Who Is Eligible For The Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period is only for beneficiaries who currently have a Medicare Advantage plan and want to make a change. This window is not a time for new beneficiaries to enroll in Medicare Part A, Part B, or Part D. It is also not a time for those on Original Medicare to enroll in a Medicare Advantage plan.

If you are a new beneficiary looking to enroll in Original Medicare, you may do so during your Initial Enrollment Period, the General Enrollment Period, or a Special Enrollment Period if you qualify.

What Plan Changes Can I Make During The Medicare Open Enrollment Period

During the Medicare open enrollment period if youre already enrolled in Medicare coverage you can:

- Switch from Original Medicare to Medicare Advantage .

- Switch from Medicare Advantage to Original Medicare .

- Switch from one Medicare Advantage plan to another.

- Switch from one Medicare Part D prescription drug plan to another.

- Enroll in a Medicare Part D plan if you didnt enroll when you were first eligible for Medicare. If you havent maintained other , a late-enrollment penalty may apply.

How To Switch Plans

It is relatively simple to switch plans during the annual fall Medicare open enrollment.

How to Switch Plans

- To switch to a new Medicare Advantage plan

- Join the plan you choose you can also do this during the Medicare Advantage open enrollment period from Jan. 1 to March 31. Once you join the new plan, youll automatically be removed from your old plan as soon as the new coverage begins.

- To switch to Original Medicare

- Contact your current plans administrator or call Medicare toll free at 1-800-633-4227. A service representative will walk you through the switch.

- To add Medicare Part D

- Original Medicare does not provide prescription drug coverage. You can contact a private insurer who provides Medicare Part D prescription drug plans to sign up. If you do not have creditable coverage, you should enroll immediately to avoid a Part D late-enrollment penalty.

- To switch from Original Medicare to Medicare Advantage

- Enroll in the Medicare Advantage plan of your choice. Once enrolled, the plan administrator will work with Medicare to transfer over your coverage. Youll need to notify your other plan administrator to drop your Medigap coverage and your Medicare Part D coverage if your new Medicare Advantage plan provides prescription drug coverage.

You May Like: Is It Possible To Get Pregnant While On Your Period

What Is The Difference Between Medicare Advantage Open Enrollment And Medicare Annual Enrollment

There are two main differences between Medicare Advantage Open Enrollment and Medicare Annual Enrollment.

The first one is who can use each period:

- Medicare Annual Enrollment is for anyone who has Medicare and wants to make coverage changes for the upcoming year,

- Medicare Advantage Open Enrollment is only for people who are currently enrolled in a Medicare Advantage plan.

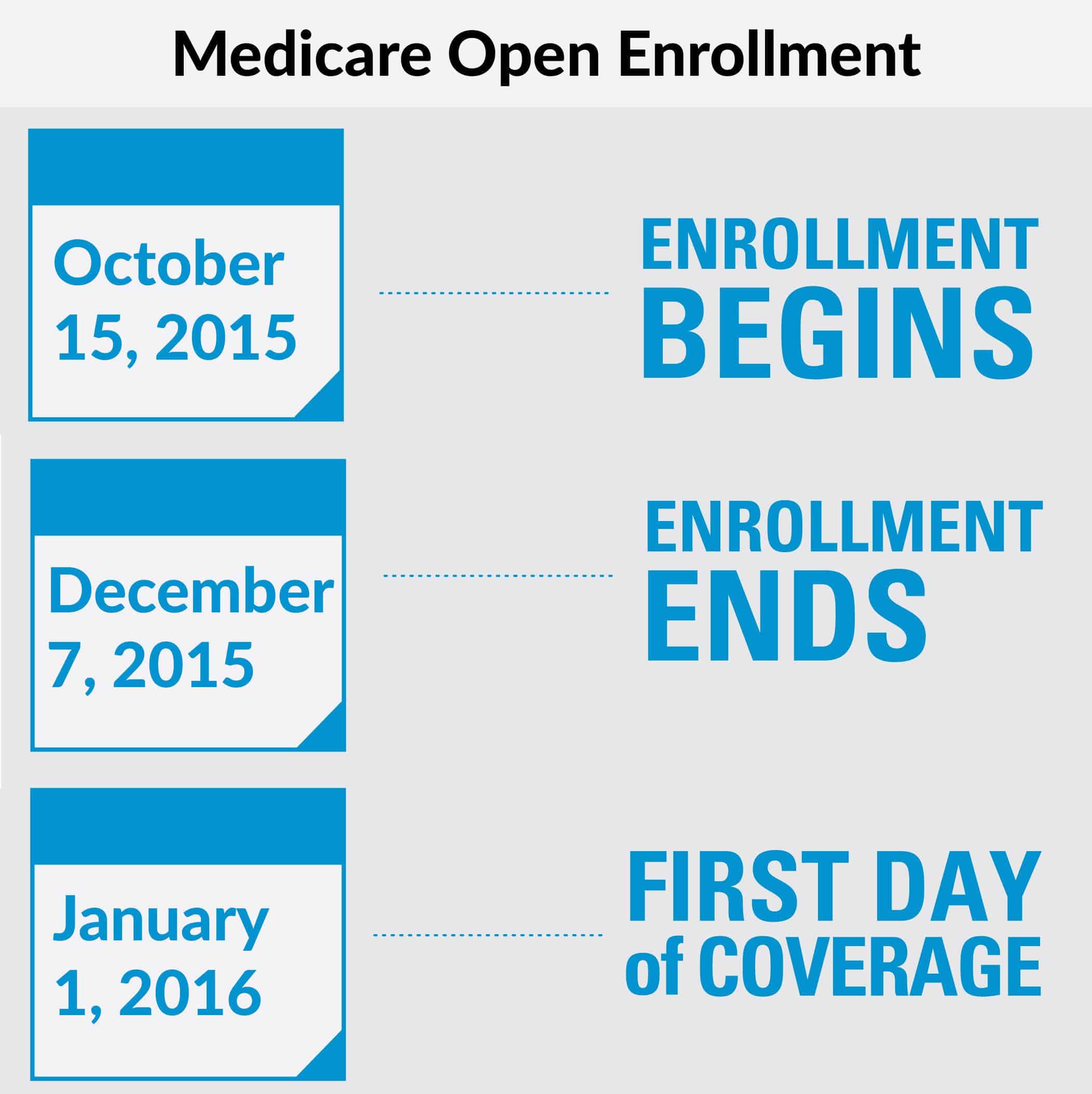

The second difference is the timing. Both happen every year:

- Medicare Annual Enrollment is October 15 December 7,

- Medicare Advantage Open Enrollment is January 1 March 31.

It basically gives you another opportunity to get the coverage you want and need.

The Medicare Advantage Open Enrollment Period is only for Medicare Advantage plan members. You cannot switch from Original Medicare to a Medicare Advantage plan at this time. For that, you generally need to wait until the Medicare Annual Enrollment Period, October 15 December 7.

What Is Medicare Open Enrollment

Medicare open enrollment also known as the annual election period or annual coordinated election period refers to an enrollment window that takes place each fall, during which Medicare plan enrollees can reevaluate their existing Medicare coverage whether its Original Medicare with supplemental drug coverage, or Medicare Advantage and make changes if they want to do so.

This guide is all about Medicares annual election period. If youre interested in learning about additional opportunities to enroll or change your Medicare coverage, weve covered those here.

Recommended Reading: Is It Possible To Have 2 Periods In One Month

Medicare Supplement Insurance Enrollment

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan , the best time to sign up is during your six-month Medigap Open Enrollment Period.

- Your Medigap Open Enrollment Period starts as soon as you are age 65 or older and are enrolled in Medicare Part B.

- Insurance companies cannot deny you Medigap coverage or charge you a higher fee for pre-existing health conditions if you apply for Medicare Supplement Insurance during your Medigap Open Enrollment Period.

If you dont sign up for a Medigap plan during your Medigap Open Enrollment Period, you may still be able to buy one at any time.

Insurance companies can take your health into consideration when setting your premiums or deciding whether or not to offer you coverage, however.

You must be enrolled in Medicare Part A and Part B in order to buy a Medigap plan.

Medigap and Medicare Advantage plans are very different, and you cannot be enrolled in a Medigap plan and a Medicare Advantage plan at the same time.

Learn more about the differences between Medicare Advantage vs. Medicare Supplement Insurance.

Request a free, no-obligation Medicare Supplement Insurance quote today by visiting MedicareSupplement.com.

What Can You Do During Medicare Advantage Open Enrollment Period

This enrollment period gives you a chance to revisit your plan choice and make changes if you need to. The changes you can make include the following:

- Switch to a different Medicare Advantage plan .

- Drop your Medicare Advantage plan and go back to Original Medicare .

- Enroll in a Medicare Prescription Drug plan , if you go back to Original Medicare.

Also Check: Why Does My Discharge Smell After My Period

Understanding Medicare Enrollment Periods

Figuring out when you can sign up for Medicare or switch Medicare health plans can feel a little confusing. Thats because Medicare has several parts, each with its own sign-up rules. Plus, there are a few different enrollment windows to keep in mind.

There are 6 main sign-up periods for Medicare:

Enrollment dates at a glance

Heres a quick look at enrollment periods, deadlines, and what you can do.

Initial enrollment period for Part A and Part B

It all starts with your initial enrollment period. This is the first time you can sign up for Medicare Part A and Part B because of your age. This deadline is specific to you because its centered around your 65th birthday. The initial enrollment period lasts 7 months it starts 3 months before and ends 3 months after the month you turn 65.

Youll need to have Part A and Part B before you can get Part C . Youll need Part A, Part B, or both before you can get Part D.

Special enrollment periods for Part CYou may qualify for a special enrollment period if any of these situations apply:

Annual open enrollment periodYou can join a Medicare health plan, switch plans, or drop a plan during the annual open enrollment period. This happens each year between October 15 and December 7. This is your chance to make changes. For example, you can:

Changes made during the annual open enrollment period take effect on January 1 of the next year.

Why Would I Switch To Another Medicare Advantage Plan

Whether you just started a new Medicare Advantage plan on January 1 or youve been in the same plan for years, your plan might not be fulfilling all of your needs. Perhaps you just signed up for the first time and now realize you didnt take everything into consideration. Or maybe youve been on cruise control with your old plan and arent sure it covers some of your circumstances that have changed over time.

Whatever the reason, the Medicare Advantage Open Enrollment Period could save the day and save you from both a coverage and cost standpoint.

If you like the added benefits offered by Medicare Advantage but think another plan may add even more value than your current one, a GoHealth licensed insurance agent can help you compare your current plan to other ones available in your area.

Read Also: How To Stop Period For Vacation

Is It Worth Getting Medicare Part D

Most people will need Medicare Part D prescription drug coverage. Even if you’re fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

When Is Open Enrollment For Medicare Supplement Plans

Your initial Medigap open enrollment period is the best time to buy a Medicare Supplement policy. Its the six-month period that begins on the first day of the month in which youre both at least 65 years old and enrolled in Medicare Part B. Some states have additional open enrollment periods, including ones for people under 65.

During this window, insurance companies cannot deny you a Medicare Supplement policy based on your health status or a medical condition, a process known as medical underwriting.

One of the most important things to know about Medigap plans is that you actually dont have many opportunities where youre guaranteed to be issued a policy, says Jacobson. Beyond , your opportunities can be relatively limited depending upon what state you live in.

The Better Medicare Alliance, an advocacy organization, is leading the charge for solutions to streamline the Medicare enrollment process. In a recent report, they note that many health equity gaps arise because of people not fully understanding their coverage options during the short open enrollment period, calling on Congress to make improvements.

Don’t Miss: How To Cut My Period Short

Can I Switch From Medicare Advantage To Medigap

Even though you can leave a Medicare Advantage plan and switch to original Medicare during open enrollment and at other times, you may not have a guaranteed right to buy a Medigap policy to help cover original Medicares out-of-pocket costs if more than six months have passed since you signed up for Medicare Part B. Except in some circumstances, such as if you leave a Medicare Advantage plan during your 12-month trial period or you move out of your plans service area, Medigap insurers in most states can legally reject you or charge more if you have preexisting conditions.

Before switching out of Medicare Advantage and into original Medicare, look at Medicares qualifications to see if you have a guaranteed issue right to get Medigap coverage.

Keep in mind

You can sign up for a Medicare Advantage plan when youre first eligible for Medicare, which is the seven-month initial enrollment period that starts three months before the month you turn 65 and ends three months afterward. If you delayed enrolling in Medicare because you or your spouse were still working and had employer health coverage, you can enroll in a Medicare Advantage plan within two months of losing that coverage.

Remember: You must sign up for Medicare Parts A and B before you can enroll in a Medicare Advantage plan. And youll usually have to pay whatever premiums you owe for traditional Medicare in addition to any premium that a Medicare Advantage plan might charge.

Coverage Complications For Preexisting Conditions

If none of the situations described above apply to you, then you fall outside the guaranteed issue rightsand could be on the hook for costs associated with your preexisting condition.

Medigap is one of areas of health care that insurers can underwrite, says Jacobson. This means if youre not in a guaranteed issue period, private insurance companies can charge you higher premiums based on your health status or preexisting condition and whether you smoke.

Medical underwriters attempt to determine a private insurance companys level of risk by granting you a Medigap policy, and they use your health history when determining whether to accept your application and how much to charge you. An analysis on medical underwriting in the long-term care insurance market, for example, estimates 40% of people in the general population would have their long-term care insurance application rejected for medical reasonsCornell PY, Grabowski DC, Cohen M, Shi X, Stevenson DG. Medical Underwriting In Long-Term Care Insurance: Market Conditions Limit Options For Higher-Risk Consumers. Health Aff . 2016 35:1494-1503. .

To avoid medical underwriting and improve your access to coverage, the best thing you can do is apply for a Medigap policy in the six-month window after you get Medicare Part B.

Don’t Miss: How To Delay Your Period For A Few Days

Who Is Eligible For Medicare

You are eligible for Medicare Part A and Part B at age 65 if:

- You are a U.S. citizen or permanent legal resident who has lived in the U.S. for five continuous years

- You or your spouse have worked long enough to be eligible for Social Security or Railroad Retirement benefits

- You or your spouse are government employees or retirees who have not paid into Social Security but have paid Medicare payroll taxes

You can meet Medicare eligibility under 65 if you:

- Have been receiving Social Security disability benefits or certain Railroad Retirement Board disability benefits for at least 24 months

- You have End-Stage Renal Disease and you or your spouse have paid Social Security taxes for a certain length of time

Medicare Part D Enrollment

Most Medicare Advantage plans include Medicare Part D prescription drug coverage. Original Medicare does not pay for the prescription drugs that you may routinely take at home. So, if you switch from a Medicare Advantage plan to Original Medicare during the open enrollment period, you will most likely lose prescription drug coverage.

You can buy a Medicare Part D plan if you make this switch.

If you already have Original Medicare and a Part D plan, you can also switch to another Medicare Part D plan during the open enrollment period.

You May Like: How Long Will My First Period Last

What Changes Are Off Limits With The New Medicare Advantage Open Enrollment Period

Not all } Medicare Advantage plans will have the new benefits, and there may be benefit caps and other rules that apply for those that do. For example, plans may limit the non-medical transportation to 20 trips a year and require you to use certain providers before benefits apply.

Still have questions? Learn more about Medicare Open Enrollment.

During the new Open Enrollment Period for Medicare Advantage, you generally cannot:

- Sign up for a Medicare Advantage plan when youâre not already enrolled in one. In other words, you can switch plans, but not get one for the first time.

- Sign up for a stand-alone Medicare Part D prescription drug plan . But suppose youâre losing this type of coverage by dropping a Medicare Advantage prescription drug plan . You might be able to sign up for a PDP in these cases.

- Switch from one stand-alone Medicare Part D prescription drug plan to another.

The Medicare Advantage Open Enrollment Period doesnât apply to other types of Medicare health plans, such as Medicare Savings Accounts, Medicare Cost plans, or the PACE program .

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Medicare General Enrollment Period

If you don’t sign up during your Initial Enrollment Period and if you aren’t eligible for a Special Enrollment Period, the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

The General Enrollment Period lasts from each year.

You can only sign up for Part A and/or Part B during this period, and your coverage starts on July 1. You may have to pay a late enrollment period for Part A and/or Part B, as detailed below.

|

Part B Late Enrollment Penalty: If you do not enroll in Medicare Part B during your Initial Enrollment Period but decide to enroll later in life, you will have to pay a late enrollment penalty. Your Part B monthly premium could go up 10 percent for each 12-month period that you were eligible for Part B but didn’t sign up. You pay the Part B late enrollment penalty for the rest of your life as long as you remain enrolled in Part B. |

You May Like: How To Masturbate While On Period

How Long Does Medicare Part D Penalty Last

Since the monthly penalty is always rounded to the nearest $0.10, she will pay $9.70 each month in addition to her plan’s monthly premium. Generally, once Medicare determines a person’s penalty amount, the person will continue to owe a penalty for as long as they’re enrolled in Medicare drug coverage.

Medicare Part D Prescription Drug Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes Part D prescription drug coverage, Medicare Part A hospital insurance and Part B medical insurance combined into a single plan

- Enroll in a Medicare Part D standalone prescription drug plan that can be paired with other insurance such as Original Medicare , Medicare Supplement plans or Medicare Advantage plans that don’t include drug coverage

In 2022, 23.1 million Medicare beneficiaries were enrolled in a standalone Part D Medicare drug plan.3

Learn more about Part D drug coverage. You can also enroll in a prescription drug plan online when you visit MyRxPlans.com.

Recommended Reading: Foods To Eat For Period Cramps

When Else Can You Enroll In Medicare Advantage Plans

If you still have questions about what is Medicare Part C, this open enrollment period may give you another chance to make Medicare coverage changes, in addition to the times listed below. You canât change Medicare Advantage plans anytime you want, in most cases.

Usually you can only add, drop or change Medicare Advantage plans or Medicare prescription drug plans during:

- Your Medicare Initial Enrollment Period or Medicare Advantage Initial Coverage Election Period

- A Special Enrollment Period, if you qualify for one

- A 5-star Special Enrollment Period for a Medicare health or prescription drug plan

Read more about Medicare Advantage enrollment periods