Basic Liability Coverage Vs Full

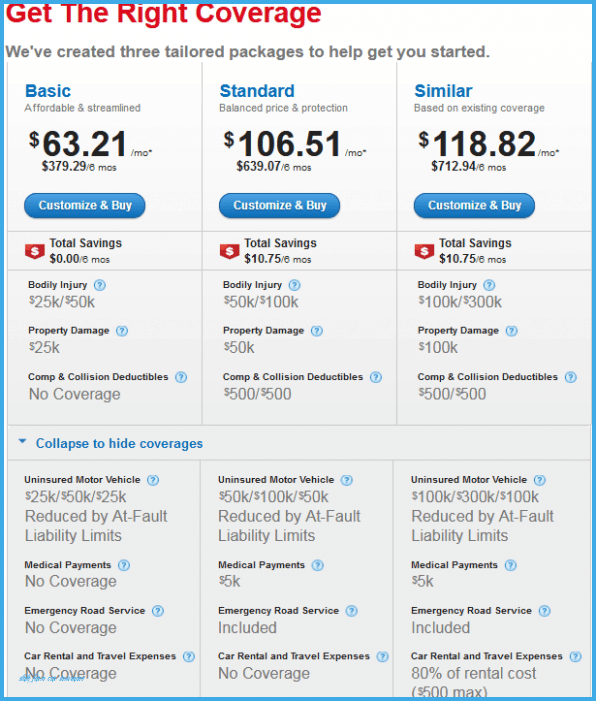

Most states require all drivers to maintain basic liability coverage if they own a registered vehicle in the state. This basic coverage level is the most affordable, but it only covers bodily injury liability coverage and property damage liability. It’s designed to cover other drivers, not you. > Essentially, it protects you from a lawsuit.

If you want to ensure that you’re fully-protected and that your personal car repair costs and medical bills are covered by your car insurance, then you may want to select State Farm’s full-coverage insurance policy.

How To Reinstate Canceled Auto Insurance

If you have a lapse in insurance due to non-payment, you might be able to reinstate your policy without purchasing another one.

“Contact your insurance company as quickly as possible after the due date to explain the circumstances and make your payment,” says Shrader. “You may be required to file a no-loss statement and pay a reinstatement fee, but your policy will continue with no lapse.”

State Farms New Car Purchase Policy

For the purchase of a new vehicle, State Farm provides a 14-day grace period. If you place an order for a new car within the 14 day period and have not yet received the vehicle, you have the right to cancel and receive a full refund. It is still possible to cancel the order after taking delivery of the car, but you will be charged a cancellation fee. State Farm will automatically charge you for missed payments if you fail to pay the amount due, State Farm will cancel the account. When State Farm sends you a notice of cancellation, it includes the date on which the company will accept full payment before your coverage expires. If your insurer has cancelled you, you may find it difficult to obtain insurance. The best insurance options are typically available, but because you are considered more risky, your premiums will likely be significantly higher.

Also Check: Im Two Days Late On My Period

Most Drivers Confused About Car Insurance

A found that most drivers do not understand their own auto insurance coverage. They cannot correctly identify the car insurance types that would cover common situations.

Liability insurance is among the most misunderstood coverage types. Heres a look at how much drivers dont know about auto insurance.

| Question | ||

|---|---|---|

| What type of car insurance pays if your car is damaged by a flood? | Comprehensive coverage | 56% got it wrong |

Many drivers also think they have car insurance coverage that isnt actually available. For example:

- 50% of respondents said accidental death and dismemberment coverage is part of their car insurance policies. AD& D coverage is not included in car insurance.

- 49% believe they currently have extended crash protection, which does not exist.

- 41% believe their auto insurance covers vehicle emissions, which it does not.

Even the best car insurance wont pay off if you dont understand the coverage you have purchased.

How Does A Grace Period Work

If you have car insurance with a grace period then it can be very handy for you. Having a grace period means, that if you have late payments then you will still get the coverage for the grace period. Moreover, you will be able to clear the let payments without any penalties or late fees. However, you should keep in mind that if you fail to make the late payments within the grace period then your insurance policy will lapse, and the insurance provider will cancel your coverage. There is no standard grace period for insurance policies. Depending on the company and insurance type, the grace period can range from 24 hours to 30 days. If you fail to make an insurance payment then the company will send you a notice of cancellation. It will contain a deadline by which you have to make your payment to keep your policy in place.

You May Like: How To Get Pregnant When You Have An Irregular Period

Erie Auto Insurance Discounts

Erie offers several auto insurance discounts, especially for safe drivers. If you have a driver under age 21on your policy, look for Eries discount for young drivers. If you dont use your car for an extended amount of time, you could benefit from the reduced usage discount. Other discounts include:

- Safe driving discount: This is for safe drivers with a clean driving record.

- Car safety equipment discount: You can get a discount if your car has safety features like factory-installed airbags, passive restraint, or anti-theft devices.

- Multi-car discount: Drivers who insure two or more vehicles under the same policy may be eligible for this discount.

- Multi-policy discount: Look for this if you bundle other insurance types with your Erie auto insurance.

- Reduced usage discount: If you dont use your car for at least 90 consecutive days during your policy period, you could be eligible for this discount.

- Young driver discount: Do you have a driver who is under age 21, unmarried and lives with you? If so, you could save on your auto insurance policy.

- Annual payment plan: Look for savings if you pay your annual auto premium in one lump sum.

- College credit: If your college driver is away at school without access to your car, you may be eligible for a discount.

What Happens If You Have A Coverage Lapse

It’s important to make sure your car insurance coverage doesn’t lapse. If you go without insurance beyond the grace period, the consequences may be serious. You won’t be covered in the event of an at-fault accident, meaning you’ll be held liable for any damages you cause. Additionally, you’ll likely face higher premiums when you reinstate your car insurance.

Coverage lapses are one of the factors insurance companies consider when determining auto insurance rates. If you have a coverage lapse, you may be regarded as a high-risk customer, which can result in more expensive premiums. On average, a driver who has continually maintained coverage for five years pays $216 per year less than someone with no recent car insurance history, according to The Zebra. Therefore, it’s essential to avoid a coverage lapse.

Auto insurance isn’t only mandatory in most states, but it also protects you against the potentially devastating financial consequences of a major accident. Therefore, even if your insurance company offers an auto insurance grace period, you should try to insure your new vehicle as soon as you can.

Check this out if you need additional information, resources, or guidance on car insurance.

Read Also: Can You Have A Uti On Your Period

Finding The Cheapest Car Insurance

Whether you are insuring your first car, a used car, or a brand-new car or looking for a new policy for an old car, shopping around for a variety of monthly quotes is essential. Between stressors at the car dealership, long wait lines at the DMV, and deciding on the right coverage from the right insurance provider, dealing with a new car or an old one can cause a headache.

Once you decide on the right coverage for youâperhaps some combination of bodily injury and property damage liability insurance, home insurance bundling, personal injury protection, or something else entirelyâcompare car insurance quotes from dozens of the nationâs top providers with the Insurify car insurance comparison tool. Try it for yourself today to save big.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

|

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All… |

Written byRachel BodineFeature Writer |

|

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his familys insurance agency, FCI Agency, for 15 years . He is licensed as an agent to write property and casualty insurance, including home, auto, umbrella, and dwelling fire insurance. Hes also been featured on sites like Reviews.com and Safeco.He reviews content, ensuring that ex… |

Don’t Miss: My Period Ended And I Started Bleeding Again

State Farm Mut Auto Ins Co V Brown

Court of Appeals of California, First Appellate District, Division Four.

STATE FARM MUTUAL AUTO INSURANCE COMPANY, Plaintiff and Appellant, v. FRANCIS BROWN et al., Defendants and Respondents

COUNSEL

Nagle, Vale, McDowall & Cotter and William D. McDowall for Plaintiff and Appellant.

Robert A. Seligson as Amicus Curiae on behalf of Plaintiff and Appellant.

Rodriguez & Hoffman and Leopold A. Rodriguez for Defendants and Respondents.

OPINION

RATTIGAN, J.

At pertinent times prior to the controversy involved herein, respondents Francis Brown and Mary Rose Brown were the named insureds in an automobile liability insurance policy issued them by appellant State Farm Mutual Automobile Insurance Company. The vehicle, identified in the policy as the described automobile, was a 1965 Chevrolet owned by the Browns. On January 11, 1971, while respondent Mary Rose Brown was driving the Chevrolet, it was involved in a collision with an automobile operated by respondent Elsie Cloud. State Farm thereafter brought this action for declaratory relief against all three respondents, seeking a judgment to the effect that it did not insure the Browns at the time of the accident. At the close of State Farms case in chief at a jury trial, the trial court granted respondent Clouds motion for nonsuit. Although counsel for respondents Brown did not join in the motion, the ensuing judgment of nonsuit was entered in favor of all defendants . State Farm appeals from the judgment.

The Pleadings

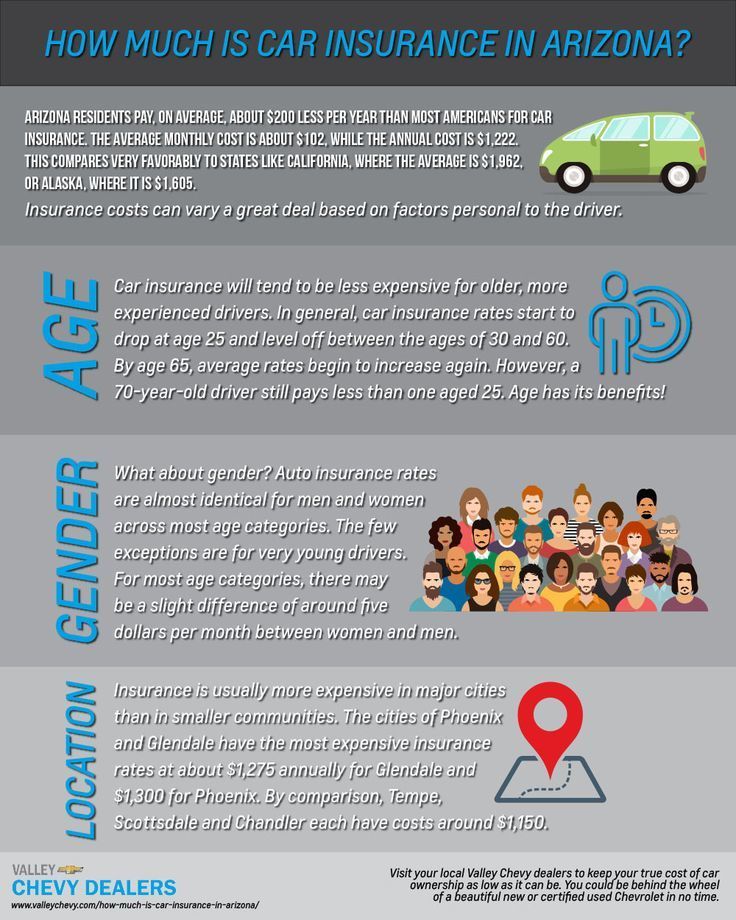

Factors That Affect Rates

There are a number of ways you can bring down your rates. Some of them weve already covered in our rate section, such as keeping a clean driving record and having good credit.

At State Farm, you can also bundle your auto insurance policy with another policy at State Farm to earn a discount. State Farm has the following types of insurance for bundling.

State Farm doesnt offer many discounts. Other competitors do offer more, as the highest number of discounts offered is 38. So State Farm is on the lower end with its amount of offered discounts.

However, State Farms rates are lower than average. If State Farm offered a high number of discounts, its rates would become too low to sustain.

Also Check: What Age Do You Usually Get Your Period

Lower Your Coverage Limits Or Drop Coverage

Another way to lower your rates is by lowering your coverage limits. Its worth mentioning, however, that this might save you more on your premium, but you might not have all the coverage you need in the event of an accident.

You can also drop coverage you dont need. A full coverage policy is one that includes comprehensive and collision coverage, in addition to liability. But comp and collision coverage are optional, and you can skip them if you want to lower your premiums, it will just mean that damage to your own vehicle wont be covered.

State Farm New Car Grace Period

After you buy a car, you have 14 days to add the vehicle to your insurance policy, State Farm insurance agents said. That means, if you already have a State Farm auto insurance policy, State Farm will automatically extend coverage to your new vehicle for up to 14 days known as a grace period. Keep in mind that if you dont officially add the car to your policy before the grace period ends, it will not be covered by insurance. Penalties for driving without insurance vary by state and can include fines and even a suspended license.

Also Check: Is It Ok To Have A Mammogram During Your Period

What Types Of Auto Insurance Are Offered In Richmond Hill

Third party liability and accident benefits – This is a basic auto insurance policy. You must carry this type of insurance to legally operate a car in Ontario. It protects your liability should you injure someone else in a collision and pays for your medical costs. You must have liability benefits worth at least $200,000 and accident benefits worth at least $50,000.

Collision – Covers costs if your car is damaged in a collision.

Comprehensive – Covers costs if your car is damaged by things other than a collision, including theft, vandalism, or falling objects.

Specified perils – Protects your car from insurable risks that you specify you want in your policy. If its not written in the policy, it isnt covered.

All perils – A hybrid between collision and comprehensive insurance. Offers coverage if your car is damaged in a collision or by any other insurable risk.

You can customize your car insurance quote to reflect any type of coverage.

Use Of Mobile Apps In Auto Insurance Claims

The last couple of years have pushed car insurance companies to streamline auto accident claims through more easily accessible means, such as mobile apps.

Tech-savvy drivers seem happy to engage with insurance companies and repair facilities via mobile apps in order to speed up their claims, but what about injury claims? CCC Information Services, a provider of data and technologies to the automotive industry, surveyed more than 500 drivers who had a minor injury from a low-impact auto accident within the last two years. CCC found that 91% of respondents used a mobile app during their auto insurance claims process. More than half of respondents used a car insurance app for the first time after their accidents.

Nearly three-quarters of the drivers had a positive impression of the claims process. A majority of respondents, 89%, said that they both would use a mobile app to submit claims and select an insurance company that offers an accelerated mobile payment option if these items would speed up the claims process.

While most injured drivers surveyed used a mobile app during some part of their claims process, only 37% submitted their injury claim using their auto insurance companys mobile app.

If youre injured in an accident, consider using your insurers mobile app to keep informed about your claims status and speed along the process.

Here are the mobile app features survey respondents used for their claims:

Read Also: Lo Loestrin Fe Period In Middle Of Pack

Average State Farm Rates By Make And Model Last 5 Year Average

Parents usually give teens the safest possible car, which means youll see more teens driving the family minivan than the summer sports car.

Insurers also care about car safety.

The Insurance Information Institute says that insurers use car crash safety ratings and expense of future repairs to determine rates. So if your car tests poorly in crash research or needs specially made parts, your insurance rates will be higher.

Curious which cars cost the most at State Farm? Below is a list of State Farms rates by make and model.

| Make and Model |

|---|

State Farms average rate increase from low to high coverage is fantastic. It will cost drivers with low coverage about $400 to upgrade to high coverage.

This means drivers will pay just over $30 dollars a month for high coverage.

Once again, this is great, as most insurers charge about $1,000 to upgrade from low to high coverage. Make sure to take advantage of these low rates, as high coverage protects you the best in an accident.

Our Recommendations For A Car Insurance Grace Period

In our industry review, we highlighted car insurance providers that put customers first through comprehensive coverage plans, affordable rates, and assistance during the quotes and claims processes. High customer care ratings are also generally a sign that a company will be easy to work with in the event of a payment slip-up.

Here are a few top contenders for auto insurance. Enter your zip code or call to start comparing free car insurance quotes in your area.

Read more in our full review of Geico insurance.

Read Also: Can You Ovulate The Day After Your Period

Is Your Car Insurance Policy At Risk Of Being Canceled

If you are having trouble paying your car insurance bill or have had a few claims in the past, you should speak with your insurer. Failure to pay your car insurance premiums on time could result in the cancellation of your policy. Unauthorized modifications to your vehicle, for example, may result in the cancellation of your policy. Your insurance may be cancelled if you have been convicted of a moving violation, such as driving while drunk or driving while impaired.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate, we strive to help you make smarter financial decisions. To help readers understand how insurance affects their finances, we have licensed insurance professionals on staff who have spent a combined 47 years in the auto, home and life insurance industries. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation of how we make money.Our content is backed byCoverage.com, LLC, a licensed entity . For more information, please see ourInsurance Disclosure

Read Also: How To Remove Period Blood From Mattress