Reason For Taking Federal Student Loans

Federal student loans are an investment in your future. You should not be afraid to take out federal student loans, but you should be smart about it.

Federal student loans offer many benefits compared to other options you may consider when paying for college:

The interest rate on federal student loans is fixed and usually lower than that on private loansand much lower than that on a credit card!

You dont need a credit check or a cosigner to get most federal student loans.

You dont have to begin repaying your federal student loansuntil after you leave college or drop below half-time.

If you demonstrate financial need, the government pays the interest on some loan types while you are in school and during some periods after school.

Federal student loans offer flexible repayment plans and options to postpone your loan payments if youre having trouble making payments.

If you work in certain jobs, you may be eligible to have a portion of your federal student loans forgiven if you meet certain conditions.

Refusing To Originate A Loan Or Originating For Less Than Maximum Eligibility

On a case-by-case basis, you may refuse to originate a Direct Loan for an individual borrower, or you may originate a loan for an amount less than the borrowers maximum eligibility. If you choose to exercise this discretion, you must ensure that your decisions are made on a case-by- case basis and do not constitute a pattern or practice that denies access to Direct Loans for borrowers because of race, sex, color, income, religion, national origin, age, or disability status. When you make a decision not to originate a loan or to reduce the amount of the loan, you must document the reasons and provide the explanation to the student in writing. Also note that your school may not have a policy of limiting Direct Loan borrowing on an across-the-board or categorical basis. For example, you may not have a policy of limiting borrowing to the amount needed to cover the school charges, or not allowing otherwise eligible students to receive the additional Direct Unsubsidized Loan amounts that are available under the annual loan limits.

Remaining Period = 1 Quarter

Chuck has attended 6 quarters in a 2-year program at Hartlieb Community College , but to finish the program, he needs to attend an additional quarter as a half-time student . Chuck is a dependent undergraduate student, and HCC defines its academic year as 36 quarter hours and 30 weeks of instructional time.

To determine the prorated Direct Loan limit for Chucks remaining period of study, convert the fraction based on the hours that Chuck is expected to attend and the hours in the academic year to a decimal .

Multiply this decimal by the combined Direct Subsidized Loan and Direct Unsubsidized Loan annual loan limit for a dependent second- year undergraduate :

$6,500 x 0.17 = $1,105 combined subsidized/unsubsidized prorated annual loan limit

To determine the maximum portion of the $1,105 prorated annual loan limit that Chuck may receive in subsidized loan funds, multiply the maximum subsidized annual loan limit of $4,500 by the same decimal :

$4,500 x 0.17 = $765 subsidized prorated annual loan limit

The maximum combined Direct Subsidized Loan and Direct Unsubsidized Loan amount Chuck can borrow for the remaining portion of the program is $1,105, not more than $765 of which may be subsidized.

Read Also: How Do You Know If Your Getting Your Period

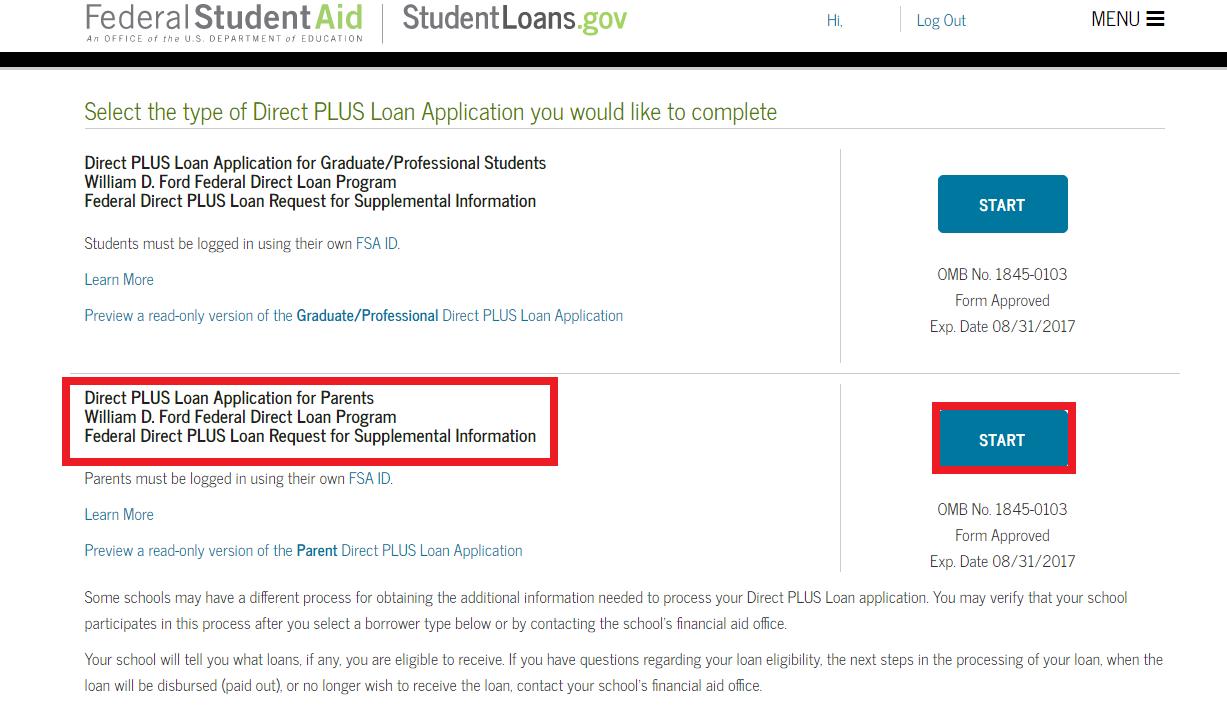

Applying For A Plus Loan

Parents, graduate and professional students who are applying for a PLUS loan must submit the Free Application for Federal Student Aid and sign a master promissory note.

To qualify, however, the student must be enrolled at least half-time and be eligible for federal student aid. Both the parent borrower and the student must be US citizens, nationals or eligible noncitizens. Neither the student nor the parent borrower can have a federal government judgment lien on his or her property. The parent cannot owe an overpayment on a federal education grant or be in default on a previous federal education loan unless he or she has made satisfactory arrangements to repay the grant overpayment or loan. The student is required to be registered with Selective Service, but the parents are not. Colleges are required to determine eligibility for both the dependent student and the parent before certifying a Parent PLUS loan. Besides obtaining the students complete financial aid history, the school may also have supplemental forms for the parent to complete, such as signing a statement of educational purpose.

When To Update Loan Periods And Academic Years

In light of SULA concerns, its very important to update loan periods and academic years in the following situations:

-

Student requests the loan/disbursement be cancelled

-

Disbursement was not made for a term/payment period included in the loan at origination

-

An actual disbursement was made but later zeroed out

-

Student enrolled in a non-term or clock-hour program and has failed to progress from one payment period to another as originally scheduled

-

Summer is not a required term and student attends the summer term and requests a loan for summer.

You May Like: Can Birth Control Stop Your Period Completely

Two Types Of Academic Years For Monitoring Annual Loan Limits: Say And Bbay

There are two types of academic years that may be used to monitor annual loan limits for Direct Subsidized Loans and Direct Unsubsidized Loans: a Scheduled Academic Year or a Borrower-Based Academic Year .

An SAY corresponds to a traditional academic year calendar that is published in a schools catalog or other materials, and is a fixed period of time that begins and ends at the same time each year. Examples of SAYs for a standard term program are fall and spring semesters, or fall, winter, and spring quarters. If a program has SE9W nonstandard terms, an SAY could consist of two or more SE9W nonstandard terms running from fall through spring. For both standard term and SE9W nonstandard term programs, the number of credit hours and weeks of instructional time in the fall through spring SAY period must meet the regulatory requirements for an academic year.

A BBAY does not have fixed beginning and ending dates. Instead, it floats with a students attendance and progression in a program of study. There are 3 types of BBAY, described below.

If a program is offered in an SAY calendar, you have the option of using either an SAY or BBAY 1 to monitor the annual loan limits for students in that program. You must use a BBAY to monitor the annual loan limits for any academic program that does not meet the definition of a program allowed to use an SAY. However, there are significant differences between the different types of BBAY:

Other Than Interest Is There A Charge For This Loan

Yes, there is a loan fee on all Direct PLUS Loans. The loan fee is a percentage of the loan amount and is proportionately deducted from each loan disbursement. The percentage varies depending on when the loan is first disbursed, as shown in the chart below.

|

Loan Fees for Direct PLUS Loans |

|

First Disbursement Date |

Also Check: My Period Is 9 Days Late

Direct Loan Periods And Amounts

The rules for awarding Direct Loans are different than for Pell Grants and other FSA programs. For Direct Subsidized Loans and Direct Unsubsidized Loans, there are annual loan limits that vary by grade level, and there are aggregate limits on the total loan amount that may be outstanding at one time. The timing of Direct Loan disbursements may not always correspond to timing of disbursements for other FSA programs. The requirement to prorate the annual loan limits for Direct Subsidized Loans and Direct Unsubsidized Loans under certain circumstances differs from the requirements for calculating Pell Grants based on the students enrollment status.

*plus Loan Award Year

On Section 2 of the loan application, you must select the appropriate Award Year that corresponds with the loan period for which you are applying. If the Award Year does not correspond to the appropriate Loan Period dates, your loan will not be awarded.

| Loan Period |

|---|

| Loan Period |

|---|

You May Like: I Have Cramps But No Period

Reporting Loan Information Changes

The requirements of the subsidized loan eligibility time limit make it particularly important for schools to accurately report academic year dates and loan period dates for all types of Direct Loans to COD. You must also update a loans previously reported loan period dates or academic year dates if the borrowers actual attendance is different from the anticipated dates that were the basis for an initial reporting to COD. Some examples of when you must update loan data in COD include:

-

If the borrower requests that a loan, or a disbursement of a loan, be cancelled

-

When the borrower does not begin attendance, or does not begin attendance on at least a half-time basis, in a payment period that was included in the originally reported loan period and you did not make any disbursements for that payment period

-

When you determine that the borrower is not eligible to receive a Direct Loan for a payment period that was part of the originally reported loan period

-

When the borrower withdraws during a payment period that was included in the originally reported loan period, and as a result, the entire amount of the loan that was intended for that payment period is returned under the Return of Title IV Funds calculation

-

For clock-hour programs, non-term credit-hour programs, and certain types of nonstandard term credit-hour program, the borrower fails to progress to the next payment period or academic year as scheduled.

To Apply For A Graduate Plus Loan

- When Do I Apply?add

To receive a Federal Direct Loan at UC Berkeley, you need to complete required processes by the following deadlines at the latest:

Attending Fall-only: November 30

Attending Fall/Spring or Spring-Only: April 30

Attending Summer Sessions:

Second to last Friday of June Any Session ending Aug. 14 Last Friday in July

Read Also: What Causes Your Period To Stop

Finding A Plus Loan Lender

All new federal education loans, including the PLUS loan, are made through the Direct Loan program. To obtain a Parent PLUS loan, contact the colleges financial aid office.

The PLUS loan borrower will need to sign a Master Promissory Note , which covers a period of continuous enrollment. Annual borrowing is capped at the cost of attendance minus other aid. The college will draw down the funds from the Common Origination and Disbursement system and deposit them into the students account. After the funds are applied to tuition and fees , any remaining funds will be disbursed to the student to pay for textbooks and other college-related costs.

Parents who are considering a PLUS loan also often consider a home equity loan or an alternative loan. Have questions? Learn more about qualifying for a Parent PLUS Loan: Questions about Qualifying for the Parent PLUS Loan

Increased Direct Unsubsidized Loan Eligibility For Independent Undergraduates And Certain Dependent Undergraduates

34 CFR 685.203

As with the loan limits for dependent undergraduates, these loan limits represent the total of all Direct Subsidized Loans and Direct Unsubsidized Loans that an independent undergraduate student may borrow at each level of study, for a single academic year. For example, an independent, first-year undergraduate may receive up to $9,500 in Direct Subsidized Loans and Direct Unsubsidized Loans for a single academic year, but no more than $3,500 of this amount may be subsidized.

Although a dependent undergraduate whose parent is unable to obtain a Direct PLUS Loan has access to the same higher Direct Unsubsidized Loan annual loan limits as an independent undergraduate at the same grade level, the student is still considered to be a dependent student for all other FSA purposes.

For more detail on the conditions under which a dependent undergraduate can receive increased Direct Unsubsidized Loan amounts, see Criteria for additional Direct Unsubsidized Loans later in this chapter.

Recommended Reading: Can Period Panties Be Used For Incontinence

Annual Loan Limits For Students Who Transfer Or Change Programs Within The Same Academic Year

The annual loan limits are based on an academic year. If a student who received a Direct Loan transfers from one school to another school or changes to a different program at the same school and there is an overlap between the academic year associated with the loan received for the first school or program and the academic year for the new school or program, this overlap may affect the amount that the student is initially eligible to borrow at the new school or for the new program.

An overlap in academic years exists if the academic year at the new school begins before the calendar end date of the academic year at the prior school or program. In the case of a transfer student from another school, you may obtain documentation from the prior school of the specific beginning and ending dates for the prior academic year or look for the academic year dates of Direct Loans originated by the prior school on the award detail information page in the Common Origination and Disbursement Web interface.

The Pros And Cons Of Direct Unsubsidized Student Loans

Unlike subsidized loans, unsubsidized loans are available to all students regardless of need. If federal loans dont cover all the costs, private student loans can also be used to pay for education.

However, before signing for loans, really look at how much youre borrowing and whether you need as much as youre taking.

Pros of Direct Unsubsidized Loans:

Undergraduate and graduate students qualify for direct unsubsidized loans.

Students dont need to demonstrate the financial need to apply.

Cons of Direct Unsubsidized Loans:

Loan limits are slightly higher for unsubsidized loans as a result, many students borrow more than the actual cost of their tuition in order to cover fees and other education-related expenses.

Accepting more money than you need can add thousands of dollars to your total debt and make it more difficult to afford your future monthly payments.

Borrowers are responsible for paying all interest accrued beginning when the loan is issued.

Youre responsible for paying interest on unsubsidized loans at all times.

Read Also: Is It Normal For Your Period To Skip A Month