How Do I Contact The Sdi Program

To get help with questions about the State Disability Insurance program, including Paid Family Leave , you need to contact the Employment Development Department of California. EDD provides a list of ways to contact them about SDI or PFL, including online chat, phone numbers, and office locations.

Tip: If you are contacting EDD by telephone, consider calling one of the non-English phone numbers — it can be quicker to get through on those phones, and the people who answer them know all about SDI and PFL, and speak English in addition to the other language.

Note: DB101 cannot answer questions about your SDI claim. If you have questions, please contact EDD.

Can An Employee Opt Out Of The Disability Insurance Or Paid Family Leave Program

No. The State Disability Insurance program and contributions are mandatory under the California Unemployment Insurance Code. The exception would be if the employer or a majority of employees applied for approval of a Voluntary Plan in place of SDI coverage. For more information visit: Voluntary Plan Information.

Why Would I Be Denied Short Term Disability

Disability claims can be denied for any number of reasons. Some disability claims are denied for valid reasons, including where the claimant was not covered by the insurance plan, the cause of the disability is excluded from coverage, or the injury or illness is not sufficiently limiting to be considered disabling.

Also Check: Can You Still Be Pregnant If You Have Your Period

Short Term Disability Vs Long Term Disability

The main differences between short term and long term disability insurance are:

- The injuries and illnesses they cover.

- How long you can receive disability benefits.

- How long you have to wait following a disabling event to receive compensation.

| Coverage Comparison | |

|---|---|

| 1, 7, 14, 30 days | 30, 60, 90, 180, 365 days |

You shouldn’t skip long term disability insurance coverage in lieu of having just a short-term policy. Short term coverage will not be adequate in the event you suffer a serious injury or illness. Without long term coverage, you could find yourself without any kind of income after just a few months.

The best strategy is to buy an individual long term disability insurance policy then supplement it with any short term and/or long term group plans your employer may offer. By combining different types of coverage, you can protect your income against just about any type of injury or illness that would affect your ability to earn an income.

Learn More:Short Term vs. Long Term Disability

Short Term Disability Insurance

Short Term Disability

If you are an eligible employee, you have the opportunity to help protect yourself and your family by purchasing Voluntary STD coverage through The Standard via convenient payroll deduction. The Voluntary STD plan offered by Hennepin County through The Standard has great flexibility allowing you to select the coverage which best fit your individual needs. You may select one of the five options listed below. Please note that premiums and coverage will vary depending on the option selected. Option 1 is no longer available after December 15, 2013.

Options 2-5:

Your weekly benefit is 60% of your insured earnings. The maximum weekly benefit is $2,000. The minimum benefit is $100. Your benefit waiting period is a period you select which can be 7, 14, 30 or 45 days. Benefits may continue during your disability for up to 90 days minus the length of the benefit waiting period.

Please Note: You must exhaust all but 80 hours of accrued paid leave and satisfy the benefit waiting period before STD benefits may be payable.

If you enroll when first eligible and your STD claim is approved by The Standard, STD benefits become payable at the later of exhaustion of all but 80 hours of your accrued paid leave* or the end of your elected benefit waiting period. No benefits are payable for or during the benefit waiting period. You may satifsy your benefit waiting period while receiving pay from your accrued paid leave* balance.

Late Entrant Penalty

You May Like: How Do You Know If Your Getting Your First Period

When Should I File My Claim

You must file your claim between 9 and 49 days after the start of your disability. You cannot submit your application until the 9th day, and if you wait too long you may lose your benefits. If you file your claim after the 49th day, include a letter explaining why you couldn’t submit your claim on time.

Can My Employee Receive Other Benefits At The Same Time As Disability Insurance Or Paid Family Leave

In general, your employees may not receive Disability Insurance or Paid Family Leave benefits at the same time they are receiving Unemployment Insurance or workersâ compensation benefits. However, there are exceptions:

- If your employeeâs weekly workersâ compensation benefit amount is less than their weekly DI or PFL benefit amount, they may be eligible to receive the difference between the two rates.

- Your employees may receive Social Security disability at the same time as DI, but it may reduce the amount of DI benefits they receive. For Social Security Administration eligibility requirements, visit the SSA website.

- Other benefits, such as employer paid benefits for baby bonding, may affect Paid Family Leave benefits.

You May Like: Can I Be Pregnant And Have My Period

How Do I Stay In The Sdi Program How Often Do I Have To Reapply

You do not have to reapply. However, you must tell SDI immediately if you:

- Go back to work part time or full time

- Recover from your disability, or

- Get any other type of income.

You must also imemdiately report the death of a person getting SDI payments.

At certain times SDI asks you to “certify” that you still qualify for benefits, and if you do not do this your benefits stop. If you are getting automatic payments, you are asked to certify after 10 weeks of getting benefits. If you are not getting automatic payments, you have to fill out a certification form every two weeks.

Once you are on SDI, as long as you are still unable to work because of your disability your benefit payments will continue up until the “return to work” date your medical provider listed on your application. If your disability lasts past that date, you and your medical provider must ask to extend your benefit period. SDI benefits replace up to 52 weeks of lost income, but if you get a partial benefit you might get payments for longer.

How Much Paperwork Is Involved

The exact paperwork youll be required to complete is again dependent on your specific plan. But the process typically begins with a relatively straightforward claim form that requires some information from you , your employer , and validation from your doctor that your condition prevents you from working.

Fortunately, if you find yourself confused about any of the documents or applications, you can ask for helpwhether its from your companys own HR department or even people at your doctors office.

I actually found the team at my physicians office to be extremely helpful, says Tiernan, who admits her own leave process was slightly more complicated, as she took advantage of both short-term disability and FMLA for the birth of her child .

They have a whole team dedicated entirely to filling out forms and navigating this process, so I was on the phone with them a lot. They helped me figure out the best forms to fill out, what the dates would be, and any follow-ups that I needed. They even spoke to my HR team directly here at the office.

Also Check: Why Do Periods Hurt So Bad

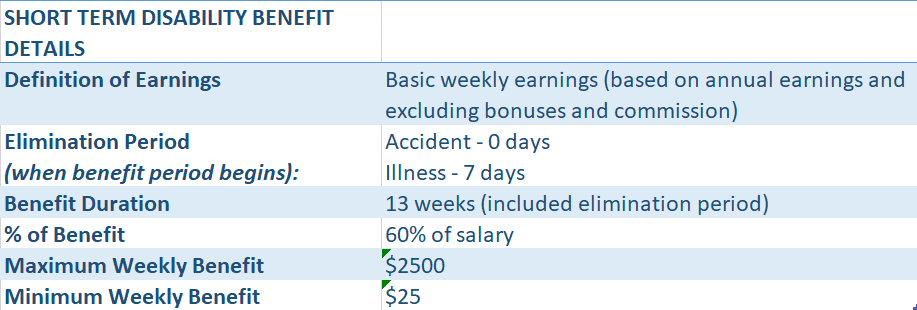

What Is An Elimination Period For Short Term Disability

Elimination Period: The elimination period is a period of time an employee must be disabled before benefits are paid. For short term disability, there is an elimination period for disabilities due to sickness and one for those due to injury. The maximum benefit period is chosen by the employer and stated in the policy.

What Is The State Disability Insurance Program

SDI is an insurance program run by the California Employment Development Department that pays weekly benefits of 60-70% of your average wages for up to a year if you are unable to work because you:

- Have a non-work-related illness or injury

- Are pregnant, or

- Need to take Paid Family Leave to care for a sick relative or to bond with a new child.

- Note: PFL only provides benefits for up to eight weeks.

The program is paid for by SDI taxes that are taken out of most employees’ paychecks. If you are self-employed or a business owner, you can pay to get Elective Coverage, which only provides benefits for 39 weeks instead of a year.

If you are sick due to COVID-19, you may qualify for SDI benefits. If you are caring for somebody who is sick due to COVID-19, you may qualify for PFL. See EDD’s questions and answers about COVID-19 and the state of California’s chart of all the different benefits that may help families impacted by COVID-19.

Recommended Reading: Do You Have A Period With Mirena

Is Short Term Disability Insurance Worth It

Most advisers will tell you not to buy a personal short term disability policy. In many cases, it may be just as expensive as long term coverage, but will only offer benefits for a much shorter period of time. A wise alternative to buying temporary disability coverage is setting aside an emergency fund to have in the event you miss work for a few months.

Individuals with pre-existing conditions are also advised not to buy short term disability insurance. In most cases, they would not even qualify for coverage. And those who can get a policy will have a longer waiting period to receive benefits, perhaps 12 months or more. As if that’s not enough reason to steer clear, most short term policies will not provide benefits if your disability is related to your pre-existing condition.

If you can get short term disability insurance from your employer or another group at a reduced cost or no cost at all, do not hesitate to take advantage. Even if you have this as an option though, you should also save money in an emergency fund. Thatâs because most short term disability policies will only pay a fraction of your income in benefits. You may need to rely on a savings account to bridge that gap and avoid going into debt.

Jack Wolstenholm is the head of content at Breeze.

What If I Dont Have Money In My Base Period Because I Was Unemployed Before I Became Disabled

There are two rules that may help you if you do not have earnings in your base period due to unemployment:

First, if you have an unexpired claim for unemployment insurance benefits when you are seeking SDI, then you may use the base period you used for your unemployment insurance claim.

Second, if you were unemployed during any quarter of your base period meaning out of work for 60 or more days and looking for work you may disregard that quarter and begin your base period three months earlier than the period set forth in the above chart. For each quarter you were unemployed, you may go back another quarter.

Read Also: How To Control Mood Swings During Periods

What Are Your Options If Your Short

The first thing to do is to carefully read the correspondence thats saying its not being approved, advises Bartolic. That will tell the person a lot, and will tell them what to do if they disagree with the decision.

Most disability plans in America are covered under the Employee Retirement Income Security Act , which means claims are reviewed through the lens of this federal law.

If your plan is covered by ERISA, the law requires that the denied individual be presented with a right to appeal that decision. Its a mandatory feature of it, explains McDonald. That period of appeal is 180 days. During that time, you have perhaps your single best opportunity to give evidence to the insurer or plan administrator about why theyre wrong and why youre entitled to those benefits.

If you go through the appeal process and still are unable to convince them of your disability, then unfortunately youll have to initiate a lawsuit.

Is It Worth Paying For Short Term Disability

In general, we can only recommend short-term disability insurance if offered by your employer either for free or at a low cost. Private short-term disability insurance is most likely not worth your money its often just as expensive as long-term disability insurance despite having a shorter coverage period.

Recommended Reading: Will Plan B Stop My Period

Does Maternity Leave Count As Short

Youve probably heard of circumstances where people use their short-term disability for pregnancy and maternity leave. Doing so is fairly common, but whether or not youre able to do so yourself is also dependent on your plan.

We actually see a lot of short-term disability policies that specifically address maternity leave, explains Bartolic. These plans also will explain how much time off is offered for maternity leave, which can vary based on things like whether the mother had a vaginal birth or a c-section.

Some employers exclude maternity leave from their short-term disability plan and have an entirely separate program to address paid leave for childbirth.

Best For Quick Issue And Simple Underwriting: Assurity

Assurity

If youre searching for short-term disability income insurance that can be obtained quickly and without arduous underwriting, Assurity sets itself apart from the competition. It offers a guaranteed four-day issue for qualified applicants with minimal medical underwriting requirements.

-

Benefit periods from six to 24 months

-

Coverage available up to $3,000 per month

-

Many features included at no charge, with a variety of additional riders available

-

Quick, simple application with a four-day- guarantee on qualified applications

-

Full and partial disability coverage

-

Not available in New York

-

Though broad, only two occupational classes are accepted

-

Policies only issued through age 59

-

Online quotes are limited and policies can only be purchased through an agent

Assuritys Simplified Disability Income Insurance is our top choice for those looking for a feature-rich policy with quick issue and simple underwriting. It provides between six and 24 months of coverage whether you are totally or partially disabled. Coverage is offered from $300 up to $3,000 with elimination periods of 30, 60, 90, or 180 days.

The Simplified Disability Income Insurance policy is only offered to two occupation classes, which include professional/office occupations as well as skilled and unskilled manual occupations . While these categories are pretty broad, the acceptance of only two classes may be limiting to some applicants.

You May Like: Is It Normal To Miss A Period For 2 Months

Best Overall: Mutual Of Omaha

Mutual_of_Omaha

Taking the top spot for best overall short-term disability insurance coverage is Mutual of Omaha. This insurer provides up to 24 months of benefits , with some policies offering coverage from the very first day of your eligible disability. Monthly benefits are available up to $5,000, and policies can be issued through age 61.

-

Benefit periods range from three to 24 months

-

Maximum monthly benefit of $5,000

-

Elimination periods between zero and 90 days

-

Generous built-in policy benefits

-

Losses resulting from mental or nervous disorders are excluded

-

Partial disability benefits only available for up to six months, regardless of overall policy length

-

Policies must be purchased through an agent

Mutual of Omaha has been around since 1909, when it first started offering health and accident insurance coverage. The company has an A+ financial strength rating from AM Best. It offers insurance coverage across the country, though not all policies are available in all states.

Short-term disability coverage through Mutual of Omaha is some of the most comprehensive and benefit-rich around, which is why we chose them as the overall best provider. Coverage maxes out at $5,000 per month, with benefit periods ranging anywhere from three months to as long as 24 months. Elimination periods are available in more typical lengths , but the company also offers immediate coverage with 0/7-day and 0/14-day options.