What Accounts Are Used In A Periodic Inventory System

Under the periodic inventory system, all purchases made between physical inventory counts are recorded in a purchases account. When a physical inventory count is done, the balance in the purchases account is then shifted into the inventory account, which in turn is adjusted to match the cost of the ending inventory.

What is the major difference between the periodic and perpetual inventory system? The periodic system relies upon an occasional physical count of the inventory to determine the ending inventory balance and the cost of goods sold, while the perpetual system keeps continual track of inventory balances. There are a number of other differences between the two systems, which are as follows: Accounts.

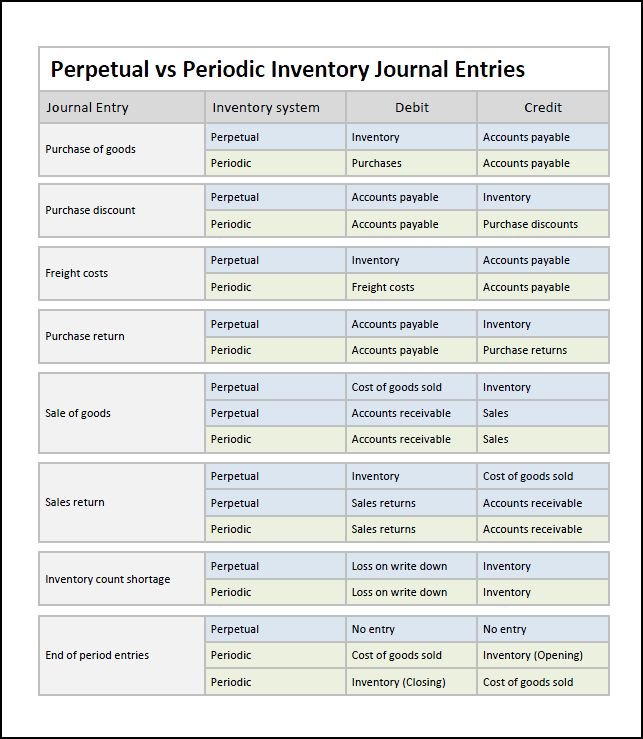

Periodic Inventory System Journal Entries

The periodic inventory system journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting under a periodic inventory system.

In each case the periodic inventory system journal entries show the debit and credit account together with a brief narrative. For a fuller explanation of journal entries, view our examples section.

Cons Of A Periodic Inventory System

Now, keep in mind that the previously mentioned advantages only benefit small businesses that deal with a couple of hundred sales a year.

As stock levels arise, and your company grows, the periodic inventory system becomes complex and difficult to manage. Thats why the approach isnt suitable for every type of company, and the majority of businesses use perpetual inventory instead.

And thats only one of the many disadvantages of the system.

Because theres no constant inventory tracking, it can be difficult for a firm to be aware of which goods are running low on stock, or if theres an excess supply for a type of inventory.

This lack of information can result in a loss of possible revenue and sales opportunities.

At the same time, it prevents a business from planning and forecasting future inventory levels. This in turn means theres no data for the company to analyze and better understand customer buying patterns, best-selling products, growing segments, or any other indicator that allows businesses to forecast demand.

Read Also: Can You Donate Plasma On Your Period

Periodic Inventory System Disadvantages

While the periodic inventory system works well for some types of businesses, in particular those with high sales volume, it does have some disadvantages. These include not knowing stock levels, a lack of detail, the potential for a loss of revenue, and not collecting useful sales information.

The periodic inventory system was created as a way to track inventory in businesses with high sales volume. Prior to computer technology, barcodes, and RFID tags, when everything had to be counted by hand, it was impractical to continuously track inventory in businesses where sales volume was high, and inventory turn-over was rapid. The periodic inventory system eliminated the need to continuously track inventory and instead used what was essentially a once-a-year batch system of inventory accounting.

How Does Periodic Inventory Work

In a periodic system, businesses dont keep a continuous record of each sale or purchase inventory balance updates are only recorded in a purchases account over a specified period of time .

At the end of the accounting period, the final inventory balance and COGS is determined through a physical inventory count.

Also Check: 90 Day Probationary Period Policy Examples

Netsuite Can Help Provide Visibility Into Your Inventory

Properly managing inventory can make or break a business, and having insight into your stock is crucial to success. While the periodic method is acceptable for companies that have minimal inventory items or small businesses, those companies that plan to scale will need to implement a perpetual inventory system. Regardless of the type of inventory control process you choose, decision makers need the right tools in place so they can manage their inventory effectively. NetSuite offers a suite of native tools for tracking inventory in multiple locations, determining reorder points and managing safety stock and cycle counts. Find the right balance between demand and supply across your entire organization with the demand planning and distribution requirements planning features.

Learn more about how you can manage inventory automatically, reduce handling costs and increase cash flow.

In This Article

Purchases Account Under The Periodic Inventory System

The general ledger account Purchases is used to record the purchases of inventory items under the periodic inventory system. Under the periodic system the account Inventory will have no entries until it is adjusted at the end of the accounting year so that it reports the cost of the ending inventory.

Under the periodic system, the cost in the account Purchases will be added to the cost of the beginning inventory to arrive at the cost of goods available. The cost of the ending inventory is computed through a physical count and is subtracted from the cost of goods available to arrive at the cost of goods sold.

Don’t Miss: Nationwide New Car Grace Period

When Is A Periodic Inventory System Used

A small company with a low number of SKUs would use a periodic system when they arent concerned about scaling their business over time. Depending on your products and needs, you could also use a periodic system in concert with a perpetual system.

Any business can use a periodic system since theres no need for additional equipment or coding to operate it, and therefore it costs less to implement and maintain. Further, you can train staff to provide simple inventory counts when time is limited or you have high staff turnover. For example, seasonal staff may come and go. They can quickly count the goods they are working with, whereas a perpetual system, which provides a more accurate inventory, requires training staff on electronic scanners and data entry. Learn more about a perpetual system and how it gives a more precise inventory solution by reading our Guide to Perpetual Inventory.

You can also use a periodic system if you have a handle on your supply chain process, sell a few products and have eyes on your goods as they flow through your business. A periodic system isnt useful if you need to investigate to identify missing inventory or unbalanced numbers. This issue will arise as your operation grows and becomes more challenging to control positively.

Fifo Perpetual Inventory Method

FIFO is a method to account for an inventory in a way that the stock purchased first will be sold first so that the leftover inventory is always the recently purchased inventory. For the perpetual FIFO cost flow assumption, the company records sales as they happen in the ledger. It is a cost flow estimation to evaluate the stocks.

The significant difference in the ledger in a perpetual inventory method compared to a periodic system is that the balance is a running tally of the value of sold units and the total units.

The total unit cost transferred over to the balances happens when the stock sold comes in. The value of the stock the company bought will be consistent throughout its lifecycle in the company.

Below is the example of Inventory card in FIFO perpetual inventory method

Image Courtesy Accounting For Management

Recommended Reading: Get Period Blood Out Of Underwear

Accounting For Purchases With The Periodic Inventory System

For accounting purposes, when using a periodic inventory system purchases are not added to inventory, but instead are added to an “assets” account. When a physical inventory is conducted the balance in the “assets” account is moved to the “inventory” account. For all practical purposes the “assets” account is an accumulation account. It accumulates the value of all purchases for an accounting period. Then it is completely emptied when the balance is transferred to the inventory account at the end of the accounting period.

An advantage of the periodic inventory system is that there is no need to have separate accounting for raw materials, work in progress, and finished goods inventory. All that is recorded are purchases. Only when the accounting period ends, and a physical inventory count is made, does the value of purchases need to be known. In some respects this simplifies the accounting system and helps to reduce inventory tracking costs.

Who Uses A Periodic Inventory System

The periodic inventory approach is primarily used by small businesses that deal with very few transactions, or companies that only have a limited number of inventory.

Sales and expenses for these companies are easily manageable, so they tend to opt for a periodic inventory system, as its more cost-effective to implement.

Examples of these types of businesses include art galleries, car dealerships, small cafes, restaurants, and so on.

Read Also: Dark Discharge Instead Of Period

How Do You Calculate Cost Of Goods Sold Using The Periodic Inventory System

The total in purchases account is added to the beginning balance of the inventory to compute the cost of goods available for sale.

The ending inventory is determined at the end of the period by a physical count of every item and its cost is computed using inventory calculation methods such as FIFI, LIFO and weighted averages.

This amount is subtracted from the cost of goods available for sale to compute the cost of goods sold.

The general formula to compute the cost of goods sold under the periodic inventory system is given below:

Cost of goods sold = Beginning inventory + Purchases Closing inventory

For example, XYZ Corporation has a beginning inventory of $100,000, has $120,000 in outgoings for purchases and its physical inventory count shows a closing inventory cost of $80,000.

The calculation of its cost of goods sold is:Cost of Goods Available = Beginning inventory + Purchases$220,000 = $100,000 + $120,000

Cost of Goods Sold = Cost of Goods Available Closing Inventory$140,000 = $220,000 $80,000

Periodic Weighted Average Costing

Weighted average cost in a periodic system is another cost flow assumption and uses an average to assign the ending inventory value. Using WAC assumes you value the inventory in stock somewhere between the oldest and newest products purchased or manufactured.

The formula is WAC = BI + P / units for sale

To maintain consistency, well use the same example from FIFO and LIFO above to the calculate weighted average. In this example, the physical inventory counted 590 units of their product at the end of the period, or Jan. 31. The same table for this is below.

Before going further, the company calculates the weighted average of the purchases over the period from the total cost divided by the total units over the period, or $11,150/1,950 units = $5.72 per unit. From this figure, it would incorporate the physical inventory the company counted of 590 units. Here is how it will list the following figures on its monthly income statement:

As you can see, weighted average in a periodic system is a calculation done outside of the ledger. In this method, you calculate an average for the period instead of moving transactions over when the company bought or sold something during the period.

Don’t Miss: Usaa New Car Grace Period

Example Using The Periodic Inventory Method

To illustrate how to record and calculate for your cost of inventory and the cost of goods sold using the periodic inventory method, let’s assume the following figures for a retail shop selling organic beauty products:

- Beginning inventory = $10,000

- Closing inventory after end-of-month count = $7,000

- There are no defective or expired items to account for this counting period.

Again, the formula for the cost of goods sold is:

| Cost of Goods Available for Sale |

| Closing Inventory |

| COGS |

We’ll need to find the total cost of goods available during the accounting period and then calculate the cost of goods sold.

| Beginning Inventory |

| Purchases | $8,000 |

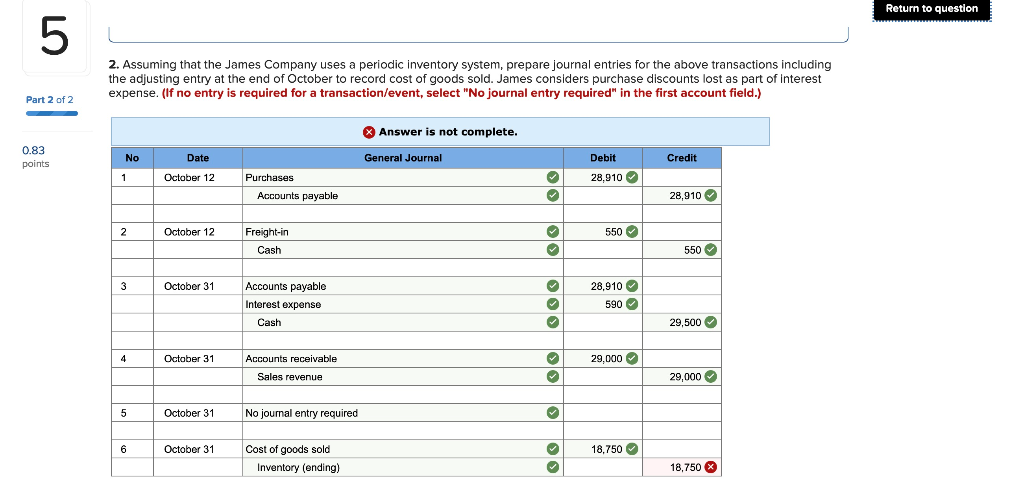

These journal entries are examples of how you’ll record purchases and the cost of sales at the end of the accounting period if you’re using a periodic inventory system.

Try Skynova’s accounting software, and you won’t have to spend time learning how to do your own journaling. The double-entry accounting feature records every transaction, ensuring there’s a complete accounting record for your business. You can also view real-time records of your earnings and expenses through the general ledger.

Purchase Return And Allowances Journal Entry

When we buy products or goods, there is the possibility of a return back to the supplier due to faulty, damaged, or defective within the agreed timeframe. The accounting for purchase return and allowances is straightforward and the recording is different between a perpetual inventory system and a periodic inventory system.

In this article, we cover the accounting for purchase return and allowances especially the purchase return and allowances journal entry under both periodic and perpetual inventory systems.

So now lets get started!

Don’t Miss: 90 Day Employee Probationary Period Template

What Is Periodic Inventory System Example

Periodic system examples include accounting for beginning inventory and all purchases made during the period as credits. Companies do not record their unique sales during the period to debit but rather perform a physical count at the end and from this reconcile their accounts.

What are the two inventory systems? Perpetual inventory system and periodic inventory systems are the two systems of keeping records of inventory. In perpetual inventory system, merchandise inventory and cost of goods sold are updated continuously on each sale and purchase transaction.

Net Method Of Recording Accounts Payable

Under the net method, the payable net of the discount would have been recorded like this:

| Payment on Bryan account inv. 1258, after disc expired |

The net method allows you to track discounts lost, which then gives you a direct read on how much profit you are losing to what is essentially a finance charge.

Next, lets tackle something a bit easierrecording sales.

You May Like: 90 Day Employment Probationary Period Template

For Accountants: Some Technical Notes About Periodic And Perpetual Inventory

The traditional periodic inventory method means that purchases are stock are booked into an expense account, Purchases, when stock is received . This expense account is combined with the difference in opening and closing stock to work out how much stock cost to book in the margin. The Purchase expenses does not include GST.

Perpetual inventory has no Purchases account. It simply does not exists for inventoried stock. Instead, when stock is received, the system does DR Inventory . So stock received is immediately capitalised as an asset . The cost of stock is recognised via a DR Cost of Goods Sold / CR Inventory when the goods are shipped this happens every time there is a shipment. So the transactions of shipping goods and generating an invoice actually creates two entries: one which is DR COGS/CR Inventory, and then DR Accounts Receivable/CR Sales. There is no need to do month end stock takes to work out the margin.