Make A Plan To Prevent Future Late Payments

To avoid missing another credit card payment deadline, you can set up autopay. With autopay, you set the date you want your automatic payments to be sent to your credit card lender. You choose the amount that will be sent on each autopay cycle to your credit card company. You can pick a minimum amount to match your monthly minimum payment, pay your total statement balance each month, or set another amount that works for you.

If you use autopay, be sure to have enough money in your bank account. The last thing you want is for the autopay to fail because of insufficient funds in your checking account or for your bank to charge you an overdraft fee. If you need help keeping track of your autopay, you can set up text or email reminders or a recurring calendar reminder to let you know when a credit card bill payment is coming due.

Pay The Minimum Amount

The sooner, the better. If your payment is within the 30-day grace period, you can usually avoid a negative ding on your credit report. Reporting agencies inform the credit bureaus of payments not made by the next billing cycle. But if its more than 30 days past due, you can minimize the negative impact by paying at least the minimum amount due as soon as possible.

Give Yourself Added Time Between Purchases

If you want to get even more usage out of your grace period, time your credit card purchases to take advantage of your cards billing cycle. Remember, your grace period begins when your billing cycle closes. So if you use your credit card for a large purchase at the beginning of your billing cycle, you have the full cycle plus the grace period before your credit card issuer will begin charging interest on that purchase. That could give you nearly two months of zero-interest borrowing.

Read Also: Can You Get Your Period While On Birth Control

How To Prevent Late Payments

Here are some steps you can take to prevent late payments:

Set up autopay

Card issuers provide an easy way for you to prevent late payments: autopay. You can set up autopay in less than a minute and benefit from peace of mind that your credit card payment is scheduled. Autopay can be set up for the minimum payment due, your total statement balance or another amount. We recommend setting it for your total statement balance so you avoid interest charges, but if that’s not possible choose at least the minimum due.

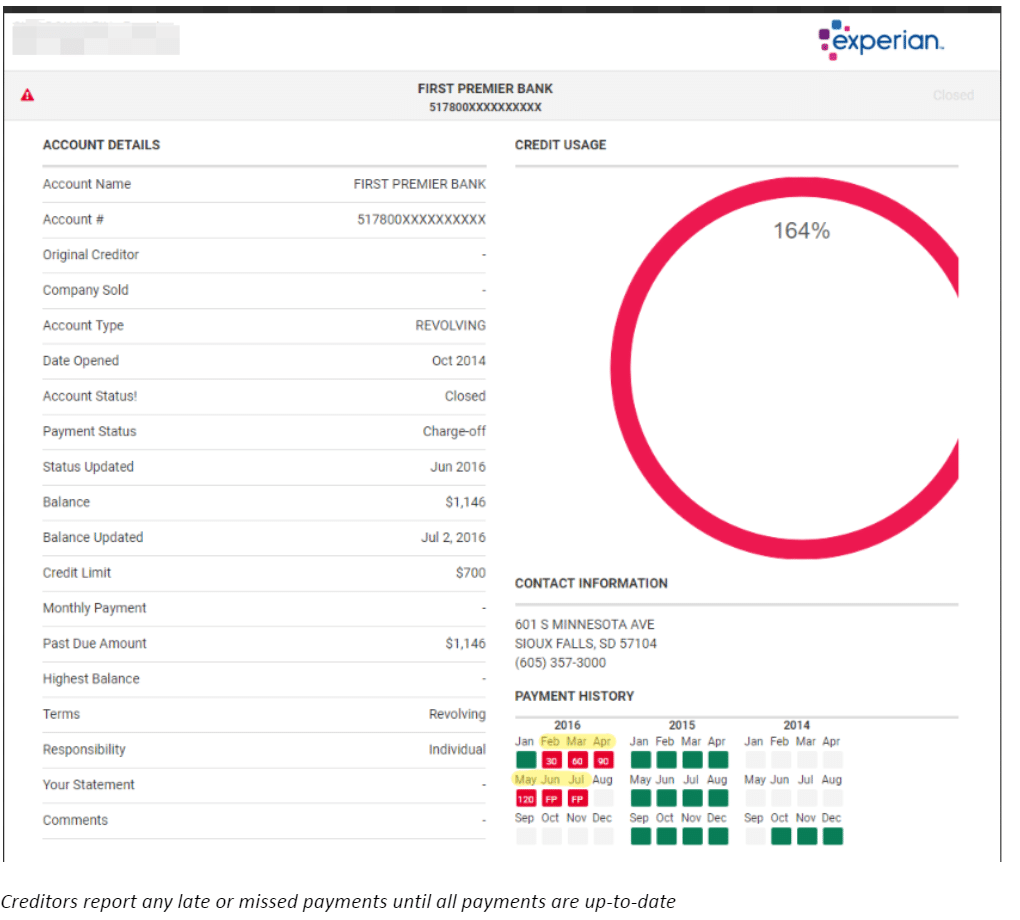

What To Do If The Reported Late Payment Is Incorrect

When your credit report shows that you missed a payment, but you know you paid the bill on time, you can file a dispute with the credit bureau where the late payment appears and ask it to correct your credit report. Each of the major credit bureausExperian, TransUnion and Equifaxhas different procedures, but you can file disputes with each by mail, phone or online.

With Experian, the simplest option is to use the online Dispute Center. After creating or logging in to your account, you can review your credit report and select the late payment that you want to dispute. You can then indicate the reason for the dispute and upload supporting documents, if you have them, such as proof of your on-time payment.

Experian will keep you updated during the investigation and resolution process, which generally takes 30 days or less. Once the investigation is complete, the disputed information will be corrected, deleted or, if deemed accurate, it will remain on your report.

You May Like: Does Having A Period Mean You Are Fertile

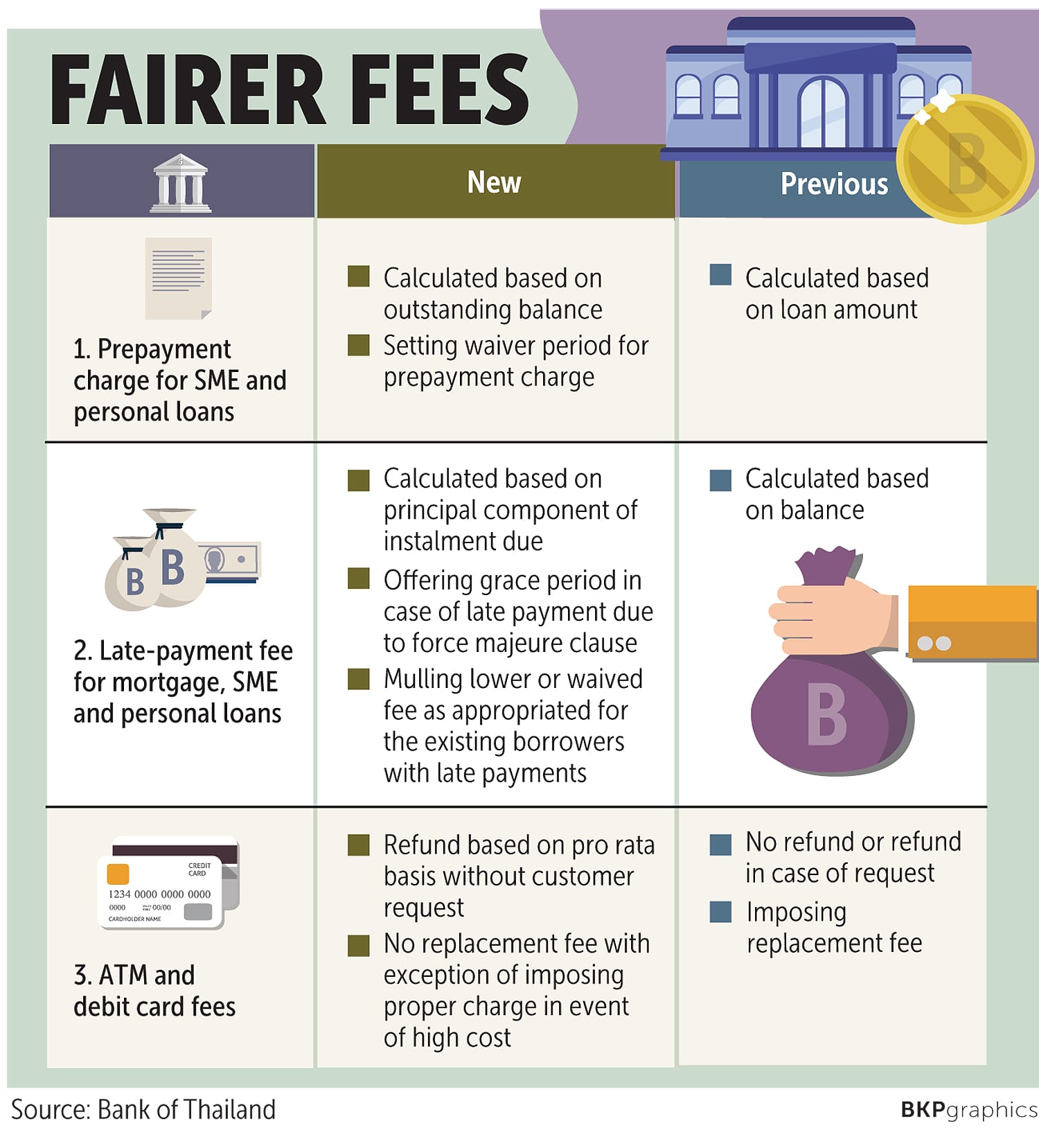

Understanding Credit Card Late Fees

Late payment fees can be a vicious cycle. If youre struggling with finances and pay your bill late, you will be charged a late fee added to your next minimum payment. If the next month you cant meet that new minimum on time, you will be charged yet another late fee.

Aside from being penalized with a fee, late payments made after an entire billing cycle, typically 30 days, will be noted on your credit report. Your on-time payment history is one of the most important considerations factored into your credit score so late fees can moderately impact your credit score.

How Do Missed Payments Affect Your Credit Score

Payment history is the single most important factor affecting your credit score, making up 35% of your FICO Score and 40% of your VantageScore.

For that reason, making on-time payments is crucial to maintaining a good credit score. If you do fall behind, take action quickly to potentially prevent or mitigate the damage to your credit score. The longer you wait, the more your credit score will drop.

Its also worth noting that the amount of the overdue payment and total balance owed can affect how many points your credit score goes down. Falling behind on a larger payment can have a bigger impact on your score if you have a large balance owed.

On the other hand, the type of account does not make a difference. A late payment on a credit card carries the same effect as a late payment on an auto loan or mortgage. But since mortgage payments are typically larger than those for credit cards or other loans, missing a mortgage payment could have a larger impact on your score because of the payment size and total amount owed.

You May Like: Will Birth Control Stop Your Period Right Away

Higher Rate Of Interest

The interest rate on your outstanding bill will also increase if you dont pay the minimum amount payable by the paymentdue date. This increased interest rate will be applicable on cash withdrawal or regular purchases also, if you continue tomake purchases from the credit card after defaulting on the bill payment.

When Is A Credit Card Payment Considered Late

Anthony Harvie / Creative RF / Getty Images

When you open a credit card, one of the most important things you agree to do is to make the required monthly minimum payment by the due date. Keeping up with this agreement is important if you want to avoid penalties: a late fee, a potential penalty rate increase, a blemish on your credit report, and losing your good standing with your credit card issuer.

Also Check: How Many Days After Period Should You Test For Ovulation

Do Late Payments Affect Your Credit Score

Late payments can hurt your credit scores, although the impact will depend on your overall credit profile and how far behind you fall on your payments.

Generally, a single late payment will lead to a greater score drop if you had excellent credit and a clean credit history. If you already have poor credit and your credit report shows other late payments, a new late payment could still hurt your score, but it may lower your score by fewer points.

The further behind you fall on your payments, the greater the potential impact on your credit scores. For example, having an account that is 60, 90 or 120 days past due will likely be worse for your credit than a single 30-day late payment. In addition, the impact of late payments on your credit scores typically . And after seven years, late payments will fall off your credit report and won’t impact your scores at all.

Figuring out when a late payment will be removed from your credit report can sometimes be confusing, though. If you miss a payment and then bring your account current, the late payment will fall off after seven years, but the rest of your payment history on the account will stay on your credit report. If you miss another payment after bringing your account current, that late payment will have its own seven-year timeline for removal.

How Your Billing Cycle Works

Its common to refer to a billing period as a one-month cycle. But with credit cards, the reality is a bit more complicated.

When you open your account with a credit card company, any purchases you make in that first billing period will be added to your statement balance and included in your bill. But once that billing cycle closes , any purchases you make after that will get added to the next months balance statement.

So, for example, if your credit card billing period ends on the 23rd of each month, any purchases you make on the 24th or 25th will get billed the next month. And thanks to your cards grace period, you wont have to pay a finance charge for those purchases until three weeks later, when your bill is due.

Also Check: How To Make Your Period Start Early

How Bad Is It To Miss A Credit Card Payment

Your bill arrives. You make a mental note to pay it, but then something happens. You forget and now youre past due.

Is that bad?

Well, it depends on how late your payment is. It also depends on your credit history. But a late credit card payment can definitely be pretty bad like, 100-points-or-more bad if it reaches 90 days.

The best way to avoid damage is to avoid missed payments in the first place. But when they happen, there are a few things you should know.

Know Your Grace Period Dates And Deadlines

Knowing your grace period and due dates help you plan your payment schedule to avoid late fees and interest charges. Be sure to know the date when your bill is due and pay the full statement balance on time to avoid paying interest on purchases.

Payments made after the due date are late payments, and they may affect your . This could impact your ability to get new credit, and affect the interest rate youre offered on new credit products.

Read Also: Heartburn Early Pregnancy Before Missed Period

What To Do If You Miss A Credit Card Payment

There are a number of actions to take if you miss a credit card payment:

- Pay the minimum as soon as you can. You have 30 days before your issuer reports the missed payment to the credit bureaus, meaning you can avoid any damage to your credit score if you pay as soon as possible. If you pay the minimum as soon as you’re able each month, you can avoid the headache of a missed payment all together.

- Contact your issuer. While you may still incur a late payment fee or penalty APR, your credit card issuer may work with you to help. You could potentially negotiate a lower minimum payment if you’re struggling.

- Don’t miss another payment. Missing another payment will result in lower credit scores and higher interest rates.

What Happens When You Miss A Payment

Missing a payment can have a number of effects on your financial life. The consequences of missing a credit card payment depend on your payment history and how long you go without paying. If you have a history of missing payments, the consequences will be more dire than if it’s a one-time occurrence.

First and foremost, you’ll incur a late payment fee. Most issuers outline how large the fee will be in the card terms, but generally it’ll range from $20 to $40. This will be a one-time payment so long as you don’t miss further payments. If you do, the late payment fee will go up.

You’ll also lose your grace period. Most credit cards typically include a 21-day grace period from your statement closing to before your payment is due. You can take advantage of this time to avoid paying interest charges. However, if you miss a payment or if you don’t pay the full statement balance, you’ll lose your grace period and your new purchases will begin to accrue interest.

If you miss a payment, you could also suffer from a penalty annual percentage rate . A penalty APR is a punitive APR your issuer will apply that’s usually capped at 29.99% — far higher than the standard APR.

When you miss a payment, after receiving notice from your issuer, your new purchases will begin to accrue interest at the penalty rate. If you miss two payments — meaning your account is delinquent for 60 days — your full statement balance will accrue interest at the penalty rate.

Also Check: I Want To Skip My Period

What To Do If You Miss A Payment

If you missed a payment, it’s important to take action fast. Here’s what you should do to minimize the negative effects of a late payment:

Pay at least the minimum as soon as possible

The sooner you make a payment, the better. If your payment is less than 30 days past due, you can avoid it hitting your credit report. And if it’s more than 30 days past due, you can still minimize the damage by paying at least the minimum as soon as you can.

If this is your first late payment, chances are good that your card issuer may waive the late fee. There are even some cards that automatically waive your first late payment, such as the Discover it® Cash Back, or have no late payment fees at all, like the Citi Simplicity® Card.

If your card doesn’t have these perks, simply pick up the phone or live chat with customer service and ask if the fee can be waived.

Don’t miss another payment

Missing one payment might not be terrible, but if you make a habit of paying late, it can have serious implications. Make sure you always make on-time payments and follow our tips for preventing late payments below.

What Happens If I Make A Late Payment On My Credit Card

If your payment is late, your credit card issuer will charge a late fee to your account. You’ll also begin accruing interest on your outstanding balance. You’ll likely lose your grace period, meaning that interest will begin accruing the moment you charge the card. If you fall far enough behind, you may have to pay a penalty rate. After 30 days, your lender will report you to the credit bureaus, which will hurt your credit score. It will also make efforts to collect the debt. After three to six months and several attempts to work with you, your creditor will charge off your debt and give it to a collection agency, which will further damage your credit.

Recommended Reading: Can I Have Sex On My Period

How A Missed Payment Affects Your Credit Score

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

A late payment can drop your credit score by as much as 180 points and may stay on your credit reports for up to seven years. However, lenders typically report late payments to the credit bureaus once youre 30 days past due, meaning your credit score wont be damaged if you pay within those 30 days. However, you could still be hit with a late fee.

Learn how a missed payment can affect your credit score, as well as how to avoid making a late payment.

On this page

How Do I Pay My Citibank Credit Card Bill

The easiest way you can pay your Citibank credit card bill is either online or through the Citi mobile app. Alternatively, you can make a payment over the phone at , by mail or at a Citibank ATM. Citibank allows cardholders to set up automatic payments, too.

How to Make a Citibank Credit Card Paymentread full answer

- Online: Log in to your online account and click on Make a Payment. Then, choose how much to pay, when to pay it, and where the payment is coming from. After that, confirm your choices and submit your payment.

- Through the mobile app: Download the app for Android or iOS. Then, log in to your account and select your card. After that, tap Make a Payment and follow the on-screen instructions to complete the process.

- Overt the phone: Call or the number on the back of the card and enter your card information when prompted. Then, follow the automated prompts to make a payment.

- Send a check or money order to:P.O. BOX 9001037

Recommended Reading: Does Taking Birth Control Stop Your Period

Reasons Why You Should Avoid Late Credit Card Payments

- Overspending and failing to make timely repayment due to insufficient funds.

- Dependency on physical bills sometimes end up missing due dates due to postal delays.

- Waiting until the last day to make the most of the interest-free period resulting in a missed payment.

- Though a rare occurrence, but simply getting confusion about the billing date and the payment due date.

Missing a credit card payment is a bigger deal than you might think. Your credit card company won’t show up at your doorafter you miss a payment, but they’re definitely taking action behind the scenes. It could affect you for months, and evenyears, to come. Knowing the consequences of a late credit card payment should be enough to make you take extra effort topay on time.

Let us look at some of the consequences of late payment of credit card dues.

How Does A Late Payment Affect Your Credit

If you make your late payment within 30 days after the due date, then itâs unlikely to have a negative impact on your credit score or report. But most credit card companies report payments that are more than 30 days past due to at least one of the three major credit bureaus. Many report to all three. This is why being more than 30 days late making a paymentcan harm your credit score and report.

Read Also: Cramps But No Period On Birth Control