior.

Understanding these different types of expenses is important to creating a budget and managing your personal finances effectively.

Don’t Miss: Cramping And Spotting But No Period

Categories Of Variable Expenses:

Necessary variable expenses comprise items like groceries and electricity. Wants include items like new clothing, eating out, and leisure activities. Take the case of a person who usually goes to the movies and likes to buy soda and sandwiches, for example. While watching a movie is entertaining, it is not a must. Opting to watch a movie at home with homemade snacks instead would save you money.

Due to their unpredictable nature, variable expenses are often a hard nut to crack in terms of tracking and budgeting. You may, for example, need to collect all your grocery receipts to learn exactly how much you spend on food supplies every month. Of course, thats an arduous task. Thats why most people end up overspending on flexible expenses than what they had intended without even noticing. These days, thanks to technological advances, you can take advantage of a budgeting app to track all your flexible expenses.

Sometimes, you have absolute control over your flexible expenses. Lets say you went out to buy new clothing. You can opt for cheaper, second-hand clothing to save money. In other cases, you have no control over how much money goes into these expenses. For example, when you fall sick and visit a hospital, your insurance provider will notify you about your copayment. Sadly, you lack any control over the matter.

Identify All Your Expenses

Have the entire month in mind when drafting your expenses. Are you going to an out-of-town event this month? Does your car need service maintenance? Think of all your fixed, flexible, and periodic expenses, and list them all down.

These could include:

- Other necessities

Remember to add a miscellaneous category to have some more leeway in your spending. That means when any expense pops up out of the blue, it isnt a challenge since theres room for it in the budget.

You May Like: Pay Period Every Two Weeks Calendar

The 3 Types Of Expenses In A Budget: Fixed Periodic And Variable

Before you sit down to start putting together your budget, it’s important to understand the three types of expenses you’ll have to account for. Get to know these expenses, how they affect your budget, and how to prepare yourself for them.

Understanding the three types of expenses in a budget.

I spent years living paycheck to paycheck.

I never understood the importance of budgeting. When I was just starting out, I would spend first and ask questions later. I didnt know there were 3 types of expenses in a budget and I didnt care.

I would get paid, go have drinks with the guys, play a round of golf, and buy new sneakers or something else I didnt really need. I would wind up struggling financially and not having enough cash to put gas in my car after paying rent. Once in a while, Id go too far, to where paying rent on time became a matter of being late on some other bill.

When a bill came in, I was never 100% sure I had the money for it. I had a vague notion of what my expenses were, but I always spent more than I thought I would. My wallet was always empty at the end of the month.

That all changed when I realized that the purpose of a budget was not to torture or bore myself. I decided I needed to get on a budget to get my finances under control.

If youre creating your first budget, there are three types of expenses you should understand: fixed, periodic, and variable.