How Many Pay Periods In

How many pay periods are there in a calendar year? Whether youre an accountant or an employee, knowing how many pay periods left in the current year is important for managing finances and the overall cash flow.

How many pay periods in a year is entirely dependent upon your pay frequency. Your pay frequency is based on the contract your employer presented you when you started your employment. It can be either one of the following.

- Weekly

- Semi-monthly

- Monthly

Although the first and the last types of pay frequencies dont need much explanation, the semi-monthly pay frequencies are oftentimes mistaken. What semi-monthly pay frequency refers to is the employee gets paid twice a month, usually at the middle of the month and the last day of the month.

The employees who are getting paid weekly have 52 pay periods. The employees who are paid on a semi-monthly basis have 26 and those who are getting paid monthly have 12.

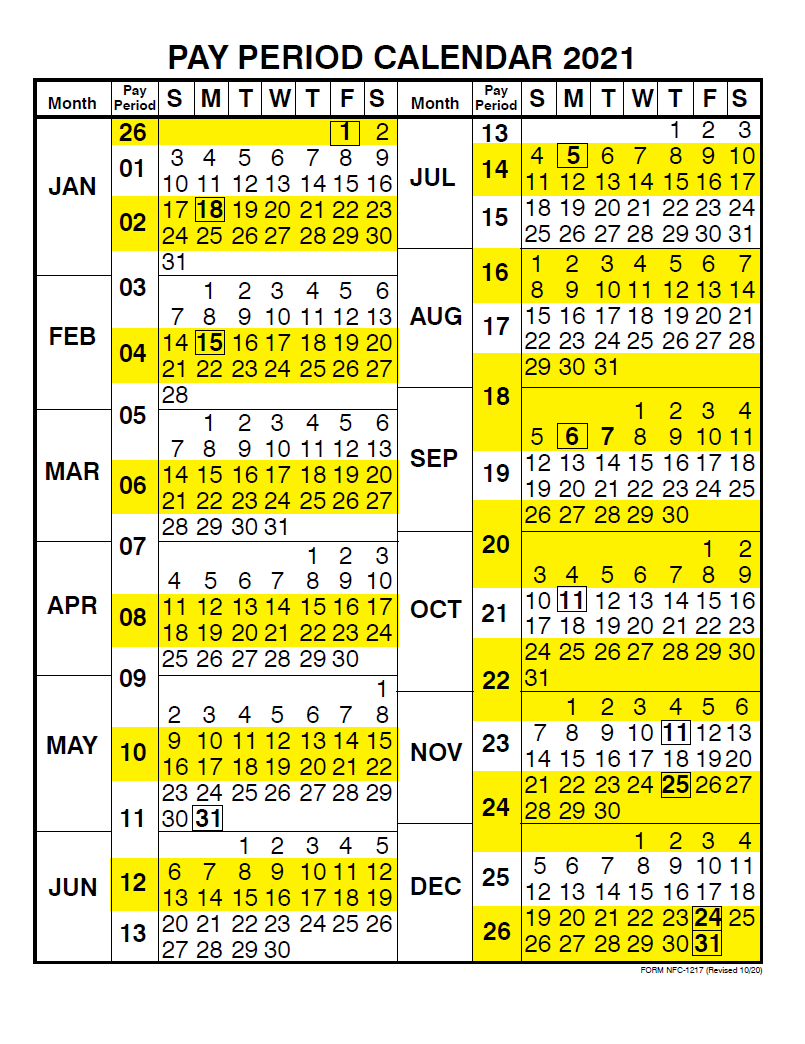

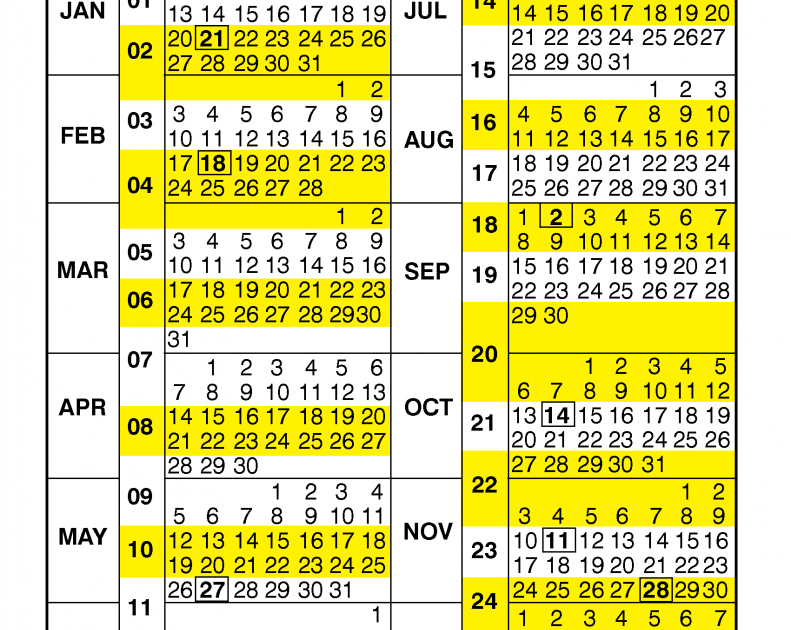

Here is a table to demonstrate the pay frequencies and the number of pay periods during the year, accounting for 2021 for the time being.

| Pay Frequency | |

|---|---|

| Monthly | 12 |

How many pay periods are left for 2020 or 2021 is connected to what month and week youre in. Simply, calculate how many pay periods are left by subtracting the number of pay periods during the year with the number of pay periods that have passed.

Can I Change My Pay Schedule

Once you choose a pay schedule, you may change it, but not frequently and not in a way that reduces your employees’ pay. For example, adjusting a pay period to avoid paying overtime to someone would violate the FLSA.

Changing your company’s pay schedule after several years for a legitimate business reason would be permissible, though.

Fridays: The 2021 Pay Period Leap Year

We have reached the first non-holiday Friday of 2021, which means today is the first payday for many employers . 2021 is one of those years that come along every 5, 6 or 11 years, depending on your exact pay period and payroll calendar.

The Pay Period Leap Year

The Pay Period Leap Year doesnt really exist. Its just the phrase Ive coined to explain a phenomenon that is critically important for large employers or employers with largely salaried workforces, in particular, because it can have a substantial impact on your bottom line and it only happens roughly once per decade.

What is a Pay Period Leap Year? Put simply, Pay Period Leap Years are years with an extra payroll period. Like the Gregorian calendar created by Pope Gregory XIII in 1582, the bi-weekly payroll calendar doesnt fit evenly into a single, 365-day year. The Gregorian calendar addresses this problem by adding 1 day every four years at the end of February, just as we did in 2020. The bi-weekly payroll calendar adjusts by adding a 27th pay period every 11 years. For employers on a weekly payroll cycle, it happens twice as often. 2021 has 53 Fridays which means that, for many employers, 2021 will be a Pay Period Leap Year .

Determining if 2021 is a Pay Period Leap Year for Your Business

If the year starts on a Friday in a non-leap year, like 2021, you end up with 53 Fridays. . For the majority of employers who pay employees on Fridays, this means that 2021 will be a Pay Period Leap Year !

Recommended Reading: Can You Donate Blood While Menstruating

Payroll Calendar: Biweekly Pay Periods In 2022

7 min read time

As HR prepares for the new year, its key to stay ahead of the curve on important dates and compliance requirements. Unlike last year, 2022 will have the usual 26 pay periods for those being paid bi-weekly. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while others are paid weekly receiving up to 52 paychecks in a given year. Read on to learn about these different pay structures, and which one is best for your organization.

First Paycheck: January 8 2021

If your first paycheck of 2021 is on Friday, January 8, the payroll leap year will not affect you. Youll only receive two paychecks in January, and your three paycheck months are April and October 2021.

First Paycheck: Friday, January 1, 2021

Paydays for 2021:

First Paycheck: Friday, January 8, 2021

Paydays for 2021:

Of course, not everyone is paid on Fridays. But you can determine your three paycheck months for 2021 by pulling out a calendar, marking your paydays and finding the months with three of them.

Also Check: 90 Day Probationary Period Policy Examples

How Many Pay Periods Are In A Year

There can be as many as 52 pay periods in a year or as few as 12. The number is ultimately determined by the employer unless the workplace or the employees are in a state that has specific payday requirements. Its important for business owners to strike a balance between the cost of running payroll and the financial needs of their staff.

Is Biweekly Pay Better

Even though you make the same amount of money regardless of your pay frequency, a biweekly pay schedule makes it easier to reduce debt or save more money in the months you receive an additional paycheck. Easy to calculate overtime: While salaried employees are exempt from collecting overtime, hourly employees are not.

Don’t Miss: 90 Day Probationary Period Letter

What Is A Pay Period

A pay period is a recurring stretch of time that represents the days that an employee has worked and is compensated. Pay periods can be weekly, bi-weekly, and semi-monthly.

Every business needs to determine which payroll schedule is right for their company. But, its not always that simple. Small businesses must take into account the needs of the business and the needs of their employees before making their decision.

When employers weigh their options about which type of pay period to use for their team, its important to take into account the kinds of employees you haveand the cost, time, and resources they need to manage their payroll.

-

Monthly: Occurs once a month on a specific recurring date

-

Semi-monthly: Occurs twice a month on two specific recurring dates

-

Bi-weekly: Occurs every two weeks on a specific day of the week

-

Weekly: Occurs once a week on a specific day of the week

One important note to keep in mind is state compliance. While there are federal regulations that must be maintained by every employer, states also have their own compliance requirements that employers need to remain aware of. This differs by state, and employers would be prudent to gain full competency over these regulations to ensure compliance.

Is There An Extra Pay Period In 2021

Most employees get paid twice a month or biweekly. If you get paid biweekly, there are two months or three months in 2021 in which you will get three paychecks depending on when you get your first paycheck. But if you get paid biweekly, you will get 26 paychecks a year. That is two extra paychecks a year.

Don’t Miss: 90 Probationary Period Employment Form

First Paycheck: January 1 2021

- If your first paycheck of 2021 is on Friday, January 1, you may receive three paychecks that month. The other two are January 15 and January 29.

- However, since New Years Day is a bank holiday, many employers will schedule payroll on December 31, 2020. If thats the case, December 2020 was a three paycheck month for you and January 2021 isnt.

- are the other three paycheck months for biweekly workers on this schedule.

Paycheck Months In : What You Need To Know

For most of my career as a salaried employee, Ive been paid biweekly and have received 26 paychecks a year. Thats two more than people who are paid twice a month.

Heres the simple math:

- Biweekly: 52 weeks ÷ 2 = 26 paychecks

- Twice a month: 12 months × 2 = 24 paychecks

Every year, I pull out a calendar and identify the three paycheck months based on my employers pay schedule. But when I reviewed the 2021 calendar for biweekly workers who are paid on Fridays, I realized that its not a typical year for everyone.

You May Like: Period Blood Stains On Sheets

Make A Plan For Your Extra Paychecks

To reach your savings goals faster, I recommend that those who are paid biweekly build their budget based on receiving two paychecks a month and nothing else.

This is something that Ive always done to simplify the budgeting process.

When I create my monthly budget, I set my projected monthly income based on receiving two paychecks and not a penny more.

During the months when you receive three paychecks instead of two, treat the money as a bonus!

Once youve identified the months with three paychecks, make a plan for how youll spend, save or invest the money. Here are just a few of the ways Ive used my third paychecks in the past:

- Pay down mortgage principal

- Pay a semi-annual bill like auto insurance

- Pay for a home improvement project

- Add to the emergency fund

- Invest in a Roth IRA

- Save money for Christmas presents

- Book a weekend getaway

Whats your strategy for your three paycheck months in 2021? Let me know in the comments below and see this step-by-step guideto learn about my personal budgeting method.

The Difference Between Bi

Semi-monthly involves paychecks being distributed on the 15th and the 30th of every month. However, there is a caveat to this. Should either of those dates fall on the weekend, the paycheck is then paid out on the preceding Friday. The upside to this pay period is that typically the paychecks are slightly higher due to there being 2 fewer paychecks throughout the year.

Bi-weekly involves being paid every other Friday. This provides employees with 26 paychecks per year as opposed to the 24 with semi-monthly. Payday is very consistent and allows for a more balanced pay schedule throughout the year.

Read Also: Usaa Grace Period

What Payroll Schedule Is Best

No one pays attention when you get payroll right, but it only takes one mistake to break HRs reputation within your organization. And of course, it is crucial you remain fully compliant as well. When you consider these factors, It comes as no surprise that so many HR pros stick with the payroll practices and schedules they inherited from their predecessor.

But your payroll practices should be intentional, not inheritedespecially when it comes to your pay schedule. Many organizations with a mix of exempt and nonexempt employees are already on a monthly or semimonthly pay schedule simply because thats the way it has always been. In HR, thats never a good reason to continue on with difficult measures.

After some consideration, a semi-monthly schedule may seem easier for calculating benefit deductions, however, the division of deductions on a biweekly schedule is not nearly as complicated as it first seems. You can use one of two methods:

divide your employer annual premium by 26 and deduct that from each biweekly paycheck

divide monthly premiums in half and deduct that from each biweekly paycheckexcept for the extra check for those two months with three pay dates.

Though weekly works similarly, having to run payroll half as often still places bi-weekly at an overall advantage.

Employees also tend to enjoy the few months that offer 3 paychecks, which is exclusively associated with biweekly payment methods.

Do I Have To Pay Employees For An Extra Payday In A Year

You’re not required to pay salaried employees more than their annual salary in years when you have extra pay periods. Some employers choose to reduce pay across all paychecks for the year to adjust for the extra payday.

This can be hard to explain to employees, though. Other employers simply absorb the expense of the extra paychecks.

Don’t Miss: 90 Day Probation Period Template

How Often Does Week 53 Occur

When does a Week 53 occur? This happens when a pay day falls on 31st December or, in a leap year, on 30th or 31st December. Week 53 occurs when there are fifty-three weekly pay days in the year: Therefore in 2019, employers who pay wages on a Tuesday will have 53 pay days thus a Week 53 payroll run.

Overview: What Are Pay Periods

Pay periods are recurring time periods for which employee wages are calculated and paid. The Fair Labor Standards Act requires businesses to pay employees on their “regular payday,” but it doesn’t specify how often those paydays must come.

Instead, states have set their own standards through payday frequency laws.

The most common pay periods are weekly, biweekly, semi-monthly, and monthly. No states allow bimonthly pay schedules. In most states, paying at least semi-monthly is acceptable, but some states have more stringent requirements.

In Connecticut, for example, businesses must pay weekly unless they get approval from the labor commission for longer pay periods. Be sure to verify your state’s laws when setting up payroll.

How often you pay employees is an important decision not only because of its effect on recruiting and retention, but because you need to be able to deliver paychecks consistently based on the schedule you create.

Missing your regular payday, even by as little as a day or two, opens you up to FLSA complaints. The cost of a wage violation can be steep, including double back wages and other penalties.

There are also strategic considerations when setting pay frequency. Employees value shorter pay periods, yet each payroll run costs your business in administrative hours or vendor expense. You’ll need to balance the administrative costs with your talent management goals to find the right frequency for your business.

Recommended Reading: 90 Day Probationary Period Template

Fortnightly Pay Calendar 2021 Australia

Fortnightly Pay Calendar 2021 Australia The pay period is the interval of time between an employees paychecks. The employees working time is tracked to determine how much they are paid. Common intervals for pay periods include weekly, bi-weekly, monthly, and semi-monthly.

Fortnightly Pay Calendar 2021 Australia