File For An Extension By Tax Day

If you can’t finish your return by the April 18 tax deadline, file IRS Form 4868. This will buy most taxpayers until Oct. 17 to file their tax returns. See more about how extensions work.

Note: A tax extension gets you more time to file your return, not more time to pay your taxes. You still must pay any tax you owe, or a good estimate of that amount, by the tax deadline. Include that payment with your extension request or you could face a late-payment penalty on the taxes due.

» MORE: See how to set up an installment plan with the IRS by yourself

Will My Refund Be Issued By Paper Check Or Electronically

Previously, the Department might have issued you a paper check, even if you selected to receive your refund by direct deposit or prepaid debit card. This protection helped the Department avoid sending your money to an account or debit card that is controlled by a criminal.

While the Department honors taxpayer requests to issue a refund electronically, there may be situations in which we will determine its safer to issue a paper check. In some cases, we may send a letter requesting verification of taxpayer identity instead of automatically changing your request to a paper check. The letter instructs you to go to myVTax, select Return filing verification, and enter the verification code included on the letter. This verifies your request and allows us to proceed with processing your refund.

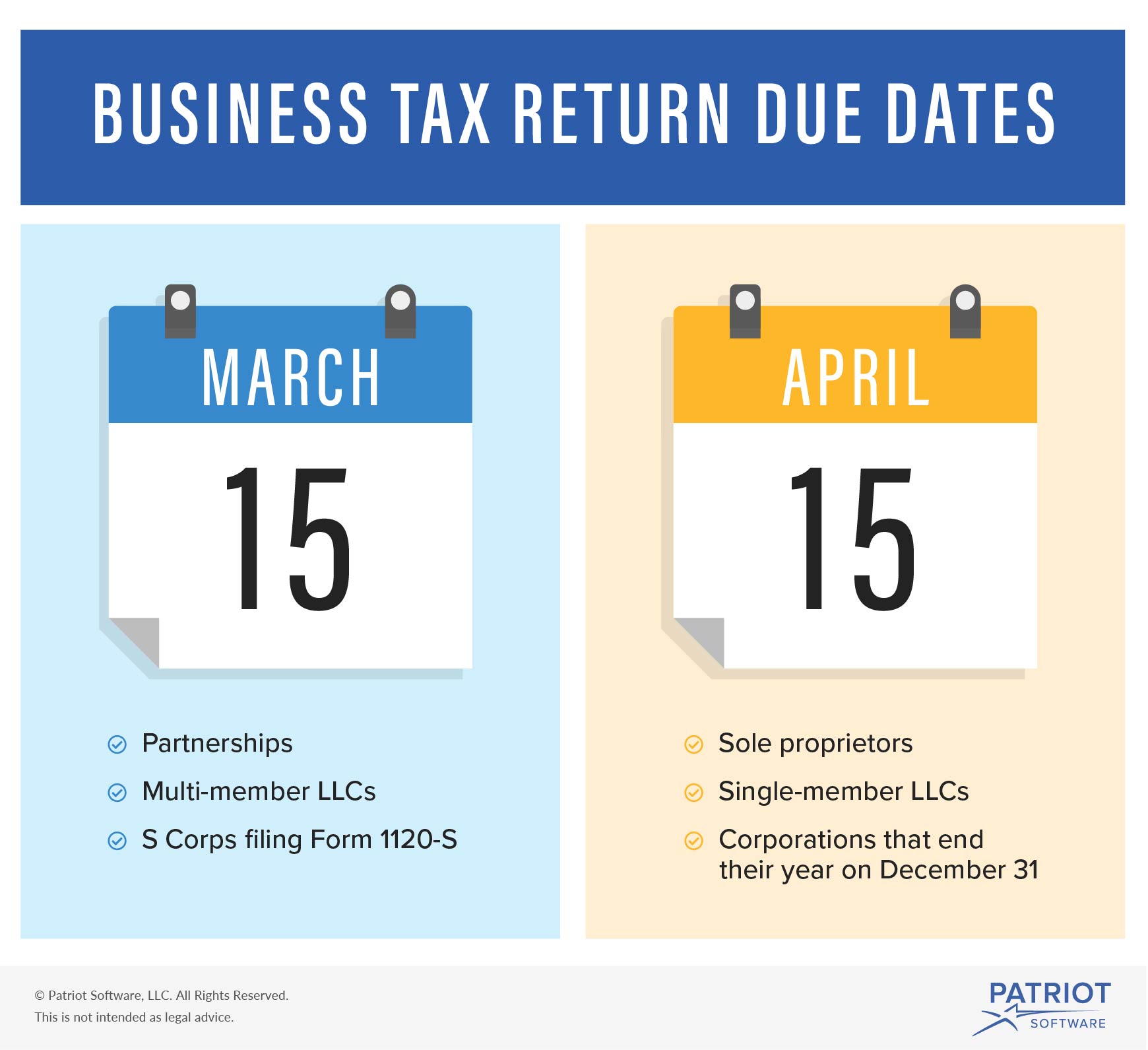

Know The Tax Deadlines That Apply To You So You Don’t Get Hit With Irs Penalties Or Miss Out On A Valuable Tax Break

Getty Images

If you miss a tax deadline, the IRS can hit you hard with penalties and interest. For instance, the standard penalty for failing to file your annual tax return on time is 5% of the amount due for each month your return is late. If you pay your taxes late, the monthly penalty is 0.5% of the unpaid amount, up to 25% of what you owe, plus interest on the unpaid taxes. Similar penalties apply for missing other deadlines. And there could also be other negative consequences for being late, like losing out on a valuable tax break.

It’s easy to avoid these headaches, though just don’t miss the deadline! But we realize that it’s not always easy keeping track of all the various IRS due dates. So, for those of you who need a little help remembering when to file a return, submit a report or pay a tax, we pulled together a list of the most important 2022 federal income tax due dates for individuals. There’s at least one deadline in every month of the year, so play close attentionwe don’t want you to get in trouble with the IRS.

NOTE: Some of the 2022 due dates listed below are extended for victims of recent natural disasters. In addition, several 2021 due dates were extended to January 3, 2022, for other natural disaster victims. In the case of Mississippi water crisis victims, several 2022 deadlines are pushed into 2023. For more information on these extensions, see our articles for victims of:

Read Also: Can You Get In A Pool While On Your Period

Contribute To Or Open An Ira By Tax Day

Contributions to a traditional IRA can be tax-deductible. You have until the April 18, 2022, tax deadline to contribute to an IRA, either Roth or traditional, for the 2021 tax year. The maximum contribution amount for either type of IRA is $6,000 or $7,000 if you’re age 50 or older. See all the rules here.

» MORE: Learn how IRAs work and where to get one

Where Can I Go To File My Taxes For Free

Last year, about 200,000 Vermont taxpayers qualified to file their federal and state income taxes through Free File, but over 12,000, or six percent, of those eligible, used this free online filing service. Taxpayers with low to moderate incomes and elderly taxpayers may also take advantage of free tax assistance through the IRS Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs, the AARP Foundation Tax-Aide Program, and the MyFreeTaxes Partnership. To find out more about these free programs and to see if you’re eligible, see Free File and Free Tax Preparation Assistance.

Also Check: Medicare Open Enrollment Period 2020 Extended

Examples Of Filing Period In A Sentence

-

However, if HL is longer than one-half page: For the Filing Period For efficacy supplements: If a waiver was previously granted, select YES in the drop- down menu because this item meets the requirement. For NDAs/BLAs and PLR conversions: Select NO in the drop-down menu because this item does not meet the requirement .

-

However, if HL is longer than one-half page: For the Filing Period For efficacy supplements: If a waiver was previously granted, select YES in the drop- down menu because this item meets the requirement. For NDAs/BLAs and PLR conversions: Select NO in the drop-down menu because this item does not meet the requirement .

-

Candidates for all positions must indicate their desire to run by completing an official Candidate Filing Form during the Filing Period.

-

The Filing Period for candidates shall be established in accordance with the CSUN Constitution.

-

Any member may nominate himself or herself as a candidate by notice to the Nominating Committee within the Candidate Filing Period.

Do You Need To File A Tax Return

Here’s how to figure out if you should file a tax return this year:

- Look at your income to see if you made the minimum required to file a tax return

- Decide which filing status is best for you

- If you’re retired, find out if your retirement income is taxable

- Find out if you qualify to claim certain to lower the amount of tax you owe

- Use the Interactive Tax Assistant to see if you need to file

You May Like: What To Do On Your Period

Learn About Paying With Web File

You can pay directly from your bank account when you Web File your sales tax return, or make payments in advance of filing. Both options conveniently save your bank account information for future use.

If you pay when you Web File, you can still schedule the payment in advanceas long as you’re filing before the due date.

To help you remit the correct amount, organize your sales data with our Sales Tax Web File worksheets.

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

Uncover industry-specific deductions, get unlimited tax advice, & an expert final review with TurboTax Live Self-Employed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Ways To Slow Down Your Period

What If I Owe More Than I Can Pay

This year, many people are dealing with financial troubles due to the pandemic, job loss, and other factors. If you’re one of them, you may not have the funds available to pay your tax bill by the deadline. But don’t put off filing just because you can’t afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize failure-to-file penalties by filing as soon as possible, paying as much as you can when you file, and setting up an installment plan for the balance.

When Are Taxes Due In Your State

Be sure to find out when your local tax day is. Most taxpayers face state income taxes, and most of the states that have an income tax follow the federal tax deadline. Ask your state’s tax department: When are taxes due?

If you request a tax extension by April 18, you can have until October 17 to file your taxes.

-

However, getting a tax extension only gives you more time to file the paperwork it does not give you more time to pay.

-

If you can’t pay your tax bill when it’s due, the IRS offers installment plans that will let you pay over time. You can apply for one on the IRS website.

If you request a tax extension by April 18, you can have until October 17 to file your taxes.

Don’t Miss: Could You Be Pregnant And Have Your Period

Tax Day For Individuals Extended To May 1: Treasury Irs Extend Filing And Payment Deadline

IR-2021-59, March 17, 2021

WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. The IRS will be providing formal guidance in the coming days.

“This continues to be a tough time for many people, and the IRS wants to continue to do everything possible to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities,” said IRS Commissioner Chuck Rettig. “Even with the new deadline, we urge taxpayers to consider filing as soon as possible, especially those who are owed refunds. Filing electronically with direct deposit is the quickest way to get refunds, and it can help some taxpayers more quickly receive any remaining stimulus payments they may be entitled to.”

Individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on April 15, 2021, to May 17, 2021, without penalties and interest, regardless of the amount owed. This postponement applies to individual taxpayers, including individuals who pay self-employment tax. Penalties, interest and additions to tax will begin to accrue on any remaining unpaid balances as of May 17, 2021. Individual taxpayers will automatically avoid interest and penalties on the taxes paid by May 17.

How Are Individuals Affected By The Tax Deadline Extension

The tax extension deadline generally applies to all calendar year tax-paying entities, including individuals, self-employed persons, and trusts and estates. The Treasury and IRS announced the deferment of filing your federal tax return as well as specific federal tax payments. This delay in payment comes interest- and penalty-free, for 90 days, until July 15, regardless of the amount owed.

Furthermore, anyone who needs to make quarterly estimated tax payments also has until July 15 to submit these payments. This means your 2020 tax year first and second quarter estimated tax payments, previously due on April 15 and June 15, are now both deferred until July 15.

Also Check: How Old Are You When Your Period Stops

Free File Available January 14

IRS Free File will open January 14 when participating providers will accept completed returns and hold them until they can be filed electronically with the IRS. Many commercial tax preparation software companies and tax professionals will also be accepting and preparing tax returns before January 24 to submit the returns when the IRS systems open.

The IRS strongly encourages people to file their tax returns electronically to minimize errors and for faster refunds as well having all the information they need to file an accurate return to avoid delays. The IRS’s Free File program allows taxpayers who made $73,000 or less in 2021 to file their taxes electronically for free using software provided by commercial tax filing companies. More information will be available on Free File later this week.

Tax Filing Season Begins Jan 24 Irs Outlines Refund Timing And What To Expect In Advance Of April 18 Tax Deadline

IR-2022-08, January 10, 2022

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring IRS systems run smoothly. Updated programming helps ensure that eligible people can claim the proper amount of the Child Tax Credit after comparing their 2021 advance credits and claim any remaining stimulus money as a Recovery Rebate Credit when they file their 2021 tax return.

“Planning for the nation’s filing season process is a massive undertaking, and IRS teams have been working non-stop these past several months to prepare,” said IRS Commissioner Chuck Rettig. “The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays. Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year. And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.”

Recommended Reading: My Period Came Twice In One Month

What’s The Fastest Way To File My Tax Return

The fastest way to file your tax return is to file electronically.

E-filing your tax return to the IRS is more secure than paper filing. Because the tax return is electronically transmitted to the IRS, you don’t have to worry about it getting lost in the mail or arriving late. You’ll also get confirmation right away that the IRS has received your return and has started processing it.

If you’re waiting for a tax refund, the fastest way to get your money is to have it electronically deposited into your bank account. The IRS typically issues 90% of refunds in less than 21 days when taxpayers combine direct deposit with electronic filing.

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

Recommended Reading: Does Nexplanon Make Your Period Longer

Does This Extension Also Give Me More Time To Contribute Funds To My Hsa Or Archer Msa For 2019

Yes. Similar to the extended time granted for making retirement account contributions, you may also make contributions to your HSA or Archer MSA by July 15, 2020 for the 2019 tax year. Keep in mind that to ensure accuracy on Form 8889, its often best to make any contributions prior to filing your tax return.

TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. Perfect for independent contractors and small businesses. Well search over 500 tax deductions to get you every dollar you deserve and help you uncover industry-specific deductions.

Penalty For Failure To Pay Or Underpayment Of Estimated Tax

Revised Statute 47:118authorizes a penalty for failure to pay or underpayment of estimated income tax. The penalty is 12 percent annually of the underpayment amount for the period of the underpayment.

Determination of the Underpayment Amount

Determination of the Underpayment PeriodThe underpayment period is from the date the installment was required to be paid to whichever of the following dates is earlier:

Notification of Underpayment of Estimated Tax Penalty

Read Also: How To Tell Your Mom You Started Your Period

What Is A Tax Period Number

Tax period: this is the period of time youve been taxed for. Its usually shown as the month number, e.g. 02 to mean February. Summary of the year to date: Your payslip may show your total earnings, deductions and pay for the current financial year .