Medicare Enrollment 2022 Important Dates You Shouldnt Miss

When you first become eligible for Medicare , you will automatically be enrolled in original Medicare Part A and Part B if you are receiving benefits from Social Security or the Railroad Retirement Board . You have an Initial Enrollment Period of seven months to add additional Medicare health care coverage with an Advantage plan, or Supplemental Insurance and/or a Prescription Drug plan.

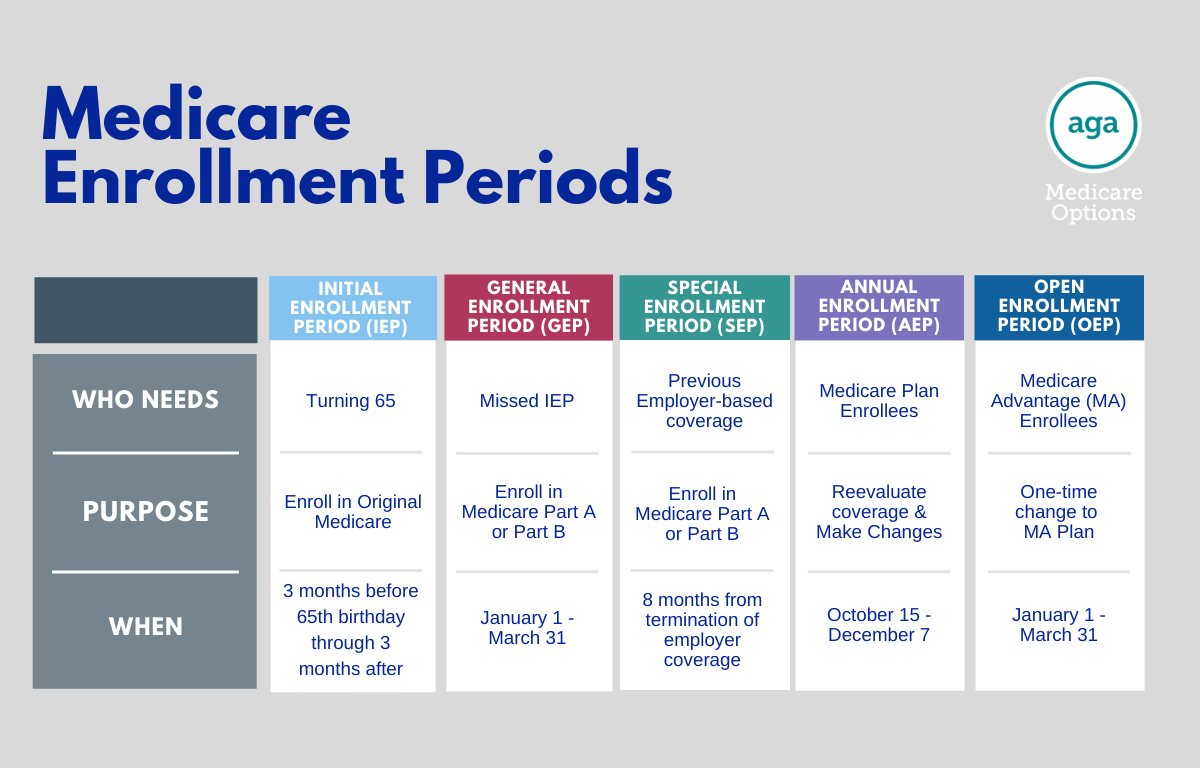

Medicare enrollment or changes to plans you are already enrolled in are limited to specific times.

Important dates to enroll in, switch or cancel a Medicare plan for 2022 are:

Visit www.medicare.gov to get detailed and current information about your Medicare eligibility and enrollment options, or call 1-800-MEDICARE or TTY 1-877-486-2048.

Special Enrollment Period For Parts A And B

Some people with health care coverage through their job or union, or through their spouse’s job or union, wait to sign up for Medicare Part A and/or Part B . If you or your spouse are actively working for an employer with more than 20 employees when you turn 65, you can get a Special Enrollment Period to sign up for Parts A and/or B:

- Any time you’re still covered by the employer or union group health plan through you or your spouses current employment or

- During the eight months following the month the employer or union group health plan coverage ends, or when the employment ends .

If you delay enrolling even longer, you may have to wait for coverage and you may pay a lifetime late enrollment penalty surcharge on your Medicare premiums.

If you’re under age 65, and eligible for Medicare because you’re disabled and working , the SEP rules also apply to you as long as the employer has more than 100 employees.

Medicare Initial Enrollment Period

The earliest time you can enroll in Original Medicare, a Medicare Advantage plan or a Medicare Part D prescription drug plan is during your Medicare Initial Enrollment Period .

Your Initial Enrollment period lasts for seven months:

- It begins three months before you turn 65

- It includes your birth month

- It extends for another three months after your birth month

If you are under 65 and qualify for Medicare due to disability, the 7-month period is based around your 25th month of disability benefits.

You May Like: Donating Blood While Menstruating

Medicare General Enrollment Period

If you don’t sign up during your Initial Enrollment Period and if you aren’t eligible for a Special Enrollment Period, the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

The General Enrollment Period lasts from each year.

You can only sign up for Part A and/or Part B during this period, and your coverage starts on July 1. You may have to pay a late enrollment period for Part A and/or Part B, as detailed below.

|

Part B Late Enrollment Penalty: If you do not enroll in Medicare Part B during your Initial Enrollment Period but decide to enroll later in life, you will have to pay a late enrollment penalty. Your Part B monthly premium could go up 10 percent for each 12-month period that you were eligible for Part B but didn’t sign up. You pay the Part B late enrollment penalty for the rest of your life as long as you remain enrolled in Part B. |

What Should I Consider When Choosing Medicare Coverage Annually

You dont need to use the Medicare Annual Enrollment Period to make a change. But you should speak with a local licensed agent to review insurance plans. After reviewing your Annual Notice of Change and Evidence of Coverage documents, ask yourself the following questions:

- Has my health changed?

- Will my Medicare plan still cover my preferred doctors and specialists?

- Will my monthly premiums increase?

- Will my out-of-pocket costs increase?

Consider these questions, and then speak with a local licensed agent to see if any new plan options are available in your area. Remember, every year, new plans become available. There may be a plan that provides better benefits at a lower cost.

When comparing your current plan with potential Medicare coverage options, question the following:

- Does the plan have better benefits?

- Does the plan accept my preferred doctors and specialists?

- Does the plan have a higher Start Rating than my current plan?

- Does the plan cover my prescription medications and maintain or lower my prescription drug costs?

- Does the plan offer additional benefits that arent covered by Original Medicare Parts A & B?

Weve created an ultimate guide for navigating the Annual Enrollment Period. to understand the Annual Enrollment Periods impact on your health and finances.

Recommended Reading: Can You Donate Blood While Menstruating

When Is Medicare Open Enrollment

Medicare open enrollment also known as Medicares annual election period runs from October 15 through December 7 each year.

During this annual window, Medicare plan enrollees can reevaluate their coverage whether its Original Medicare with supplemental drug coverage, or Medicare Advantage and make changes or purchase new policies if they want to do so.

During the Medicare open enrollment period, you can:

- Switch from Original Medicare to Medicare Advantage .

- Switch from Medicare Advantage to Original Medicare .

- Switch from one Medicare Advantage plan to another.

- Switch from one Medicare Part D prescription drug plan to another.

- Enroll in a Medicare Part D plan if you didnt enroll when you were first eligible for Medicare. If you havent maintained other , a late-enrollment penalty may apply.

Prior to 2021, patients with end-stage renal disease were unable to enroll in Medicare Advantage plans unless there was a Medicare Special Needs plan available in their area for ESRD patients. But that changed as of 2021, under the terms of the 21st Century Cures Act. People with ESRD gained the option to enroll in Medicare Advantage as of 2021, and CMS expected more than 40,000 to do so. This can be particularly advantageous for beneficiaries with ESRD who are under age 65 and living in states that dont guarantee access to Medigap plans for people under the age of 65.

Medigap Plan C And Plan F Changed In 2020

A slight but important change was made to the selection of standardized Medigap plans available in most states.

Plan C and Plan F are no longer available to new Medicare beneficiaries who became eligible for Medicare after January 1, 2020.

If you were already eligible for Medicare before January 1, 2020, you may still purchase Plan C or Plan F in 2020 and beyond if either plan is available where you live.

But anyone who became eligible for Medicare after January 1, 2020, will not be allowed to enroll in either of those two plans.

Anyone currently enrolled in Plan C or Plan F will be allowed to keep their plan going forward.

This 2020 Medigap plans change came as a result of federal legislation that prohibits full coverage for the Medicare Part B deductible. Plan C and Plan F are the only standardized Medigap plans that provide this benefit.

Recommended Reading: New Hire 90 Day-probationary Period Template

When Is The Medicare Initial Enrollment Period

Your initial enrollment period begins three months before the month of your 65th birthday and ends three months after your 65th birthday month.

This happens with one exception: if your birthday is on the first of the month. This will cause your enrollment period to begin one month early. For example: if your birthday is October 1, your enrollment period will begin June 1 and your Medicare will begin one month early as well September 1.

During your initial enrollment period, you can enroll in Original Medicare , Medicare Advantage plan, or Medicare Part D.

I Currently Have A Medicare Advantage Plan With Built

- Switch from your current Medicare Advantage plan to another Medicare Advantage plan with or without built-in drug coverage.

- Drop your Medicare Advantage plan and go back to Original Medicare.

- Join a stand-alone Medicare prescription drug plan if you go back to Original Medicare or if you switch to a Medicare Advantage plan that does not include drug coverage.

- Drop Medicare prescription drug coverage completely. Note that you may be charged a penalty if you decide you want drug coverage again later.

- Make no changes and your current coverage will renew as is.

Recommended Reading: Brown Stuff Instead Of Period

What Changes Are Allowed During The Medicare Annual Enrollment Period

The Medicare Annual Enrollment Period is for people enrolled in Medicare Parts A & B.

Wondering when to enroll in Medicare for the first time? That is either during your Initial Enrollment Period, the General Enrollment Period, or a Special Enrollment Period. But its not during the Annual Enrollment Period.

Everyone enrolled in Medicare can make up to two changes during the Annual Enrollment Period. Here are the six plan coverage changes that are possible:

When You First Get Medicare

- I’m newly eligible for Medicare because I turned 65.

-

What can I do?

Sign up for a Medicare Advantage Plan and/or a Medicare drug plan.

When?

During the 7-month period that:

- Starts 3 months before the month you turn 65

- Includes the month you turn 65

- Ends 3 months after the month you turn 65

If you join

Read Also: 90 Day Probationary Period Template

General Enrollment For Medicare Advantage And Part D

If you sign up for Medicare Part A and/or Part B during general enrollment, you will have a different opportunity to sign up for a Medicare Advantage or Part D prescription drug plan.

This special enrollment period for Medicare Advantage and Part D runs from April through June.

Your coverage will begin July 1.

The Initial Enrollment Period For Original Medicare

![Oregon Medicare Enrollment 2019 [All Questions Answered] Oregon Medicare Enrollment 2019 [All Questions Answered]](https://www.periodprohelp.com/wp-content/uploads/oregon-medicare-enrollment-2019-all-questions-answered.jpeg)

When you first enroll in Medicare, youll be enrolled in Original Medicare , a federally run health care program.

Because of their age, the majority of people are eligible for Medicare. If this describes you, your first opportunity to enroll in Medicare is often during your Initial Enrollment Period, which lasts seven months. It begins three months before your 65th birthday includes your 65th birthday month, and concludes three months after. Most people dont have to sign up if youre already getting Social Security or Railroad Retirement Board payments when you turn 65, youll be automatically enrolled in Medicare. If you need to register personally, you can do so during your Initial Enrollment Period .

If youve been collecting Social Security or Railroad Retirement Board disability benefits for two years, you might be eligible for Medicare before you turn 65. In the 25th month of disability benefits, youll be automatically enrolled in Medicare Parts A and B. If you have amyotrophic lateral sclerosis or end-stage renal disease, you may be eligible for Medicare at any age.

Even if you qualify for automatic enrollment in Medicare Part A, you must enroll in Medicare Part B if you live in Puerto Rico. To avoid late-enrollment fines, you may choose to do so during your IEP.

Some people choose to put off signing up for Medicare Part B. You must pay a premium . Perhaps youre still covered under your employers healthcare plan. Learn more about deferring enrollment in Part B.

You May Like: Period Blood Stains On Sheets

What Is The Initial Enrollment Period For Medicare

The Medicare Initial Enrollment Period is your seven-month window to apply for Medicare and enroll in a Medicare plan. The period starts three months before the month of your 65th birthday and ends three months after. Choosing your Medicare plan during the IEP is your best way to avoid late-enrollment penalties.

First time enrollment tip: If you need coverage the month you turn 65, be sure to sign up in the 3-month window before your birthday.

A Medicare Advantage Plan That Surrenders Contracts With Providers

If your Medicare Advantage plan ceases contracts with many of its providers and these terminations are considered substantial, you will be granted a one-time opportunity to switch to a different Medicare Advantage plan.

The period given to make the change will begin the month you are notified of the opportunity and will continue for two months thereafter.

If your circumstances do not fit into any of the Special Enrollment Periods described above, you may ask the Centers for Medicare and Medicaid Services for your own Special Enrollment Period based on your situation.

Recommended Reading: Usaa Grace Period Auto Insurance New Car

How To Avoid Costly Gaps In Coverage When You Retire After 65

If you anticipate losing your employer-based health insurance, its best to enroll in Medicare before you lose that coverage. This will ensure that you dont experience any gaps in coverage. If you plan to retire, contact your or your spouses employer one or two months in advance to avoid costly gaps in coverage. The human resources department can help you time your Medicare enrollment to start once you lose your employer-based coverage.

Medicare Advantage Open Enrollment Period Ends March 31 Heres What You Need To Know

Medicare Advantage Plans are another way to get your Medicare Part A and Part B coverage and often includes prescription drug coverage. These plans are offered by Medicare-approved private companies that must follow rules set by Medicare.

For Medicare Advantage enrollees there are important dates to understand relating to plan options.

The Medicare Advantage Open Enrollment Period occurs each year from Jan. 1 to March 31. During this time, only individuals currently enrolled in a Medicare Advantage plan have a one-time opportunity to:

- Switch to a different Medicare Advantage plan OR

- Drop their current Medicare Advantage plan and return to Original Medicare and sign up for a stand-alone Medicare Part D Prescription Drug plan

Jeanet Reyes-Cordero, director of Medicare Solutions at Advocate Aurora Health, further explains why Medicare Advantage enrollees need to understand this key enrollment period.

If youre dissatisfied with your current Medicare Advantage plan or have needs that recently changed, the Medicare Advantage Open Enrollment Period allows you the flexibility and option to make a one-time change during this 3 month period, says Reyes-Cordero.

Before making a change, Reyes-Cordero suggests asking the following questions:

Recommended Reading: 90 Day Probationary Period Letter

The Initial Enrollment Period For Medicare Part D

Prescription drug coverage is available through either a Medicare Advantage prescription drug plan or a stand-alone Medicare Part D prescription drug plan. Its worth noting that not all Medicare Advantage plans cover prescription drugs, but the vast majority do.

To be eligible for a stand-alone Medicare Part D prescription medication coverage, you must meet the following criteria:

- Have Medicare Part A and Part B.

- Live in the service area of a Medicare plan that covers prescription drugs.

You can enroll during your Initial Enrollment Period, at the same time that youre first eligible for Medicare Part A and Part B.