Associates Degree Debt Repayment

Student borrowers with associates degrees are significantly less likely to take on student loan debt if they attend public institutions. Private school attendees are actually more likely than their bachelors degree-seeking peers to use student loans to pay for school.

- Just 41% of Associates degree holders who graduated from public institutions use student loans to pay for school.

- 84% of attendees of private, nonprofit schools take on student loan debt.

- 88% of attendees of private, for-profit schools take on student loan debt.

- $46,100 is the average annual salary for a recently graduated associates degree holder.

- 4 to 7+ years is the projected student loan debt repayment period for associates degree holders who graduate in 2021.

| Monthly |

|---|

| 6 yrs, 9 mos |

Teacher Loan Forgiveness Program

Student loan forgiveness for teachers is neither generous nor easy to qualify for. Teachers can have up to $17,500 of their federal direct and Stafford student loans forgiven by teaching for five complete and consecutive academic years at a qualifying low-income school or educational service agency.

Even if you were unable to complete a full academic year of teaching, it may still be counted toward the required five academic years if you completed at least half of the academic year your employer considers your contract requirements for the academic year fulfilled for the purposes of salary increases, tenure, and retirement and you were unable to complete the academic year because you either returned to postsecondary education in an area of study directly related to the five academic years of qualifying teaching service, had a condition covered under the Family and Medical Leave Act of 1993, or were called to over 30 days active duty as a member of a reserve component of the U.S. armed forces.

If you have had an outstanding balance on a direct loan or an FFEL on or after Oct. 1, 1998, then you will be ineligible for the program. Additionally, only loans made before the end of your five academic years of qualifying teaching service will be eligible for Teacher Loan Forgiveness.

Tips For Paying Off Student Loan

Also Check: Guaranteed Acceptance Life Insurance No Waiting Period

Public Service Loan Forgiveness

You may get some of your loan debt forgiven at the end. You will need to sign up for an income-driven plan if you are interested in federal Public Service Loan Forgiveness.

On October 6, 2021, the Department of Education announced temporary changes to the Public Service Loan Forgiveness program . This was in response to the coronavirus pandemic. Borrowers can now receive credit for past payments, regardless of whether they were made on time or for full amounts. Also, any payments made before the current iteration were not eligible for credit and count towards the 120 total payment amount.

Borrowers can also receive credit for past payment regardless of their loan program or payment plan. All loans must be federal student loans, or consolidated into direct loans by October 31, 2022.

Similar to previous requirements, borrowers must have worked for a qualifying employer at the time of prior payments. Qualifying employment status is any person employed by the government, 501 not for profit, or another not-for profit organization that provides a qualifying services.

The program has been updated to allow active-duty military personnel to count deferments or forbearance towards it. The new changes allow those who have previously applied for the PSLF to review their applications and request a reconsideration of their PSLF decision.

Know How Much To Borrow And Dont Borrow More Than You Need

Never take out more in student loans than you absolutely need. Ask your college if they offer other options like work-study programs that can help reduce your debt load.

Ask your lender what the monthly payment will be before taking out the loans to see if it will be affordable. Or, use the student loan repayment calculator to figure it out yourself.

Recommended Reading: Likelihood Of Getting Pregnant Right After Period

Managing Student Loans After Graduation

Taking out a student loan means being comfortable with taking on and repaying a certain level of debt. That means being prepared, says Blotz. âFreshmen families,â he notes should understand and calculate the amount of loans they are taking out not only for the first year, but for the full four-year experience. I’ve seen families that have selected a school, only to be unable to pay the cost of the loan after the first semester or first year.â

How Much Are Student Loan Payments

The average monthly federal student loan payment for recent undergraduate degree-recipients is $234.Footnote People generally borrow more and have higher interest rates for graduate degrees. Therefore, their monthly payments are higher. Average federal student loan payments for master’s degree-holders are about $570 a month.

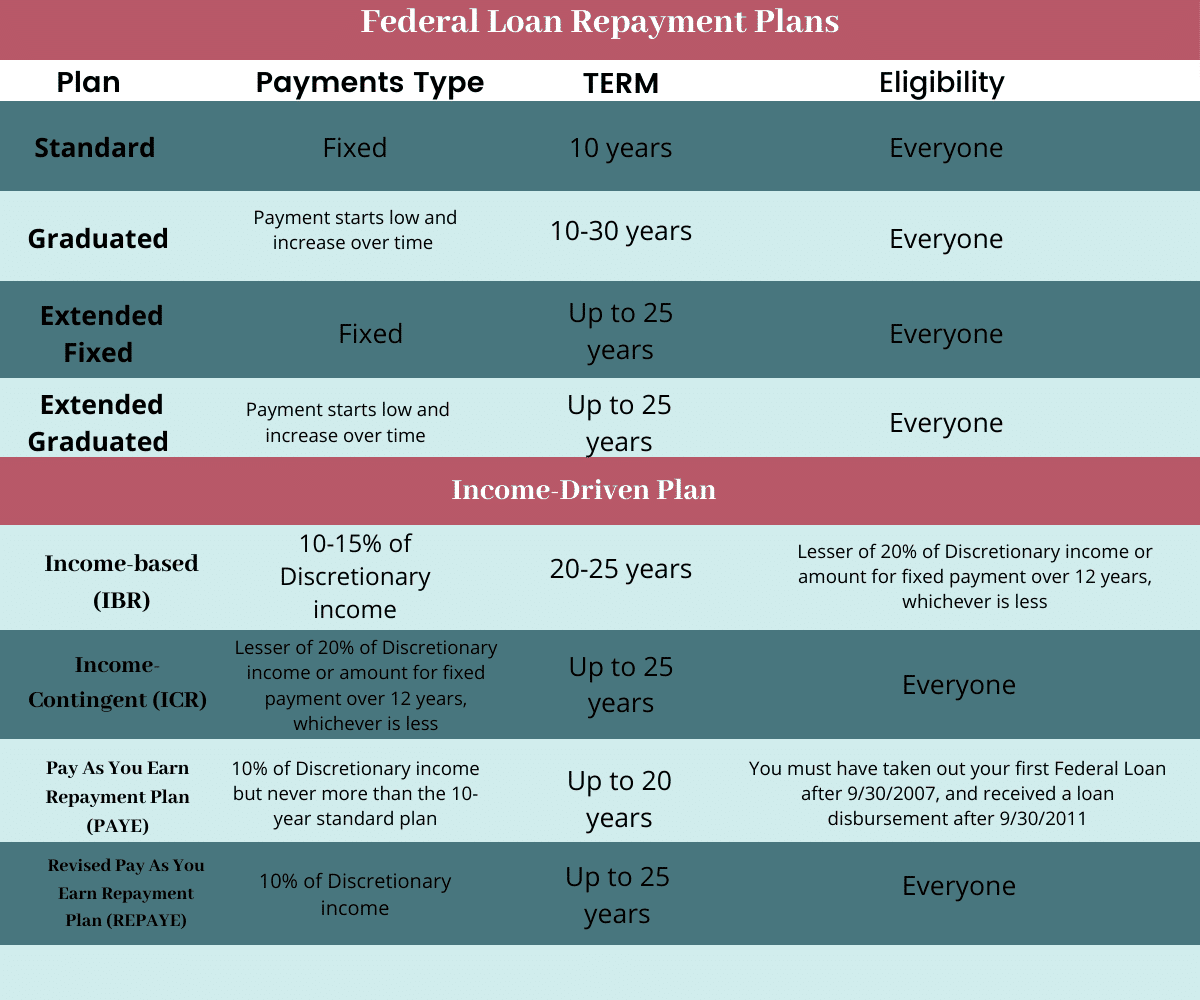

If you cannot afford your federal student loan payment, you may enroll in IDR. On an IDR plan, you usually pay 10-20% of your discretionary income against your student loans for 20-25 years.

Read Also: When Do You Ovulate With Irregular Periods

Current Personal Loan Rates By Credit Score

In October, the average prequalified rate selected by borrowers was:

- 9.90% for borrowers with credit scores of 780 or above choosing a 3-year loan

- 29.90% for borrowers with credit scores below 600 choosing a 5-year loan

Depending on factors such as your credit score, which type of personal loan youre seeking and the loan repayment term, the interest rate can differ.

As shown in the chart above, a good credit score can mean a lower interest rate, and rates tend to be higher on loans with fixed interest rates and longer repayment terms.

Shop Around For A Heloc Or Home Equity Loan

While interest rates for home equity loans and HELOCs tend to be more competitive, theyre expected to go up as the Fed carries out additional rate hikes into 2023.

However, you might get a rate thats significantly different from the average depending on your financial situation. Thats why its a good idea to shop around for lenders to see who can offer you the best rate.

Before committing to borrowing with a home equity loan or HELOC, ensure you can afford the carrying cost if rates go up dramatically. While a home equity loan provides security in that your monthly payment isnt subject to fluctuations, a rising rate environment impacts your entire financial picture.

Be sure to have a repayment plan that doesnt put a strain on your budget. Establishing an adequate emergency fund is a great way to give yourself some extra breathing room.

I think if people can hold off on doing anything that would really increase their debt obligations, this is definitely the right time to reconsider spending behaviors, Roach says.

Another reason home equity financing is so attractive today? There are not a lot of hoops to jump through in order to get it. After shopping around for the right lender, youll fill out an application which will determine how much financing youre eligible for.

Also Check: Can You Get Pregnant After Your Period

Loan Cost For Vocational School Or Associate Degrees

The numbers used to determine average loan amounts come from a study by the CollegeBoard on student debt in 20152016. Keep in mind that total loan costs would also include origination fees and interest over the lifetime of the loan.

For those who earned an associate degree, the good news is that more than half graduated with no debt. Those who earned their degrees from public institutions had a total outstanding debt at graduation of approximately $6,850, on average. Those who earned their degrees from private for-profit institutions owed over three times more.

Those who earned vocational certificates had varying debt levels as well, with numbers totaling the following approximate average amounts:

- Public two-year: $7,300

Disclaimer: The College Finance Company works hard to keep information listed on our site accurate and up to date. The information provided on CollegeFinance.com may be different than what you encounter when you go to the website of a financial institution, bank, loan servicer or a specific product page on a different site. When evaluating any offers, please review the legal pages on the other partys site. Product name, logo, brands, and other trademarks featured or referred to within CollegeFinance.com are the property of their respective trademark holders. Information obtained via CollegeFinance.com is for educational purposes only. Always consult a licensed financial expert before committing to any financial decision.

Average Monthly Payment And Terms

Across the board, the average monthly repayment plans cost for student loans is $460. However, actual monthly repayment may vary depending on the level of education. For instance, the repayment amount for an associate student loan ranges from $281 to $384. Meanwhile, repayment for doctorate student loans ranges from $575 to $1,844.

Repayment terms may vary based on the level of education. While the average borrower repays student loan debt for 20 years, repayment plans can range from 10 to 30 years. For professional graduates, it may take up to 45 years.

For instance, the actual repayment term for a $30,000 graduate student loan is five years and 10 months. With an APR of 3% and a $465 monthly payment, the total repayment cost is $32,800. The table below shows how cost and repayment terms vary as the average debt gets adjusted.

Average New Graduates Loan Payments

Read Also: How Long To Period Cramps Last

More Student Loan Debt Facts & Statistics:

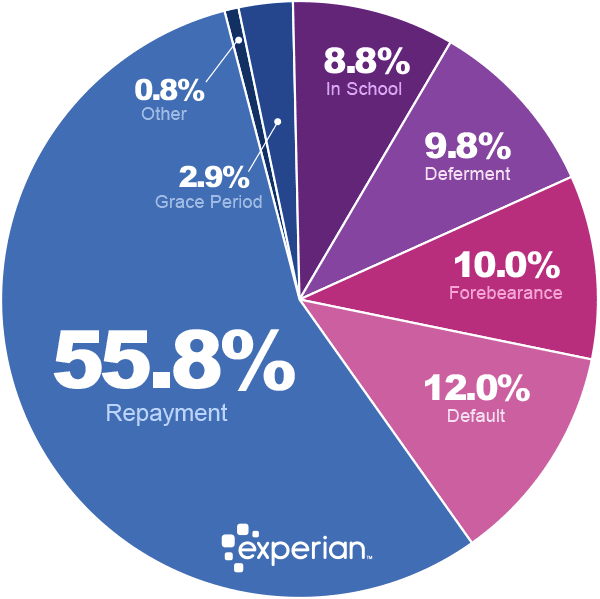

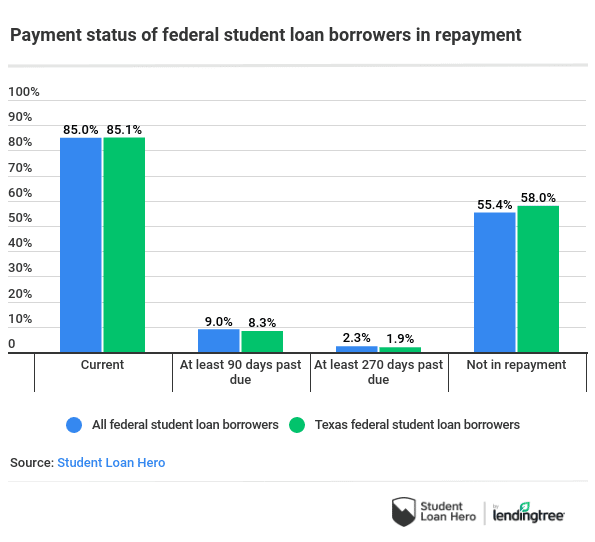

Note: The charts and statistics shown below are based on the most recently available data. As inflation has only increased, especially in the past 12 months, the consensus is these trends have only gotten worse.

- Processing and keeping track of payments

- Helping borrowers change payment plans

- Dealing with requests for deferment or forbearance

- Certifying borrowers for loan forgiveness

Four servicers handle the majority of federal direct loans and Federal Family Education Loans. The largest of these is FedLoan Servicing , which controls 31% of the total. The others are Great Lakes Higher Education Corporation with 23%, Navient with 21%, and Nelnet with 17%. Multiple nonprofit servicers handle the remaining loans.

Keep In Touch With Your Lender

If you move or change your contact information, dont forget to let your lender know. Missing an update about your loans could set you back. Do not ignore mail or phone calls from your lender.

Defaulting on your loans can cause serious financial problems for you in the future. Also, know about the rules that collection agencies are supposed to follow.

Also Check: Why Is My Period Lasting 2 Weeks

Which Are The Most

Levels of educational attainment vary widely across the country. The states with the most bachelors degree recipients age 25 or older are Massachusetts , Maryland , Colorado , and Connecticut . The states with the fewest bachelors degree holders are West Virginia , Mississippi , Arkansas , and Kentucky .

Public Service Loan Forgiveness Program

If you work for a qualifying public service organization, the PSLF program may provide student loan forgiveness. To qualify, you must have Direct Loans and make 120 monthly payments while working full time at a qualifying employer.

The following programs are considered to be eligible:

- Peace Corps Volunteers

- Some alternative repayment plans such as Income-Driven Repayment Plans, Pay As You Earn Plan, Revised Pay As You Earn Plan , Income-Based Repayment Plan , or Income-Contingent Repayment Plan .

Recommended Reading: Why Have I Not Had My Period

Consolidating Your Student Loans

Consolidating federal student loans allows borrowers to combine multiple federal student loans into one. This means making a single monthly loan payment on all of your student debt instead of multiple payments.

While this can streamline the repayment process, it also can reset the clock to zero, since youre signing up for a new loan with its own new term. That means that consolidation will generally increase the amount of time youve got to spend paying back your loans. If you are working towards student loan forgiveness, either with the Public Service Loan Forgiveness program or forgiveness offered by income-driven repayment plans, consolidating will reset the clock starting you at day one of repayment.

Average Student Loan Debt By Education Level

Borrowers with doctorate degrees had the highest average student loan debt at $159,625. The average debt of individuals with a masters degree was $71,287, while the average for undergraduate students was $36,635.

The average student loan debt for graduate degree holders was 141.8% higher than other student borrowers. Graduate studies refer to degrees beyond a bachelors, such as masters and doctorate degrees.

Most graduate student loan borrowers also carried undergraduate loan debts.

Don’t Miss: What Is Considered A Heavy Period

Student Loan Forgiveness Is Not The Same As Forbearance

Forgiveness eliminates your debt forbearance postpones your payments. If you’re having trouble making student loan payments, you can ask your lender for forbearance. Your lender may not give you a forbearance if you don’t meet eligibility requirements, such as being unemployed or having major medical expenses.

Interest on your loan will still accrue, and you can pay that interest during the forbearance period if you want. If you don’t pay it, the accrued interest will be added to your principal balance once your forbearance period is up. Your new monthly payment will be slightly higher as a result, and you’ll pay more interest in the long run.

The only relationship between forbearance and forgiveness is that when you’re in forbearance, since you’re not making payments, you’re not making progress toward the payment requirements of a forgiveness program you might be participating in.

What You Should Know Before You Borrow

Make a plan to know what you will owe before you borrow. Many people have to take out student loans. The most important thing is to be smart about the loans you take out.

Congratulations! You have made the decision to further your education and are beginning to look at various schools. Higher education is a major financial investment. It is important to know exactly what you are getting and what it will cost. The student loan process can be overwhelming at times. This information will help you navigate the process.

Read Also: Cramps But No Period On Birth Control

Pay More Than The Minimum Amount

If you have the means, pay more than what you owe each month. The more money you put toward your principal balance, the less youll pay in total interest over the life of the loan and the faster youll pay off your loans. If you do choose to make more than the minimum payment, let your lender know that the money is an extra payment or change your automatic payment option online. Otherwise, that money might be applied toward your next payment instead.

You should also indicate which exact loan should get the extra payment, so you can target the loans with the highest interest rate or lowest loan balance, depending on your goals.

Who Has Student Loan Debt

Forty-five million Americans have student loan debt that’s about one in 7 Americans , according to an analysis of January 2022 census data.

Those ages 25-to-34 are the most likely to hold student loan debt, but the greatest amount is owed by those 35 to 49 more than $600 billion, federal data show.

Among all borrowers, women typically borrow more for college compared with men , according to 2020 data by the American Association of University Women. And Black students borrow more often and greater amounts compared with all other races and ethnicities, according to federal data.

Learn more about the characteristics of student loan borrowers here.

Don’t Miss: How To Regulate Periods With Pcos

Plan How To Pay Tuition And Living Expenses

Undergraduate students who qualify are eligible to directly receive $5,500 to $12,500 a year in federal loans. Parents can also take out PLUS loans to cover the remaining cost of tuition, room and board. When borrowing PLUS loans, keep in mind what is affordable for your family.

Once you have received your loans, create a budget and plan how to pay your expenses. Track what you have, what you spend, and identify your financial goals.