How Can I Calculate My Bi

If you are paid an annual salary, divide your annual salary by the number of days in the current fiscal year* and multiply by 14 .

*The City’s fiscal year begins on July 1 of the previous calendar year and ends on June 30 of the current calendar year. For example, fiscal year 2023 begins July 1, 2022 and ends June 30, 2023. Fiscal year 2023 is not a leap year.

What Is A Pay Period Everything You Need To Know

A pay period is a time frame in which you receive your earnings from a company. Pay periods are used by businesses of all sizes to manage their accounting for payroll. If you have pay stubs, your pay period will be on your pay stubs. There are several pay periods businesses will choose based on their needs.

The Best Payroll Software For Your Pay Schedule

As a busy business owner, do you really have the time to manually calculate employee payroll? Maybe youre still not sure exactly how payroll works and could use a virtual hand.

There are numerous payroll service and software applications on the market today that automate the entire process from beginning to end. Here are just a few choices to consider.

Read Also: Using Birth Control To Stop Period Once It Starts

Types Of Pay Periods & How To Choose

A year can be divided into 52 weeks, 365 days, or 12 months, which means there are numerous schedules you can use for your payroll. Some businesses are more concerned with weekly payouts and opt to pay once a week or every other week. Others divide each month in half and choose to pay in the middle and at the end. Additionally, although not as frequent, a monthly pay schedule works better for some companies.

Here are some factors you should consider when determining your pay schedule.

- Average wages: Restaurant employees who earn tipped minimum wage may be better suited for weekly paychecks. Forcing employees who receive low wages to wait two to three weeks for payday could damage morale.

- Company cash flow: Paying weekly means you must have enough cash available to pay more often. Some businesses have cash flow cycles that require more time before bank accounts are replenishedlike stores that sell merchandise on credit.

- Profitability: Processing payroll more often usually costs more money , and some businesses, especially startups, have to manage their expenses more carefully. Using providers like Gusto allows employers to run unlimited monthly payrolls at no extra cost.

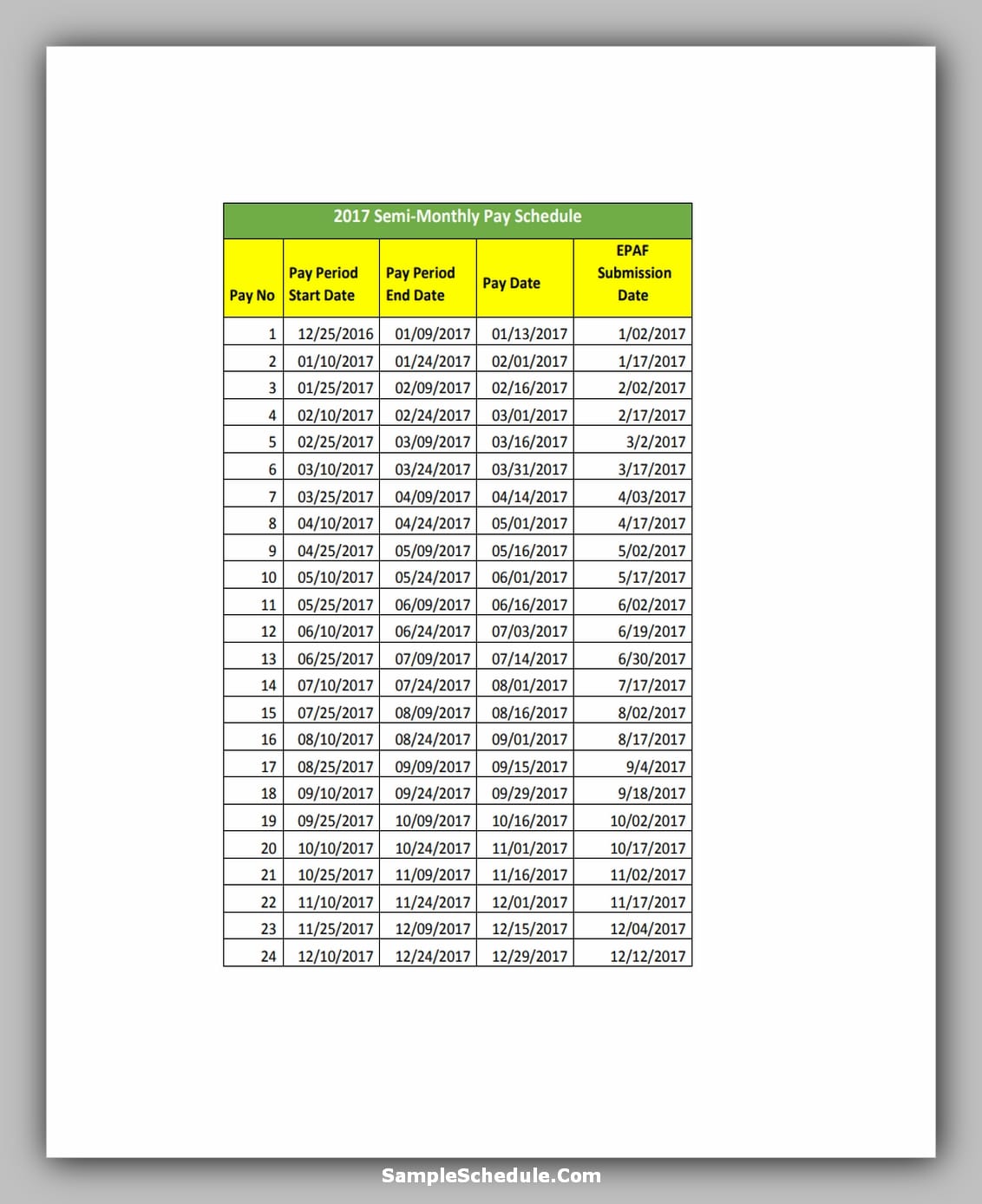

Here are a few pay period examples and some of the most common pay schedules from which you can choose. Keep in mind that certain industries have norms, and you may need to follow your industrys tradition to remain a competitive employer.

We recommend using a pay period calendar and/or chart to help you.

How Many Pay Periods Are In 2021

The number of pay periods always stays the same with monthly and bi-monthly. But the number of times payroll is processed with a weekly or bi-weekly pay period structure can change depending on the year â including if it begins on a Friday or includes an extra day .

There are 53 Fridays in 2021 â meaning that if the organization adopted a weekly or bi-weekly pay period and paid employees on Jan. 1, there is a possibility that employees receive an âextraâ paycheck. If thatâs the case, on a bi-weekly pay schedule, the three paycheck months are January, July and December. For organizations that processed their first payroll of the year the following Friday, April and October will be the three paycheck months.

In This Article

You May Like: How Many Days Late Is My Period

How Is A Pay Period Calculated

Companies decide what pay period length they want to run their payroll on.

This can be based on a variety of factors, like when the company gets paid for its products and services, how often employees need money, and whether you have hourly employees or if your team is on an annual salary schedule. Thereâs also state law to factor in â you may prefer to pay monthly while state law requires bi-weekly payments.

For example, a company that employs mostly hourly workers might find it beneficial to have a week-long pay period. Weekly payments are easier for financial planning and make employees happier by giving them access to more readily available cash flows.

However, a company that bills its clients at the end of the month and has mostly salaried employees may prefer to pay its employees less frequently â a bi-weekly basis is typical.

How To Calculate Biweekly Pay

Read Also: Period Symptoms But No Period Iud

Check Date And Pay Period

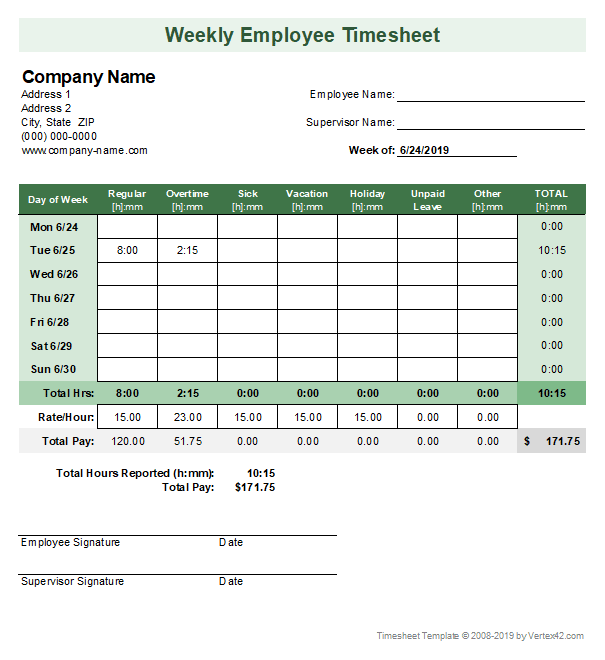

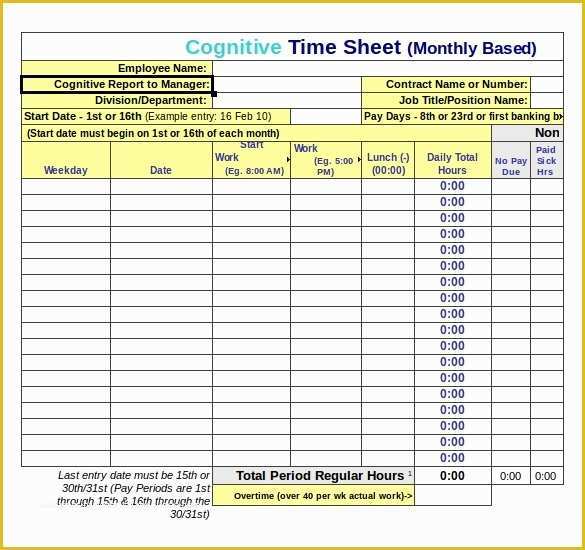

While your options will vary depending on your chosen pay frequency, you will always need to choose the first check date, the date that pay period begins, and the date when it ends. Remember that the last day of the period should be the day before the start of the next, not on the same day.

Note: Learn more about the differences of these pay periods in .

The Difference Between Semimonthly And Biweekly

At first glance, these two terms sound awfully similar — once every two weeks or twice a month are the same thing, aren’t they?

Actually, they’re not. Semimonthly means your employees get paid on two specific days of the month, regardless of when they fall. For instance, you might choose to pay your employees on the 15th and 30th of every month. Biweekly, on the other hand, promises employees a paycheck once every two weeks regardless of what day of the month it is — hence, in the calendars above, employees receive paychecks on the 4th, 18th, 1st, and 15th of the month.

Semimonthly means employees receive 24 paychecks per year, instead of 26. Additionally, the 15th and 30th of each month could fall on a holiday or weekend depending on the month, so your HR team needs to ensure they’re on-top of processing deadlines and pay dates to ensure your employees still receive a paycheck.

Recommended Reading: Can Your Period Feel Like A Uti

Flsa Workweek Vs Pay Period

Your workweek and your pay frequency might not line up.

If you run payroll on a weekly or biweekly basis, your workweek and pay period probably line up.

If you have a different pay frequency, the pay period might split a workweek into two paychecks. If this happens, the pay for a workweek, including overtime wages, will be split into two paychecks. You still calculate overtime wages by the workweek, not by the pay period.

Lets say your workweek runs from 12 a.m. Sunday to 11:59 p.m. Saturday. Your business has a semimonthly pay period which ends on the 15th and the last day of every month. To keep things simple, lets say a Sunday is the first day of the month. For this example, your pay period would cover two full workweeks plus the first day of the third workweek. The remaining six days of the third workweek would be in the next pay period.

When you use payroll software that pairs with a reliable time and attendance software add-on, you can make sure you consistently use the same workweek and calculate overtime wages correctly. Start a free trial of Patriots online payroll software. We guarantee accurate calculations.

This article has been updated from its original publication date of July 21, 2017.

This is not intended as legal advice for more information, please

How Can I Tell How Much Time I Have

For most City agencies, your leave balances are indicated on your pay statement. The “as of” date is based on a two-week lag. If you want to know your exact balances, do the following: Subtract any time you used and add any compensatory time you earned after the “as of” date that appears on your pay statement. Check the dates that accruals show up on your pay statement, and add accruals for the prior month that are not on your pay statement.

Also Check: Pros And Cons Of Period Underwear

Is It Possible To Have 27 Pay Periods In A Year

Yes, it is possible to have 27 pay periods in a year. If you run the payroll on a bi-weekly basis, you could have 27 pay periods whenever there is an extra day in a leap year.

If you run the payroll weekly, you could have 53 pay periods in one year even when it isnât a leap year. The number of pay periods depends on which specific day of the week you pay employees.

Ready To Take The Next Step

For nearly 30 years, Paycor has maintained a core expertise in payroll and compliance. Our payroll software is an easy-to-use yet powerful tool that gives your team time back and our expert tax team assists with complicated areas like payroll tax compliance and workers comp so you can focus on paying your people. Contact us today to learn more about how our expert payroll and tax solution can help you pay your employees on time and avoid compliance missteps.

Read Also: What Makes Period Cramps Go Away

Your Decision Has Other Effects

Payroll TaxesThe amount of pay will affect the total Social Security and Medicare you and your employees pay. Some employees may reach the maximum Social Security contribution earlier and may reach the threshold for the additional Medicare tax if you make an additional payment.

Employee BenefitsPaying additional salary may also result in paying additional benefits. For example, you might be over-funding someones 401 with the extra pay period, beyond the maximum allowable amount. If that happens, you would have to give back the money to the employee.

Tax Year for W-2sHaving a pay period extend over the end of a year brings up the issue of which years taxes the payment is in. The general rule is that the tax should be on the W-2 for the year when the paycheck is issued, and the employee has use of it.

What Type Of Pay Period Should I Use

The type of pay period to use really depends on what works best for you. If you have been in business for a while, you probably have an idea of what payroll schedule you prefer. However, if youre new to the business world, or in a new industry, you should seek the advice of your CPA or accountant on what payroll schedule will work best for your employees.

Its important to understand what a pay period is and what pay period schedules you can use to keep your business organized and keep employees paid on time.

You might also like

Your employees want a bigger piece of the pie. You want to attract and retain top talent while motivating employees to perform at their best. In this webinar, PayScale and BambooHR experts guide you to create a compensation plan thats a win/win for both you and your employees.

Read Also: How To Regulate Your Period With Pcos

Don’t Miss: Why Am I Bleeding Again After My Period

Pros Of Semi Monthly Pay Period

The pros to the Semi Monthly Pay include having twice as many checks as bi-weekly pay, but without extra accounting paperwork because those check would match up with your paycheck from the previous month its convenient for people who get paid bi-weekly sometimes their employer will only give them two whole weeks worth of paychecks in one month, making it harder for them to manage their finances correctly.

How To Choose The Right Pay Period For Your Business

Choosing the right pay period is crucial for your small business and you need to evaluate a variety of factors, such as finances, logistics, and human resources. Consider the type of employees you have, the structure of your business, and if your employees are paid overtime. Here are the pros and cons to each pay period option:

Don’t Miss: Why Has My Period Not Stopped

Your Pay Schedule Options

Digging into our data, it appears that most employers pay their employees on weekly or bi-weekly schedules. Semi-monthly pay schedules are also very common for reasons well cover a little later:

In addition to size, industry also can have a major impact on how often businesses choose to pay their employees. For example, construction companies are five times as likely to use weekly pay periods as education and health care companies:

How To Calculate Monthly Wages If You Are Paid Every Two Weeks

When you receive pay every two weeks, you may think that its the equivalent of being paid twice per month. While usually you do get paid twice per month when you receive bi-weekly pay, sometimes you get paid more than twice in a month, depending on how many weeks are in the month. Because there are 52 weeks in a year, there are 26 bi-weekly pay periods. This means that receiving pay every two weeks will result in a different calculation of monthly wages than if you receive your pay twice per month, so multiplying your check by two will not bring you the correct amount.

Tips

-

If you receive bi-weekly pay, you can calculate your monthly earnings using a simple formula. After multiplying your current wages , you can then divide this sum total in order to calculate your monthly wages.

Recommended Reading: Can You Get Pregnant The Day After Your Period Ends

Some Options For A 27

Option 1: Divide the total salary among the 27 pay periods for that year, rather than 26. It will result in smaller amounts in each paycheck. In Jerrys case, his bi-weekly pay for that year would be $1037.04 . You would have to do this starting at the beginning of the 27-pay-period year.

Option 2: Do nothing. Pay the same amount each payday. Because of the extra payday, you will effectively be giving employees a slight increase. This is the easiest option, but the most costly for you.

If you take Option 2, inform employees so that you can take credit for the increase. Also, be sure to inform the employees that their pay the following year will be reduced because they will be back to being paid over 26 pay periods.

According to HR consulting firm ERC, most employers , use the pay-as-usual option.

Option 3: Use the actual multiplier in every year. For bi-weekly pay periods, it would be 26.0893. In Johns case, this would result in payments of $1,073.23 each pay period, for a total of $27,904.16 in a 26-pay period year and $28,977.21 in a 27-pay-period year, an increase of $977.21 for the year.

The benefit of using the actual multiplier every year is that you wouldnt have to re-calculate every year. You would still have to make an additional payment to employees in a 26-pay-period year to bring them up to their stated salary. You would also have an increase in a 27-pay-period year, but not as much as if you used option 2.

Withholding & Reporting Requirements

Employers are required to withhold the appropriate amount of federal, state and local taxes from each employee paycheck. The more often you run payroll the more accounting must be managed to ensure monthly and quarterly payroll tax payments and reports are submitted accurately. Failure to do so can result in substantial fines and penalties.

Also Check: Is It Ok To Skip A Period

What Payroll Schedule Is Best

No one pays attention when you get payroll right, but it only takes one mistake to harm HRs reputation within your organization. And, of course, it is crucial you remain fully compliant as well. When you consider these factors, It comes as no surprise that so many HR pros stick with the payroll practices and schedules they inherited from their predecessors.

But your payroll practices should be intentional, not inheritedespecially when it comes to your pay schedule. Many organizations with a mix of exempt and nonexempt employees are already on a monthly or semimonthly pay schedule simply because thats the way it has always been. In HR, thats never a good reason to continue on with difficult measures.

After some consideration, a semi-monthly schedule may seem easier for calculating benefit deductions however, the division of deductions on a biweekly schedule is not nearly as complicated as it first seems. You can use one of two methods:

Divide your employer’s annual premium by 26, and deduct that from each biweekly paycheck.

Divide monthly premiums in half, and deduct that from each biweekly paycheckexcept for the extra check for those two months with three pay dates.

Though weekly works similarly, having to run payroll half as often still places biweekly at an overall advantage.

Employees also tend to enjoy the few months that offer three paychecks, which is exclusively associated with biweekly payment methods.

How Does A Biweekly Pay Schedule Work

Biweekly pay means you pay your employees once every two weeks, on a set day you choose. Once you start the year, youll pay your employees once every two weeks. This might sound simple, but that means for two months out of the year, youll have three pay periods instead of two.

Is bi-weekly pay every two weeks?

Under a biweekly payroll schedule, employees receive a check every two weeks, which equals 26 paychecks per year. Typically employees receive their paycheck on a specific day of the week, such as Friday.

What is a biweekly pay period?

Biweekly pay is when a business pays its employees every other week on a specific day of the week. For example, you might choose to pay your employees every other Friday. Since every calendar year has 52 weeks, this results in a total of 26 paychecks per year.

Also Check: Is It Bad If Your Period Is Late