Periodic Report Due Date

The Secretary of States office sends an email notification reminder notice 7 days before the start of the periodic report month. Even though a reminder is sent, its important to make an additional reminder for yourself should you not receive it.

The annual filing is due by the last day of the anniversary month the LLC or Corporation was formed. For example, if your Colorado LLC or Corporation was formed January 1st, the Annual Report deadline will be every year thereafter before January 31st. You are able to file up to 2 months in advance.

If youre unsure what month your entity was registered, you can find the approval date on your Articles of Incorporation or Articles of Organization.

What If I Filled Out My Companys Information Wrong During Purchasing

Please reach out to us through our contact form and we will work with you to get the proper information filed with the Colorado Secretary of State. Please note that if change documents need to be filed with the Colorado Secretary of State, you may be subject to a $30 charge. Errors will be handled on a case by case basis.

Q What Are The Consequences Of Not Submitting A Periodic Report

A Businesses for which periodic reports are not submitted on time will end up receiving a noncompliant designation. After this occurs, that entity will have two months to submit a periodic report before the status is changed to delinquent, meaning that it cannot legally conduct business in the state.

In order to reverse a delinquency status for a business and get it back in good standing, a Statement Curing Delinquency will have to be filed with the Secretary of State.

Contact a Denver Business Lawyer at Downey & Associates, PC

If you need help keeping your business in compliance or resolving any business legal matter, you can count on Denver Business Lawyer Thomas E. Downey. Since 1983, Thomas Downey and the other legal professionals at Downey & Associates, PC, have been providing individuals and businesses in the Denver Metro Area and throughout the U.S. with the highest level of legal service for their litigation, property tax and real estate legal issues.

To learn more about how we can help you and your business, call us at 813-1111 or email us using the contact form on this page. From our law offices in Centennial, we serve clients throughout Colorado and the U.S.

You May Like: How To Tell If Your Period Is Over

Creating A New Record

You can print the form for your records by using the print option for the PDF.

Colorado Periodic Report: Everything You Need To Know

A Colorado periodic report is a report submitted to the Colorado Secretary of State Business Division in order to keep information about a business entity current.3 min read

A Colorado periodic report is a report submitted to the Colorado Secretary of State Business Division to keep information about a business entity current.

Every year, the following entities are legally required to submit a periodic report:

- Corporations

Anyone with authority is allowed to file the report.

On the periodic report, a business entity can update information such as:

- Principal office address

- Registered agent’s name and address

This ensures that the public has the correct and most current information. Businesses that submit their public report maintain their good standing with the state.

The filing fee is $10, and it’s paid annually by the following:

- Profit corporations

- Non-profit corporations

- Limited Liability Companies

- Professional Limited Liability Companies

- Limited Liability Partnerships

Accepted forms of payment include:

- Visa

There are strict guidelines that businesses must follow when filing a periodic report. These are:

Don’t Miss: Do You Have A Period With Mirena

What Are The Penalties For Not Filing A Colorado Periodic Report

You will have a two month grace period before your business is considered non-compliant. In addition, a $50 late fee will be assessed.

Your business will enter non-compliant status the day after your report is due, and youll be charged an additional $50 late fee. After 90 days of this non-compliant status, you will enter a new delinquent status, your late fee goes up to $90, and you will also have to file a Statement Curing Delinquency.

Affecting An Existing Record

You can print the form for your records by using the print option for the PDF.

You May Like: Period Like Cramps During Early Pregnancy

File Periodic Report State Of Colorado

In a world where tricky spam, and even trickier phishing scams, constantly flood your inbox as a small business owner, it can be hard to know what is and isnt legitimate email, especially when you see something you maybe werent expecting.

Today, I got an email from the Colorado Secretary of State that I ignored for 10 years as what I thought was fraudulent spam to get my business details. Finally, I ended up reading a newspaper article about how it WAS used for fraud, but not the way I thought.

Why Is A Colorado Annual Report Required

Annual reports are required by statute in nearly every state. They provide state agencies with updated information on the entities registered in their state. Your company is required to file annual reports to maintain good standing and continue operating.

Failure to file annual reports on time can result in late fees. Most states enforce additional penalties on lapsed entities. These include the loss of naming rights, loss of access to the courts, and administrative dissolution. Many banks, licensing agencies, and even prospective clients require evidence that a business is in good standing. By filing annual reports each year on time, companies avoid the costly and potentially embarrassing consequences of noncompliance.

Also Check: What Is Ovulation Period And How Is It Calculated

Prepare An Operating Agreement

An LLC operating agreement is not required in Colorado, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed. It can also help preserve your limited liability by showing that your LLC is truly a separate business entity. In the absence of an operating agreement, state LLC law will govern how your LLC operates.

For help creating an LLC operating agreement, see Form Your Own Limited Liability Company, by Anthony Mancuso . If an operating agreement is created, it need not be filed with the Articles of Organization.

Colorado State Periodic Report Scam

Now, just because the email isnt a scam, doesnt mean there isnt a Colorado Periodic Report scam out there. Basically, the way it works is they scrape the mailing address from the Secretary of State database and then send you an official looking notice about filing your Periodic Report. It seems very legitimate, and if you do some research, youll see its a real thing.

The scam is that they offer to do it for you for a high fee, like $49 or $99 or worse. Dont do it. Do it yourself online. It costs $10. It literally takes two minutes and all it does is ask for your address.

Also Check: What Helps Your Period Go Away Faster

How To File Your Colorado Secretary Of State Annual Report

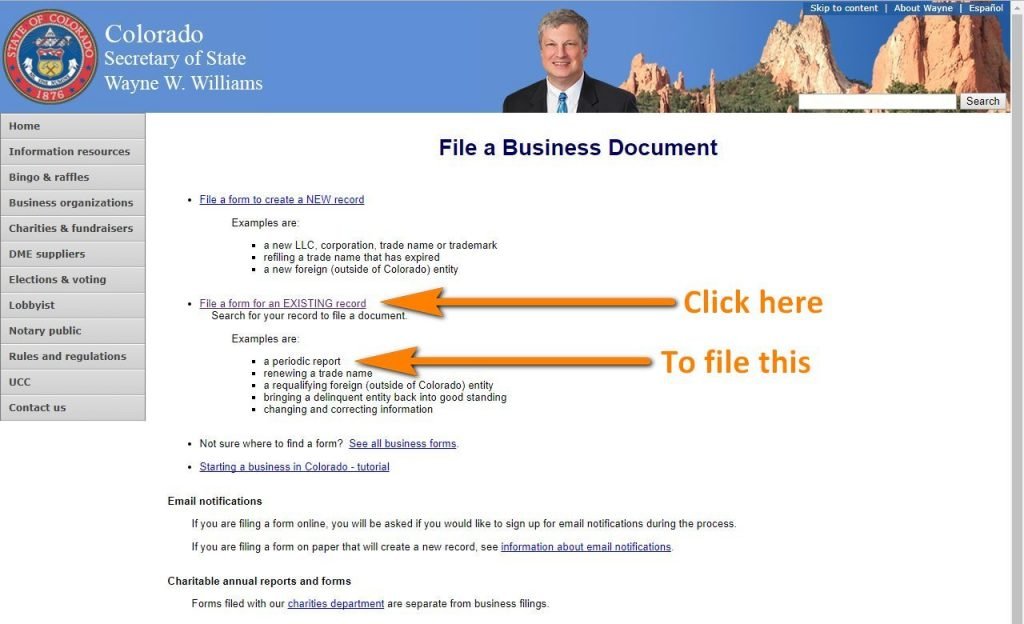

Colorado Periodic Reports are a requirement, but you can either file your report on your own or outsource and let a professional organization file for you. This latter option removes stress and hassle, but for those who plan on filing on their own, you can expect several steps. In most cases you can complete the process online by doing the following:

- Visit the Colorado Secretary of State website and find the Periodic Report filing link. This is located on the Business home page.

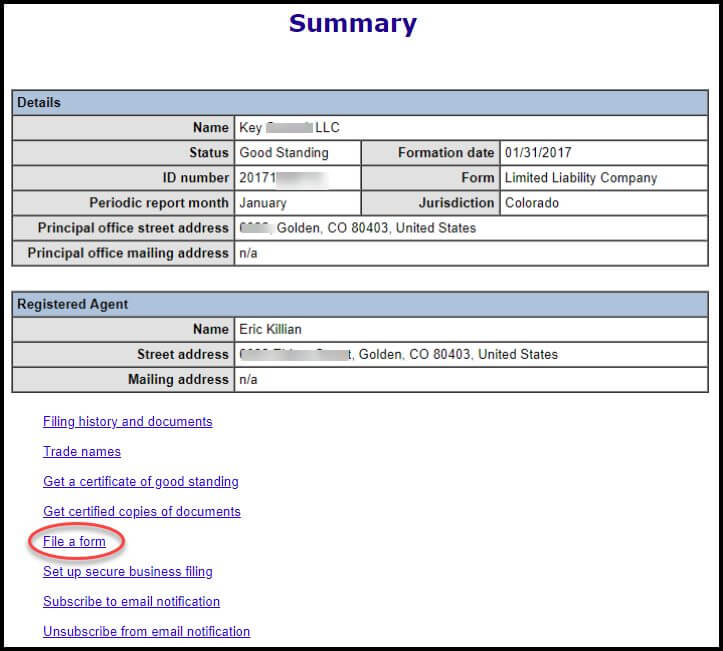

- Search for and locate your business by searching for its name or ID number.

- Review the information and confirm that you are at the correct business and that you have the ability to make changes.

- Fill out the form. This will include a large amount of info including things like executives and officers, structure, earnings information, and more.

- Enter all applicable payment information. You will have to use either a credit or debit card number. Then, pay for the filing process.

- You will then have the option to confirm the reports filing and payment. You can also now print out your own copy of the report for recordkeeping.

Again, using our service is an easier option that removes the inconvenience and makes the process simple, saving you time and the worry that you may not be filing properly.

Periodic Report Service Benefits

At Northwest Registered Agent, were committed to protecting our clients privacy. Colorado Periodic Reports are public record, so weve designed our periodic report service to protect your privacy. Heres how:

In order to preserve your privacy, we will list OUR contact information instead of yours.

Only the minimum required information will be included.

We will list our IP address limiting the connection between your cell phone, personal computer, and work computers this makes it harder for advertisers to follow you.

We will list our bank and credit card information not yours.

We believe everyone has the right to keep their information private. Thats why privacy is our guiding principle when we create every service and product.

Read Also: How To Make Period Stop Immediately

Colorado Llc Periodic Report: What It Is And How To File

You did it. Your Colorado LLC is officially up and running, ready to take on challenges, roll in the profits, and change the world.

Theres no doubt that this is an exciting time in your business journey. After starting your LLC, its easy to get carried away in all the excitement and expectations. After all, as a new business owner, youve got a lot on your plate.

But the state does too. They need to keep updated records on thousands of businesses so that they can effectively reach out with any important tax or legal communications down the road. How do they do it? With your cooperation, of course.

In Colorado, an LLCs annual report is known as a Periodic Report, and every LLC must file one yearly to keep the state updated regarding some basic information. Unsure how to go about it? Never even heard of it? No worries at all. Thats why were here. Keep reading for everything you need to know.

Quick Note:

What Happens If You Dont File

In the case of failing to file a Periodic Report, the company may be subject to sanctions, and some of them are quite serious.

When your periodic report month passes, the state gives you two more grace months in which to file your Periodic Report, avoiding negative consequences. Otherwise, the LLC will receive Noncompliant status and a $50 late fee, which is required to be paid.

If the violation is still not resolved after that, the company becomes Delinquent. This case is highly undesirable because the options for Delinquent businesses are severely limited. For example, you cannot get a certificate of good standing or file a lawsuit. Also, the state has the right to forcibly dismiss an LLC if the owner fails to file a Periodic Report and Statement Curing Delinquency.

Recommended Reading: Is It Bad To Stop Your Period With Birth Control

Colorado Annual Registration Filing Fees And Instructions

No matter what type of business you run in Colorado, you must file a Periodic Report with the Secretary of State’s office. These reports cost $10 to submit, which is much cheaper than the cost to register in other states.

However, the costs will begin to add up quickly is if you file your report late. You have up to three months after your filing anniversary to submit your Periodic Report. If you do not file within this three-month window, your business will be required to pay a late fee of $40. Continued non-compliance may result in the loss of your ability to do business within Colorado.