Setting Up A Google Calendar Reminder

The Payroll Office advises that each hourly employee and their supervisors create a tickler on their Google calendar so that they automatically receive an email every other week reminding them of payroll deadlines.

For example, if you want an email prompt to remind you to submit your time sheet to your supervisor every other Monday, follow these procedures:

How Pay Periods Work

Employers set a regular pay period to ensure their employees receive consistent paychecks. While most companies base their pay schedule on the needs of the business, there are labor laws in place that govern the minimum consistency with which these schedules must comply.

Before choosing your pay schedule, its important to know how often your state requires employers to process payroll, which we detail in our state payroll guides.

Check out our state payroll directory for details.

Employers consider the minimum frequency at which they can legally process payrollusually monthlyto set a regular pay schedule. Remember, every pay schedule includes start and end dates for time worked and a payday on which employees receive their paychecks. The payday varies depending on the employer some designate the payday to be the last date of every pay period, while others may opt to pay a week after the pay period ends.

If youre using a professional employer organization , your payday options may be limited .

How Often Do You Have To Pay Your Employees Biweekly

Most states dictate how often you must pay your employees. If the state-required payday frequency is biweekly, you may pay more often, such as weekly, but not less frequently. To allow enough time for payroll processing, the pay period end date for your biweekly payroll is set prior to the actual payday.

How to calculate federal income tax for biweekly pay period?

For an hourly-paid employee, multiply her pay rate by her total work hours for the biweekly pay period. Deductions are done based on the two-week pay period. Use the respective Internal Revenue Service Circular Es biweekly tax-withholding table to figure federal income tax.

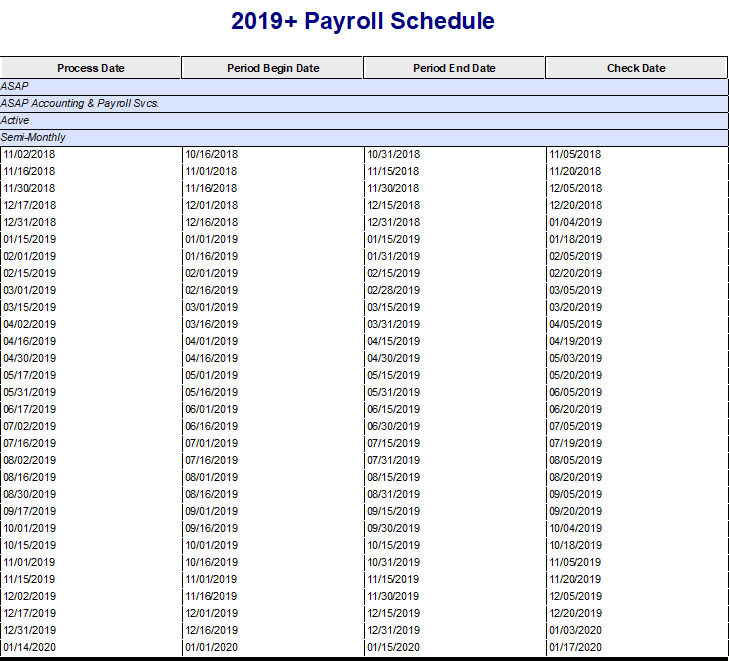

When does the biweekly payroll start at UAB?

2020 Biweekly Payroll Schedule Period Start Date End Date Check Date Extra Pay Date 23 25-Oct-20 7-Nov-20 13-Nov-20 19-Nov-20 24 8-Nov-20 21-Nov-20 27-Nov-20 3-Dec-20 25 22-Nov-20 5-Dec-20 11-Dec-20 17-Dec-20 26 6-Dec-20 19-Dec-20 24-Dec-20 31-Dec-20

Also Check: Can I Get Pregnant After My Period

Can A Business Change Pay Periods

While changing your companys pay period is possible, it shouldnt be done without some considerations. Along with any overtime considerations , ask yourself these questions:

Does your company offer direct deposit? If so, youll need to coordinate with all of the various financial institutions and make sure deposits arent interrupted during the transition. Typically, direct deposit funds are transferred one to two days prior to the direct deposit date.

Do you have payday traditions? If you give employees extra time over their lunch hour to deposit paychecks, provide special office hours for workers in the field to collect their checks or have the CEO hand out checks, consider how changing your pay period will affect these traditions. SHRM advises these traditions may be cherished by employees and changing them may cause negative reactions.

How well do you communicate with your employees? Changing the pay period is a big deal. Your employees count on their paychecks being available on payday. If your communication isnt great, not only will there be confusion but there are also likely to be negative employee reactions. Aside from sending emails and placing notices on bulletin boards, SHRM advises making communication more proactive by hosting a new payday fair. Invite your payroll processor or other vendors to participate. Use the opportunity to educate employees about direct deposit, 401 and other financial planning options.

When Is Federal Payday

Federal Government employees are paid on the same day regardless of their pay scale. The federal government pays salaries on a biweekly basis known as a pay period. A pay period is typically 80 hours of work. If an employee works less than 80 hours per pay period, such as if they take unpaid leave or are an hourly employee, they will be paid at a pro-rated rate. Pay periods start on Sunday and end on Saturday at midnight.

Sick and Annual Leave is also accrued at the same time that pay is issued. If an employee works less than a full 80-hour pay period, paid leave is accrued at a pro-rated rate as well.

Payday is Wednesday morning. However, for most employees pay is typically deposited into employees accounts on Thursday the morning. Employees may receive pay on the Wednesday afternoon in somecases. If an employee banks with a federal credit union or another bank that works closely with the federal government, their pay will likely be deposited on Wednesday afternoon.

Payments are issued two weeks after a pay period ends. Employees are hired at the beginning of a pay period so new employees will work for nearly 4 weeks before receiving their first paycheck. This also means that any overtime worked will not be paid for at least two weeks.

Related Articles

Read Also: How To Count Safe Days Before And After Periods

Common Pay Period Mistakes To Avoid

Mistakes with payroll can result in fines and deeply unsatisfied workers. In fiscal year 2019, the U.S. Department of Labor recovered $322 million in back wages owed to workers. And an average $1,120 was due per employee in back wages in FY 2020. Some common payroll mistakes include the following.

What Is Biweekly Pay

A biweekly pay schedule means you pay your employees every other week on a particular day of the week. For instance, you may send paychecks out to employees every other Friday. Since one year has 52 weeks, the biweekly pay schedule has 26 pay periods during the calendar year.

According to the U.S. Bureau of Labor Statistics, 43% of businesses use the biweekly pay schedule, making it the most common payroll schedule.

Recommended Reading: Due Date Based On Last Period

What Is Weekly Pay

Weekly pay is when you get paid every 7 days. If your pay period starts on Monday, you usually get paid on Friday at the end of the day.

The weekly pay schedule is a common pay schedule in the US and has grown popular over the years. Since there are 52 weeks in a year, there are 52 weekly pay periods as well.

While not used in all industries, weekly pay is the standard schedule in retail, retail, wholesale, and food service workplaces.

Cons Of Quarterly Pay Period

The cons of having quarterly pay include you cannot plan around an annual event such as vacations without risking running out of funds mid-way through one payday versus biweekly pay periods which already come back two weeks those employees who feel that receiving four payments instead of twelve over the year is very beneficial

Read Also: How To Make Your Period Come Later

Cons Of Annual Pay Period

One con to Annual Pay is if any income changes midyear, you will need to wait until next year for final settlement. Another con to annual pay is you have to budget for every paycheck. Annual Pay businesses can be very diverse such as medical doctors and dentists, tax accountants and attorneys etc.

Annual pay schedule is common for people that get bonuses and commissions, since their earnings arent always varying amounts.

Paying In Arrears Vs Current

When you pay on a current schedule, you pay employees as soon as or before their pay cycle ends. Paying in arrears means theres a delay between the time employees work and when they receive pay for that work. This delay could be a week or more, depending on state laws.

Heres an example of paying employees in arrears.

Jeff sets his pay period as Sunday through Saturday but opts to pay Friday of the following week . While this is sometimes a nuisance to new employees who may have to work a week in the hole, meaning theyre not paid at the end of their first week, it can be beneficial for some employers.

If you pay your employees for time that has not yet passed, there could be unexpected changes in their schedule for which youll need to make adjustments on the next pay period. This can become cumbersome, as youll have to keep track of pay cycles for which youve already processed payroll it can also involve complying with federal overtime lawspaying time and a half for hours worked over 40 in a workweek.

Also Check: Does Birth Control Delay Your Period

Differences Between Payday Pay Period And Pay Cycle

Employers, workers, and independent contractors mustunderstand three important payroll terms: payday, pay period, and pay cycle.Business owners must be able to set up payroll systems that accuratelycalculate and pay workers, and the pay process must be explained to the entirestaff.

In this article we will define these payroll terms, explain the information that is reported on a pay stub, and provide a real world payroll calculation example.

Biweekly Payroll Calendar Template For Small Businesses

So, your business is growing, and youâre hiring employees. Itâs an exciting time for sure, but it comes with many questionsâespecially if youâre a first-time employer.

One of the questions you need to figure out before your employees start working is, âHow often should I run payroll?â

As the business owner, this is entirely up to youâbut the most popular payroll schedule is biweekly. But what, exactly, does this payroll schedule entail? And is there a calendar you can follow? Weâll dive into all that and more, so keep reading!

Don’t Miss: What To Do When Your Dog Starts Her Period

How To Choose The Right Pay Period For Your Business

Choosing the right pay period is crucial for your small business and you need to evaluate a variety of factors, such as finances, logistics, and human resources. Consider the type of employees you have, the structure of your business, and if your employees are paid overtime. Here are the pros and cons to each pay period option:

Pay Period Start And End

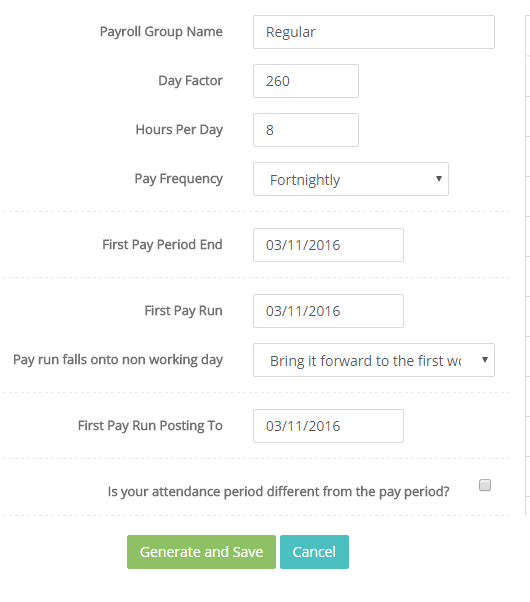

I have gone to Set up preferences and put Wednesday as the first day of the pay week but when i go to do the pays it comes up with the Tuesday date. Also how do I set the payment date to the Thursday of each week

Welcome to the MYOB Community Forum, I hope you find it a wealth of knowledge

When you go to Payroll> > Process Payroll, the payment date is determined by the current date. For example, if you go to Process Payroll on 01/06/2017, this date will be the payment date. This date is also used as the pay period end date, with the payment frequency selected determining the pay period start date.

When you go to Setup> > Preferences> > System tab you get the option for “I use Timesheets for Payroll and My week starts on x”. The day of the week that you set in this window decides how the Enter Timesheet window looks and doesn’t impact the Process Payroll window.

So as you are opening the window on Tuesday this will make the Payment Date Tuesday and therefore flow through to date elsewhere on the window. You are unable to set that you would like x day to be the payment date/period dates for the Process Payroll window only the Enter Timesheet window.

Kind regards,

Recommended Reading: How To Get Pregnant While Breastfeeding And No Period

Determining Whether To Pay In Arrears Or Current

There is no hard rule guiding whether you should pay in arrears or current. You should consider the needs of your business and your employees. Paying in arrears gives you time to gather all time sheets, tip reports, and other information to ensure you process payroll correctly theres no need to forecast employee schedules.

Paying current is less confusing for some employees and works well in certain instances. Lets assume a company has a Sunday through Saturday pay cycle, with Friday being the payday. If the employees only work weekdays, Monday through Friday, there would be less guesswork. Although Saturday is a part of the pay cycle, the employees dont work on Saturdays. It also works for salaried employees who are paid the same amount every pay period, regardless of hours worked.

For a list of other payroll terms that small business owners need to know, check out our guide on payroll terminology. Its also helpful to get a good grasp as to what payroll is and isnt.

Why Do Some Years Have 27 Paydays

When you use a biweekly schedule, most years have 26 pay periods. However, some years will have 27. Why is that? Well, calendar math can be complicated. Hereâs why it happens.

Paying your employees every other week means you have two weeks, or 14 days, per period. If you look at how many pay periods there should be in a year, it turns out itâs a little over 26.

In other words, when you take the 365 days in a year and divide by the 14 days per period, you get 26.071 pay dates per year. That extra .071 is less than 10% of a single pay period. After about 14 years, that extra amount equals a whole extra pay period.

All you need to know is that technically, about every 14 years, you will have 27 pay periods. Unfortunately, it doesnât happen in the same year for every business.

Say you started your business five years ago, and your friend started one three years ago. Each of you will have a different amount of rollover time. Ultimately, your 27-period year depends on when you began using a biweekly payroll schedule.

If you want to find out when your 27-period year is due, you can speak with a human resources specialist who can look at your previous records and let you know when youâll need to add an extra payday to your schedule.

Read Also: Why Does My Stomach Hurt On My Period

What Payroll Schedule Is Best

No one pays attention when you get payroll right, but it only takes one mistake to harm HRs reputation within your organization. And, of course, it is crucial you remain fully compliant as well. When you consider these factors, It comes as no surprise that so many HR pros stick with the payroll practices and schedules they inherited from their predecessors.

But your payroll practices should be intentional, not inheritedespecially when it comes to your pay schedule. Many organizations with a mix of exempt and nonexempt employees are already on a monthly or semimonthly pay schedule simply because thats the way it has always been. In HR, thats never a good reason to continue on with difficult measures.

After some consideration, a semi-monthly schedule may seem easier for calculating benefit deductions however, the division of deductions on a biweekly schedule is not nearly as complicated as it first seems. You can use one of two methods:

Divide your employer’s annual premium by 26, and deduct that from each biweekly paycheck.

Divide monthly premiums in half, and deduct that from each biweekly paycheckexcept for the extra check for those two months with three pay dates.

Though weekly works similarly, having to run payroll half as often still places biweekly at an overall advantage.

Employees also tend to enjoy the few months that offer three paychecks, which is exclusively associated with biweekly payment methods.

Pros Of Annual Pay Period

The main pro to Annual Pay is you get paid a large sum amount. Which can make it easier to make big purchases. For example, a $6,000 annual bonus sounds like a big bonus, but it is only $500 a month .

If you were given an extra $500 a month, you may spend it on smaller purchases, whereas if you were given $6000, you may consider a larger purchase.

Don’t Miss: How To Regulate Periods With Pcos

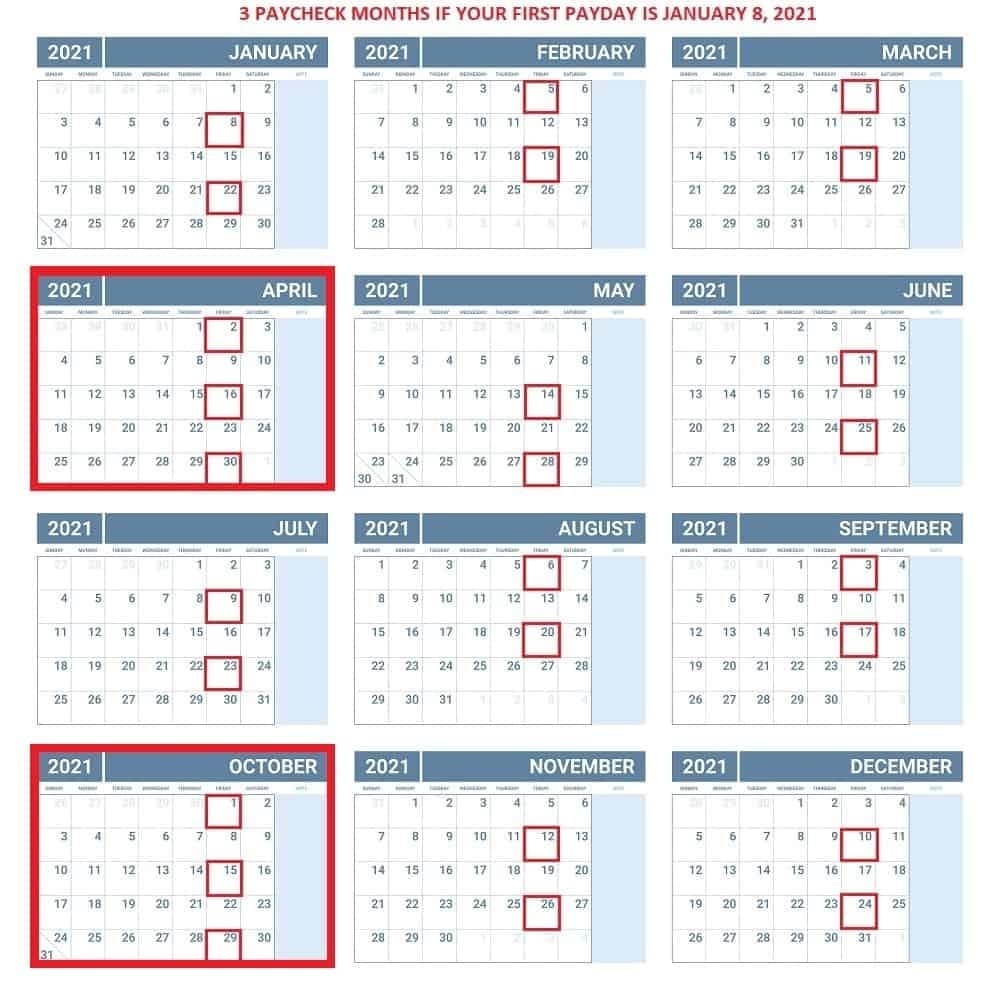

Which Months Have Three Pay Periods In Them

Some months are longer than others, and that means payday may occur three times, instead of two. If you start your biweekly payroll schedule on Friday, January 6, 2023, your three-paycheck months will be March and September.

As the employer, you donât need to plan too much for this since it happens automatically due to your payment schedule. However, itâs good to be aware since your payroll expenses will appear higher for those two months.

Things To Know About Pay Periods

Weekly, bi-weekly, monthly? Compensation planning isnt just about how much you pay employees. Its about the when. Determining an appropriate timeline for paying employees is a challenge all new businesses face. With multiple options to consider, its certainly not an easy decision, especially when changing pay periods can be a major hassle. To help you understand which pay period frequency is the right fit for your business, well go through the ten things you need to know.

Also Check: Average Age A Girl Starts Her Period