A Relatively Small Share Of Medicare Beneficiaries Compared Plans During A Recent Open Enrollment Period

Each year, people with Medicare can review their coverage options and change plans during the annual open enrollment period . Medicare beneficiaries with traditional Medicare can compare and switch Medicare Part D stand-alone drug plans or join a Medicare Advantage plan, while enrollees in Medicare Advantage can compare and switch Medicare Advantage plans or elect coverage under traditional Medicare with or without a stand-alone drug plan. Beneficiaries have no shortage of plans to choose from: in 2022, the average Medicare beneficiaries can choose among 39 Medicare Advantage plans and 23 Part D stand-alone prescription drug plans .

In this analysis, we examine the share of Medicare beneficiaries who reviewed their coverage and compared plans during the open enrollment period for 2020 , and who made use of Medicares official information resources, as well as variations by demographic groups, based on an analysis of the 2020 Medicare Current Beneficiary Survey . All reported results are statistically significant.

During the Medicare open enrollment period for 2020, we find:

The Part D Standard Benefit

At a minimum, plan sponsors must offer a standard benefit package mandated by law. The standard benefit includes an annual deductible and a gap in coverage, previously referred to as the Donut Hole. Sponsors may also offer plans that differ from but are actuarially equivalent to the standard benefit. Finally, they may also offer enhanced plans that provide benefits in addition to the standard benefit. Typically, the enhanced plans offer some coverage during the Donut Hole.

The Standard Benefit is defined in terms of the financial structure of the cost-sharing, not the drugs that must be covered under the plan.

Medicare does not establish premium amounts for plans. Instead, premiums are established through an annual competitive bidding process and evaluated by CMS. Premiums vary from plan to plan and from region to region. Medicare does establish the maximum deductible amount, the Initial Coverage Limit, the TrOOP threshold, and Catastrophic Coverage levels every year. The table below shows the standard benefit for this year .

Standard Part D Benefit 2020-2021

Alternatives to the Standard Benefit

Income-Related Monthly Adjustment Amount Part D

Income-Related Adjustments 2021

How Can You Take Advantage Of The Special Enrollment Periods

Contact Medicare.gov to discuss your special enrollment period options.

Since SEPs are granted on a case-by-case basis, you should contact Medicare.gov to learn how you best can take advantage of your SEP. They will also be able to tell you what steps to take to complete the process.

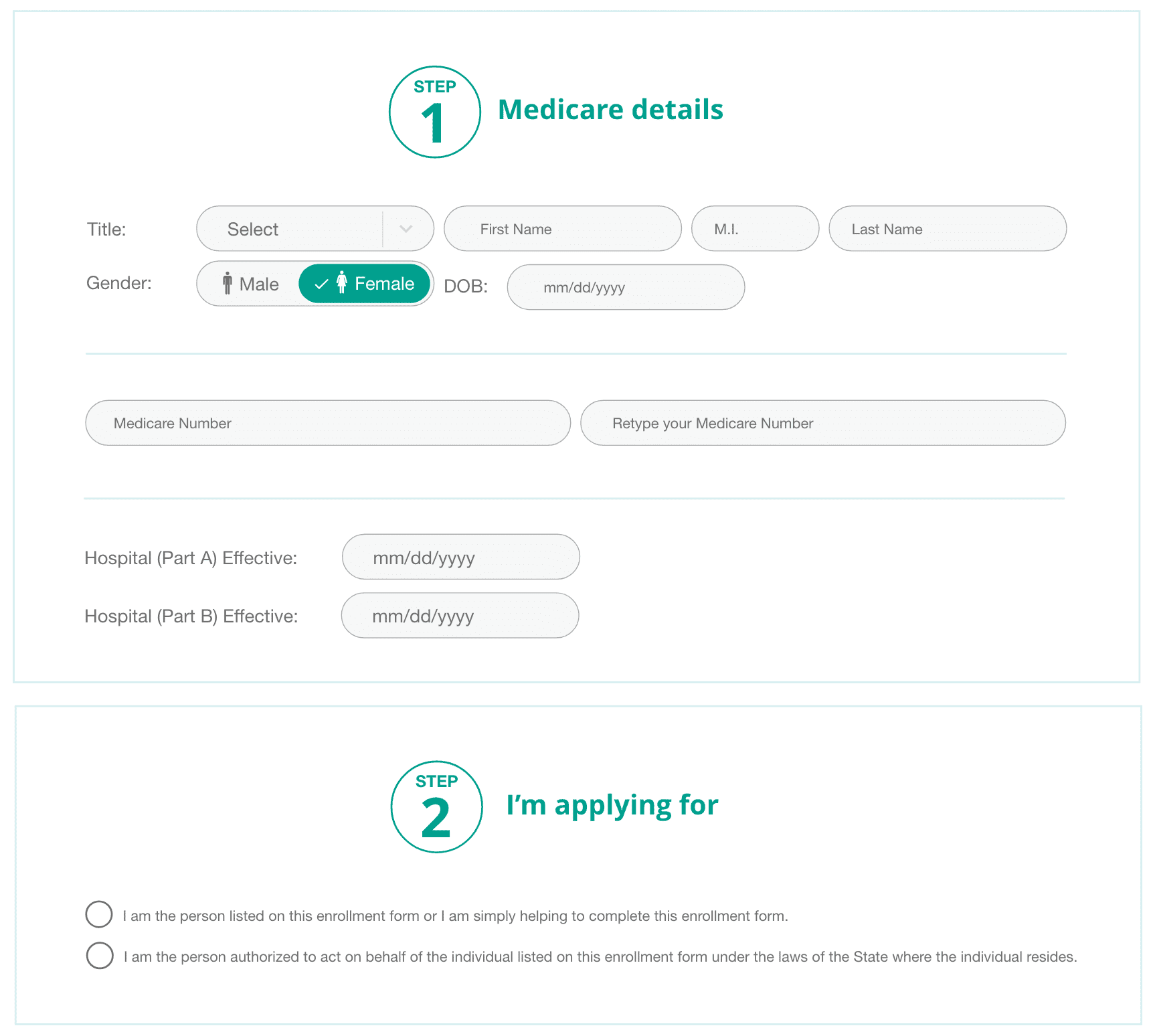

There are specific forms you must complete based on the reason you qualify for an SEP, Boden says. For instance, if you become eligible for Part B during a SEP, you may need to provide a Request for Employment Information . Youll also need to send proof of employment, Group Health Plan or large Group Health Plan coverage.

No-contact enrollment options are available. You can enroll over the phone with an agent or online.

During COVID, you can now do this online for the first time ever, Boden says. In non-COVID times, you must fax, mail or hand deliver your forms to the Social Security office.

Also Check: Bleeding A Few Days Before Period

Whats The Difference Between The Annual Enrollment Period And Medigap Open Enrollment Period

Your Medicare Supplement Open Enrollment Period is not the same as the Annual Election Period in the fall. The latter pertains to Medicare Advantage and Medicare Part D plans and the dates are the same every year. Your Medigap Open Enrollment Period is unique to you, only happens once in your lifetime, and only concerns Medicare Supplement selection.

Many new beneficiaries think they can enroll in a Medigap plan and bypass health questions during the Annual Enrollment Period. However, this isnt the case.

This is one of the biggest misconceptions and causes the most problems for beneficiaries. Its also why its so important to know about enrollment periods. One option during the Annual Enrollment Period is to disenroll from a Medicare Advantage plan and return to Original Medicare. This allows the beneficiary to enroll in prescription drug plan coverage and Medigap.

Read Also: Is It Normal To Have Two Periods In A Month

Whats New For Medicare Advantage Plans

The new benefits focus on keeping you safe and healthy at home and may include one or more of the following:

- Monthly premiums down to around $19 per month for 2022

- People with ESRD can enroll in Medicare Advantage Plans as of 2021

- Caregiver support with coverage for custodial home health care and respite care

- Benefits for in-home meal delivery

- Non-medical transportation between home and the doctorâs office, hospital, or pharmacy

- Yearly allowances for home safety equipment such as bath and shower pull bars

- Monthly or yearly allowances for over-the-counter medications and devices such as blood pressure cuffs or reading glasses

- Expanded telehealth benefits to help you get health care at home

- Coverage for alternative therapies such as acupuncture

- Wellness benefits such as gym memberships and fitness classes

Read Also: How Do I Know When My Period Is Over

Who Is Eligible To Make Changes During Annual Open Enrollment

During Medicare annual open enrollment, anyone with any type of Medicare plan can make changes to their coverage.

Who Can Make Changes During Medicares Annual Open Enrollment

- People with Original Medicare can switch to Medicare Advantage .

- People with Medicare Advantage plans can switch to Original Medicare .

- People with a Medicare Advantage plan can switch to a different Medicare Advantage plan.

- People with a Medicare Part D drug plan can switch to a different Part D plan.

- People with Original Medicare can enroll in a Part D plan for the first time.

- People with a Medicare Part D plan can drop it completely.

What Dates To Know

Written by: PeopleKeep TeamOctober 18, 2019 at 12:00 PM

Its that time of year again. Open enrollment for most states is starting soon and in some states its already begun. You may be wondering why open enrollment matters and which deadlines apply to you.

Open enrollment is important because its the only time consumers can sign up for individual health insurance without experiencing a qualifying life event. A qualifying event triggers a special enrollment period that allows individuals and their dependents to enroll in coverage up to 60 days before or after the date of the event. Those who miss open enrollment deadlines and arent eligible for an SEP must wait until the following years open enrollment to sign up for coverage.

In this post, well discuss each states open enrollment periods as well as other information relating to QSEHRAs, ICHRAs, and alternate enrollment options.

Read Also: How Do You Calculate Your Period Cycle Length

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Changes Can I Make During Medicare Advantage Open Enrollment Period

If your Medicare Advantage plan isnât serving your needs, you may want to compare the plans available in } and change to a different one.

- During the new Medicare Advantage Open Enrollment Period, you can switch Medicare Advantage plans.

- Or, if you decide Medicare Advantage isnât the best choice for you, you can drop your Medicare Advantage coverage and go back to in Original Medicare.

- You can also make changes to your Part D prescription drug coverage in certain situations:

- If you have Medicare Advantage without prescription drug coverage, and you switch to a Medicare Advantage prescription drug plan.

- If you drop Medicare Advantage altogether, and go back to Original Medicare . You can then enroll in a stand-alone Part D prescription drug plan during this open enrollment period.

Note that you must be currently enrolled in Medicare Advantage to make any changes in coverage during the Medicare Advantage Open Enrollment Period. If youâre enrolled in Original Medicare , the new open enrollment period doesnât apply to you.

If you want to switch from Original Medicare to one of the new Medicare Advantage plans for }, youâll need to make changes during one of the enrollment periods described below. You also canât use the new Medicare Advantage Open Enrollment Period to switch between stand-alone Medicare Part D prescription drug plans.

Don’t Miss: What Is The Grace Period For Capital One Auto Loans

If You Missed Enrolling Your Initial Or General Enrollment Period

If a group health plan covers you through your or your spouses employer or union, you can sign up for Medicare Part A or Part B anytime.

If your employment or group health plan ends, you have an eight-month Special Enrollment Period to sign up for Part A and Part B without facing a late enrollment penalty. Keep in mind that retiree health plans and COBRA dont qualify you for a Special Enrollment Period when that coverage ends.

Medicare Open Enrollment 202: What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

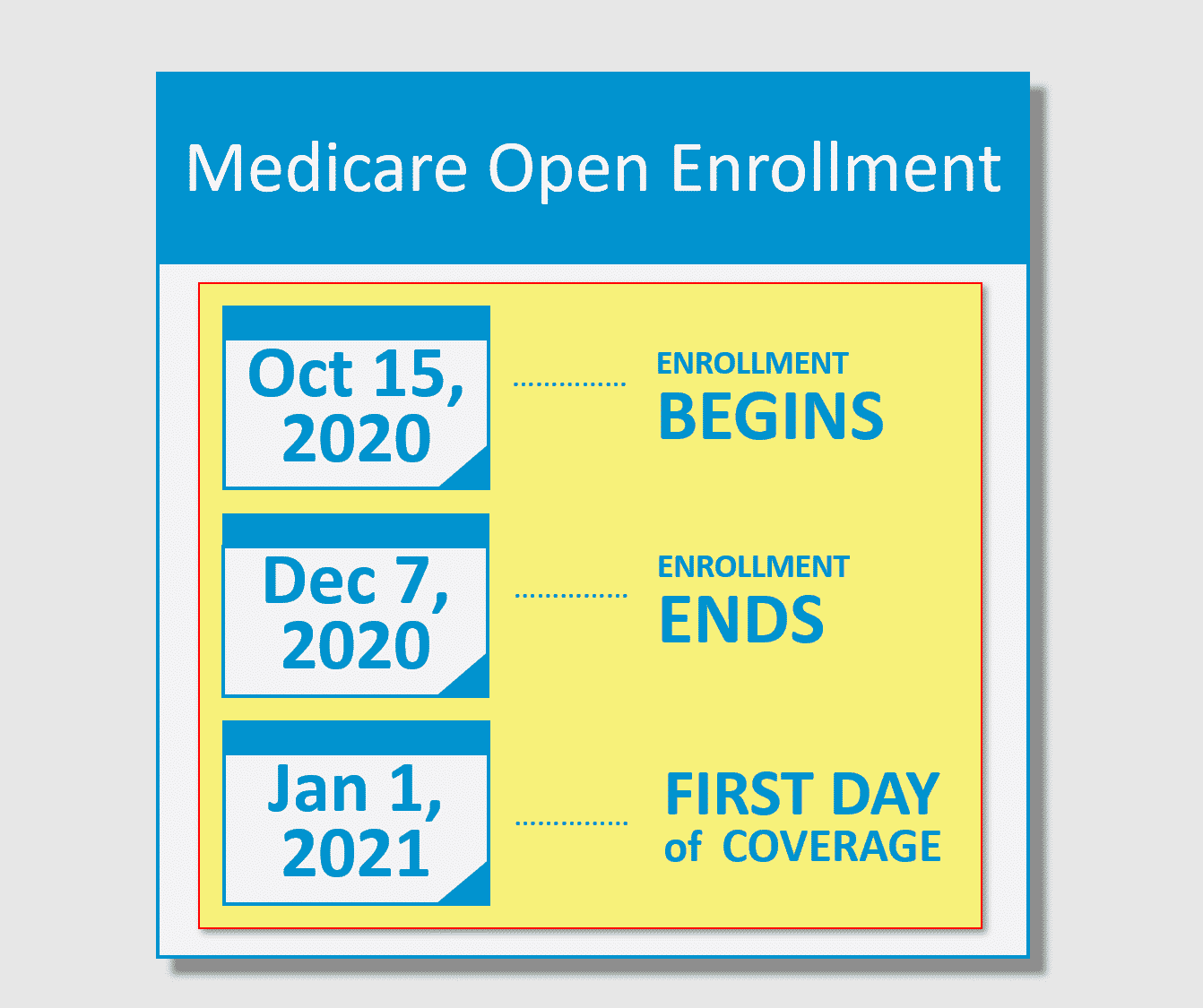

Medicare open enrollment is the period from Oct. 15 to Dec. 7 each year when people already enrolled in Medicare can make changes to their coverage

Medicare open enrollment runs from Oct. 15 thru Dec. 7. You can switch from Original Medicare to a Medicare Advantage plan, or vice versa. You can also compare your Part D prescription drug plan coverage to other options.

Its always a good idea to compare coverage and assess your health and prescription drug needs during this time to make sure you have the Medicare coverage thats best for you and your budget, says David Lipschutz, associate director of the Center for Medicare Advocacy.

Don’t Miss: When Will I Get My Next Period Calculator

Can Medicare Supplement Plans Be Purchased At Any Time

You can apply for a Medicare Supplement plan at any time. So, even after your Medigap Open Enrollment window closes, you can still enroll. However, you will most likely need to undergo medical underwriting and answer health questions during the application process.

Outside your one-time Medicare Supplement Open Enrollment Period, a carrier can deny you coverage due to pre-existing conditions or health issues. The only way around this is through guaranteed issue rights due to a circumstance that qualifies you for a Special Enrollment Period.

Some states have unique open enrollment rules, such as birthday rules. These rules allow you to enroll in Medigap at certain times without answering health questions.

You Have A Chance To Get Other Coverage

- I have a chance to enroll in other coverage offered by my employer or union.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan to enroll in the private plan offered by your employer or union.

When?

Whenever your employer or union allows you to make changes in your plan.

- I have or am enrolling in other drug coverage as good as Medicare prescription drug coverage .

-

What can I do?

Drop your current Medicare Advantage Plan with drug coverage or your Medicare Prescription Drug Plan.

When?

- I enrolled in a Program of All-inclusive Care for the Elderly plan.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan.

When?

Anytime.

Recommended Reading: Skipping Period On Pill Side Effects

Do I Need Medigap Coverage

Medigap plans can save you money by paying many of Medicare’s out-of-pocket costs. However, they’re not required or always necessary.

You can only purchase a Medigap plan if you’re enrolled in Original Medicare.

You donât need a Medigap plan if you have Original Medicare and already have supplemental health insurance. Some people receive this through Medicaid or a former employer.

You donât need a Medigap plan if you have a Medicare Advantage plan from a commercial insurance company. These plans replace both Original Medicare and Medicare supplement plans.

Show Sources

Choose Coverage For Prescription Drugs

Once youve completed Steps 1 and 2, youre ready to decide about your drug coverage.

Medicare doesnt cover the cost of most prescription drugs. Still, there are two ways to sign up for insurance that will help pay for your medications: If you stay on Original Medicare, Parts A and B, you can buy a standalone policy specifically for prescription drug coverage. This policy is called a Medicare Part D prescription drug plan.

Or, if you opt for a Medicare Advantage plan, prescription drug insurance is often included. Medicare.gov offers a tool to compare and shop for Part D and Medicare Advantage plans.

Also Check: Can You Swim In A Pool On Your Period

Medicare Select Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

It differs from Medicare Supplement insurance because you are expected to use a network of hospitals associated with the insurance company. In return, you will usually pay lower premiums. Also, in order to enroll in a Medicare SELECT plan, you must live within the service area of a network facility.

Recommended Reading: Why Do You Get Headaches On Your Period

States That Have Extended Health Insurance Open Enrollment

Counseling Medicare clients OEP related. Medicare Plan Finder walk-thru video Medicare outreach and advertising. Medicare Open Enrollment Period outreach & media materials Open Enrollment materials for Spanish speakers Open Enrollment materials for other audiences in Medicare and the Marketplace for the 2021 pla

You May Like: My Period Is 2 Weeks Late

The Medicare Part D Open Enrollment Period: What You And Your Audience Need To Know

By its design as the national health plan for older Americans, Medicare insures a disproportionate number of people who take prescription drugs.

The majority of participants in the giant federal health program last year 52.6 million, or 86% of the 61.2 million enrolled were age 65 and older, according to the most recent report from the Medicare board of trustees, which comprises federal officials leading health, labor and retirement programs. The rest of the enrollees qualified due to disabilities.

And people are more likely to need medicine as they age, as shown in a May 2019 report from the Centers for Disease Control and Prevention . About 85% of people age 60 and older in the U.S. reported having taken one or more prescription drugs in the past 30 days, while only 47% of those ages 20 to 59 did, according to 2015-2016 data from the CDCs National Health and Nutrition Examination Survey.

Medicare Part D is an optional program to help people enrolled in the federal health program pay for prescription drugs. With annual expenses running to about $100 billion last year, it is the dominant insurer in the U.S. pharmaceutical market.

While funded by Medicare, Medicare Part D plans are managed by insurers such as the for-profit UnitedHealth and nonprofit Blue Cross Blue Shield plans. These insurers compete for customers, offering plans with varied monthly premiums and deductibles.

Who Is Eligible For Medicare

You are eligible for Medicare Part A and Part B at age 65 if:

- You are a U.S. citizen or permanent legal resident who has lived in the U.S. for five continuous years

- You or your spouse have worked long enough to be eligible for Social Security or Railroad Retirement benefits

- You or your spouse are government employees or retirees who have not paid into Social Security but have paid Medicare payroll taxes

You can meet Medicare eligibility under 65 if you:

- Have been receiving Social Security disability benefits or certain Railroad Retirement Board disability benefits for at least 24 months

- You have End-Stage Renal Disease and you or your spouse have paid Social Security taxes for a certain length of time

Recommended Reading: What Are The Signs Of Starting Your First Period

Consider Whether You Need Medicare Supplement Insurance

You might already know that Medicare doesnt pay 100% of approved charges. For example, Medicare Part B coverage pays 80% of covered medical costs after you meet the annual deductible. That means youre responsible for the remaining 20% and for paying your deductible.

Thats why many people who choose Original Medicare also buy Medicare Supplement Insurance, often called a Medigap policy, to help pay for some or all of these gaps in benefits. Private insurance companies sell these policies. They help pay for other costs, including coinsurance and copays.

Medicare 2020 And 2021 Enrollment Dates: Key Takeaways

- The plan-year 2020 Medicare open enrollment period has ended. The next open enrollment period will run from October 15, 2020 to December 7, 2020, for coverage effective in 2021.

If youre enrolling in Medicare for the first time, theres a fairly straightforward process and timeline

But beyond that first opportunity to enroll in Medicare plans, the federal government provides other windows for enrollment: annual opportunities to enroll if youve delayed your enrollment for some reason, or to change your coverage if youve already enrolled.

Heres a quick guide to the times when you can enroll in or change Medicare coverage during the course of the year.

Don’t Miss: Why Have I Been On My Period For A Month