Medicare Enrollment: Special Enrollment Periods

In some cases, you might be able to enroll in Medicare, or get other Medicare coverage, outside of the regular enrollment periods. Please note that this table doesnt include every situation that might qualify you for a Special Enrollment Period.

| Your situation with Original Medicare | Medicare Enrollment Period |

| You want to enroll in Medicare Part A and/or Part B. Your employer- or union-based coverage is ending. | Your Special Enrollment Period generally lasts 8 months. It starts at one of these times, whichever happens first.

The month after employment ends The month after employment-based health insurance ends Your SEP Period is usually 2 full months after the month of the triggering events. |

When To Get Medicare Part D

You can enroll in a Medicare Part D prescription drug plan when you first sign up for Medicare.

If you have a special enrollment period due to a qualifying life event, you can take that opportunity to sign up for a Medicare Part D prescription drug plan.

During Open Enrollment, which goes from October 15 to December 7 of every year, you can sign up for a Medicare Part D plan.

The Medicare Secret No One Tells You

Here is the deal, there is a catch if you dont sign up for Medicare parts A, B or D during the initial enrollment period. What no one tells you is that you could face an enrollment penalty later on. This means you may have to pay a higher premium until you DO sign up for the health benefits. Ugh, stupid right?! But its important for you to be aware! I dont want you stuck with extra costs. Its hard enough surviving on the little income you get from retirement.

Also Check: Usaa Car Insurance Grace Period

Am I Automatically Signed Up For Medicare When I Turn 65

The short answer is no, unless you are already receiving Social Security or Railroad Retirement Board benefits. If youre already receiving those benefits, youll receive your Medicare card in the mail before your 65th birthday.

Otherwise, youll have to sign up for Medicare on your own and you may or may not be notified about your eligibility. Thats why it is even more important to know your Initial Enrollment Period dates so you are ready to enroll when its your time.

Medicare Enrollment Periods: When To Sign Up

When to join a Medicare Advantage Plan or Medicare Prescription Drug Plan

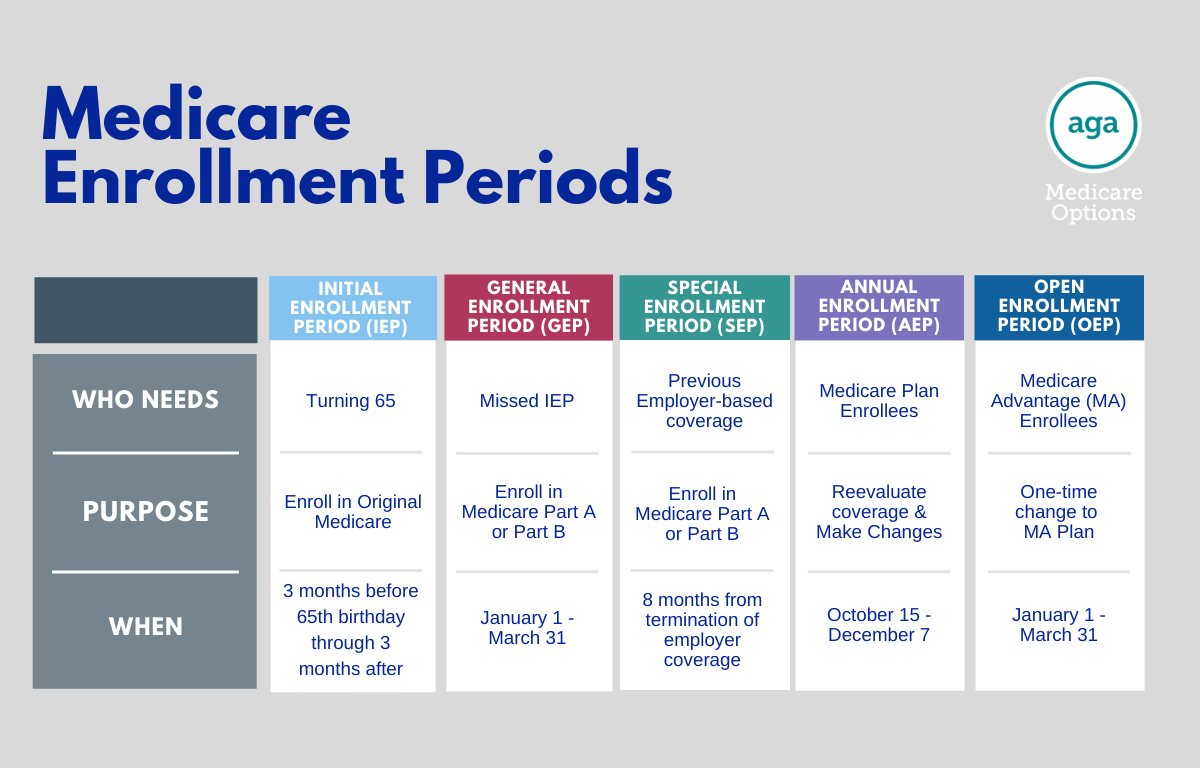

Its important for you to know when to sign up for Medicare or when to join a Medicare plan. Remember these times so you get the most out of your Medicare and avoid late enrollment penalties:

- Initial Medicare Enrollment Period: Most people get Medicare Part A and Part B during this period. It starts 3 months before you turn 65 and ends 3 months after you turn 65. If youre not already collecting Social Security benefits before your Initial Enrollment Period starts, youll need to sign up for Medicare online or contact Social Security.To get the most from your Medicare and avoid the Part B late enrollment penalty, complete your Medicare enrollment application during your Initial Enrollment Period. This lifetime penalty gets added to your monthly Part B premium, and it goes up the longer you wait to sign up. Find out if you should get Part B based on your situation.

- General Medicare Enrollment Period: If you miss your Initial Enrollment Period, you can sign up during Medicares General Enrollment Period , and your coverage will start July 1.

- Special Enrollment Period: Once your Initial Enrollment Period ends, you may have the chance to sign up for Medicare during a Special Enrollment Period . You can sign up for Part A and or Part B during an SEP if you have special circumstances.

When to join a Medicare Advantage Plan or Medicare Prescription Drug Plan

Don’t Miss: Usaa Auto Loan Grace Period

Eligibility Or Loss Of Eligibility For A Special Needs Plan

If you are eligible to enroll in a Special Needs Plan , you may leave a Medicare Advantage plan at any time in order to do so.

If you are already enrolled in an SNP but are losing your eligibility, you may join a Medicare Advantage plan beginning the month that you are no longer eligible for the SNP and lasting for three months.

The Window This Year Is From Oct 15 To Dec 7

Medicare provides health care coverage for many Americans over the age of 65. An estimated 63.3 million people were enrolled in Medicare Part A or B, while another 26.7 million had a private Medicare Advantage plan as of July 2021. The annual Medicare open enrollment period offers an opportunity for recipients to make updates to their coverage. Knowing when the Medicare open enrollment window opens and closes is important for managing coverage year to year.

Also Check: 90 Day Employment Probationary Period Template

The Parts Of Medicare

- Medicare Part A- covers inpatient hospital stays, a short stay at a skilled nursing facility for rehab and part of home health care services. There is no out of pocket premium cost for this part of Medicare.

- Medicare Part B- covers doctors visits, outpatient services, physical and occupational therapies, and certain medical equipment you may need to recover or for physical safety purposes. There is an out of pocket premium cost for this part of Medicare.

- Medicare Part D- is a prescription plan to help cover the cost of your medications. There is an out of pocket premium but your State may offer an assistance program if the cost is too high.

Ok, so did we have A, B, and D, did they just decide to skip a part C?

No, Medicare part C is considered the Medicare Advantage plans. Medicare Advantage plans are private insurance companies that work as a third party to manage your Medicare insurance. Advantage plans basically offer an all-inclusive type of deal rather than Original/Traditional Medicares a la carte service.

There are certainly advantages and disadvantages to choosing Medicare part C or a Medicare Advantage plan. You can see the previous posts where we talked about the differences between Traditional Medicare and Medicare Advantage Plans.

How Do I Qualify For Automatic Enrollment Into Medicare

You qualify for automatic enrollment if youre collecting Social Security benefits. You should receive your Medicare card about three months before your 65th birthday. If youre not collecting Social Security by the time you age into Medicare at 65, youll need to actively enroll yourself.

If you have Social Security or Railroad Retirement Board disability for at least 24 months, you qualify for automatic enrollment as well. Your Medicare card is mailed out about three months before the 25th month of collecting disability benefits.

Read Also: 90 Day Probationary Period Form

Special Enrollment Period For Medicare

In the memorandum issued by CMS, the agency stated that the SEP is applicable and available for beneficiaries who were eligible for, but unable to make, an election because they were affected by the ongoing public health crisis. All states, tribes, territories, and the District of Columbia are covered by this SEP beginning March 1, 2020, and ending June 30, 2020.

CMS considers individuals as “affected” and eligible for this SEP under FEMA if they:

- Reside, or resided at the start of the incident period, in an area for which FEMA has declared an emergency or major disaster and has designated affected counties as being eligible to apply for individual or public level assistance

- Had another valid election period at the time of the incident period and

- Did not make an election during that other valid election period.

In addition, the SEP is available to those individuals who do not live in the affected areas but rely on help making healthcare decisions from friends or family members who live in the affected areas. The SEP is available from the start of the incident period and for four full calendar months after the start of the incident period. Further, an eligible beneficiary would be given one opportunity to make that missed election as a result of this SEP. Beneficiaries will not be expected to provide proof that they were affected by the pandemic-related emergency.

How Does Medicare Open Enrollment Work

Medicare consists of a few key parts. Original Medicare refers to Part A and Part B, the basic parts of Medicare that cover hospital care and outpatient care. There is also Medicare Part D, prescription drug coverage, and Part C, which allows you to receive Medicare benefits through a private insurance company.

If you would like to make changes to your Medicare coverage, there are options available. If you only have Part A, you can add on Part B, and vice versa.

Part D is offered through private insurance companies, and you may want to keep that coverage but simply switch to a different plan. These are the types of scenarios Medicare Open Enrollment is for: you are able to change any part of your coverage you like, to mix and match the parts.

Don’t Miss: Usaa New Car Insurance Grace Period

Annual Open Enrollment And Medicare Advantage

Medicare Advantage plans are a unique offering in the world of Medicare. With Advantage plans, sometimes called Part C plans, you can receive your coverage through a private insurance company rather than through Medicare. This means your coverage will function in the way you are used to from before you received Medicare: your plan may have a specific network, as well as unique benefits, perks and pricing structures.

Many Advantage plans are out there, but one thing holds true for all of them. If you have a Medicare Advantage plan, you can’t be enrolled in Part A or Part B. The coverage would overlap, so this protects you from the possibility of accidentally receiving redundant coverage. You can make the switch from Original Medicare to a Part C plan during the Open Enrollment Period.

You Have A Chance To Get Other Coverage

- I have a chance to enroll in other coverage offered by my employer or union.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan to enroll in the private plan offered by your employer or union.

When?

Whenever your employer or union allows you to make changes in your plan.

- I have or am enrolling in other drug coverage as good as Medicare prescription drug coverage .

-

What can I do?

Drop your current Medicare Advantage Plan with drug coverage or your Medicare Prescription Drug Plan.

When?

- I enrolled in a Program of All-inclusive Care for the Elderly plan.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan.

When?

Anytime.

You May Like: Usaa Grace Period Auto Insurance

Medicare Sign Up: What You Cant Do

The annual Medicare open enrollment period does not apply to Medigap plans, which are only guaranteed-issue in most states during a beneficiarys initial enrollment period, and during limited special enrollment periods.

If you didnt enroll in Medicare when you were first eligible, you cannot use the fall open enrollment period to sign up. Instead, youll use the Medicare general enrollment period, which runs from January 1 to March 31.

Medicares general enrollment period is for people who didnt sign up for Medicare Part B when they were first eligible, and who dont have access to a Medicare Part B special enrollment period. Its also for people who have to pay a premium for Medicare Part A and didnt enroll in Part A when they were first eligible.

If you enroll during the general enrollment period, your coverage will take effect July 1.

Learn more about Medicares general enrollment period.

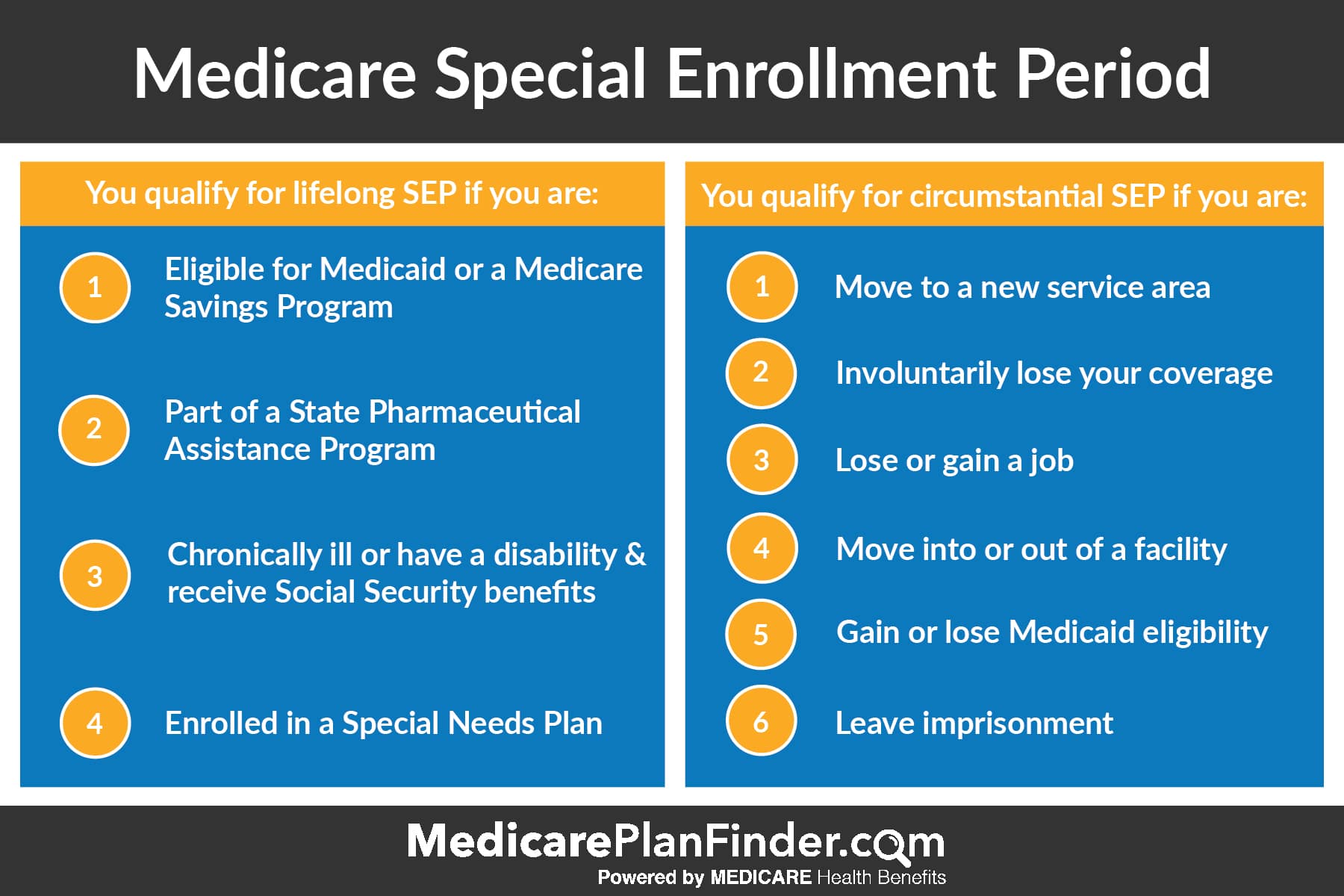

Medicare Special Enrollment Period

Depending on your circumstances, you may also qualify for a Special Enrollment Period .

Medicare Special Enrollment Periods can happen at any time during the year. You may qualify for a Special Enrollment Period for a number of reasons, which can include:

- You moved to a new area that is outside of your current Medicare Advantage plan’s service area

- You left your employer coverage

- Medicare ended your current Medicare Advantage plan’s contract

A licensed insurance agent can help you find out if you qualify for a Medicare Special Enrollment Period.

You May Like: New Hire 90 Day-probationary Period Template

Delaying Medicare Part B Enrollment

If you enroll for Part B during GEP, there is also a late Medicare enrollment penalty. The penalty is 10 percent of your premium and will be added to your monthly premium unfortunately, you will have to pay this extra fee for as long as you have Medicare Part B.

You may be able to avoid Medicare Part A and Part B if you have group health coverage through your employer or spouses employer group plan. In this case, when you retire or your coverage ends, you will be able to apply for Medicare during the Special Enrollment Period.

However, despite all this, we still recommend that you enroll in Medicare as soon as you become eligible to avoid any gaps in coverage and late enrollment penalties.

I Currently Have A Medicare Advantage Plan With Built

- Switch from your current Medicare Advantage plan to another Medicare Advantage plan with or without built-in drug coverage.

- Drop your Medicare Advantage plan and go back to Original Medicare.

- Join a stand-alone Medicare prescription drug plan if you go back to Original Medicare or if you switch to a Medicare Advantage plan that does not include drug coverage.

- Drop Medicare prescription drug coverage completely. Note that you may be charged a penalty if you decide you want drug coverage again later.

- Make no changes and your current coverage will renew as is.

Read Also: How To Get Period Blood Out Of Your Underwear

Contract Violations Or Enrollment Errors

If you are enrolled in a Medicare Advantage plan that failed to provide benefits in accordance with the plans terms or provided misleading information about coverage or other circumstances, you may be given an opportunity to disenroll from or switch to a new Medicare Advantage plan.

The timeframe in which you may do so will depend on the situation.

When Working Past : 8

For people who work past 65 and qualify to delay Medicare with creditable employer coverage, there is an 8-month Special Enrollment Period that allows you to enroll in Part A , Part B , Part C and Part D without late penalties.

This Special Enrollment Period is tricky though. Why? Because while you have the whole 8 months to get Parts A & B, you only get the first 2 monthsto enroll in Part C or Part D without penalty. If you enroll after the two-month mark, youll face late enrollment penalties for Part D .

To qualify for the Part B Special Enrollment Period, you must have creditable employer or union health coverage based on current employment. Your Special Enrollment Period will begin eight months after your employer coverage ends or you leave your job, whichever happens first.

Recommended Reading: Dark Discharge Instead Of Period