Should I Get Guaranteed Issue Life Insurance

There are a few circumstances that may make a guaranteed issue life insurance policy worth it for you. Some insurance companies will shy away from customers with serious health issues, but Aflac knows that everyone could benefit from a life insurance policy to fit their needs.

Typically, those who are terminally ill, on dialysis, need an organ transplant, are on hospice, have a chronic illness, have AIDS or HIV, or have Alzheimer’s or dementia, have a more difficult time finding the right coverage.9 Thats where some type of guaranteed acceptance life insurance with no health questions could come in.

Guaranteed issue life insurance exists to help those with serious health problems find the coverage they need. These plans may help prevent consumers from being turned down based on their medical history. If you or someone you know is battling a serious illness, life insurance without medical questions could make all the difference for their loved ones.

Guaranteed life insurance for seniors may be particularly helpful as new health conditions can arise with age. This type of plan could make coverage possible, even if you have a new diagnosis. At Aflac, you can explore term and whole life insurance options for seniors, with enhanced benefits to fit your lifestyle.

Whole Life Insurance No Medical Exam No Waiting Period

Some people prefer not to have a medical exam because of needles, doctors, or tests. If the thoughts of undergoing a physical examination make you uncomfortable, guaranteed issue whole life insurance provides a way to apply for coverage without taking an exam.

Specific individuals may also prefer to avoid a medical exam because they fear being charged higher life insurance premiums because of their health being turned down. Lot life insurance rates are dictated in part health. Many applicants can face more expensive policies based on medical exam results during the insurance underwriting process. Others may assume they wont get aordable coverage due to their health and will not even go through with the exam.

Guaranteed issue whole life, a person cannot be denied health issues, and no exam or lab will be necessary. The policy coverage is subject to payment and verification of identity as required law and is eective upon receipt of the policy.

Online Quotes are online at woodysinsurance.com and also a complete application. No sales pressure you decide for yourself.

A Complete Guide To Guaranteed Life Insurance

Typically, applying for a life insurance policy has a lot of unknowns because you never know if the insurer is going to approve your application. But with a guaranteed issue life insurance policy, also called a guaranteed acceptance policy, you can have confidence your application will be approved.

………………………………………………….

Read Also: Dental Insurance Alabama No Waiting Period

Eligibility For Each Medical Condition

The table below lists health issues and whether they are eligible for no waiting period life insurance.

Please keep in mind that your age and your state may result in a different outcome. Remember that not all insurance products are available for all ages, nor are they available in all states.

That said, this list is pretty accurate for most people in the USA looking for coverage.

New York is the only state where this list will not be very accurate. The problem with New York is a severe lack of options. Very few companies offer coverage there.

Does Veteran & Active Military Status Affect Life Insurance

Military service members are considered high-risk because of their occupation. Its not impossible for active military or veterans to get life insurance though.

There are extra factors that will be considered if you have active military status. Where youre located and the duties that you have for your occupation will be assessed. There are people with some military jobs who are denied coverage.

Military service members are automatically issued coverage from Servicemembers Group Life Insurance. The military does have burial and memorial benefits for veterans or soldiers.

If you are a veteran, you may be eligible for life insurance through the VAs benefits.

These benefits can range from a burial at Arlington National Cemetery to a free headstone or a cash allowance for final expenses.

Recommended Reading: How Can You Stop Your Period From Coming

K Life Insurance No Medical Exam

Rates for life insurance are calculated based on the insureds age, health profile, lifestyle, driving record and other factors. Policy details like term length and coverage amount also affect premiums.

A 40-year-old with excellent health buying $500,000 life insurance with a 10-year term will pay $18.44 per month on average. The same individual will pay approximately $24.82 per month for a 20-year term.

Difference Between Conventional Whole Life And Guaranteed Issue Whole Life Insurance

Traditional whole life insurance policies and guaranteed issue whole life insurance policies are quite different in how they approve applicants for a policy.

When applying for a conventional life insurance policy, you will have to sit for a medical exam or answer some questions related to your health. You will also have to undergo financial scrutiny. The insurer uses underwriters to examine your health and financial history to determine whether or not you are a good risk. If you are, the insurer will issue you a policy. But if youre not, your application could be denied. If approved, the insurance company determines your premiums based on your age, sex, and health.

On the other hand, when you apply for a guaranteed issue whole life insurance policy, the insurer does not use underwriters. Instead, everyone who applies is automatically accepted. And your premiums wont be based on your health. Instead, the insurer has premium guidelines that apply to everyone regardless of health or finances.

You May Like: When Your Period Is Heavier Than Usual

How To Get Senior Life Insurance With No Waiting Period

Typical guaranteed life insurance policies have a waiting period. It can be as long as 2 years. This means if you die within those 2 years, your beneficiaries receive little or no benefits. If they receive anything, it is usually the equivalent of the premiums you paid thus far plus a small percentage .

Why is this waiting period?

Compare life insurance quotes and save!

Insurance companies have a waiting period to keep the terminally ill and who will pass away soon from purchasing the policy.

Insurance companies take a risk insuring anyone â the waiting period protects them from financial distress.

How Can Funeral Funds Help Me

The reality is that inexperienced and less knowledgeable insurance agents will cost you loads of money by selling you overpriced burial and final expense policies.

Getting on affordable burial, final expense, funeral expense insurance for parents or yourself doesnt have to cost an arm and a leg.

Our job at Funeral Funds is to be the most knowledgeable burial insurance expert available. By doing so, we can knock it out of the park and get you the most accurate quote and affordable rates.

Once we know more about your age and health history, we can accurately give you burial insurance quotes from the final expense companies that best fit you.

Working with independent final expense insurance brokers, such as Funeral Funds, is always in your best interest.

With access to all the best final expense insurance companies, we will help you understand your best options, given your current age, health, and financial situation.

GET 1ST-DAY COVERAGE & SAVE 30-50% WITH OUR INSTANT QUOTER

Don’t Miss: Good Foods To Eat On Your Period

Plans With No Health Questions

Burial life insurance without a medical exam or health questions will result in a waiting period. This is known as guaranteed acceptance life insurance or guaranteed issue.

Below are a few examples of medical questions on an application. Look them over to ensure you can get approved for a burial insurance no waiting period plan regarding your specific health situation.

- Have you had any major surgeries recently?

- Do you have a terminal illness or a current cancer diagnosis?

- Do you have a defibrillator implant or require continuous oxygen use?

- Do you have AIDS, ARC, or HIV?

- Are you bedridden, confined to a hospital, or on hospice?

- Have you been treated for dementia, Alzheimers Disease, or memory loss?

If you answered YES to any of these medical questions, we recommend learning more about guaranteed acceptance life insurance plans to gauge your next steps.

A guaranteed life insurance plan is unnecessary if you can answer NO to the above questions.

Sample Rates For Guaranteed Acceptance Life Insurance With Immediate Coverage

In the table below we’ve provided some sample rates by age and gender for $50,000 of guaranteed issue life insurance without a waiting period. If you purchase one on these policies, your family or loved ones will be protected as soon as you make your first payment.

Sample Rates for $50,000 of Guaranteed Issue Life Insurance

| Current Age |

Read Also: At What Age Do Women Stop Having Periods

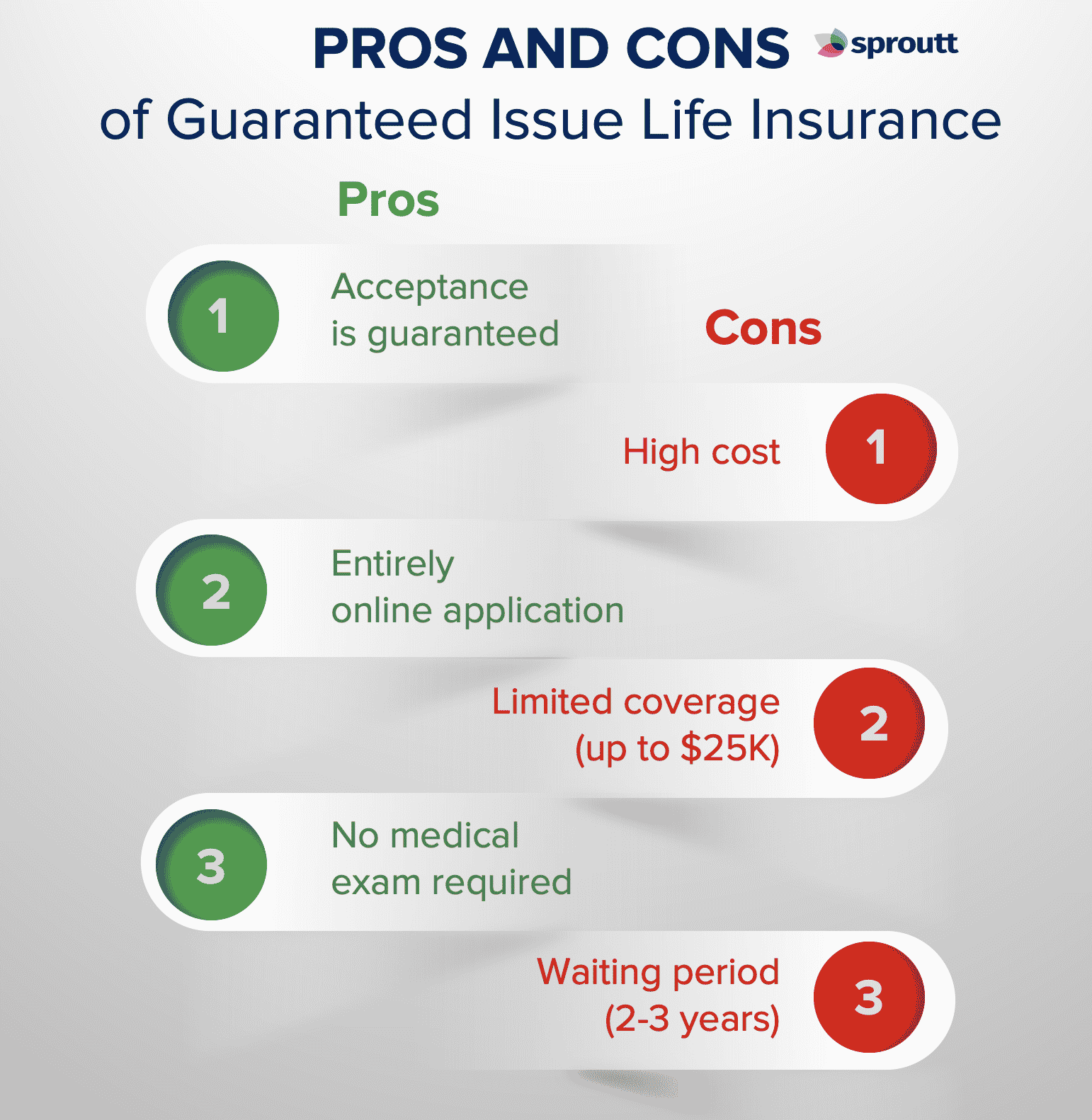

Pros Of Guaranteed Life Insurance

There are a handful of benefits attached to a guaranteed life insurance policy:

- These plans help provide coverage for those who may usually have a difficult time getting life insurance.

- You can save time by avoiding a trip to the doctors office skipping the medical exam and medical questions.

- The policyholder can scale the death benefit up and down, usually somewhere between $2,000 and $25,000.7

You Dont Have Any Coverage During The Waiting Period

The biggest thing to know about the life insurance waiting period is that you do not have any coverage during this time, unless you receive a conditional receipt by submitting an initial premium along with your application. Simply applying online or speaking to an agent does not guarantee coverage until your policy is formally approved by an underwriter. Youâll be notified when your coverage takes effect.

As a result, that means if you pass away during the life insurance waiting period, your loved ones will not be eligible to receive the death benefit. Until you pay the first premium, your policy is not in force. If you pass away before your policy is approved and paid for, there are no benefits available to your beneficiary.

Recommended Reading: How Many Days Before Period Can You Get Pregnant

The Waiting Period / Graded Benefit

The waiting period is referred to as a graded benefit, which simply means your death benefit is limited for a certain portion of time. Ideally you want to have a limited benefit no longer than 2 years, this is the best available. After 2 years, the 24th month you will be covered for the full death benefit.

The waiting period on most guaranteed acceptance life insurance plans are 2 years, some of them are as long as 3 years. but they do exist. All the guaranteed issue quotes that you get here will be 2-year waiting periods.

What Are The Average Male Versus Female Life Insurance Rates

There will be a difference between male and female insurance rates. This is because men pay higher rates for life insurance than women do.

A 35-year-old male will have a higher rate than a 35-year-old female. Men have a shorter life expectancy, so they are considered a higher risk to insure, and their rates are higher. Take a look at this table to see what we mean.

Average Annual Life Insurance Rates for Non-Smokers by Age, Marital Status, and Gender

| Age, Marital Status, and Gender | New York Life Average Annual Life Insurance Rates | Prudential Financial Average Annual Life Insurance Rates | Lincoln Financial Average Annual Life Insurance Rates | Massachusetts Mutual Average Annual Life Insurance Rates | Aegon / |

|---|

MassMutual and State Farm are the cheapest options in comparison to the average life insurance rates.

Also Check: Can You Swim On Your Period With A Pad

Should I Get Guaranteed Acceptance Life Insurance

You should only get guaranteed acceptance life insurance if you’ve already applied for simplified issue life insurance and have been rejected. Guaranteed issue life insurance is the most expensive form of life insurance, so it should only be applied for if there are no other life insurance alternatives.

About the Author

Mandy Sleight is a professional freelance writer and licensed insurance agent. She has her property, casualty, life, and health licenses and has been working in the industry since 2005. Mandy has worked for well-known insurance companies like State Farm and Nationwide Insurance, and most recently as the Operations Coordinator for a start-up employee benefits company.

Mandy earned her Bachelor of Science degree in Business Administration and Management from the University of Baltimore and her Master in Business Administration from Southern New Hampshire University. She uses her vast knowledge of the insurance industry and personal finance combined with her writing background to create easy-to-understand and engaging content to help readers make smarter choices with their budget and finances.

Who Thinks Medical Test Is A Hassle

Other than this, some people do not want to go through the hassle of medical examinations. They look for more accessible policy options in a quick time.

Life insurance without medical examination becomes their ultimate choice. Sometimes people do not want to disclose their medical condition to their family, friends, or business allies.

Their concern for their familys financial future makes them purchase life insurance with no medical no waiting period. It ensures that their survivors get a comfortable life even when they depart from the world.

There are several reasons that people have started showing significant interest in buying such policies.

Their rising demands and queries have been the reason that the insurance companies have introduced such plans for their customers.

You May Like: What Can I Do For Period Cramps

What Health Conditions Cant Get Life Insurance With No Waiting Period

Life insurance with no waiting period will give the contract holder immediate access to full benefits, but this is at the insurers risk.

Because the risk is on the insurer, those suffering from specific medical conditions arent eligible for a no-waiting period. These conditions include:

- Heart attack or heart surgery in the last 12 months

- Stroke in the last 12 months

That doesnt mean you wouldnt be eligible for life insurance, though. Having one or more conditions like this just means you will have to get a life insurance policy with a standard waiting period.

Cons Of Guaranteed Issue

- Guaranteed issue life insurance is expensive compared to some other options.

- Some guaranteed acceptance policies have a graded death benefit period. This means that if you pass during this time, your beneficiary wont receive the full coverage amount of the policy.

- You cant buy as much coverage as with other life insurance options. For example, the typical maximum coverage for a guaranteed issue plan is $25,000, with some exceptions going up to $50,000.

Also Check: How To Get Dried Period Blood Out Of Sheets

You Can Get Term And Whole Life Insurance With No Waiting Period

Dealing with a life insurance waiting period can be frustrating. The good news is that you can purchase traditional life insurance with no medical exam and no waiting period.

Through Ethos, you can get term life insurance with no waiting period or whole life insurance with no waiting period and get approved in minutes. Many applicants get same-day coverage.

To get a quote online, youâll provide some personal information, answer a few health questions, and see your estimated rate. If youâre ready to buy, you can pay the first monthâs premium and activate your coverage instantly.

You can start applying on our website anytime, anywhere. Our customer service team is available if you have questions or need help with your application.

Pros Of Guaranteed Issue

- You can leave a decent amount of money to your loved ones, even if your health or financial history isnt stellar.

- There are no medical examinations or health questions to answer.

- Depending on the insurance company, a guaranteed issue policy can be approved as soon as the same day, though there may be a waiting period before coverage starts.

Read Also: How To Stop Diarrhea On Period

Who Is Guaranteed Issue Life Good For

A guaranteed issue final expense policy is good for seniors who cannot qualify for other life insurance coverage or do not want to answer health questions.

Seniors must fit the accepted age range and be healthy enough to enter a contract legally. These are essentially the only two things that could prevent someone from getting guaranteed coverage.

What About Guaranteed Acceptance Burial Insurance

Overall, the insurance company offers these to cover a final expense such as burial, cremation, or leaving a legacy. These carriers are rated A/A+ and are highly rated for claims-paying ability before they are offered to our clients.

Its important to know that burial insurance is the same as funeral insurance, cremation insurance, and final expense insurance. They are all small whole life policies. In addition, come as a guaranteed issue policy when needed.

Also, use National Funeral Directors Association as a source for any and all burial information.

Read Also: My Period Only Lasted 3 Days Could I Be Pregnant

Who Is Guaranteed Acceptance Life Insurance For

Guaranteed acceptance life insurance is more expensive than other alternatives. Therefore, its most common for seniors or people who are considered high-risk.

When Are You Considered High-Risk?

The most common reason to be considered high-risk is primarily because of health or health history. If youre diagnosed with a serious health condition, such as some types of cancer, youll be considered high-risk for many years to come. Other reasons to be flagged as high-risk are dangerous professions or hobbies. Skydiving or deep-sea diving are just two examples.

If youre a high-risk individual, a guaranteed issue policy can be a good option. However, most guaranteed acceptance products do have a graded benefit duration of 2 years. For that reason, your beneficiaries wont receive your full coverage amount during this period. Instead, theyll receive your paid premiums, plus a certain amount of interest. A guaranteed issue policy can provide up to $40,000 of coverage . This is enough to pay off debt, pay for funeral costs, or leave a small inheritance.